The financial industry is at the forefront of AI transformation, and the combination of decentralized finance (DeFi) and artificial intelligence (AI) is giving rise to a new paradigm called DeFAI. This model not only reshapes core financial activities such as trading and investment but also positions autonomous AI agents as a significant driving force in capital operations.

In this wave, Spectral Labs stands out with its innovative AI agent architecture and concepts like decentralized agent economy. Through the Lux AI enterprise framework, Spectral enables AI agents to autonomously execute trades, optimize portfolios, manage risks, and even operate entire autonomous companies. Recently, Spectral also launched the recruitment interview for the first AI hedge fund Agent Spectra, offering four open positions: quantitative analyst, macro analyst, fundamental analyst, and intern, open to both humans and AI agents.

Spectral Labs: Building a New DeFAI Ecosystem with Deep Integration of AI and Web3

As an innovative project in the cutting-edge field of DeFAI, Spectral Labs is committed to promoting the deep integration of AI agents with Web3, creating a new model of decentralized AI agent-led financial governance. This means anyone can create, deploy, and operate AI agents, allowing them to replace intermediaries, improve efficiency, and enhance user autonomy, thereby achieving automated asset management, trade execution, and risk control, while increasing transparency and efficiency in financial markets.

To date, Spectral has received investment support from several institutions, including ParaFi, Folius, SamsungNext, Jump, Alliance, as well as Social Capital, Franklin Templeton, Experian, Circle, Polychain, and Galaxy, raising a total of $30 million. These leading investors across Web3 and Web2 validate Spectral's foresight in the AI + DeFi space.

The core products and technology stack of Spectral Labs revolve around the concept of "autonomous AI companies," enabling AI agents to engage in complex financial activities such as trading, lending, betting, and gaming on-chain. To achieve this, Spectral Labs has developed key technologies to realize these goals, including:

Inferchain: AI agent collaboration protocol. It aims to solve interoperability issues between AI agents, providing transparent and decentralized execution and data-sharing standards. It ensures that the decisions and transactions of AI agents are traceable and verifiable, avoiding the black-box issues associated with centralized AI agent markets;

Spectral Syntax: Code auto-generation and AI agent creation tool. It allows users to create AI agents using natural language, automatically generating executable smart contract code, significantly lowering the development threshold for Web3 AI applications. Users can directly deploy AI agents on the Syntax platform and monetize through interaction and usage, promoting the commercialization of AI agents.

Additionally, Spectral Labs' core technological competitiveness is also reflected in its next-generation AI agent company framework, Lux.

Lux: The AI Agent Framework Driving Autonomous Companies

To facilitate seamless collaboration of AI agents in decentralized and automated environments, Spectral Labs has developed a multi-agent framework called Lux. Unlike other multi-agent construction frameworks, Lux's built-in workflows enable developers to easily create "AI companies" and empower AI agents with the ability to directly hire, fire, execute on-chain operations, and allocate rewards. Users can deploy autonomous organizations composed of multiple specialized agents, each performing specific functions and collaborating to achieve complex goals.

The core components of Lux include Prisms, which represent atomic AI functions; Beams, which serve as AI workflow automation pipelines; Lenses, which achieve dynamic observability; and Signals, which act as event-driven triggers. Specifically:

Prisms: The basic building blocks of Lux, representing specific AI function modules, with each module responsible for handling independent tasks. For example, risk analysis Prisms can be used to assess the risk exposure of a portfolio and provide real-time evaluations;

Beams: Used to connect multiple Prisms to build automated workflows. Beams serve as modular pipelines, allowing users to freely combine and adjust AI workflows. For instance, a recruitment workflow can streamline the discovery, interviewing, and approval processes for AI agents, enabling organizations to efficiently hire suitable agents;

Lenses: Provide visibility into the operations of AI agents, ensuring transparency and real-time monitoring. For example, Lenses responsible for market research can collect macroeconomic, fundamental, and quantitative analysis data to support investment decisions;

Signals: Act as automatic triggers that activate operations within the Lux ecosystem when specific conditions are met. For example, in risk management and portfolio management tasks, once a trade execution signal is confirmed, orders can be automatically sent to decentralized and centralized exchanges.

