Just yesterday, Andre Cronje, the founder of Sonic, updated his social media profile to include his role as the founder of FlyingTulip. Following his strong promotion of Shadow's (3,3) micro-innovation, this move has sparked a discussion on Sonic. In the current phase of market transition between bull and bear, the market is eagerly seeking new narratives and increments. What has AC, who once brought glory to DeFi, prepared this time, and what will it bring to Sonic? Before FlyingTulip officially launches, Rhythm BlockBeats will provide you with a preliminary analysis based on the existing information.

Although the product has not officially launched, according to the information on the official website, FlyingTulip will be a one-stop DeFi integration platform, including trading, liquidity pools, lending, and other functions, allowing spot, leverage, and perpetual trading to be concentrated in one AMM protocol without needing to store them in different protocols, thus solving the problem of fragmented liquidity. The official claims that this product can bring: a 42% reduction in impermanent loss, a 9-fold increase in LP return rates, and an 85% improvement in capital efficiency compared to other DEX protocols.

For traders, LP pool providers, and institutional traders, the official has listed several points and compared them with the top similar functions of CEX and DEX in the market. For ordinary traders, it can provide lower trading fees, better liquidity quotes, and higher leverage "claimed to be up to 1000X." For liquidity providers, it offers multi-purpose liquidity "earning trading fees, lending fees, and options fees simultaneously." For institutional traders, the product adopts a hybrid compliance model "fully integrated with compliance tools, including OFAC screening, tax reporting, and wallet reporting," and uses a "non-custodial wallet" format to reduce credit costs.

Two Innovative Technologies

Adaptive Curve AMM

Typically, AMM pools, like Uniswap V2, follow the constant product formula "X*Y=k," which leads to liquidity being evenly distributed across all price points, but most trades occur within a smaller price range. The concentrated liquidity range introduced in V3 requires more specialized knowledge, and when prices experience large fluctuations, liquidity providers suffer from impermanent loss, making it very unfriendly for newcomers.

