Macroeconomic Interpretation: While Wall Street traders hold their breath waiting for the Federal Reserve's interest rate cut signal in June, the cryptocurrency market is experiencing extreme volatility. This chain reaction triggered by a sudden shift in macroeconomic expectations has not only caused the S&P 500 index to plummet 3.2% in a single week but has also led Bitcoin to drop sharply from nearly $95,000 to $76,000, gradually approaching our previously predicted target of $70,000 for the 2B top decline, showcasing the most thrilling "roller coaster" market of the year. The formation of this perfect storm resembles the convergence of three forces: the uncertainty of the Federal Reserve's monetary policy, the "powder keg effect" of Trump's economic policies, and the liquidity restructuring within the crypto market itself.

Currently, the futures market has woven a dramatic script for the Federal Reserve—although the March meeting remained unchanged, traders are betting with almost artistic imagination on consecutive rate cuts in June, July, and October. This expectation sharply contrasts with Fed Chairman Powell's hawkish remarks on the unfinished battle against inflation, exposing the deep contradictions in market logic: while CME interest rate futures indicate a 78% probability of a rate cut in June, Goldman Sachs has downgraded its U.S. GDP growth forecast to 1.7% while raising inflation expectations. This bet on rate cuts under the shadow of "stagflation" is essentially a panic hedge against a hard landing of the economy. As Ed Yardeni, president of Yardeni Research, warned, a 35% probability of recession combined with Trump's Tariff 2.0 policy could repeat the lightning crash of 1987, bringing "the calm before the storm" to the crypto market.

The "powder keg effect" of Trump's policies is reshaping the global capital flow landscape. The former president's recent shocking statement that "a significant drop on Wall Street would be beneficial for negotiations" is akin to throwing a cognitive nuclear bomb into the financial market. Data shows that within two months of his taking office, the crypto market's market value evaporated by $912 billion, a drop of 25.18%, while the holdings of the seven major tech stocks in the U.S. fell to a 22-month low. More strategically significant is the Trump administration's support for stablecoin policies, which is triggering the European Central Bank's defensive mechanisms—when the Eurogroup president warns that "this could undermine the monetary sovereignty of the Eurozone," digital assets have quietly become a new battleground for great power competition. This elevation of geopolitical financial games presents an opportunity for the "digital gold" narrative of Bitcoin to undergo a value reassessment.

The crypto market is undergoing an unprecedented liquidity restructuring. Coinank data shows that as BTC fell to a recent low of $76,600, gradually approaching our previously predicted target of $70,000 for the 2B top decline, there was a spectacular outflow of over 2,800 BTC from centralized exchanges (CEX) in the past 24 hours, with a massive outflow of 8,533 BTC from Coinbase Pro alone, indicating that major players are hoarding and reluctant to sell. This phenomenon of migration among exchanges coincides with on-chain monitoring revealing that the inflow rate of stablecoins has hit a six-month low, suggesting that the market is experiencing a paradigm shift from "leverage frenzy" to "holding and waiting." Interestingly, while U.S. stock crypto concept stocks saw a subtle 4% rise, exposing the cognitive time lag between traditional capital and on-chain funds—when BlackRock's IBIT continues to attract capital, on-chain whales have begun transferring their ammunition to cold wallets.

At this current juncture, Bitcoin's volatility index (BVOL) has climbed to an annual high of 87, which reflects both the pricing of macro uncertainty and a stress test of market resilience. Historical experience shows that when the Federal Reserve begins a rate-cutting cycle, crypto assets often exhibit a deep V-shaped trend of initial suppression followed by a rise. However, the uniqueness of this cycle lies in the fact that the crypto market is facing multiple tests of geopolitical games, regulatory framework restructuring, and deep participation from traditional institutions for the first time at a trillion-dollar scale. As the managing director of the European Stability Mechanism stated: the butterfly effect of the digital asset market can stir up a hurricane in the sovereign currency system. In this spring filled with uncertainty, Bitcoin may be undergoing its final rite of passage before becoming a mainstream asset—only by navigating through this perfect storm can it truly complete its transformation from a rebellious youth to a financial new aristocrat.

Data Analysis:

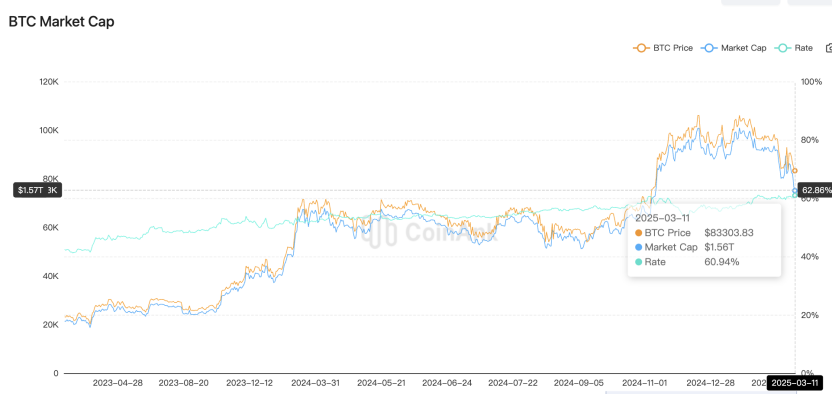

Coinank data shows that BTC's market value has fallen to around $1.56 trillion. Since reaching an all-time high on December 16, 2024, the cryptocurrency market has evaporated $1.3 trillion in market value, a decline of 33%, equivalent to an average daily loss of $15.5 billion over 84 consecutive days. This marks the largest three-month market value correction in cryptocurrency history, with the total value of the crypto market now at its lowest level since November 6, 2024, meaning that the bullish market brought about by the U.S. presidential election has been completely reversed.

We believe that the current deep correction in the cryptocurrency market can be seen as the result of multiple factors resonating. First, changes in the political cycle and policy expectations constitute the core driver. During the 2024 U.S. election, the "regulatory easing expectations" brought about by Trump's victory had previously propelled the market to an all-time high, with his supportive stance on cryptocurrencies seen as a structural positive. However, as the policy dividends are gradually digested, the market has begun to reassess the uncertainties of actual regulatory implementation, especially the liquidity contraction triggered by the Federal Reserve's shift in monetary policy (reduction of rate cut plans), which has directly exacerbated the evaporation of market value. Secondly, changes in the macroeconomic environment have prompted an increase in demand for safe-haven assets. The surge in U.S. Treasury yields reflects a decline in risk appetite in traditional financial markets, with some funds flowing back from the high volatility of cryptocurrencies to low-risk assets, further shrinking market liquidity. Additionally, there is significant endogenous adjustment pressure within the market. The previous speculative rise overly reliant on the "Trump trade" lacked fundamental support, and when there is a gap between policy expectations and implementation pace, it inevitably triggers a reassessment of value. Notably, this correction has completely reversed the gains from the election market, indicating that the market's pricing of political factors is shifting from emotion-driven to rational gaming. Looking ahead, the recovery of the cryptocurrency market will depend on the clarification of the regulatory framework, the synergistic effects of macroeconomic policies, and whether it can break through the "political narrative dependency" to form a new value consensus.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。