Original Title: "Of nadirs and bidding death in memecoins"

Original Author: @Ga__ke

Translation: Scof, ChainCatcher

It has been a while since I wrote something. Looking back at my trading thoughts in 2024, some of the views on meme coin selection still apply, but it seems we have now entered a whole new realm. In 2024, we experienced a market evolution from pure meme coins > celebrity coins > art tokens > AI/tech/utility tokens. At that time, the replacement of mainstream market hotspots was relatively clear—when and what themes became market trends often had clear boundaries and timelines.

However, fast forward to 2025, what we see is a chaotic token landscape: past hot projects are struggling to capture market attention—they once thrived, but most have now experienced a 70-90% retracement. Unfortunately, those still holding on are often just a few "last buyers" or old players who frequently enter and exit, hoping for the next wave of selling. Of course, these projects are not necessarily scams; they resemble a game of "pass the parcel"—the market (or players) always chases the latest hotspots, unless there is sufficient reason for everyone to refocus on past projects.

Meanwhile, entirely new meme tracks and tech concepts are fiercely competing, making the market landscape even more complex. 2024 has laid the groundwork for "attention tokenization" across various industries, and Trump's "official" token has given the entire market (both good and bad projects) a green light. In this chaos, we begin to see multiple tokens of different themes and lifecycles coexisting simultaneously. However, it must be recognized that market liquidity, like our attention, is cyclical. Today's headline hotspot may be ignored tomorrow, and tomorrow's hotspot is unpredictable (laughs).

