Sonic is a bold attempt to replicate the success of Fantom and surpass it through a new L1 economics, bridging security, and high-speed execution.

Author: arndxt

Compiled by: Deep Tide TechFlow

Sonic is one of the most overlooked projects in the crypto space.

While Sei, Berachain, and Monad are still in the hype phase of their testnets, Sonic has already launched and has over 80 years of operational time. They are accumulating TVL (Total Value Locked) and rewarding developers in ways never attempted by other chains.

With over 10,000 transactions per second, sub-second final confirmation times, and a FeeM model that returns 90% of gas fees to developers, they are building a DeFi flywheel.

More importantly, they have also launched an airdrop worth over $190 million. Here are the key points you need to pay attention to, and how to achieve an annual percentage yield (APY) of up to 145,000%.

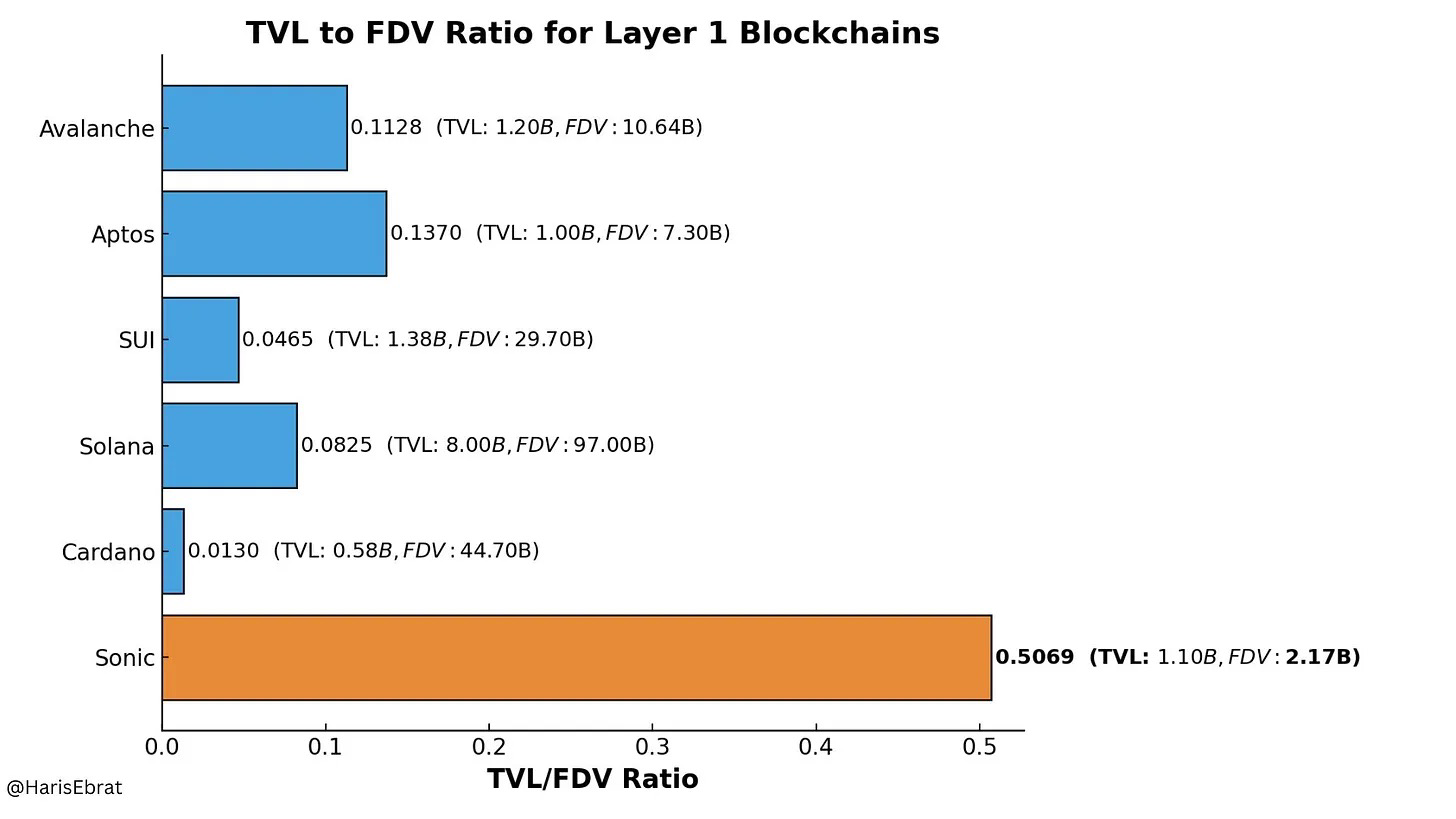

Source: @HarisEbrat

By the end of 2024, Fantom will officially rebrand as @SonicLabs, re-entering the Layer-1 (L1) blockchain space with a focus on transaction speed, ecological incentive mechanisms, and cross-chain interoperability.

In just a few months, Sonic's Total Value Locked (TVL) has seen significant growth, attracting a large number of new protocols to deploy on its chain. Notably, Sonic is about to launch an airdrop plan exceeding 190 million $S tokens, which has become a major driving force to attract DeFi developers and high-yield strategy participants.