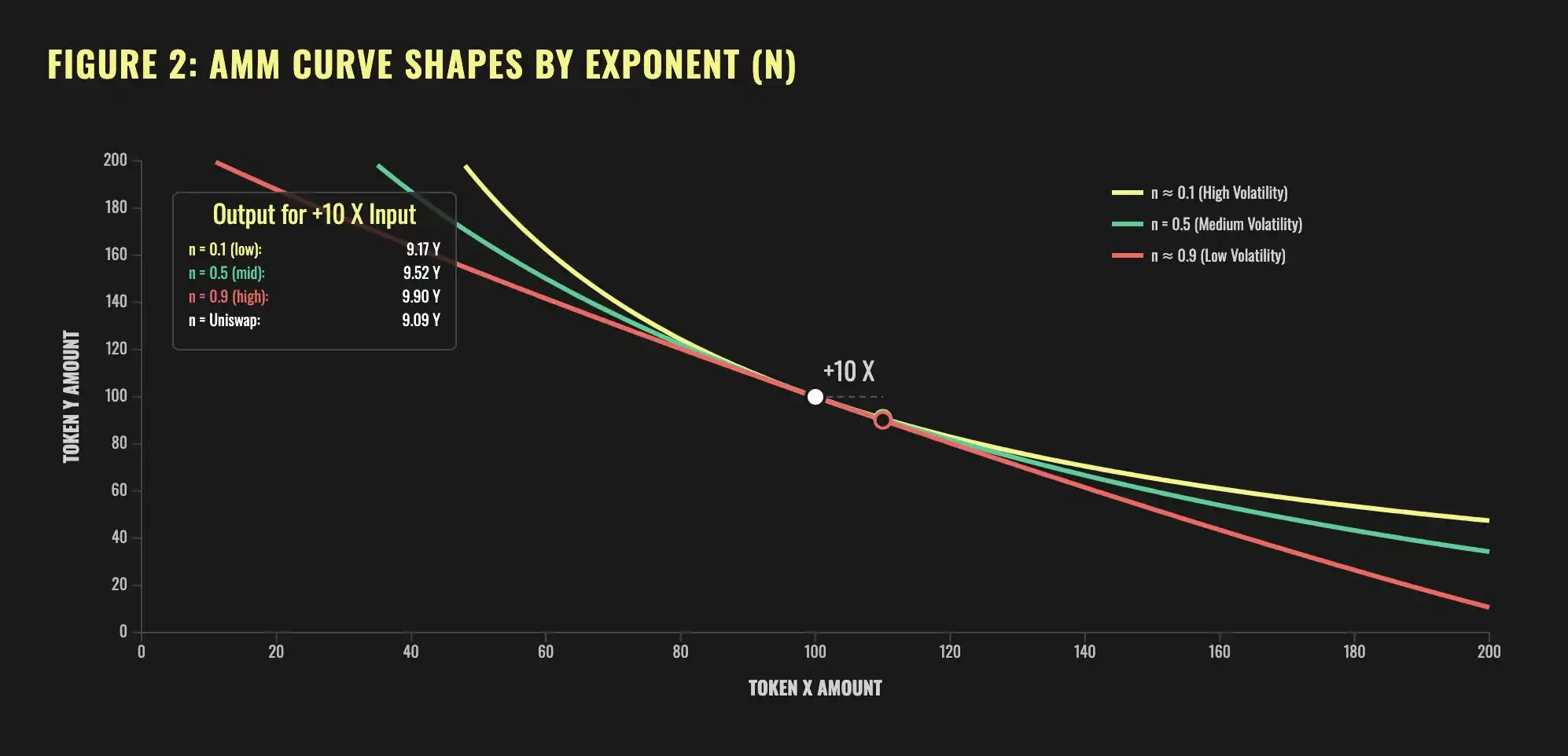

FlyingTulip's innovative dynamic AMM automatically adjusts the curve shape based on market volatility. In low-volatility markets, the curve approaches the shape of "X+Y=K" (constant sum curve), while in high-volatility markets, the curve approaches the shape of "X*Y=K" (constant product curve). The system continuously monitors the real-time volatility "rVOL" and implied volatility "IV" of assets through oracles. When volatility is low, liquidity automatically concentrates around the current price "similar to LP manually concentrating liquidity in Uniswap V3." When volatility is high, liquidity automatically disperses to cope with potential large price changes.

This makes FlyingTulip a platform where newcomers can provide liquidity without complex interval strategy settings; they just need to add liquidity, and the system will customize the interval and change it according to market fluctuations, thus obtaining the best return rates while reducing impermanent loss, a "grandma-friendly DeFi."

AMM-Based LTV Model

Based on the adaptive AMM, FlyingTulip has also created a new LTV lending model "Loan-to-Value."

