Only with the mass adoption of more consumer-level applications can true user adoption and sustainable business value be brought to this overbuilt infrastructure ecosystem.

Author: @Web3Mario

Abstract: Recently, market sentiment has been relatively low, as potential policy dividends have gradually materialized but have not met expectations. Additionally, with a series of celebrity Memecoins, such as Trump, draining the liquidity from the crypto speculation market, the two-year-long wave of cryptocurrency speculation driven by macroeconomic benefits seems to have come to an end.

In response, an increasing number of investors and believers have begun to contemplate the next value narrative for the Web3 industry, with the Web3 consumer application track becoming the focal point of many discussions. Only with the mass adoption of more consumer-level applications can true user adoption and sustainable business value be brought to this overbuilt infrastructure ecosystem.

Therefore, during this period, I have been thinking about the issues surrounding Web3 consumer applications. I would like to share some insights with you.

In this article, I will provide an overview of the current mainstream paradigms of Web3 consumer applications and explore their respective opportunities and challenges. In subsequent articles, I will continue to share specific market opportunity insights and ideas, and I welcome everyone to engage in discussions with me.

What is a Web3 Consumer Application

A Consumer Application refers to To C applications in the Chinese context, meaning that your target users are the majority of ordinary consumers rather than enterprise-level users. Open your App Store, and all the applications inside belong to this category. Web3 Consumer Applications refer to software applications aimed at consumers that have Web3 characteristics.

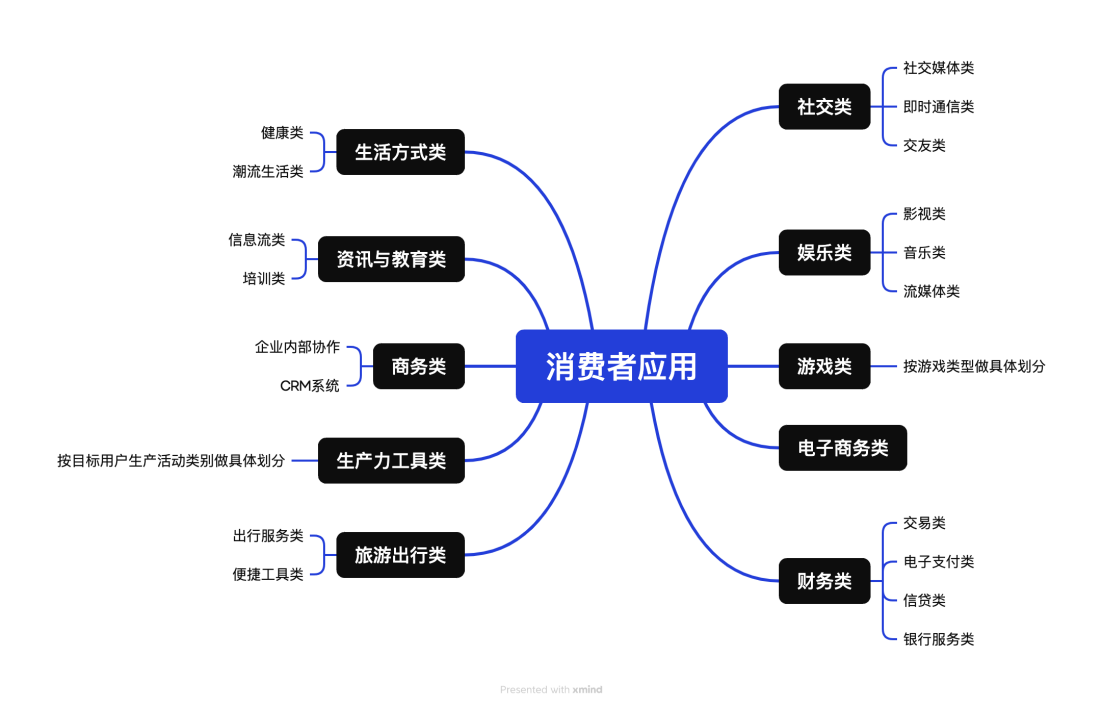

Typically, according to the classifications in most App Stores, we can roughly divide the entire Consumer Application track into the following 10 categories, each with different subcategories. Of course, as the market matures, many new products will combine multiple features to find their unique selling points to some extent, but we can still categorize them based on their core selling points.

