Author: Nancy, PANews

In the last bull market, Avalanche, which was primarily known as the "Ethereum killer," achieved prosperous development of its ecosystem through strategic layouts in DeFi and other sectors, reaching a market cap that once placed it in the top ten. However, with the significant cooling of the crypto market and intensified competition, the momentum of this once high-performance public chain has gradually faded. Now, Avalanche is exploring new growth paths through technological upgrades, ecosystem expansion, and real-world applications. Although there has been a recent uptick in on-chain activity, challenges such as management turmoil and external market pressures pose significant obstacles to a full recovery of its ecosystem.

On-chain activity shows signs of recovery, but ecological challenges remain

In this round of the crypto market cycle, most L1 public chains have gradually faded from mainstream view, with only a few remaining active. Avalanche is no exception. The overall vitality of the Avalanche ecosystem has significantly declined from its peak, with on-chain activities becoming increasingly sluggish, and key indicators such as total locked value (TVL), trading volume, and user activity showing substantial declines.

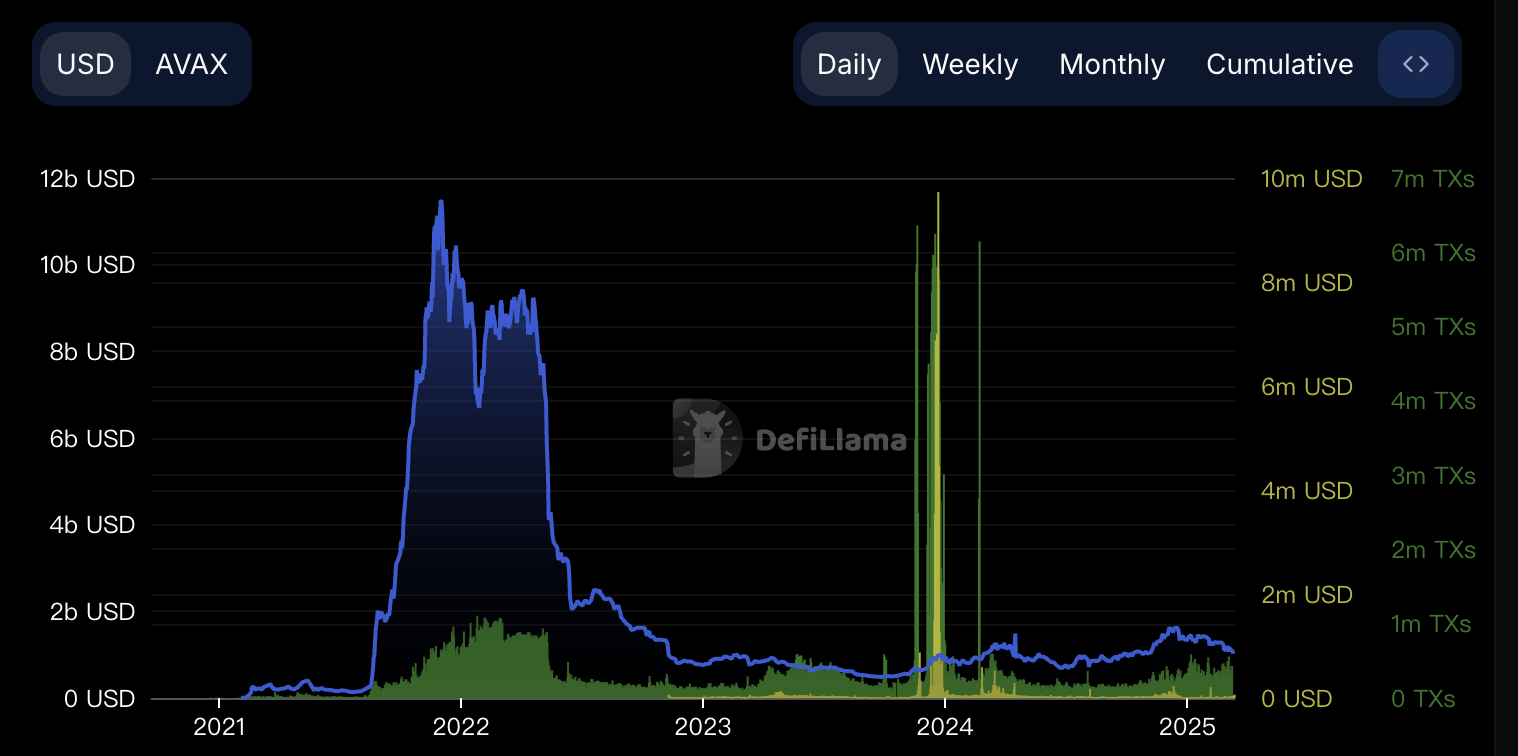

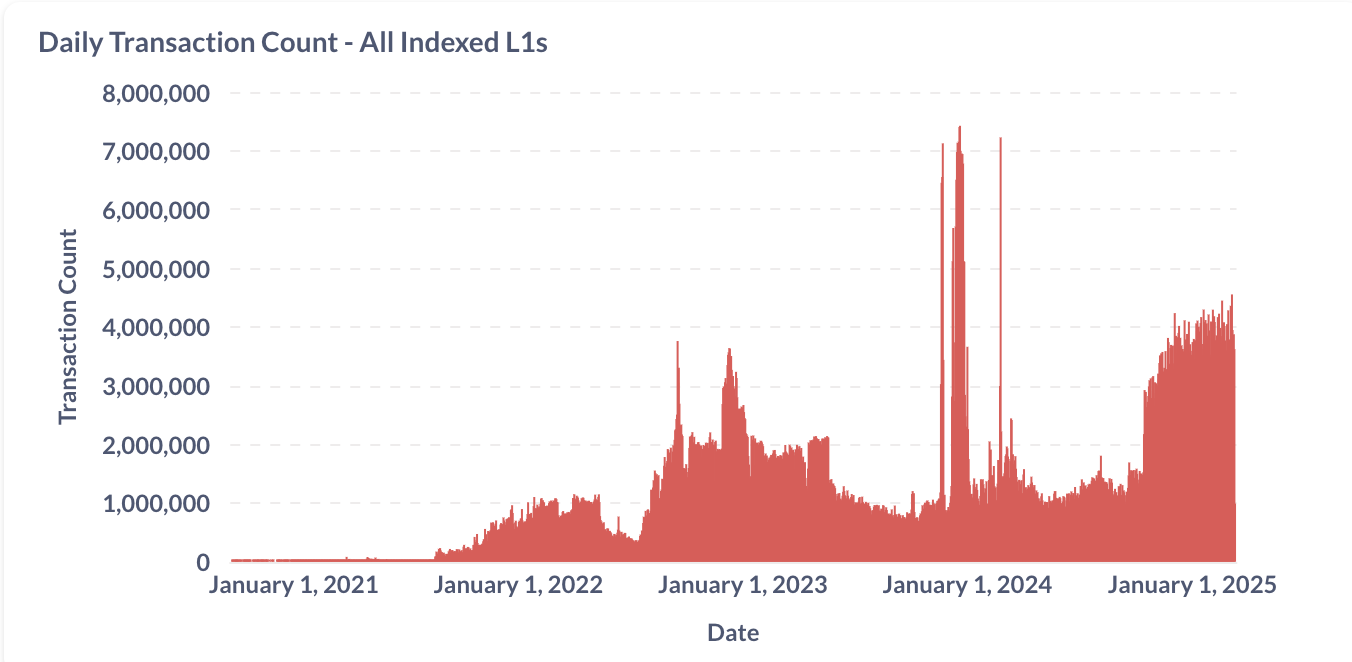

According to data from DeFiLlama, as of March 11, Avalanche's TVL was approximately $1.02 billion, a sharp drop of about 91.1% from its historical peak. Meanwhile, the daily number of transactions on Avalanche plummeted from 6.36 million in 2023 to the current 427,000, and daily revenue fell from $9.72 million at the end of 2023 to about $60,000. Although the decline of the Avalanche ecosystem is not an isolated phenomenon but rather a reflection of the overall weakness in the current crypto market, this series of data still indicates that the scale and economic activity of Avalanche's ecosystem are facing severe challenges.