1. Origin and Background: What Makes Sonic Unique

When @SonicLabs first launched, many did not see it as a project worth paying attention to. After all, the market is already flooded with countless Layer-1 (L1) blockchains claiming "high speed, low fees."

However, Sonic is indeed different for the following reasons:

Already Launched, Stable Operation: Unlike Sei, Berachain, and Monad, which are still in the testnet phase, Sonic has achieved real transactions, liquidity, and user operations, with plans for sustainable development lasting up to 80 years.

Born to Reward Developers: Through its innovative FeeM model, Sonic returns 90% of gas fees to decentralized application (dApp) developers, allowing project teams to profit directly from user activity.

Massive Airdrop Plan: Sonic plans to airdrop over 190 million S tokens to reward users who stake, provide liquidity, and actively participate in the ecosystem.

Rooted in the Best Ideas of DeFi: Sonic adopts and improves the ve(3,3) model while integrating advanced Ethereum Virtual Machine (EVM) scaling technologies to provide developers with more efficient solutions.

DeFi Flywheel Effect: The Cycle of Capital and Growth

Sonic's success is closely tied to the DeFi flywheel effect. The core of this effect lies in the time lag between capital deployment and actual value realization:

Liquidity Inflow: After funds flow in, token prices rise, attracting more users to join due to "fear of missing out (FOMO)";

Early Participants Profit: The ecosystem begins to reward early participants, attracting more users and gradually expanding the ecosystem;

New Users Stake or Reinvest: Holders maintain ecosystem momentum by staking or reinvesting tokens, keeping the flywheel effect in motion.

This model was first introduced in 2022 by DeFi legend Andre Cronje with the Solidly Exchange on Fantom.

Andre Cronje is the founder of Yearn Finance ($YFI), a token that skyrocketed from $6 to $30,000 in just two months during the DeFi summer.

The ve(3,3) model combines Curve Finance's veToken model with Olympus DAO's (3,3) game theory:

Voting Escrow (ve) Model: The longer users lock their tokens, the more rewards they receive;

(3,3) Game Theory: By incentivizing users to stake rather than sell, it reduces selling pressure and enhances ecosystem stability.

The core design of ve(3,3) is to enhance protocol liquidity through token staking while providing generous returns to long-term holders.

Unlike traditional liquidity mining models, ve(3,3) does not rely on high-inflation token rewards to attract "short-term speculative capital." Instead, it directly allocates fees generated by the protocol to locked token holders, incentivizing those willing to support ecosystem development in the long term.

This mechanism's underlying "flywheel effect" has been a significant driving force behind the rapid rise of the DeFi space.

Protocols adopting the ve(3,3) model often attract substantial liquidity, as users seek higher yields through token staking, and the increase in user numbers further drives yield growth.

However, this model is not a perpetual motion machine.

Over time, the momentum of the flywheel effect will inevitably weaken. Liquidity cannot grow indefinitely, and once early participants choose to cash out, the ecosystem will shift from "growth mode" to "exit mode," leading to a gradual stagnation of the cycle.

This leads us to the development history of Sonic:

Rebranding of Fantom

The once highly regarded blockchain Fantom (FTM) fell into difficulties after the Multichain bridging incident. This incident involved government asset seizures and system instability caused by bridging vulnerabilities, leading to a significant withdrawal of liquidity and stablecoins from the ecosystem, severely impacting developer morale.

The Rise of Sonic

In December 2024, Fantom announced a new start under the Sonic brand. This rebranding not only retained compatibility with the Ethereum Virtual Machine (EVM) but also brought several key technological upgrades, including a more secure cross-chain bridging mechanism and a more attractive, developer-oriented token economic model. Additionally, this rebranding welcomed back core figure Andre Cronje from the Fantom community, shifting the focus towards supporting high-speed, parallel transaction execution. This series of changes marks a comprehensive upgrade for Sonic in both technology and ecosystem, reinvigorating efforts to attract developers and users.

Why is it Worth Paying Attention to Right Now?

