4 Alpha Core Insights (3.3-3.8)

I. Macroeconomic Review of the Week

1. Market Overview

Market sentiment is at a temporary low, with the S&P 500 (SPX) breaking below the 200-day moving average, triggering sell-offs from CTA strategies, but the selling is nearing its end.

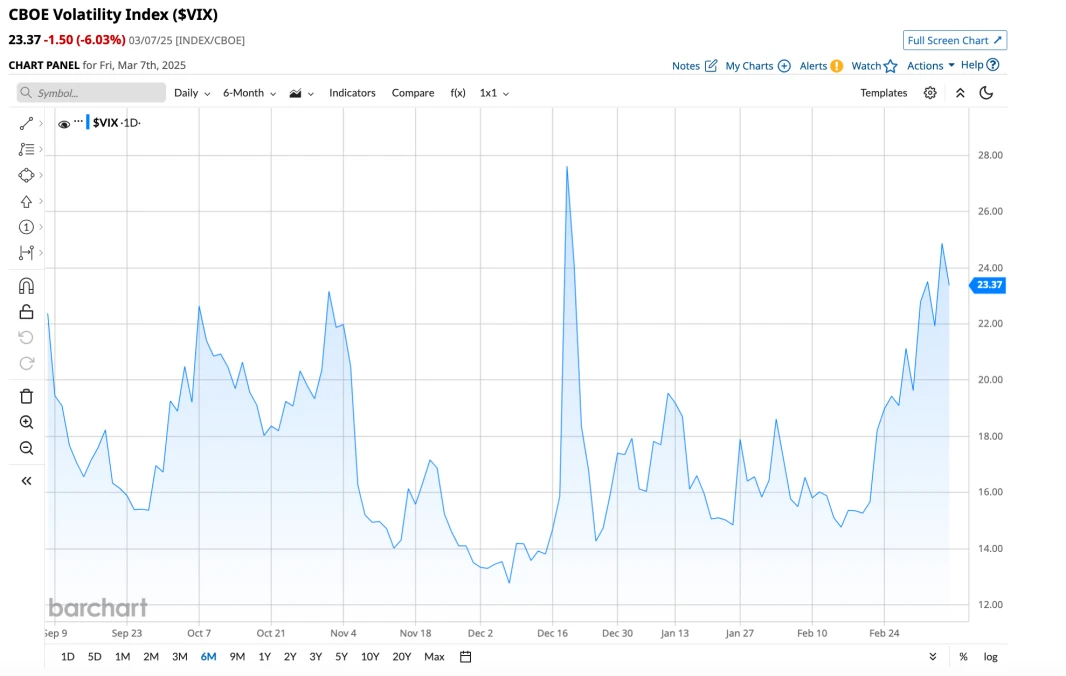

The VIX index remains above 20, and the Put/Call ratio is rising, indicating high levels of market fear.

The cryptocurrency market is only slightly stimulated by news of Trump's national strategy reserve for crypto assets, as policy details fell short of expectations, and overall risk appetite is contracting.

2. Economic Data Analysis

Manufacturing PMI: The new orders index fell below the expansion threshold, and the employment index was below expectations, indicating caution in manufacturing due to tariffs.

Non-Manufacturing PMI: Exceeded expectations, suggesting resilience in the U.S. economy, with the service sector remaining stable, though expansion is slowing.