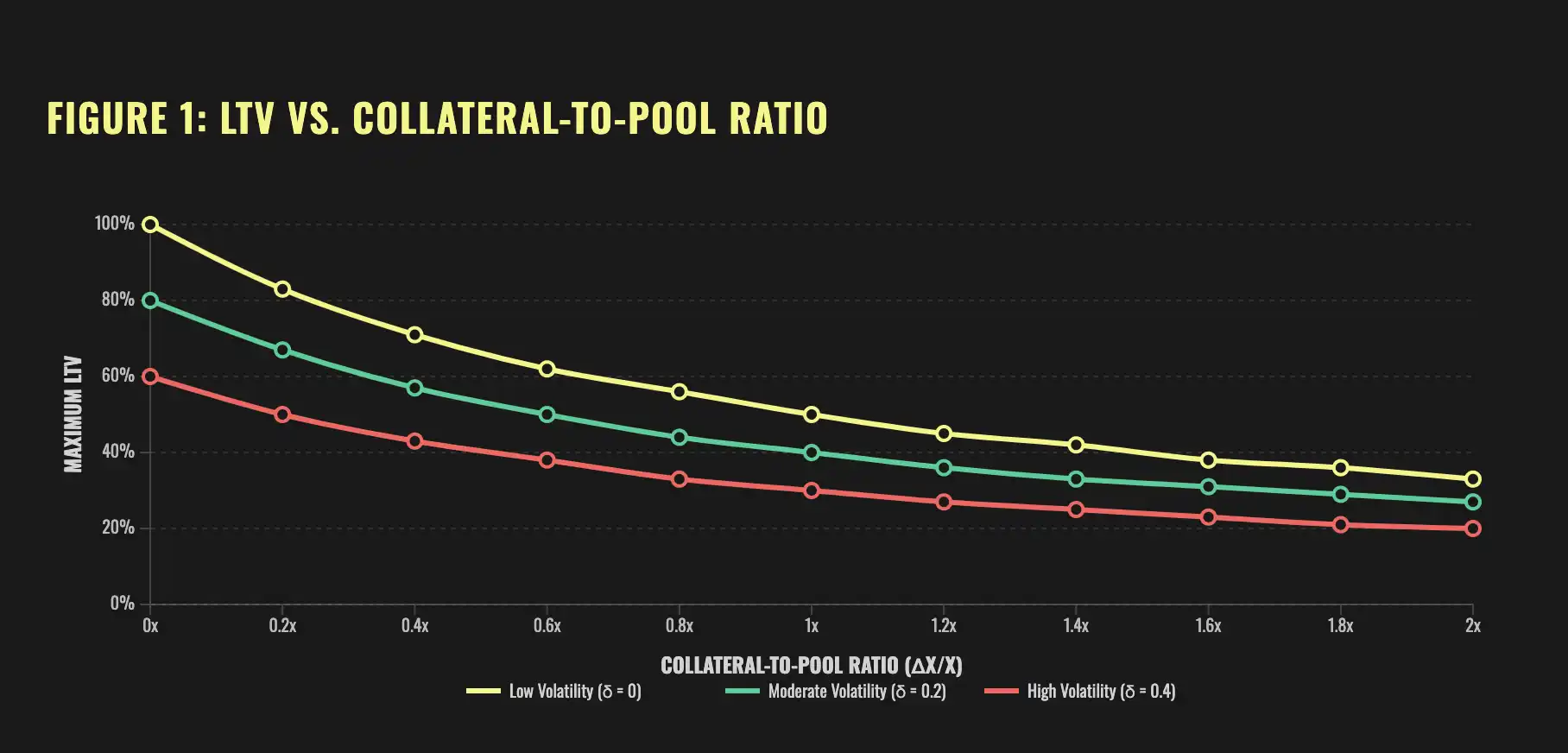

LTV refers to the ratio of how much other tokens can be borrowed after collateralizing a certain token. In traditional DeFi, platforms typically assess the risk level of a token. For example, if a token is deemed to have a medium risk level, only 70% of its collateral value can be borrowed. This fixed ratio overlooks two important factors: "market depth" and "real-time volatility." The former can significantly impact token prices when the borrowing amount is too large, while the latter can create substantial liquidation risks in times of high market uncertainty.

FlyingTulip has created a mathematical model that dynamically adjusts LTV based on real-time conditions, balancing "market depth" and "real-time volatility." For instance, if 1 ETH (worth $2000) is collateralized, various scenarios may arise in FlyingTulip. In a calm market, one might be able to borrow $1600 (80% LTV), while in a highly volatile market, only $1000 (50% LTV) might be available. If the collateral's value is significantly larger than the current market depth ratio, borrowing might be limited to $900 (45% LTV).

The benefit of this approach is that in a safe market, users can borrow more funds, while in high-risk situations, the borrowing limit is automatically reduced to minimize risk, allowing users not to constantly monitor market fluctuations and adjust positions. This overall reduces the likelihood of chain reactions like price crashes during large liquidations.

The Next Generation of DeFi?

Indeed, in the current environment where CEX black swans frequently emerge, everyone is more concerned about the safety of funds and is gradually growing weary of the issues brought about by the closed market's dark forest, such as "pulling the plug," "pinning," "mysteriously being liquidated," and "being charged exorbitant trading fees," which has gradually diminished the advantages of CeFi. Coupled with the continuously upgraded DeFi infrastructure, more aggregated DEX/ecosystems like Hyperliquid are being recognized by the market.

The official FlyingTulip has directly claimed that "the next generation of DeFi" is about to arrive, with on-chain transparent execution, gasless transactions, ultra-low funding rates "below 0.02%," zero learning cost abstract wallets, no KYC requirements, adaptive curve AMM, better lending ratios, and LP returns. FlyingTulip aims to lower the entry barrier for users to the greatest extent, allowing newcomers to experience almost the same as CEX without high learning costs, as Web2 users' liquidity flows directly into the chain through simple and understandable DeFi without going through exchanges to earn returns.

Moreover, the innovation of dynamically adjusting prices and fees may redefine the balance between liquidity and stability. Additionally, integrating compliance tools like OFAC screening into the decentralized ecosystem aims to ensure that future decentralized finance does not compromise the core essence of DeFi while operating within regulatory frameworks.

However, two core issues will determine whether FlyingTulip can succeed. The first is whether the oracle can operate stably, which will represent whether the product can outperform other competitors at the product level, as both the AMM and LTV models are affected by realized volatility "rVOL," implied volatility "IV," time-weighted average price "TWAP," and risk-weighted average price "RWAP," all of which will directly impact yield and product stability.

The second is whether Andre Cronje can continuously create a wealth effect on Sonic that drives the ecosystem to "fission," achieving a critical effect that drives the flywheel, allowing FlyingTulip to serve as a bridge between Web2 and Web3. Regardless, we will have to wait until the product launches to draw conclusions, and Rhythm BlockBeats will continue to follow up.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。