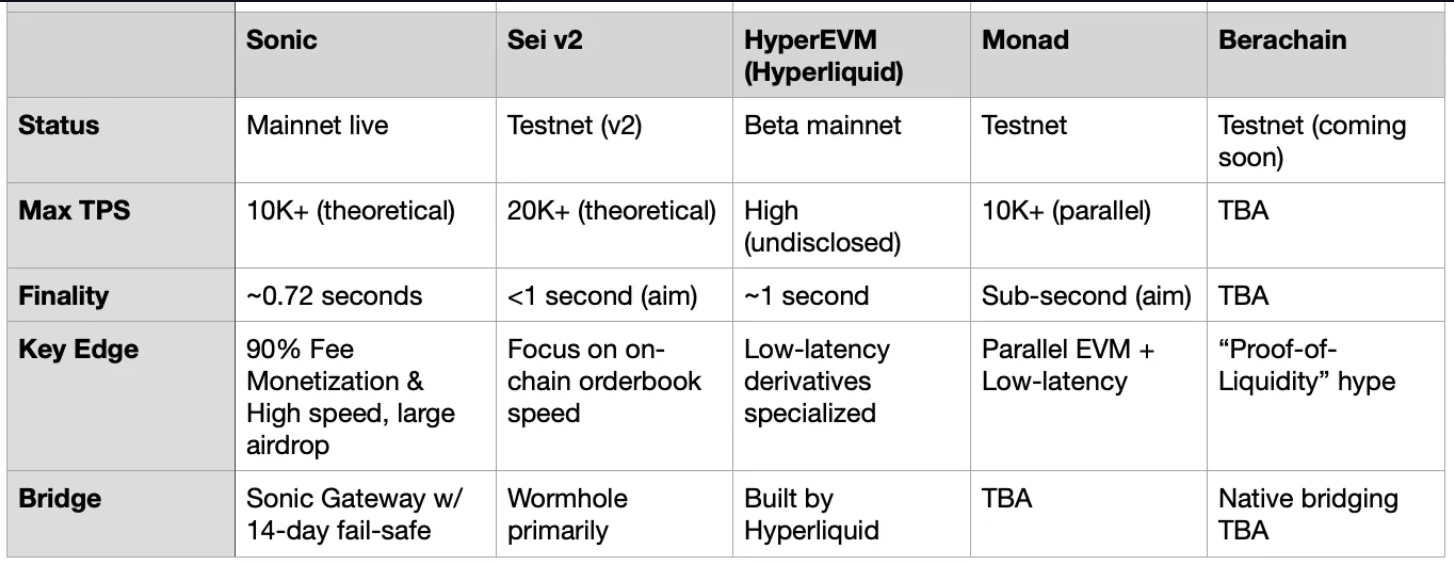

Despite many emerging L1 blockchains with advanced execution layers (such as Sei V2, HyperEVM, Monad, Berachain, MegaETH) still in testnet or pre-launch phases, Sonic has launched its mainnet and has withstood the pressure test of real TVL (Total Value Locked) inflows.

Sonic achieves speeds comparable to professionally optimized L1/L2 chains through sub-second final confirmation times and a parallel transaction engine, attracting the attention of DeFi developers and seasoned yield seekers—who are ready to shift their funds to faster, lower-cost chains.

2. Key Advantages Analysis

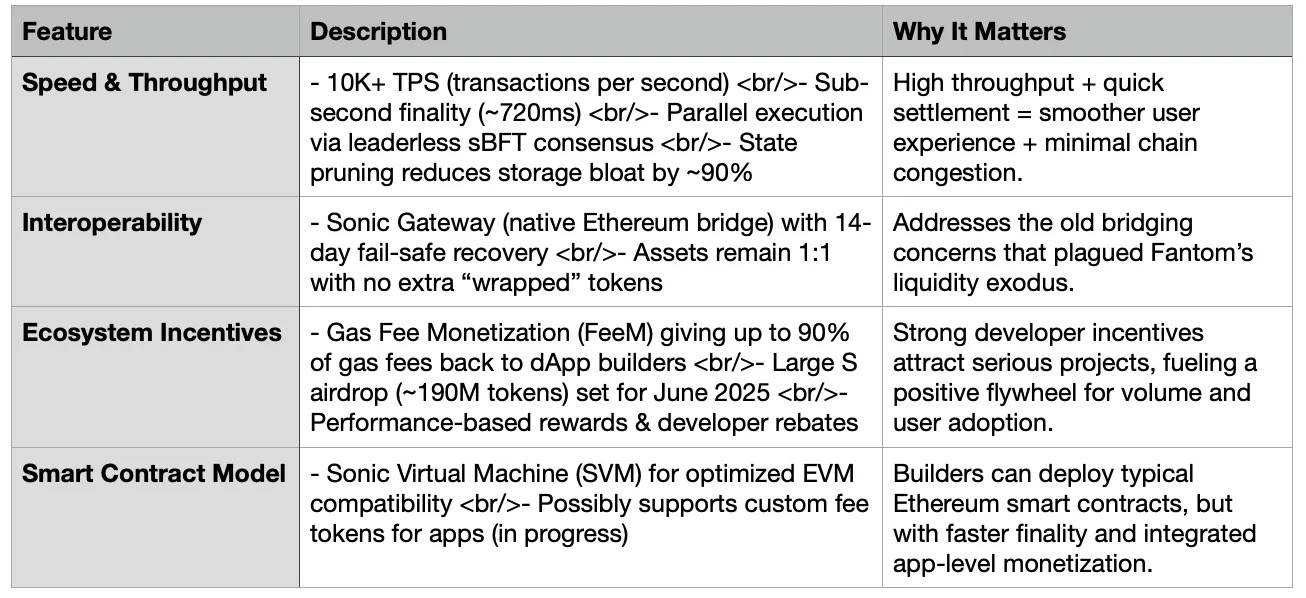

Here is a summary of Sonic's standout features, derived from this image ("What Makes Sonic Different from Other Chains?").

1. High Speed

Sonic prioritizes high-speed transactions, making it one of the fastest Layer-1 (L1) blockchains compatible with EVM. Key features include:

High Transaction Throughput

Sonic focuses on high-speed, parallel execution, and efficient state management, outperforming many existing EVM chains in scalability and transaction cost optimization.

Ten Thousand TPS Processing Capacity: Actual throughput exceeds 10,000 TPS, with daily transaction capacity surpassing 800 million, supporting large GameFi/DeFi ecosystem explosions.

Leaderless sBFT Consensus with Parallel Execution: Unlike traditional blockchains that rely on sequential execution, Sonic's consensus mechanism can process multiple transactions in parallel. This design enhances speed while maintaining security and finality.