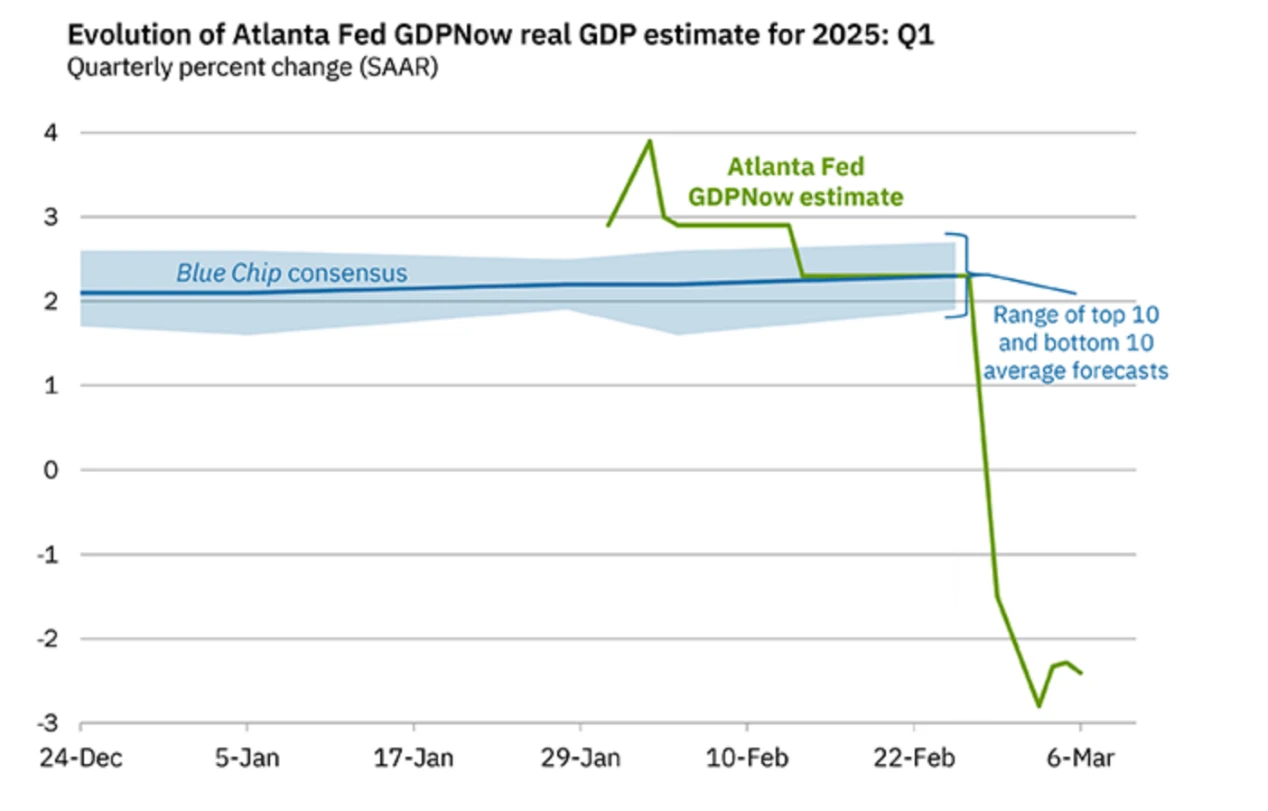

GDP Forecast: The Atlanta Fed revised its first-quarter GDP forecast to -2.4%, primarily dragged down by net exports, while consumer spending remains robust.

