Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@Jingchun333)

The crypto storm continues to stir over America.

On March 7, President Trump signed the executive order "Establishing a Strategic Bitcoin Reserve and U.S. Digital Asset Reserves"; on March 8, the White House held a crypto summit where government officials and crypto industry leaders gathered; on March 9, Texas's new move reignited the passion of the entire crypto market—the state Senate officially passed Senate Bill 21 (SB 21), creating the first state-level cryptocurrency fund in U.S. history—Texas Bitcoin Reserve!

This land of the "Wild West" is now set to become the "State of Digital Gold," with plans to invest 500 million dollars annually to buy Bitcoin (BTC) and other top cryptocurrencies. This is not just a "small move" within the state, but a bellwether for crypto policy across the U.S. and even globally. Is Texas really going to gallop ahead and lead the U.S. to Bitcoin dominance? Odaily Planet Daily takes readers on a deep dive.

How does Texas navigate the legal and technical maze of Bitcoin reserves?

Establishing a Bitcoin reserve is not as simple as just buying a Bitcoin hardware wallet. Texas needs to go through a series of legal, regulatory, and technical steps to ensure that this "digital vault" is securely established.

According to the latest news, the SB 21 bill was passed by the Texas Senate on March 6, 2025, with a vote of 25 to 5. This is good news, but hold on, this is just the beginning; the bill needs to go through several steps for smooth implementation:

Step 1: First, the legislative proposal needs to be drafted by state legislators or relevant committees and submitted to the state legislature. The bill's content includes specific goals for the Bitcoin reserve, sources of funding, methods of purchase and management, and other details. After the proposal is made, it is usually assigned to the state legislature's finance or economic development committee for detailed review, and hearings may be held to gather opinions from various parties.

Step 2: Next, the bill needs to be voted on by both chambers of the state legislature (if the state has a bicameral system). First, the state House of Representatives will discuss and vote; if it passes with a majority, it will be submitted to the Senate for further review and voting. Some states may have the reverse process. After both chambers approve, the bill can enter the final approval stage. Readers should note that all references to the House and Senate in this article refer to the state's House and Senate. Generally, state legislation does not require approval from the federal Senate and House. _ (Note: Texas is currently at this step!)_

Step 3: Once the bill is passed by both chambers of the state legislature, it will be sent to the governor for signature. If the governor agrees and signs, the bill officially becomes law, and the state government can initiate the implementation of the Bitcoin strategic reserve. If the governor vetoes, the legislature can revise or attempt to override the veto with a higher vote count (usually a two-thirds majority).

Step 4: Once the bill takes effect, the state government will designate relevant agencies to implement the reserve plan, usually managed by the state treasury or a specially established fund management department. They need to develop specific purchasing strategies, choose appropriate custody methods (such as third-party custody or self-custody), and ensure the security of the reserve funds. At the same time, the state government needs to establish transparent regulatory and auditing mechanisms, regularly reporting the status of the Bitcoin reserves to the public or legislative bodies.

If any step above encounters issues, the Bitcoin reserve bill will not pass in the state.

So next, the bill still needs to undergo intense debate in the House (there may be opposition questioning the volatility of Bitcoin), and it ultimately requires the governor's signature to officially take effect. However, according to the latest public information, the bill has been reported as "Engrossed," meaning it has been sent to the House for review; there is currently no specific public information on when it will be sent to the House for a vote.

The House vote may take place in the next 2-4 months (roughly between May and July 2025), but this has not been officially confirmed; the actual timing depends on the arrangements and priorities of the House committee. If more specific official timelines are announced, they will typically be updated on the Texas legislative website (capitol.texas.gov) or in related news.

Additionally, on the technical side, the Texas government plans to have the state comptroller manage this fund, using cold storage (like locking gold bars in a vault, offline storage to prevent hacking) to protect Bitcoin from threats; the investment strategy plans to purchase up to 500 million dollars in Bitcoin annually. The entire process is akin to building a digital Fort Knox, complex but full of potential. Furthermore, Texas plans to reduce risks associated with Bitcoin's price volatility or threats to public funds through advisory committees and strict audits (submitting reports to the state legislature every two years).

Why is Texas taking the lead?

First, Texas has strong advantages in economic scale and policy environment. Texas is the second-largest economy in the U.S., ranking second in GDP nationally and making it into the top ten globally. This strong economic foundation allows Texas to adopt a relatively open attitude towards new things and be willing to experiment, especially in high-risk, high-reward areas like cryptocurrency. Additionally, Texas's long-standing "low regulation, high freedom" policy has attracted a slew of innovative companies, particularly in the blockchain and cryptocurrency sectors. The previously passed HB4474 bill in 2021 has already incorporated virtual currencies into the commercial law framework, laying a policy foundation for the subsequent crypto industry.