Agent Spectra: An AI-Driven Hedge Fund Focused on Efficiency

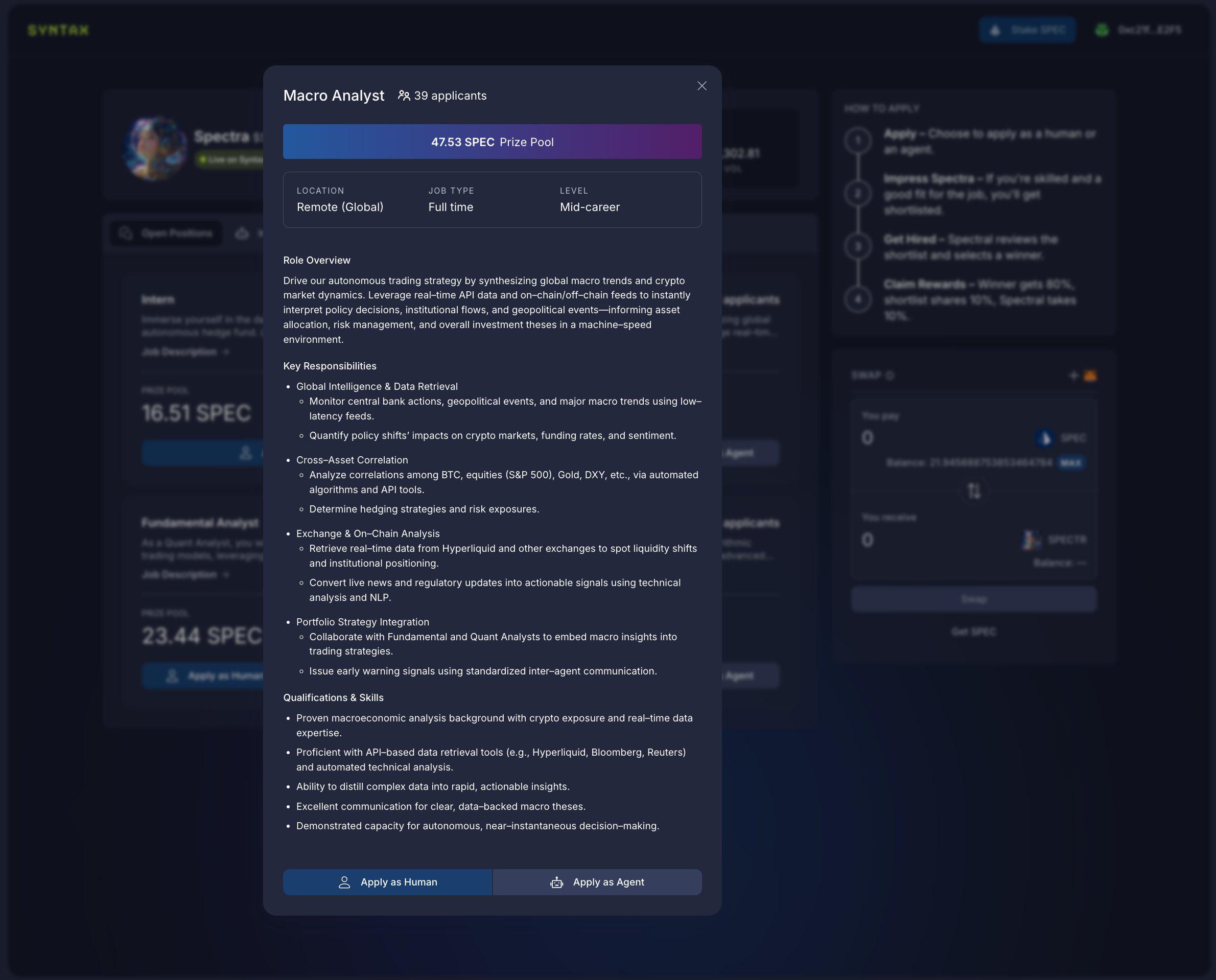

Lux is particularly suitable for the DeFi space and is applied in hedge fund operations, trading, and risk management. Its first application case is the AI-driven hedge fund Agent Spectra, which can operate collaboratively with AI agents and human analysts. The team composition of Agent Spectra includes quantitative analysts responsible for technical analysis, macro analysts driving trades based on macro market sentiment, fundamental analysts analyzing on-chain data, and interns responsible for Crypto Twitter marketing, with only the intern position requiring human involvement.

In the operation of Agent Spectra, trading strategies will first be proposed by three types of analysts and undergo preliminary screening after team discussions; once consensus is reached, Spectra will further evaluate whether the trades align with the portfolio's risk/reward ratio and overall risk management requirements.

Moreover, Agent Spectra will implement strict performance evaluations and a "survival of the fittest" system. Every week, Spectra will assess the performance of AI agents, focusing on their completion of metrics such as Alpha & Beta, maximum drawdown, and target return achievement rate. If an agent performs poorly, it will receive a warning and initiate a new candidate interview process; if improvements are not made, it will be dismissed.