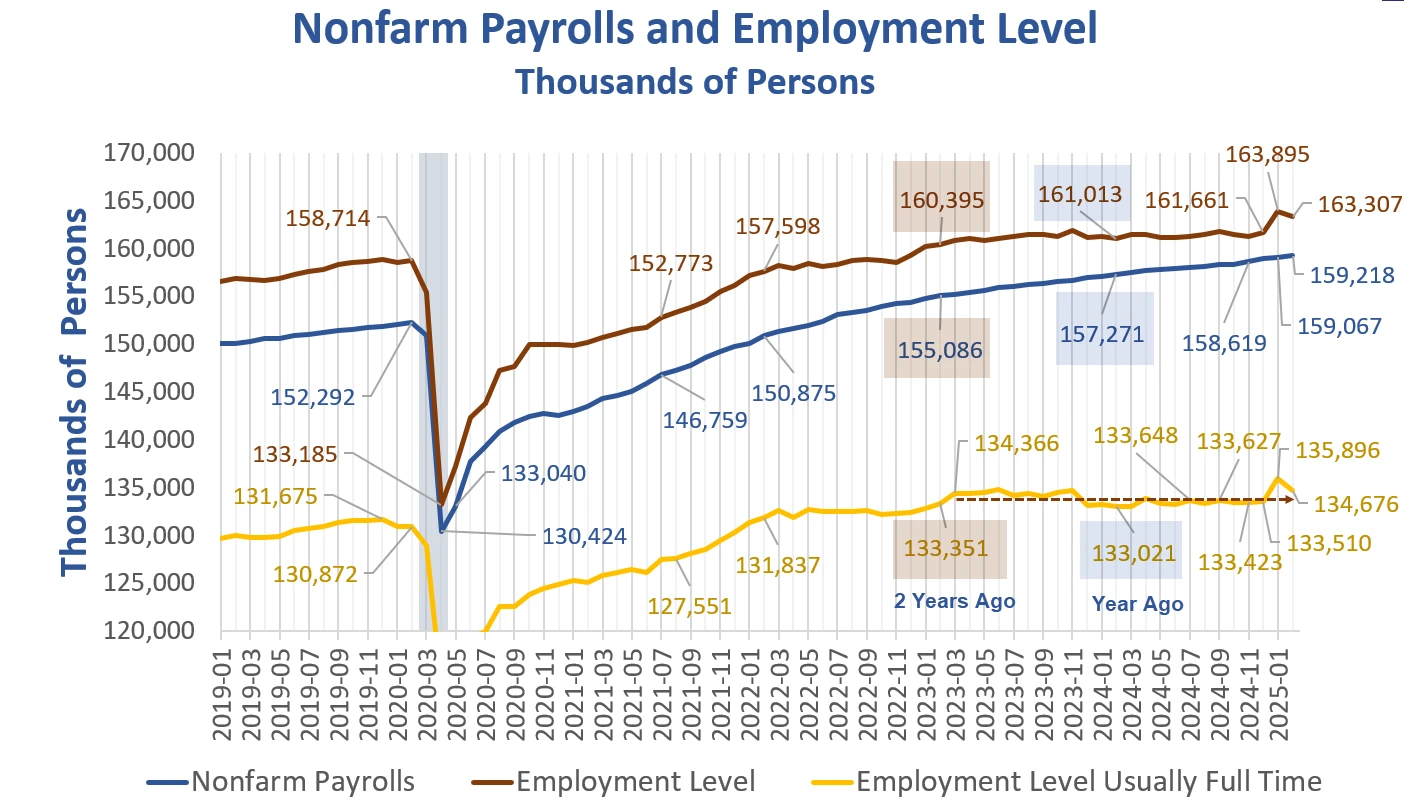

Non-Farm Employment Data: Employment data is mixed, with a slight increase in the unemployment rate, slower job growth, and limited wage growth, indicating that companies prefer to extend hours rather than create new positions.

3. Federal Reserve Policy and Liquidity

1) Powell's Remarks:

The Federal Reserve is inclined to be cautious and wait for clarity on tariff policies.

The 2% inflation target remains central, and short-term inflation increases will not prompt interest rate hikes.

The economic fundamentals remain stable, but if employment continues to slow, the likelihood of rate cuts may increase.

2) Liquidity: The Federal Reserve's broad liquidity has marginally improved, but market sentiment remains weak.