Efficient State Management

State Pruning (90% Reduction in Storage Bloat): By removing unnecessary blockchain data, Sonic makes node operations lighter while reducing hardware requirements for validators. This helps improve decentralization as more participants can run full nodes.

Dynamic Gas Model: Ensures Low Fees Even Under High Load: The network automatically adjusts gas fees based on demand, preventing fee spikes due to congestion. This mechanism is crucial for maintaining affordability in high-traffic scenarios (such as token launches or DeFi transactions).

2. Interoperability

Sonic is designed for seamless cross-chain connectivity, allowing assets and liquidity to flow freely between blockchains.

Its interoperability model prioritizes security and reliability, addressing key weaknesses in existing multi-chain ecosystems.

Sonic Gateway – Trustless Native Bridging

No Dependence on Third Parties: Unlike traditional bridging methods that introduce centralized risks, Sonic's Gateway is natively integrated into the protocol. This significantly reduces the risk of being hacked or manipulated.

Fault Recovery System: Users Can Still Retrieve Assets Even if the Network or Bridge is Offline: One of the main issues with blockchain bridging is the risk of downtime or vulnerabilities. Sonic's fault recovery system ensures that assets remain recoverable even when the bridge is temporarily unavailable.

1:1 Asset Support, No Need for Wrapped Tokens

Always Support Asset Movement Between Sonic and Ethereum Unlike creating wrapped tokens (such as wBTC, wETH), Sonic ensures that native assets retain their original value. This not only enhances liquidity and usability but also reduces the smart contract risks associated with wrapping mechanisms.

3. Incentive Mechanism

Sonic offers the most developer-friendly incentive structure to promote ecosystem growth. Its incentive model tightly integrates network success with developer profitability and user participation, driving organic development of the ecosystem.

Gas Fee Monetization (FeeM Program)

Developers Earn 90% of Transaction Fee Revenue

Unlike traditional blockchain models that burn fees or allocate them to validators, Sonic directly returns gas fees to the applications generating transactions. This creates direct economic incentives for developers, encouraging them to build high-usage dApps (decentralized applications).

Performance-Based Rewards

High Usage Applications Can Earn Gems

Popular applications created by developers will receive additional Gems rewards, which can be passed on to users. This mechanism incentivizes both developers and end-users to actively participate in the ecosystem.

$200 Million Airdrop Through Sonic Innovators Fund

6% of Token Supply Allocated to Users

Users can earn points by interacting with eligible protocols, providing liquidity, or participating in governance. This structure encourages long-term participation and DeFi experimentation.

4. Smart Contracts

Sonic enhances the Ethereum Virtual Machine (EVM) experience through a more optimized and flexible framework. Its smart contract improvements make it an ideal alternative to traditional EVM environments, offering higher cost efficiency, execution speed, and flexibility.

Sonic Virtual Machine (SVM)

Optimized Smart Contract Performance

SVM optimizes Ethereum-based contract execution, reducing gas fees and improving efficiency. This is particularly important for complex DeFi applications, automated trading strategies, and gaming environments.

Custom Payment Tokens for dApps

Applications Can Use Their Native Tokens to Pay Transaction Fees

This feature allows projects to cover gas fees with their native tokens, improving user experience. Developers do not need to force users to hold $S tokens to pay gas fees but can set their own fee structures.

Seamless EVM Compatibility

Deploy Ethereum-Based Smart Contracts Without Modification

Developers can easily migrate their dApps from Ethereum, Arbitrum, Optimism, or other EVM-compatible chains to Sonic. This ensures a low-friction onboarding experience for projects transitioning to Sonic.