What are the Existing Paradigms of Web3 Consumer Applications and Their Opportunities and Challenges

As of now, I believe there are three common paradigms of Web3 Consumer Applications:

- Utilizing the technical characteristics of Web3 infrastructure to optimize certain issues present in traditional Consumer Applications:

This is a relatively common paradigm. We know that a large amount of investment in the Web3 industry revolves around infrastructure construction, and creators of applications adopting this paradigm hope to leverage the technical characteristics of Web3 infrastructure to enhance their product's competitive advantage or provide new services. Typically, we can categorize the benefits brought by these technological innovations into the following two types:

l Extreme privacy protection and data sovereignty:

n Opportunity: The privacy track has always been the main theme of innovation in Web3 infrastructure. From the initial asymmetric encryption algorithm identity verification systems, it has gradually integrated numerous software and hardware technologies, such as ZK, FHE, and TEE. Many tech giants in Web3 seem to adhere to an extreme view of human nature, aiming to create a network environment that completely does not rely on third-party trust and provides users with the ability to interact with information or value. The most direct benefit of this technical characteristic is that it brings data sovereignty to users, allowing personal privacy information to be directly hosted on locally trusted software and hardware devices, thus avoiding privacy information leakage. There are many Web3 Consumer Applications optimized for this technical characteristic; any project that claims to be decentralized XX falls into this paradigm, such as decentralized social media platforms, decentralized AI large models, decentralized video websites, etc.

n Challenge: After years of market validation, it can be said that using this as a core selling point has not shown significant advantages in market competition for two reasons. First, consumer users' emphasis on privacy is based on the occurrence of large-scale privacy breaches and infringement events. However, in most cases, more comprehensive laws and regulations can effectively alleviate this issue. Therefore, if privacy protection is based on a more complex product experience or higher usage costs, its competitiveness will be significantly insufficient. Second, we know that the current business models of most consumer applications are built on extracting value from big data, such as precision marketing. Overemphasizing privacy protection will undermine mainstream business models because user data will be scattered across a number of data islands, making it difficult to design sustainable business models. If it ultimately relies solely on so-called "Tokenomics," it will inevitably introduce unnecessary speculative attributes to the product, which will divert the team's resources and energy to cope with the impact of this attribute on the product, and it will also be detrimental to finding PMF, which will be analyzed in detail below.

l Low-cost, globally available, and trustworthy execution environment:

n Opportunity: The emergence of numerous L1 and L2 solutions provides application developers with a new, global, and round-the-clock multi-party trustworthy program execution environment. Typically, traditional software service providers independently maintain their programs, such as running on their own server clusters or clouds. This naturally incurs trust costs in businesses involving multi-party collaboration, especially when the parties involved are on an equal footing or when the data involved is particularly sensitive and critical. Such trust costs usually translate into significant development costs and user usage costs, such as in cross-border payment scenarios. Utilizing the execution environment brought by Web3 can effectively reduce the related costs of providing such services. Stablecoins are a good example of such applications.

n Challenge: From the perspective of cost reduction and efficiency improvement, this is indeed a competitive advantage, but exploring application scenarios is relatively difficult. As mentioned above, benefits from using this execution environment only arise in services involving multi-party collaboration, where the relevant parties are independent, on an equal footing, and the data involved is particularly sensitive. This is a relatively stringent condition. Currently, most of these application scenarios are concentrated in the financial services sector.

- Utilizing crypto assets to design new marketing strategies, user loyalty programs, or business models:

Similar to the first point, developers adopting this paradigm also hope to gain a competitive advantage for their products by introducing Web3 attributes in a relatively mature and market-validated scenario. However, these developers focus more on introducing crypto assets and leveraging their high financial attributes to design better marketing strategies, user loyalty programs, and business models.

We know that any investment target has two types of value: commodity attributes and financial attributes. The former relates to the use value of the target in a specific practical scenario, such as the livability of real estate assets, while the latter relates to its trading value in the financial market. This trading value in the crypto asset field usually comes from liquidity and high volatility. Crypto assets are a category of assets where financial attributes far exceed commodity attributes.

In the eyes of most developers of such applications, introducing crypto assets can typically bring three benefits:

l Lower customer acquisition costs through Token-based marketing activities like Airdrops:

n Opportunity: For most consumer applications, how to acquire customers at a low cost in the early stages of a project is a key issue. Tokens, with their high financial attributes and being assets created from scratch, can significantly reduce the risks of early-stage projects. After all, compared to directly spending real money to buy traffic and gain exposure, using zero-cost created tokens for user acquisition is indeed a more cost-effective choice. From a certain perspective, such tokens are similar to advertising tokens. Many projects adopting this paradigm exist, such as most projects in the TON ecosystem and casual games.