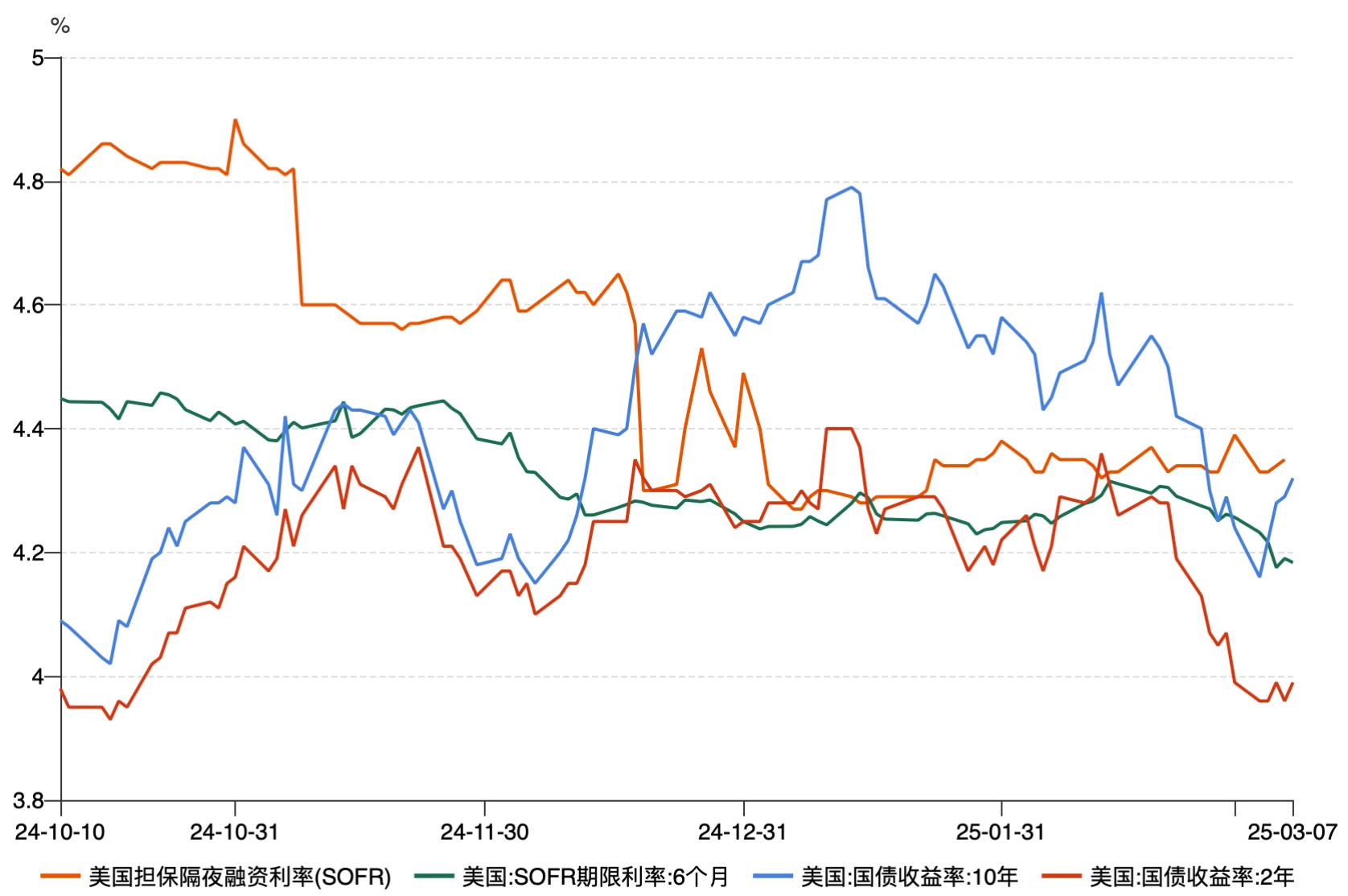

3) Interest Rate Market: Short-term financing rates have decreased, with the market betting on rate cuts in the next six months. The yield on 10-year U.S. Treasuries has turned upward, indicating a slight easing of recession expectations.

II. Macroeconomic Outlook for Next Week

The market is still in a phase of expectation games, with unclear trends, and institutional funds are more inclined to wait and see, making it difficult for the market to form a clear direction in the short term.

Attention should be paid to micro changes in economic data from March to April, as the impacts of tariffs, government layoffs, and interest rates have a lagging effect; confirmation of market trends requires more data support.

The market should not be overly pessimistic, as the economy has not significantly deteriorated. Investors should manage their positions well, maintain a balance between offense and defense, and wait for clearer trend signals.