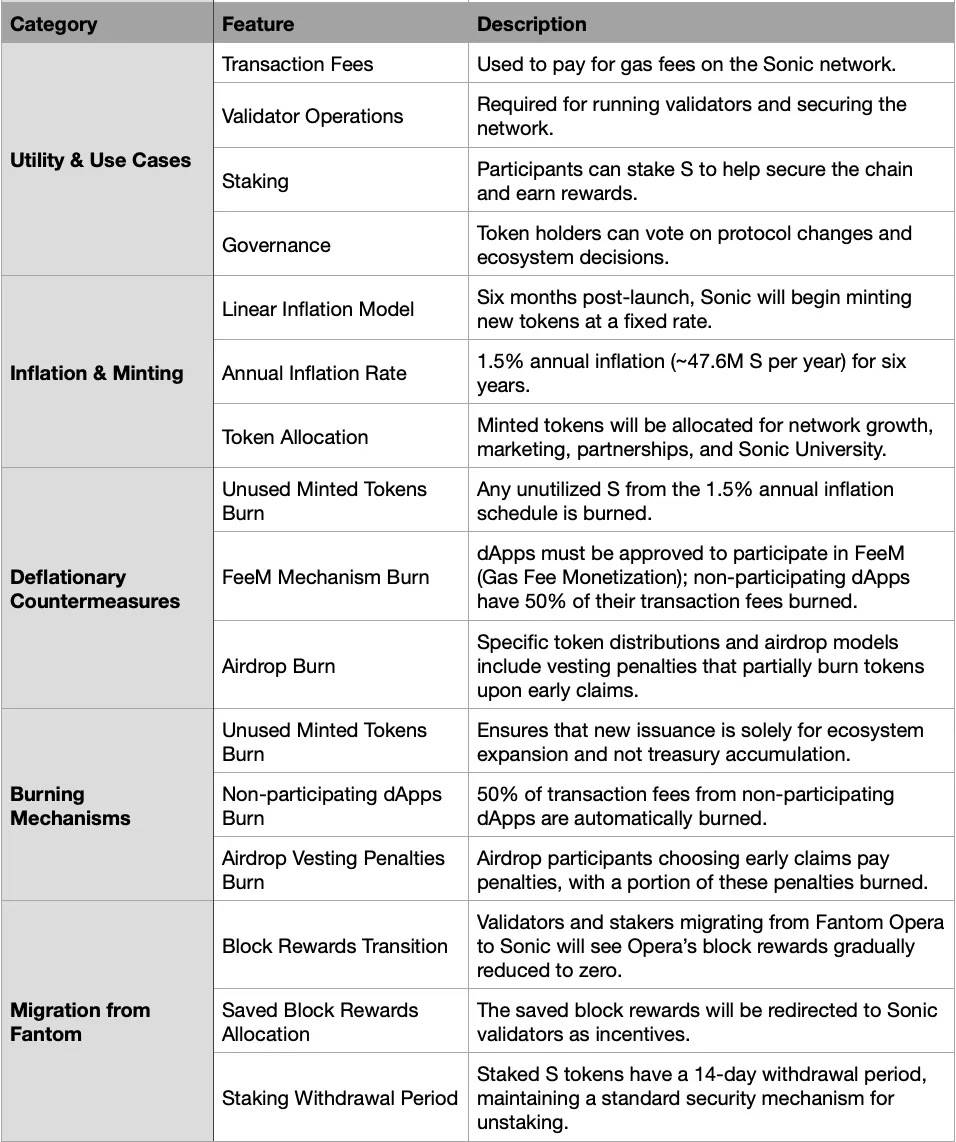

### Token Economics and Airdrop Mechanism

The S Token is the Native Asset of the Sonic Network, with Multiple Functions:

Functions and Use Cases

Transaction Fees: Used to pay gas fees on the Sonic network.

Validator Operations: Tokens required to run validator nodes and secure the network.

Staking: Participants can stake S tokens to help secure the chain and earn rewards.

Governance: Token holders can vote on protocol changes and ecosystem decisions.

Inflation and Minting Mechanism

Linear Inflation Model

Six months after the mainnet launch, Sonic will mint new tokens at a fixed rate.

The annual inflation rate is 1.5% (approximately 47.6 million new S tokens per year), continuing for six years.

Minted tokens will be used for network growth, marketing, partnerships, and the development of Sonic University.

Deflationary Measures

Any unused minted tokens will be burned at the end of each year.

This mechanism ensures that newly issued tokens are only used for ecosystem expansion and not accumulated in reserves.

Burning Mechanism

Sonic introduces various burning mechanisms to balance token issuance:

Burning of Unused Minted Tokens: Any unused annual 1.5% inflation tokens will be burned.

FeeM Mechanism Burn:

dApps participating in FeeM (Gas Fee Monetization) need to be approved.

Non-participating dApps: 50% of the transaction fees from these applications will be automatically burned.

Airdrop Burn: Certain token allocation and airdrop models include a vesting penalty mechanism, where a portion of tokens will be burned if users withdraw tokens early.

Migration from Fantom Opera

Transition of Block Rewards

Validators and stakers migrating from Fantom Opera to Sonic will see Opera's block rewards gradually decrease to zero.

The saved block rewards will be redistributed to Sonic's validators as an incentive.

Staking Withdrawal Period

Staked S tokens are subject to a 14-day withdrawal period to maintain standard unbonding security mechanisms.

Supply and Inflation

Initial Supply: Sonic's initial total supply is the same as Fantom's (approximately 3.175 billion tokens) to achieve a 1:1 FTM → S exchange.

Ongoing Inflation: Sonic introduces a 1.5% annual inflation mechanism, lasting up to 6 years, to fund ecosystem growth. Any unused tokens will be burned to prevent uncontrolled dilution.

Fee Burn: By default, 50% of transaction fees will be burned. As network usage increases, $S has the potential to become a net deflationary token under high network activity.

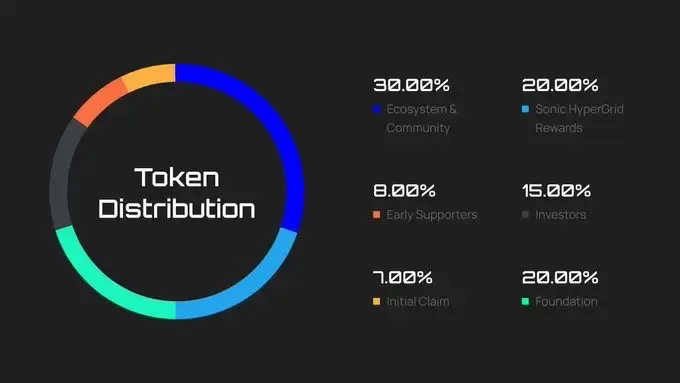

190.5M $S Airdrop (June 2025)

Purpose: Attract new users, reward early participants, and stimulate DeFi usage on Sonic.