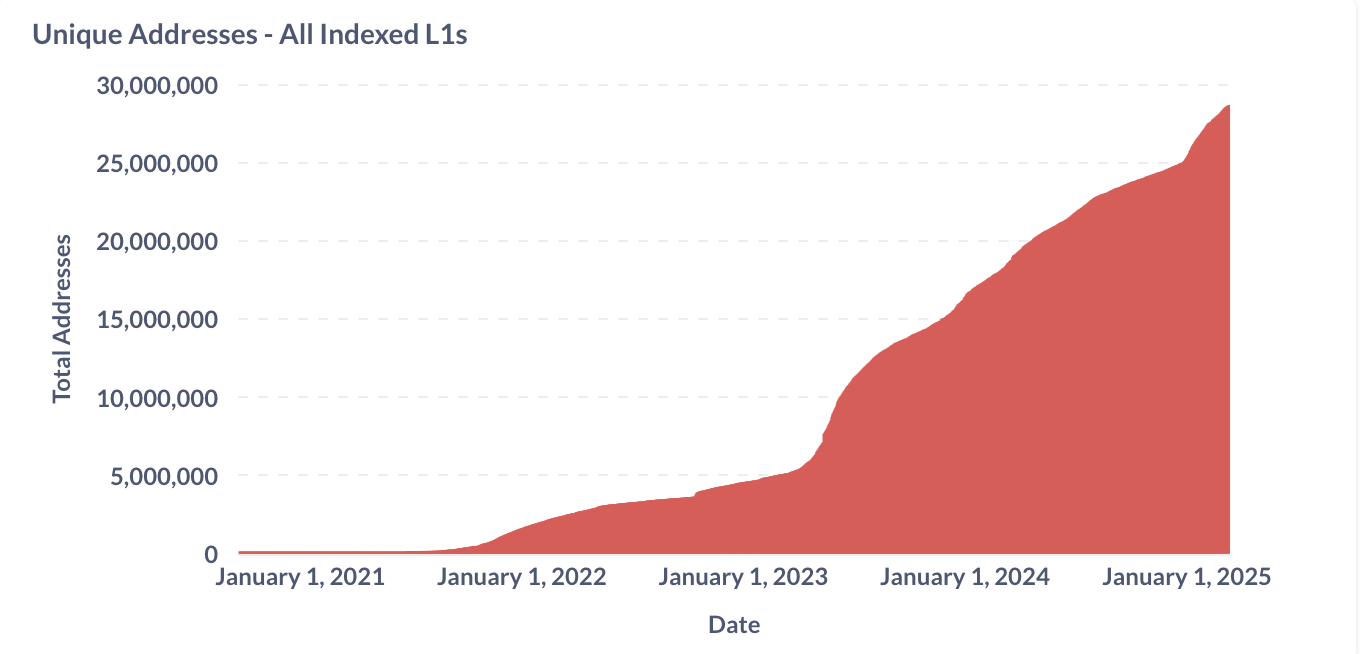

However, recent technological and ecological adjustments have brought some signs of recovery. According to the official website, as of March 11, the daily number of transactions on the Avalanche network peaked at 4.55 million this year, setting a new high for nearly a year. The total number of unique addresses has climbed to approximately 28.66 million, with the number of daily active addresses reaching 359,000 at one point this year, the best performance since February 2024.

Additionally, data from the Avalanche website and Staking Rewards shows that as of March 13, nearly 250 million AVAX have been staked, with a staking ratio as high as 56.16%, making it the tenth largest PoS blockchain network.

In the community's view, the rebound in several on-chain data points may indicate that Avalanche has not completely lost its competitiveness, but a full recovery of the ecosystem still faces multiple tests. Especially as the survival space for most L1 public chains continues to shrink, Avalanche's recovery will not only depend on improvements in the external market environment but also require revitalization and breakthroughs within its ecosystem.

