Original Author: Decentralised.Co

Original Compilation: Block unicorn

This article is inspired by a series of conversations with Ganesh Swami, covering the seasonality of income, the evolution of business models, and whether token buybacks are the best use of protocol capital. It serves as a supplement to my previous article on the stagnation of cryptocurrency.

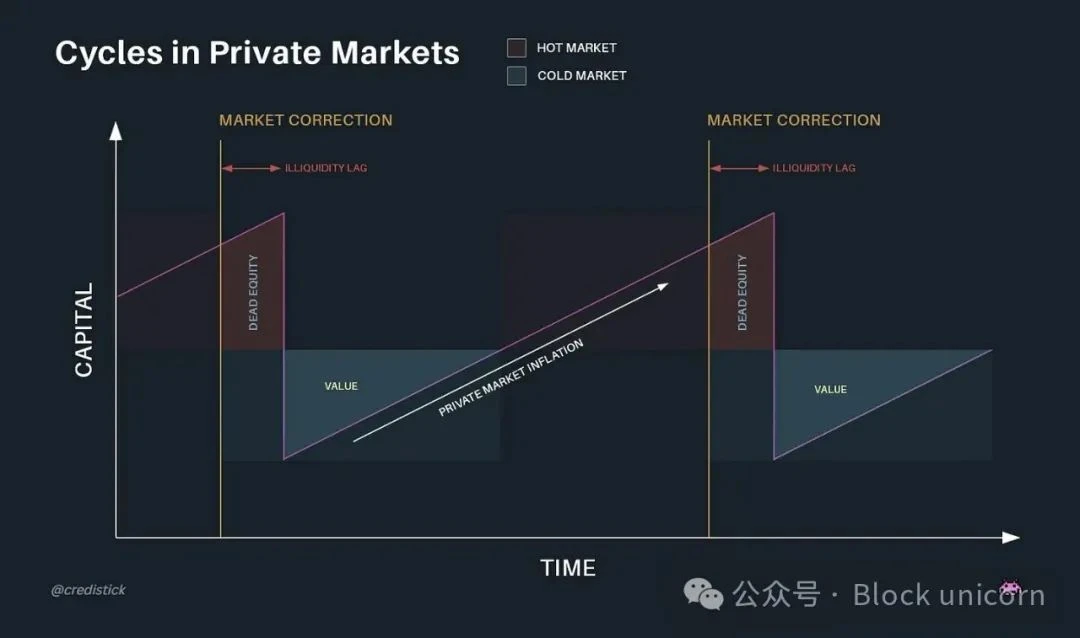

Private capital markets, such as venture capital, oscillate between liquidity excess and scarcity. When these assets become liquid and external capital floods in, market euphoria drives prices up. Think of newly launched IPOs or token offerings. Newly discovered liquidity allows investors to take on more risk, which in turn spurs the birth of a new generation of companies. As asset prices rise, investors seek to shift funds into early applications, hoping for higher returns than benchmarks like ETH and SOL. This is a feature, not a bug.

The liquidity of cryptocurrencies follows a cyclical pattern tied to Bitcoin halving. Historically, market rebounds occur within six months following a Bitcoin halving. In 2024, ETF inflows and Saylor's purchases will act as absorbers of Bitcoin supply. Saylor alone spent $22.1 billion on Bitcoin last year. However, the surge in Bitcoin's price last year did not translate into a rebound for the long tail of small altcoins.

We are witnessing an era where capital allocators face liquidity constraints, their attention scattered across thousands of assets, while founders who have been working on tokens for years struggle to find meaning in it all. Why would anyone bother building real applications when launching meme assets can yield more financial returns? In previous cycles, L2 tokens enjoyed a premium due to exchange listings and venture capital support, driven by perceived value. But as more participants flood the market, that perception (and its valuation premium) is fading.

As a result, the valuations of tokens held by L2s are decreasing, limiting their ability to subsidize smaller products through grants or token-based revenue. This overvaluation, in turn, forces founders to confront an age-old question that plagues all economic activity—where does revenue come from?