Moreover, Texas's energy resources and industrial structure provide strong support for crypto mining. Crypto mining consumes an astonishing amount of electricity, and Texas has abundant wind, solar, and natural gas resources, with relatively low electricity prices and high grid independence (the ERCOT system operates largely independently), making it highly attractive for mining companies. Many Bitcoin mining companies, such as Riot Blockchain, have already established a presence in Texas. If the SB21 bill is truly passed, Texas can also use public funds to directly invest in cryptocurrencies, further leveraging its energy advantages to attract more players.

Riot Blockchain's Bitcoin mining facility in Texas

Secondly, the political climate and the leadership's attitude have also played a supportive role. Texas's current governor, Greg Abbott, has always maintained an open attitude towards cryptocurrencies and has even publicly expressed support for related legislation. The bill's sponsor, Senator Charles Schwertner, has also prioritized this bill, with the Texas Blockchain Council, an industry organization, lobbying behind it. Everyone shares the same goal: to make Texas a "testing ground" for crypto reserves, setting rules and capturing the market ahead of other states.

Finally, Texas's culture and history also contribute to its success. The people here have always liked to stand out, emphasize independence, and doing something "counter-mainstream" is not unusual. Additionally, Texas has previously taken similar steps with gold reserves (Texas Bullion Depository), having established the first state-level depository in the U.S. in 2015. Now, implementing Bitcoin reserves aligns with its consistent tone.

The Texas crypto reserve is not yet fully settled. If it truly succeeds, Texas is likely to further distance itself from other states, becoming a "leader" in the cryptocurrency field. However, there are also risks involved, especially given the volatility of cryptocurrencies; whether Texas's move is a bold innovation or a misstep remains to be seen.

The U.S. Crypto Map: The Crazy Adventures of Various States in the Digital Currency Field

Why are states suddenly interested in cryptocurrency reserves?

The enthusiasm of U.S. states for cryptocurrencies is not without reason. In recent years, the prices of crypto investment targets like Bitcoin and Ethereum have skyrocketed, making them highly attractive. In 2021, El Salvador directly designated Bitcoin as legal tender, and in 2024, Trump called for the U.S. to become the "global cryptocurrency capital" at the Bitcoin conference in Nashville, proposing a "Strategic Bitcoin Reserve." All of this has energized state governments.

Adding to this is the overall economic environment in the U.S.—high inflation, questioning of the dollar's dominance, and the growing popularity of decentralized finance concepts—states are beginning to ponder: can they innovate with cryptocurrencies to attract investment and showcase their "avant-garde" status? Moreover, competition among state governments is already fierce; whoever takes the first step may seize the initiative, both economically and politically.

Some states' "crazy adventures"

Texas: The "Cowboy" at the Starting Line

Texas has always been a big player in the cryptocurrency field. As mentioned, their Senate has just passed the SB 21 bill, intending to establish the "Texas Strategic Bitcoin Reserve," allowing public funds to directly invest in cryptocurrencies.

New Hampshire: High Potential

New Hampshire's core action regarding cryptocurrency reserves is House Bill 302 (HB302), their "Bitcoin Reserve Bill." This bill was introduced by Republican legislator Keith Ammon on January 10, 2025, and has received support from some Democratic legislators, making it a small bipartisan attempt.

Utah: Low-key but Not Behind

Utah is also working on Bitcoin reserves, being part of the "actively supportive" camp. They have a characteristic where the bill sets a threshold: only cryptocurrencies with a market cap of over 500 billion dollars can be invested in, and currently, only Bitcoin meets this criterion. Utah's logic is more cautious, possibly aiming to leverage cryptocurrencies to boost tech investments (they already have a bit of a "Silicon Valley branch" vibe).

Arizona: Following Closely

Arizona is also pushing a Bitcoin reserve bill, with progress just behind Utah. They are moving quickly, possibly aiming to make a mark in the Southwest. Arizona's crypto community is already active, and the state government wants to attract more blockchain companies. However, the details of their bill have not been fully disclosed.

Opposition: Five States Say "No" Directly

Not all states are on board. It is said that five states (Montana, South Dakota, North Dakota, Pennsylvania, and Wyoming) have explicitly opposed the establishment of Bitcoin reserves, mainly focusing on volatility and fiscal compatibility. After all, state government money doesn't come from thin air, and it's not unheard of for cryptocurrencies to plummet by 30% overnight. Most of the opposing states are "red states" (Republican strongholds), which is somewhat surprising; one would have thought Trump's support would lead red states to jump in, but it still depends on specific fiscal conditions and voter attitudes.