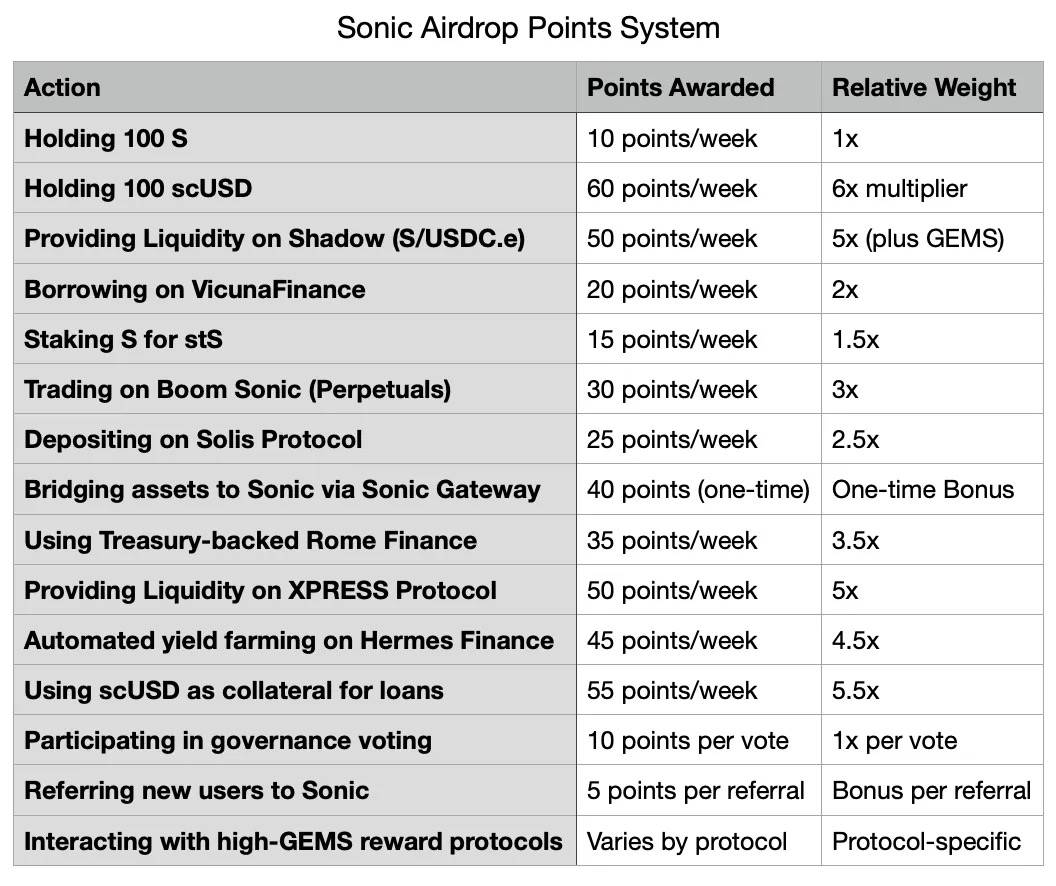

Point System: Users can accumulate "points" through the following methods:

Holding whitelisted assets (such as scUSD, stS, USDC.e, etc.) in their Sonic wallet.

Interacting with dApps (such as providing liquidity, lending).

Earning GEMS from specific protocols within the ecosystem (defined by developers).

Vesting Mechanism:

25% of the airdrop can be claimed immediately, while the remaining portion will be released linearly over approximately 9 months.

Users can also choose to accelerate their claim but will incur a penalty, resulting in a portion of tokens being burned.

Here is an example table of points and potential airdrop distribution:

Figure: Exact values may vary; check the MySonic Dashboard for real-time data.

### Gas Fee Monetization (FeeM) Program

Sonic's FeeM program is described as "applying the Web2 advertising revenue model to blockchain." In this program, developers of specific dApps can earn up to 90% of transaction gas fee revenue.

Key Features Include:

When users interact with smart contracts, a portion of the transaction fees is automatically transferred to the developer's address (or designated treasury).

This fee diversion mechanism reduces the amount of token burning, slightly alleviating the default deflationary pressure on the blockchain.

Advantages:

Incentive Alignment: dApps generating actual usage can earn more from transaction fees.

Attracting Developers: Reduces reliance on external venture capital or token issuance.

Early data shows that top protocols can earn tens of thousands of dollars weekly through transaction fees, incentivizing high-quality developers to deploy applications on Sonic, even in a competitive L1 market.