So Transactional

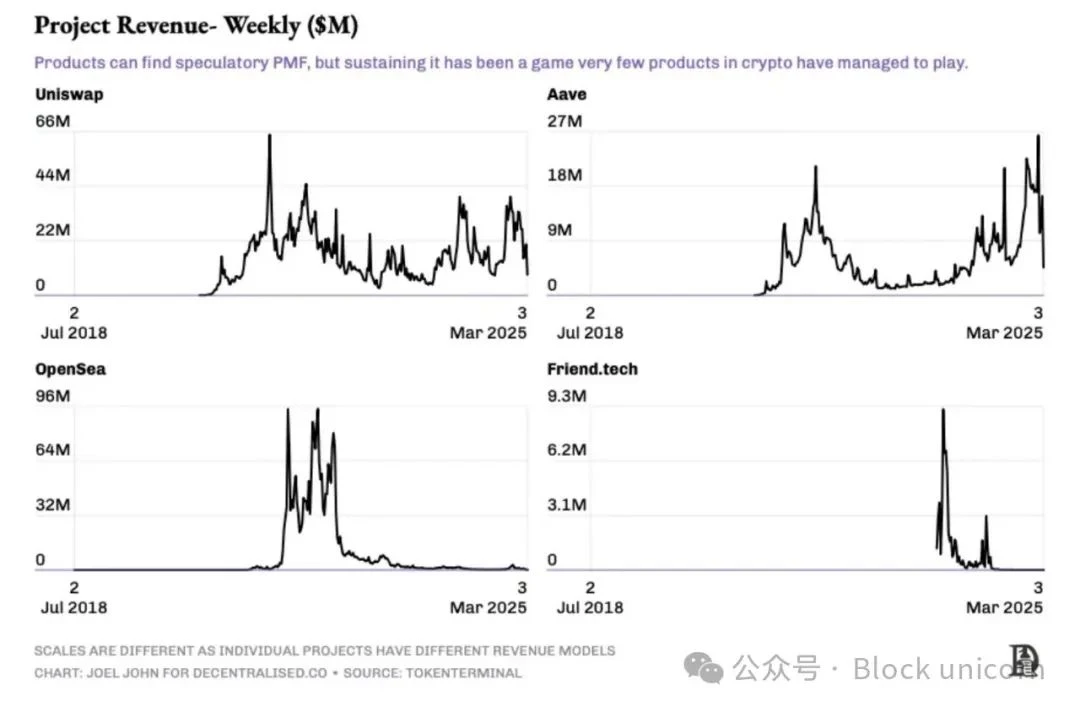

The above image illustrates how cryptocurrency income typically operates. For most products, the ideal state is that of AAVE and Uniswap. Thanks to the Lindy effect or early advantages—these two products have maintained fees for years. Uniswap can even increase front-end fees and generate revenue. This indicates the degree to which consumer preferences are defined. Uniswap is to decentralized exchanges what Google is to search.

In contrast, the revenues of friendtech and OpenSea are seasonal. During NFT summer, the market cycle lasted two quarters, while social finance speculation lasted only two months. If the scale of revenue is large enough and aligns with product intent, speculative revenue from the product makes sense. Many meme trading platforms have joined the club of those with fees exceeding $100 million. The scale of this figure is what most founders can expect at best through tokens or acquisitions. But for most founders, such success is rare. They are not building consumer applications; they focus on infrastructure, where the revenue dynamics are different.

Between 2018 and 2021, venture capital heavily funded developer tools, hoping developers would attract large user bases. But by 2024, two significant changes occurred in the ecosystem. First, smart contracts achieved unlimited scalability with limited human intervention. Uniswap or OpenSea do not need to scale their teams in proportion to trading volume. Second, advancements in LLM and AI have reduced the investment demand for cryptocurrency developer tools. Thus, as a category, it is at a moment of reckoning.