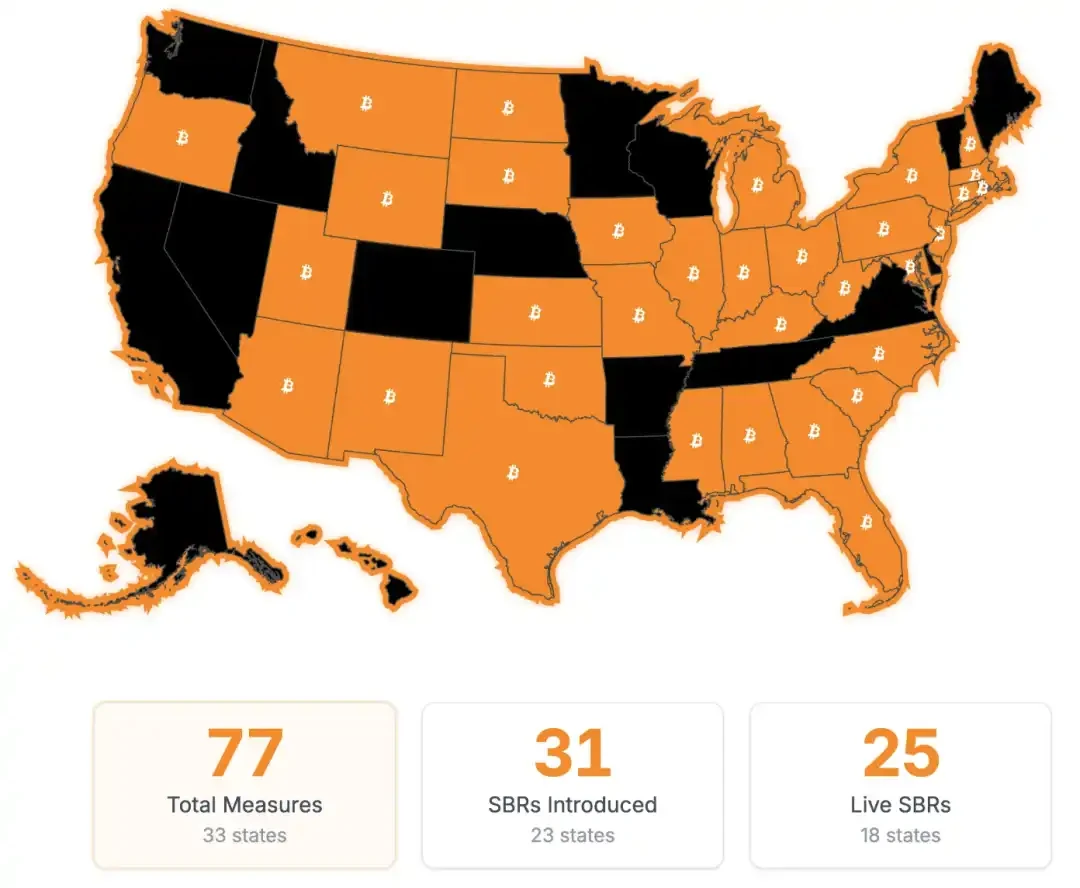

The current status of U.S. state governments actively promoting the Strategic Bitcoin Reserve Act (yellow represents support, black represents opposition)

Conclusion: Who will be the next Bitcoin reserve champion?

Texas's Bitcoin reserve fund plan has ignited enthusiasm for crypto across the U.S. Who will be next? I boldly predict that New Hampshire has the most potential! This "Live Free or Die" state is known for its crypto-friendly policies, and state legislators have proposed similar reserve initiatives, with local communities showing high enthusiasm for Bitcoin. Another possible contender is Utah, whose blockchain innovation and economic strength also make it a potential candidate.

Of course, the complexity of the cryptocurrency market cannot be overlooked. Whether it's the dramatic price fluctuations or the uncertainties in regulation, these could become stumbling blocks on the path to crypto reserves. Other regions looking to follow suit will not only need to draw from Texas's policy framework but also tailor their strategies to their own economic structures for a more robust approach.

Looking ahead, the potential of cryptocurrencies goes far beyond reserves. For regions aiming to delve deep into the digital economy, supporting innovations in areas like crypto digital retail and startup incubation may be the key step to unlocking the true potential of the Bitcoin market. Who will be the next leader in the Bitcoin market? Let's wait and see!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。