1. Market Observation

Keywords: Coinbase, ETH, BTC

BTC fell below $77,000 this morning. According to the Greeks.live briefing, traders generally hold a bearish outlook, with most focusing on the $74,000-$76,000 area as a potential downside target, and viewing $87,000 as a resistance level. BitMEX co-founder Arthur Hayes predicts that Bitcoin may bottom around $70,000, which represents a 36% retracement from the historical high of $110,000, a normal adjustment in a bull market. Although Strategy did not increase its Bitcoin holdings last week, it has submitted a prospectus to issue $21 billion in preferred stock, potentially for purchasing Bitcoin.

The situation is more severe for Ethereum, which has dropped below $1,800 this morning. An address holding 65,000 ETH faces liquidation risk, and another whale has sold 25,800 ETH to hedge, incurring a loss of $31.75 million. Yuga Labs executives warned that if the market enters a bear phase, ETH could drop below $1,500, or even reach the $200-$400 range, consistent with a maximum drawdown of 90% seen in historical bear markets.

In traditional financial markets, U.S. stocks experienced a "Black Monday," with the Nasdaq plunging 4% and Tesla dropping 15%. Blockchain-related stocks generally fell, with Coinbase down 17.58% and MicroStrategy down 16.68%. In response, Arthur Hayes believes the next focus should be on the sharp decline in U.S. stocks and the bankruptcy risks of traditional financial institutions, after which major central banks may adopt easing policies to stimulate the economy. ARK Invest founder Cathie Wood believes the market is digesting the final stages of a recession, expecting a deflationary boom in the second half of the year. However, Federal Reserve Chairman Jerome Powell recently stated that due to the still strong labor market, the inflation path is uneven, and with uncertainties surrounding Trump's trade, fiscal, immigration, and regulatory policies, the Fed is not in a hurry to cut interest rates. Goldman Sachs has lowered its U.S. economic growth forecast to 1.7% and raised its inflation expectations. Notably, futures traders are increasingly betting that the Fed will cut rates consecutively in June, July, and October.

In light of the current market conditions, Delphi Digital researcher Minty advises investors not to measure investments against historical highs but rather aim for a target of 50-70%. He stated that most altcoins may never return to their historical highs, and significant opportunities arise only a few times a year and are fleeting; overtrading and lack of patience are the main reasons for profit loss.

2. Key Data (As of March 11, 13:00 HKT)

Fear and Greed Index: 24 (Extreme Fear)

24-hour BTC Long/Short Ratio: 0.9685

Average GAS: BTC 3 sat/vB, ETH 1.11 Gwei

Market Share: BTC 61.1%, ETH 8.7%

Upbit 24-hour Trading Volume Ranking: XRP, BTC, ETH

Sector Performance: DeFi sector down 8.32%, Meme sector down 9.19%

Bitcoin: $80,007.13 (Year-to-date -14.6%), daily spot trading volume $58.486 billion

Ethereum: $1,865.44 (Year-to-date -44.05%), daily spot trading volume $38.414 billion