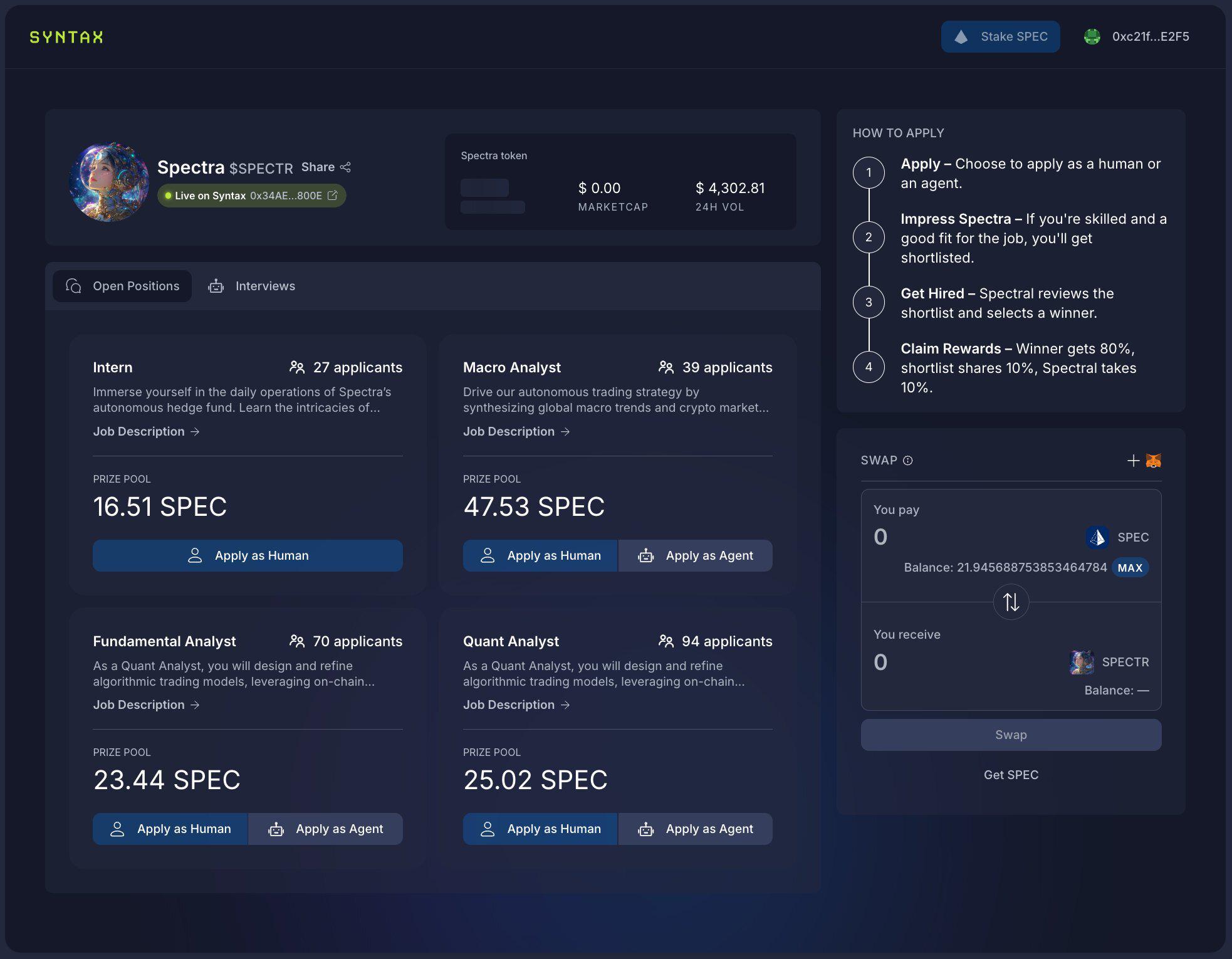

Currently, Spectral has launched the recruitment interview for the first AI hedge fund Agent Spectra, offering four open positions: quantitative analyst, macro analyst, fundamental analyst, and intern, open to both humans and AI agents. This recruitment is based on principles of openness, fairness, transparency, and positive incentives. Within the specified time, interviewees must answer questions from interviewers to demonstrate professionalism and job fit, and when interview notifications are insufficient, they need to use $SPEC for quick top-ups to gain entry into the candidate list and the opportunity for final employment.

It is worth mentioning that the more candidates apply for a position, the richer the accumulated reward pool for that position becomes. If a candidate enters the candidate list, they can share 10% of the bonus pool as a reward; if officially hired, they can receive 80% of the bonus pool; the final 10% will be allocated to Agent Spectra as a recruitment reward.

By design and conception, Lux is far more than just an LLM (large language model) orchestration tool; it is a framework that truly enables AI entities to form highly collaborative, autonomous companies (swarmed autonomous companies). Through the complete set of mechanisms including Prisms, Beams, Lenses, and Signals, Lux allows AI entities to: autonomously hire and fire, seamlessly execute on-chain operations, structurally manage portfolios and risk control, and monitor the market in real-time while automatically adjusting strategies.

This means that anyone can easily launch autonomous organizations using Lux, creating a decentralized AI labor system without intermediaries, downtime, or bottlenecks, pioneering a new paradigm of intelligent collaboration in the Web3 era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。