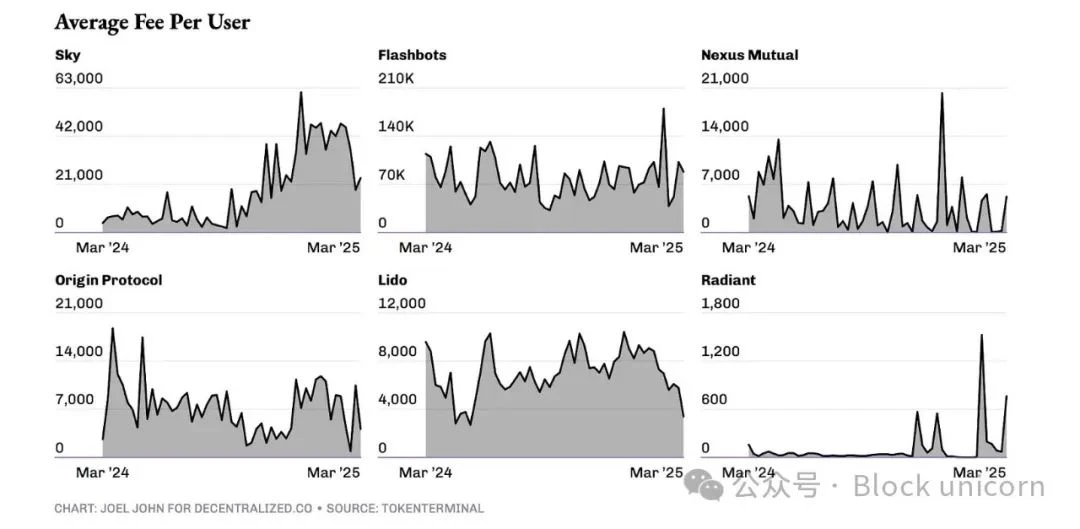

In Web2, the effectiveness of API-based subscription models stems from the vast number of online users. However, Web3 is a smaller niche market, with few applications scaling to millions of users. Our advantage lies in the high revenue metrics per user. Cryptocurrency's average user tends to spend more money more frequently because blockchains enable this—they facilitate the flow of funds. Therefore, in the next 18 months, most businesses will have to redesign their business models to derive revenue directly from users in the form of transaction fees.

This is not a new concept. Stripe initially charged per API call, and Shopify charged a fixed fee for subscriptions, later both shifted to revenue-sharing models. For infrastructure providers, this model's conversion in Web3 is quite straightforward. They will undercut the market on API aspects—possibly even offering products for free up to a certain trading volume before negotiating revenue-sharing. This is the ideal hypothetical scenario.

What would this look like in practice? One example is Polymarket. Currently, the UMA protocol's token is used for dispute resolution, with tokens tied to disputes. The more markets there are, the higher the probability of disputes occurring. This drives demand for UMA tokens. In the trading model, the required margin could be a small fraction of the total bet amount, say 0.10%. For example, a $1 billion bet on the presidential election outcome would generate $1 million in revenue for UMA. Hypothetically, UMA could use this revenue to buy back and burn their tokens. This practice has its benefits and challenges, which we will soon see.

Another participant doing this is MetaMask. The trading volume processed through its embedded exchange feature is about $36 billion. Revenue from swaps alone exceeds $300 million. Similar models apply to staking providers like Luganode, where fees are based on the amount of staked assets.

But in a market where the cost of API calls is decreasing, why would developers choose one infrastructure provider over another? If revenue sharing is required, why choose one oracle over another? The answer lies in network effects. Data providers that support multiple blockchains, offer unparalleled data granularity, and can index new chains faster will become the preferred choice for new products. The same logic applies to transaction categories like intent or gasless swap facilitators. The more chains supported, the lower the margins, and the faster the speed, the higher the likelihood of attracting new products, as this marginal efficiency helps retain users.