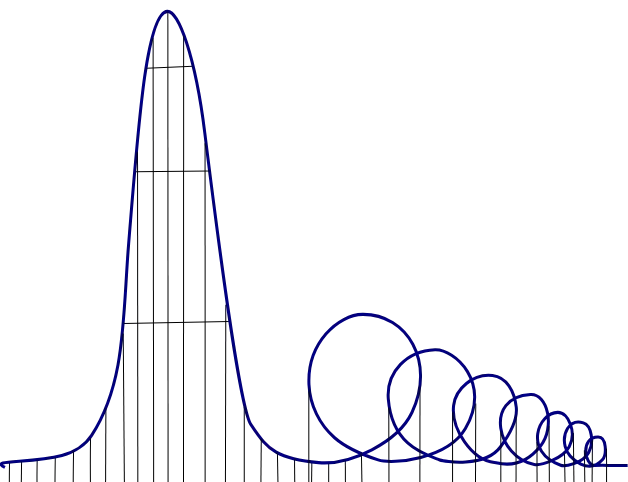

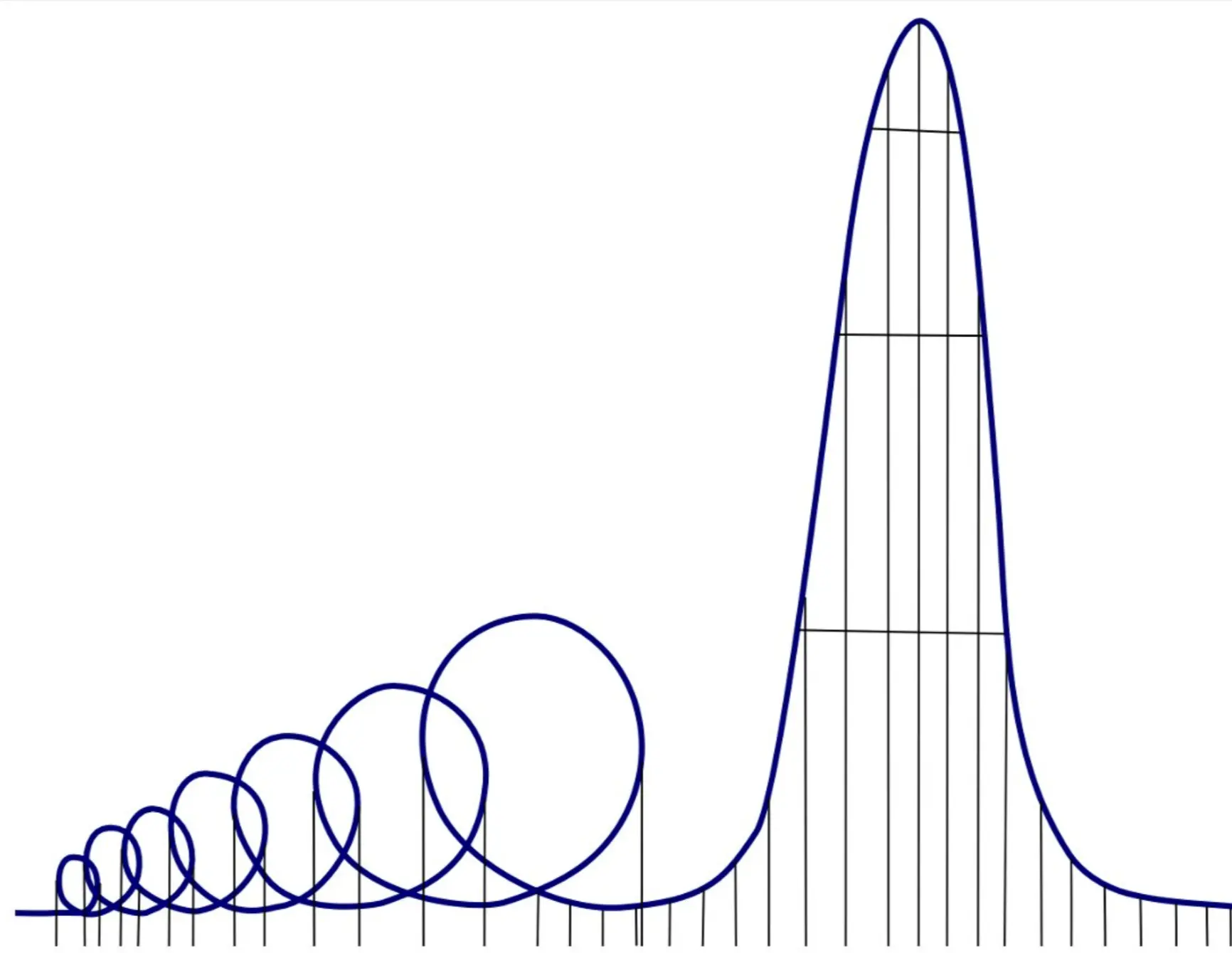

Therefore, various themed tokens will continue to coexist, and each track will experience its own liquidity cycle. What does this mean? Do you remember this image?

Now, imagine this as a price chart of a single token; at the same time, you can flip it over, and it becomes the chart of another token.

Further, in your mind, overlay these charts, realizing that there are 112,931,920,482 tokens on the blockchain, each with its own highs and lows; meanwhile, the overall trends of each track are at different stages—some have just hit the nadir, while others have reached the zenith.

My core point is: there are always countless trading opportunities in the market; the key is to discover those trades that have not yet been fully exploited. Of course, the vast majority of tokens may ultimately amount to nothing, but you can at least put them on your watchlist, leave yourself a note, or set price alerts to revisit them at the right time.

In 2024, we covered almost all major tokenized attention tracks. I previously mentioned some key categories, and now I will elaborate. Some projects last less than a week, while others that once thrived have already bottomed out.

Pure meme coins—these tokens are purely for fun, often originating from viral trends on X (Twitter) / TikTok, or retro nostalgic memes. The "copypasta" play and the viral spread's flywheel effect are most prominent here.

Celebrity coins—these tokens rely on a certain influential figure, with many projects' core logic being to harvest the market using fan effects. Although this field is filled with "ATM-like" projects, it still provides an opportunity window—because they can "guide ordinary users into the crypto space."

Art tokens—tokens supported by art, which can be seen as an evolved version of the NFT community to some extent.

AI/tech/utility tokens—these tokens carry some form of technology or utility at least conceptually. I once said I would never trade such tokens, but market conditions are constantly changing, and we need to adapt. The market often values "technological prospects" rather than the actual technology itself—in other words, the selling point is "news expectations," not the technology itself (sell the news / the idea of the news).

Web2 community tokens—similar to celebrity coins, but they rely on existing Web2 communities, leveraging the existing fan base to project into the Web3 space.