n Challenge: This customer acquisition method faces two main issues. First, the conversion cost of seed users acquired through this method is extremely high. We know that most users attracted by this scheme are cryptocurrency speculators, so their attention to the project itself is not very strong; they are more interested in the potential financial attributes of the rewards. Moreover, there are currently many professional airdrop hunters or "haircut" studios, which makes it extremely difficult to convert them into actual product users later on. This may also lead to a misjudgment of PMF by the project, resulting in excessive investment in the wrong direction. Second, as this model becomes widely used, the marginal returns of acquiring customers through Airdrops diminish, meaning that if one wants to establish sufficient appeal within the cryptocurrency speculator community, costs will gradually increase.

l User loyalty programs based on X to Earn:

n Opportunity: Retention and activation are another concern for consumer applications. Ensuring that users continue to use your product requires significant effort and cost. Similar to marketing, utilizing the financial attributes of tokens to lower retention and activation costs is a common choice for most projects in this category. A representative model is X to Earn, which rewards users based on predefined key behaviors with tokens, thereby establishing a user loyalty program.

n Challenge: Relying on users' motivation to earn profits for activation will shift their focus from the product's functionality to the rate of return. Therefore, if the potential rate of return declines, users' attention will quickly wane, which is a significant harm to consumer applications, especially for products that rely heavily on UGC. If the rate of return is based on the price of the tokens issued by the project, it will create pressure for market value management on the project side, especially during bear markets, where they will have to bear high maintenance costs.

l Direct monetization using the financial attributes of tokens:

n Opportunity: For traditional consumer applications, the most common business models are twofold: one is free usage, monetizing the platform's traffic value after large-scale adoption, and the other is paid usage, where users must pay a fee to access certain Pro services of the product. However, the former has a longer cycle, and the latter is more challenging. Therefore, tokens bring a new business model, which is to directly monetize by selling tokens.

n Challenge: It can be clearly stated that this is an unsustainable business model. The reason is that once a project moves past the early high-growth stage, the lack of incremental capital inflow will inevitably place the project's interests in opposition to user interests in this zero-sum game model, accelerating user attrition. If the project does not actively cash out, it will have to rely on financing to maintain the team or expand the business due to a lack of robust cash flow revenue, which will lead to a predicament of dependence on market conditions.

- Fully serving Web3 native users and addressing their unique pain points:

The last paradigm refers to consumer applications that fully serve Web3 native users. They can be roughly divided into two categories based on innovation direction:

l Constructing new narratives and monetization designs around certain untapped value elements of Web3 native users, creating new asset classes:

n Opportunity: By providing new speculative targets for Web3 native users (such as in the SocialFi track), the benefit lies in having pricing power over a certain asset from the initial stage of the project, thus obtaining monopoly profits, which in traditional industries would require intense market competition to build strong competitive barriers.

n Challenge: Frankly speaking, this paradigm relies heavily on team resources, specifically whether it can gain recognition and support from individuals or institutions that have strong influence among Web3 native users or possess "pricing power" over crypto assets. This brings two difficulties: first, as the market develops, the pricing power of crypto assets dynamically shifts among different groups, for example, from the initial Crypto OGs to crypto VCs, then to CEXs, crypto KOLs, and finally to traditional politicians, entrepreneurs, or celebrities. In this process, being able to identify trends and establish collaborations with new elites during each transition of power places significant demands on team resources and market sensitivity. Second, establishing cooperative relationships with "price setters" usually requires substantial costs and sacrifices, because in this market, you are not competing for a larger market share within a specific application track against other opponents, but rather competing with all other crypto asset creators for the preferences of the "price setters," which is a highly competitive game.

l Providing new tool-based products to meet the unmet needs of Web3 native users during their market participation, or offering better and more convenient products from the user experience perspective for this group of users:

n Opportunity: I believe this is the most promising paradigm moving forward. As cryptocurrencies gradually become more popular, the overall base of this user group will expand, creating possibilities for user segmentation. Moreover, by focusing on the genuine needs of a specific user group, such products often find it easier to achieve PMF, thereby establishing more robust business models, such as trading-related data analysis platforms, Trading Bots, information platforms, etc.

n Challenge: While returning to genuine user needs makes the development path of the product more robust, the construction cycle is longer than that of other paradigm projects. Additionally, since these projects are not narrative-driven but rather driven by specific needs, the PMF of the product is relatively easy to verify, but they typically cannot secure large amounts of funding in the early stages. Therefore, maintaining patience and staying true to one's original intentions amidst the complex wealth myths brought about by "token issuance" or high-valuation financing is a challenging task.

Of course, these three paradigms are not completely independent; you can see their shadows in many projects. This classification is made for the sake of analysis. Therefore, for those looking to start a venture in the Web3 Consumer Application track, it is crucial to comprehensively assess one's own advantages and demands and choose the paradigm that best suits oneself.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。