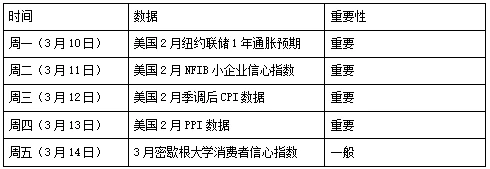

Key Data Next Week: Focus on CPI, PPI, Consumer Confidence Index, and other key data to assess changes in inflation and consumption trends.

Trends Uncertain, Non-Farm Data Mixed, Rebound or Further Bottoming?

I. Macroeconomic Review of the Week

1. Market Overview This Week

From the perspective of major asset volatility, market sentiment remains at a temporary low this week. Although Friday's non-farm payroll data and Powell's remarks eased market pricing on "recession trades," the uncertainty surrounding tariffs offset the positive impact of the data on the market.

In the U.S. stock market, the SPX broke below the 200-day moving average for the first time in 16 months, triggering sell-offs from U.S. stock CTA strategies. According to statistics from Goldman Sachs' trading department, a total of $47 billion was sold off in the past week, but fortunately, the selling is nearing its end. From a volatility perspective, the VIX index has remained above 20, significantly higher than the approximately 15 level at the beginning of the year, while the Put/Call Ratio has again risen above 0.9. These data points corroborate each other, reflecting that market fear and bearish sentiment remain high.

Chart 1: This Week's VIX Index Remains Above 20 Source: Barchart

From the cryptocurrency market perspective, despite the positive stimulus from Trump's signing of the national strategy reserve for crypto assets this week, the improvement in the market is not significant. One reason is that the main form of the strategic reserve is based on U.S. seized assets, which did not provide hints of new purchases, falling short of market expectations; another reason is the pullback in major risk assets like U.S. stocks, leading to a clear contraction in risk appetite and overall poor liquidity, making BTC's rebound weak.

As we pointed out last week, the market currently has not formed stable trading expectations, and concerns over macro policy uncertainty are suppressing improvements in market sentiment.

2. Economic Data Analysis

This week's data analysis focuses on the U.S. economy. Several data points released this week further confirm that the U.S. economy is indeed slowing down, but from the micro-structural perspective of the data, we believe that market concerns about recession are somewhat exaggerated.

The ISM manufacturing index for February released on Monday continued the expansion trend from January, but at a slower pace, with a composite index of 50.3, below market expectations. Notably, the new orders index fell below the expansion threshold for the first time since October last year, and the employment index was significantly below expectations, while the price index was above expectations. The structural data divergence indicates that manufacturers are becoming cautious in production and hiring due to the impact of Trump's tariffs, while demand may further slow; however, the non-manufacturing PMI released on Wednesday provided contrary data, exceeding market expectations. These two data points point to two facts about the current U.S. economy:

Trump's tariff policy has indeed caused significant disruption to U.S. importers/manufacturers and continues to exert negative pressure.

The momentum of the U.S. economy has indeed slowed, but it is important to note that U.S. GDP primarily relies on the service sector, which remains relatively stable overall, albeit slowing from aggressive expansion to slow growth, indicating that there are no clear signs of deterioration in the U.S. economic fundamentals.

On Thursday, the Atlanta Fed updated its latest GDP forecast, showing a revised first-quarter GDP forecast of -2.4%, slightly better than the -2.8% forecast from March 3.

Chart 2: As of March 6, GDP Forecast Continues to Decline Source: Atlanta Fed

The market is concerned about the continued negative GDP forecast, but structurally, U.S. personal consumption expenditures and private investment in the first quarter have not declined. However, due to the surge in imports caused by tariffs, the contribution of net exports to GDP has significantly decreased, which is the core reason for the decline in GDP forecasts. This also indicates that as long as consumer spending remains stable, concerns about the fundamentals of the consumption-driven U.S. economy may be overly pessimistic.