Technological, ecological, and ETF narratives resonate, internal crises may become hidden concerns

From technological upgrades to real-world applications, and potential ETF narratives, Avalanche's recent market dynamics demonstrate its attempt to revitalize ecosystem vitality through multi-dimensional efforts. However, Avalanche is also facing uncertainties due to internal governance crises and external market pressures.

On the technological front, at the end of December 2024, Avalanche announced the launch of the Avalanche9000 upgrade, which can significantly reduce the costs of deploying "subnet" blockchains and running smart contracts, while optimizing the validation model and lowering the basic fees of the C chain (from 25 nAVAX to 1 nAVAX). This upgrade also supports independent operation of chains through the "Etna" module, significantly reducing project startup costs and meeting different regulatory requirements. Notably, the Avalanche Foundation raised $250 million from investment institutions such as Galaxy Digital, Dragonfly, and ParaFi Capital to support the upgrade deployment, with hundreds of first-level blockchains expected to go live in the coming months.

Earlier this month, Avalanche released its roadmap for 2025, which includes major updates such as the Etna network upgrade, the global adoption plan Avalanche9000 Campaign, and renaming subnets to Avalanche L1 to enhance flexibility. This further showcases Avalanche's ongoing deep optimization in technology.

On the ecological application front, Avalanche is showing a trend of blossoming in multiple areas. On one hand, Avalanche is refining its products, such as the comprehensive upgrade of the Avalanche core wallet, Core, which features a new brand identity, UI optimizations for mobile and browser plugins, with the new version expected to be released in early spring, aiming to lower the entry barrier for new users and enhance ecosystem stickiness through a simplified user interface and enhanced features (such as AI-driven interactions). On the other hand, Avalanche is expanding real-world use cases; for instance, in February this year, the Avalanche Visa card was launched, allowing users to use AVAX, wrapped AVAX, and stablecoins USDT and USDC at any store that accepts Visa; and Avalanche has partnered with tech companies like Republic, New York Red Bulls, Dantavada County in India, crypto disclosure solution provider Bluprynt, and crypto payment solution NOWPayments to implement real-world applications in areas such as film, sports, land, and payments. Additionally, Avalanche is also expanding its ecosystem, such as in the AI field, where the Avalanche Foundation has teamed up with Aethir to launch a $100 million fund, the infraBUIDL(AI) Program, to support AI innovation projects within the ecosystem.

As a U.S. concept project, Avalanche's parent company, Ava Labs, is a domestic company that may benefit from the gradual opening of the U.S. crypto regulatory environment. Ava Labs founder and CEO Emin Gün Sirer revealed last year that Avalanche is in discussions with the incoming new U.S. government, but the team will not flaunt its political connections with the government on social media; instead, it will showcase results in a "fully Avalanche style" and suggest the community "plan accordingly."

Moreover, according to Delaware company registration information, VanEck registered the "VanEck Avalanche ETF" on March 10, 2025. In addition to Avalanche, VanEck has also applied for spot ETFs for Solana and Ripple. Although these cryptocurrencies may attract more institutional attention and capital inflow after the ETF applications are approved, they are currently widely regarded by the market as being in a stage of hype rather than based on solid ecological value, making it difficult to translate into long-term growth momentum.

Despite the bright external progress, Avalanche faces turbulent challenges internally. According to a recent statement by former Avalanche Foundation director Omer on X, three directors, including Omer, Aytunç Yildizli, and Vikram Nagrani, officially resigned from the board of the foundation and its subsidiaries earlier this week. Among them, executive director Aytunç Yildizli ceased to perform his duties on February 28, 2025. This collective resignation was a difficult decision, and since then, the board has been in a state of stagnation, trying to find a way forward. The turmoil in management may affect Avalanche's strategic execution and weaken community confidence, especially during a market downturn.

In summary, the current technological upgrades and real-world applications inject vitality into the Avalanche ecosystem, while U.S. regulatory dividends and ETF potential add imaginative space. However, whether Avalanche can sound the horn for a counterattack will depend not only on the internal cultivation of technology and ecology but also on leveraging the tailwind of a market recovery.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。