News/tweet tokens—these tokens are often quick speculations on a short-term hotspot and can set a "market direction" (meta) in a short time. These tokens usually rise very quickly and fall just as rapidly; of course, they may also have a second chance. But don't FOMO (fear of missing out) too much during the first surge, or you might get buried.

The categories listed above are not exhaustive; they are merely an attempt to simplify the analysis process. So, will new categories emerge in the future? I hope so—generally speaking, new market trends (meta) often come with the richest rewards. However, as mentioned earlier, different categories of tokens are gradually establishing themselves, and their lifecycles are at different stages, making the market boundaries increasingly blurred. Coupled with the market cooling after the Trump token frenzy, we see more "bearposting." Indeed, it is hard to imagine what events could surpass that wave of excitement; at least for now, I personally do not see a clear direction.

Nevertheless, I still welcome this slowdown in market rhythm. As someone who leans more towards holding rather than short-term trading, I benefit more in such a market environment—the market is returning to the dominance of categories 1/3/4, which are typically slower-paced, community-driven, and have more organic growth characteristics.

In the selection of meme coins, some thoughts from 2024 still apply (especially categories 1/3). However, as more and more tokens experience over 90% retracement, new entry opportunities arise. Here are some key factors that may become catalysts in the future:

Community expansion: Who might be the future supporters of this token? In fact, in most cases, they don't even need to actually buy in; just the market's expectation of their buying can be enough to drive the price up. For example, the MLG token was dormant for 7 months until it was picked up again, ultimately attracting attention from big names like Faze. Core strategy: tell a good story and leverage the "attention flywheel" (sell the story and the idea of an attention flywheel).

Current community/team status: Is the tech still progressing? (Is the tech still teching?) Are developers still maintaining it? (Is dev still devving?) Is the community atmosphere still active? (Is the community still vibing?) For traditional meme coins, I usually recommend assessing community resilience during market pullbacks; for category 4 tokens (tech/utility tokens), deeper research into project progress is needed to see if more funding and attention are flowing in. This growth does not always directly reflect in market cap, so there are arbitrage opportunities here.

Mainstream coverage: Similar to community expansion, but here the emphasis is on traditional media's attention to specific events. For example, the political discussions around the pnut token, ongoing coverage of moo deng, or traditional finance (TradFi) shifting towards a specific industry (like AI/robotics). Essentially, this is about positioning for news expectations in advance, but the key is: the expectations cannot be too obvious; otherwise, the trade becomes crowded too early.

As with any trade, you need to enter before the market becomes crowded and exit in batches as the market gradually fills up. Think at each stage: who is the marginal buyer? Is this story still a good story?

Potential risks to be aware of:

Position management (Sizing). You may have found 312,849 reasons to believe certain tokens will skyrocket, but the question is—do you really have enough capital to allocate reasonably? Be aware that the funds you put into these projects may never return, so you still need to keep enough liquidity to participate in the mainstream tracks and hot tokens in the current market. The good side is that if you bought these tokens at the bottom, even if they ultimately do not explode, your retracement is usually not too large. But if you spread your funds across 1,293 tokens, you will realize this could become a serious issue.

Moat/legitimacy. You may have ample reasons to believe a certain token should rise again, and the market trend seems to be developing as you expected. But suddenly—someone issues a brand new token, and all market funds flood into that project! This is the sad reality of the Pump.fun era; now anyone who knows nothing about blockchain can easily issue tokens, which is why the market is flooded with 12,312 "broccolis" and 12,903 "neiros." Solution? If you truly believe in your investment logic, then spread your funds across all possible options and patiently wait for the market to filter out the winners. If your capital distribution is too scattered, you can withdraw part of your initial investment early and then wait for the market to choose the final winner before concentrating your position. My personal examples are chillguy and mnc; ultimately, the market will decide which one prevails.

I also understand that this trading approach is not suitable for everyone. In this market, there are countless ways to make and lose money—at best, you will be seen as a genius; at worst, it is just a form of self-comfort. But repeated experiences have taught me that focusing on those forgotten corners of the market and lurking on tokens after the storm is an effective strategy for me. Just as I write this article, a random Fortnite token is the latest case of this pattern, and we have seen similar situations many times before.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。