### Ecosystem and DeFi Protocols

Existing Quality Projects

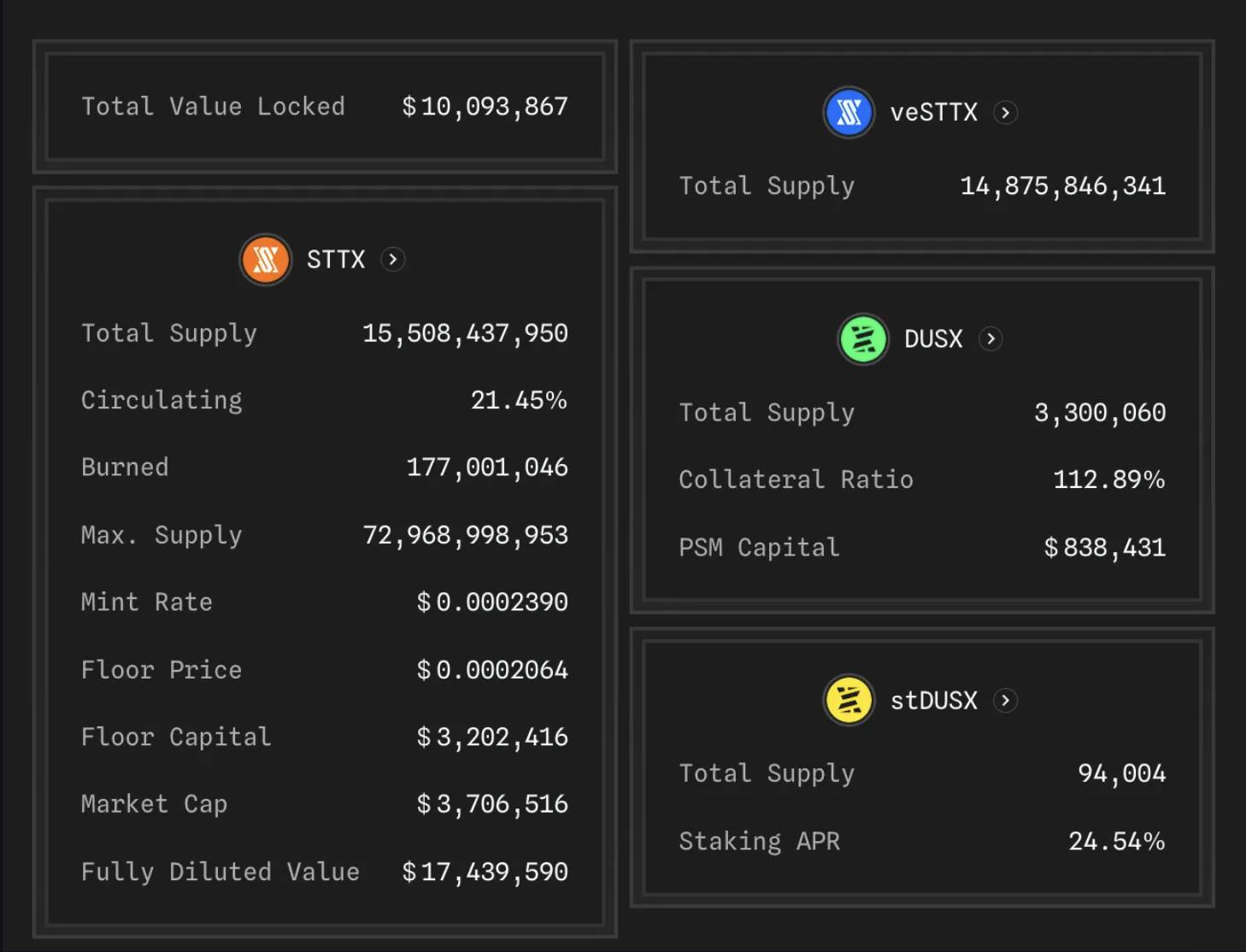

A centralized liquidity DEX using the x(3,3) model (inspired by ve(3,3)).

High TVL (Total Value Locked of over $100 million), with daily trading volume reaching $100 million or more, making it the top DEX on Sonic.

Liquidity providers can earn both trading fees and protocol rewards (such as GEMS and xSHADOW) simultaneously.

A lending protocol.

May have synergies with scUSD or other stable assets.

- A perpetual contract DEX focused on advanced trading features, expected to launch on Sonic.

Rome, Solis, XPRESS, Hermes Finance

- Some projects that have not yet launched, covering treasury-backed tokens, yield optimizers, or order book DEX models.

Other Protocols Mentioned by the Community

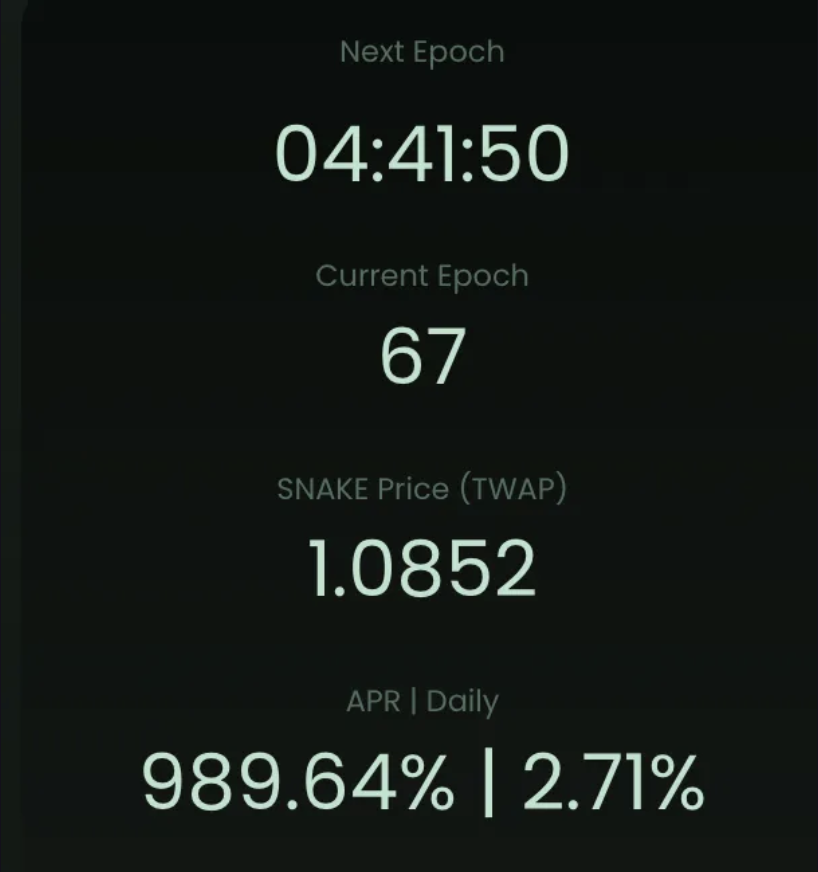

Earn 990% APR by staking $GSNAKE.