Total Burn

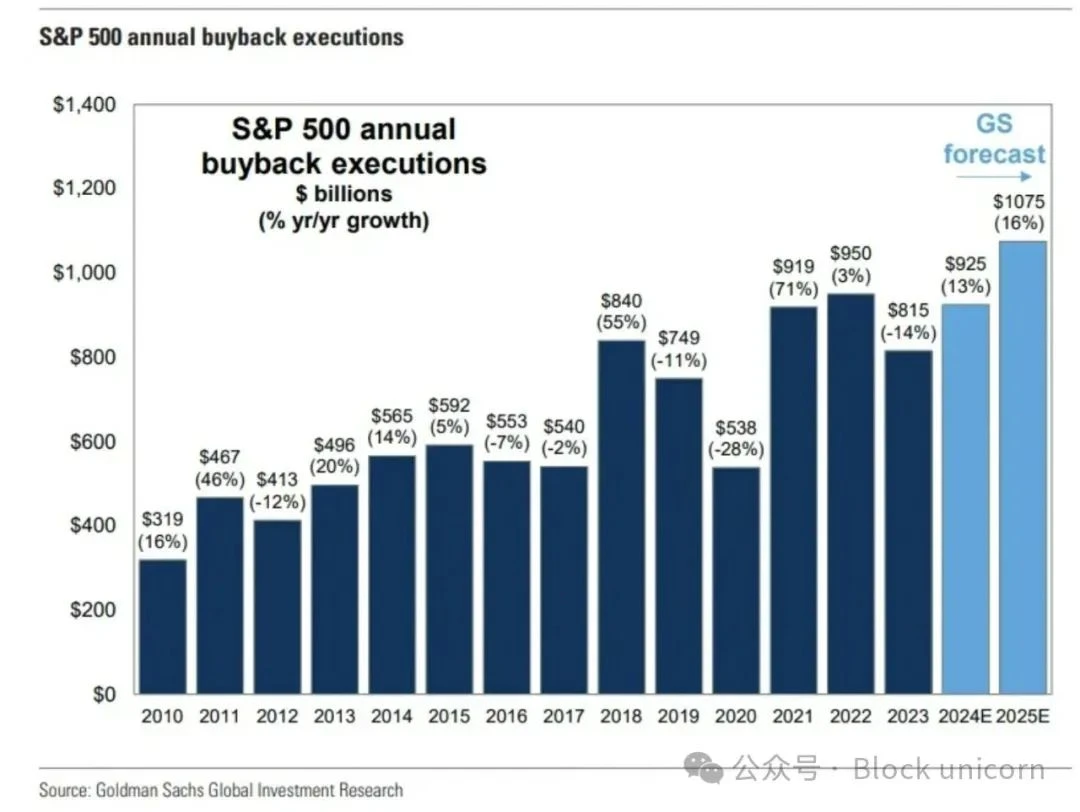

The shift to tie token value to protocol revenue is not new. In recent weeks, several teams have announced mechanisms for proportional buybacks or burns based on revenue. Notable among them are SkyEcosystem, Ronin Network, Jito SOL, Kaito AI, and Gearbox Protocol. Token buybacks are akin to stock buybacks in the U.S. stock market—essentially a way to return value to shareholders (or in this case, token holders) without violating securities laws. In 2024, there will be about $790 billion for stock buybacks in the U.S. market, compared to $170 billion in 2000. Whether these trends will continue remains to be seen, but we clearly see a market divide, with one side having cash flow and a willingness to invest in its own value, and the other side lacking both.

For most early protocols or dApps, using revenue to buy back their own tokens may not be the best use of capital. One way to execute such operations is to allocate enough capital to offset the dilution caused by newly issued tokens. This is how the founder of Kaito recently explained their token buyback method. Kaito is a centralized company that uses tokens to incentivize its user base. The company receives centralized cash flow from its enterprise clients. They use a portion of that cash flow to execute buybacks through market makers. The amount purchased is double that of newly issued tokens, effectively making the network deflationary.

Ronin, on the other hand, takes a different approach. The blockchain adjusts fees based on the number of transactions per block. During peak usage, a portion of the network fees goes into Ronin's treasury. This is a way to control asset supply without necessarily buying back the tokens themselves. In both cases, the founders have designed mechanisms to link value to network economic activity.

In future articles, we will delve deeper into how these operations impact the price and on-chain behavior of tokens participating in such activities. But it is evident that as valuations are suppressed and the amount of venture capital flowing into cryptocurrency decreases, more teams will have to compete for the marginal funds flowing into our ecosystem. Since blockchains are essentially tracks for funds, most teams will turn to a model of charging based on trading volume. When this happens, if teams are tokenized, they will be incentivized to issue buyback and burn models. Teams that excel in this regard will emerge as winners in the liquidity market.

Of course, one day, all this discussion about price, yield, and income will become irrelevant. We will once again spend money on pictures of dogs and buy monkey NFTs. But looking at the current state of the market, most founders concerned about survival have already begun discussions around income and destruction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。