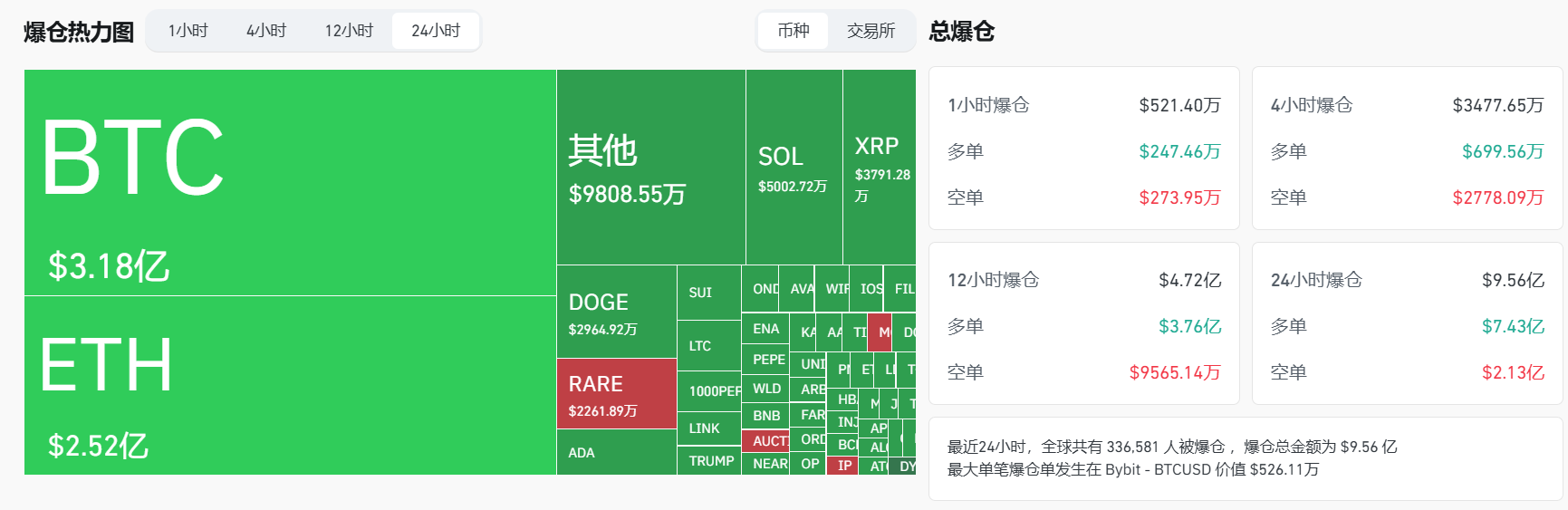

24-hour Liquidation Data: A total of 336,581 people were liquidated globally, with a total liquidation amount of $956 million, including $318 million in BTC and $252 million in ETH.

3. ETF Flows (As of March 10 EST)

Bitcoin ETF: -$189 million

Ethereum ETF: -$34 million

4. Important Dates (Hong Kong Time)

U.S. President Trump meets with American tech leaders, including CEOs from HP, Intel, IBM, and Qualcomm. (March 11, 2:00)

U.S. President Trump signs an executive order. U.S. February unadjusted CPI year-on-year (March 12, 20:30)

- Actual: N/A / Previous: 3% / Expected: 2.9%

U.S. February seasonally adjusted CPI month-on-month (March 12, 20:30)

- Actual: N/A / Previous: 0.50% / Expected: 0.30%

U.S. initial jobless claims for the week ending March 8 (in thousands) (March 13, 20:30)

- Actual: N/A / Previous: 22.1 / Expected: N/A

5. Hot News

El Salvador Signs Cryptocurrency Regulation Agreement with Paraguay

Bithumb Launches Elixir (ELX) Korean Won Trading Market

Longling Capital Transfers 21,000 ETH to Binance, Approximately $38.81 million

BTC Falls Below $77,000, Down 3.80% for the Day

U.S. Stocks Black Monday: Nasdaq Plummets 4%, Tesla Drops 15%

Coinbase to Launch Cookie DAO (COOKIE)

Coinbase to Launch Around-the-Clock Bitcoin and Ethereum Futures Contracts in the U.S.

Movement Public Mainnet Beta Version Launched

UK Treasury: "No Plans" to Introduce U.S.-Style Bitcoin Reserves

Thai Regulators Add Stablecoins USDC and USDT to Approved Cryptocurrencies

Strategy Submits Prospectus to Issue Up to $21 Billion in Preferred Stock

Crypto Executives Propose: Consider Exchanging Bitcoin for Trump's "Gold Card"

Singapore Exchange Plans to Launch Bitcoin Perpetual Futures Contracts in the Second Half of 2025

Market News: Japan's Cryptocurrency Reform Bill to be Submitted to Parliament After Cabinet Approval

Standard Chartered: The U.S. Can Establish Bitcoin Reserves by Selling Gold and Using Treasury Funds

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。