This Friday's non-farm payroll data slightly reversed the market's pessimistic sentiment and partially weakened recession expectations. The unemployment rate for February was slightly above market expectations at 4.1%; the seasonally adjusted non-farm employment figure was 151,000, below the market expectation of 160,000; in terms of wages, the annual growth rate was below expectations, while the monthly rate met expectations but was lower than the previous value. Further analysis of the detailed data yields the following key conclusions:

Despite an increase in net job positions, the number of underemployed and newly unemployed individuals has increased rapidly, reflecting a clear overall weakness in employment conditions, but not to the point of indicating deterioration.

Limited wage growth and longer working hours indicate that companies are currently more willing to extend the hours of existing employees rather than hire new ones; limited wage growth reflects a slowdown in demand and an increased desire for companies to control costs.

Chart 3: Changes in U.S. Non-Farm Employment from 2019 to 2025 Source: Mish Talk

On Friday, Federal Reserve Chairman Powell's speech at the 18th Monetary Policy Forum attracted significant market attention, and the market remained generally stable after his remarks. Powell's speech essentially provided several key guiding messages:

Indicated that the Federal Reserve is inclined to be cautious and wait for clarity on Trump's tariff policy, stating: "The cost of being cautious is very low."

Reiterated the 2% inflation target; also specifically indicated that the Federal Reserve is more focused on long-term inflation expectations, and a rise in short-term inflation expectations will not lead the Fed to restart rate hikes.

In assessing the current economic situation, the Federal Reserve is relatively optimistic, believing that although consumer spending has slowed, economic growth remains relatively stable, and the labor market is generally robust.

If more data points to a slowdown in the labor market, the possibility of the Federal Reserve restarting rate cuts will increase.

These four points together convey a relatively loose monetary policy expectation to the market. In other words, Powell's remarks indicate that the current decision-making path of the Federal Reserve is: First, with long-term inflation expectations stable, the Federal Reserve does not face pressure to raise rates; against the backdrop of continuously slowing employment data, the Federal Reserve may tolerate short-term inflation above the target while maintaining a loose stance.

3. Liquidity and Interest Rates

From the perspective of the Federal Reserve's balance sheet, broad liquidity marginally improved this week, standing back above $6 trillion as of March 6, but the scale of improvement is insufficient to offset the decline in market sentiment.

From the interest rate market perspective, short-term financing rates are clearly betting on rate cuts in the next six months, with a significant downward slope in the SOFR six-month rate. From the perspective of Treasury yields, the market is pricing in three rate cuts of 25 basis points each, but at the same time, the yield on 10-year Treasuries has turned upward, indicating that recession concerns have eased somewhat following Powell's remarks.

Chart 4: Changes in U.S. Overnight Financing Rates and Treasury Yields Source: Wind

II. Macroeconomic Outlook for Next Week

Based on the conclusions from the interest rate market, risk market, and economic data, we believe the market is still in a critical period of digesting risk expectations. The re-inflation and recession risks brought by tariffs cannot be falsified by existing data, which means that confirming the trend of the market still requires more real data for calibration. In other words, for mainstream institutional funds, based on risk-averse considerations, they are unlikely to build large positions and are more likely to adopt a cautious wait-and-see attitude.

Based on the aforementioned analysis, our overall view is:

The current market's main theme is still "expectation games" rather than trend confirmation, so from a risk logic perspective, the market cannot provide a clear direction in the short term. For investors, it is better to either wait or make decisions when the market pulls back to reasonable levels for a higher risk-reward ratio.

Due to the lagging effects of tariffs, U.S. government layoffs, interest rates, and other factors on the market, investors should focus on micro changes in economic data from March to April. Macroeconomic variables will gradually become clearer in the next two months. Once interest rates confirm a market turning point, the rebound potential in the cryptocurrency market will be greater.

Micro data does not point to a significant deterioration in the economy, so there is no need to be overly pessimistic. The market always accumulates risks during upward trends and alleviates risks during downward trends. It is still recommended that investors manage their portfolio position risks well, increase defensive allocations, and maintain a balance between offense and defense amid significant market volatility.

Key macro data for next week is as follows:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。