Introduced a stablecoin ($SNAKE) pegged 1:1 to $S, offering high APR "forest" mining pools.

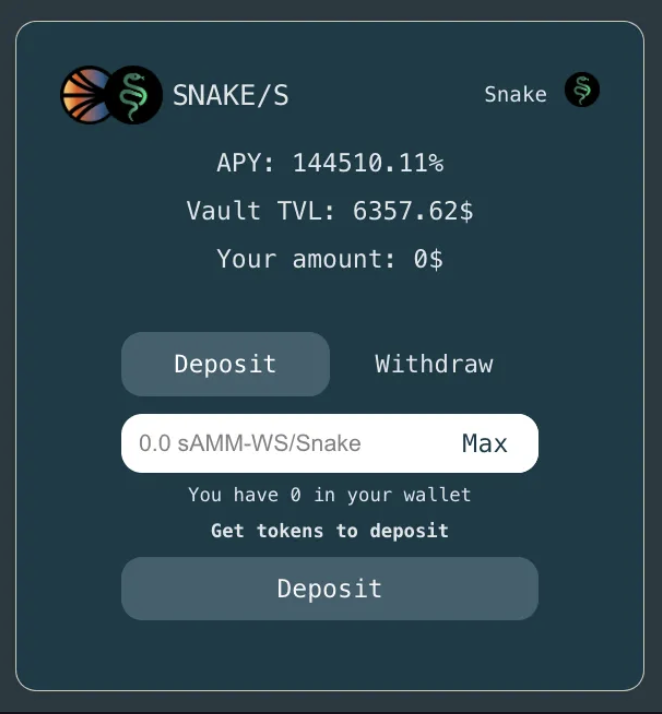

- Alternatively, earn over 144,510% APR by staking $wS/$SNAKE on @VoltaFarm, an auto-compounding tool on Sonic.

Offers over 1700% APR.

Be cautious when setting trading ranges while providing liquidity—narrow ranges yield higher but less frequent returns, while wider ranges provide more stable but lower returns.

Users can also mint EGGS by depositing $S or other assets, then use EGGS for leverage strategies.

A lending platform offering leveraged returns.

Early participants may receive token airdrops.

Rings Protocol, Spectra Finance, GammaSwapLabs

- Promoting advanced DeFi use cases on Sonic through derivatives, yield, and treasury protocols.

### Yield Opportunities

DeFi miners have viewed Sonic as an ideal place to chase high yields:

High Annual Yield DEX Mining Strategies

Trading pairs like S/USDC.e or USDC.e/EGGS can generate over 1000% annual yield on Shadow, Snake, or other DEXs (but with some volatility).

Concentrated liquidity strategies can amplify yields when prices remain within a range.

Lending and Liquidity Staking

Staking $S through MySonic or third-party LSD providers (like Beets, Origin) can yield about 5–8% annual returns.

Liquid staking tokens (like stS) can be redeployed into DEX pools for compounded returns.

Airdrop Boost

- Protocol-specific "GEMS" or synergistic rewards can also enhance airdrop points.

A Possible Mining Strategy:

Swap some stablecoins (like USDC) for $S on Shadow.

Stake some $S to earn stS or scUSD.

Create liquidity trading pairs of stS/S or scUSD/USDC.e on DEXs with high APR rewards.

Claim GEMS or xSHADOW, and re-stake or compound.

Monitor point growth on the MySonic points dashboard.

Refer to @phtevenstrong for insights on achieving over 300% annual yield in stablecoin mining on Sonic.

### Comparison with Other L1s

Sonic has a significant first-mover advantage among the next-generation high-performance EVM L1s. While competitors are still in testnet phases, Sonic has already attracted real liquidity and usage—this advantage may persist, especially as the airdrop and FeeM program can lock in developer loyalty.

Many "fast L1" blockchains are currently launching or about to launch.

### Conclusion and Outlook

Sonic is a bold attempt to replicate the success of Fantom and surpass it through a new L1 economics model, bridging security, and high-speed execution. Its core advantages include:

High throughput (approximately 10,000 TPS)

Sub-second finality (around 720 milliseconds)

Generous developer incentives (90% fee monetization, $190 million $S airdrop)

Safer cross-chain bridging (14-day failure recovery mechanism)

In the short term, real usage, new liquidity, and widespread interest in parallel EVM execution give Sonic an enviable edge over competitors still in testnet phases. Of course, the sustainability after the June 2025 airdrop remains the biggest challenge for the chain. If user activity and developer confidence can be sustained, Sonic is poised to carve out a place in the multi-chain future of DeFi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。