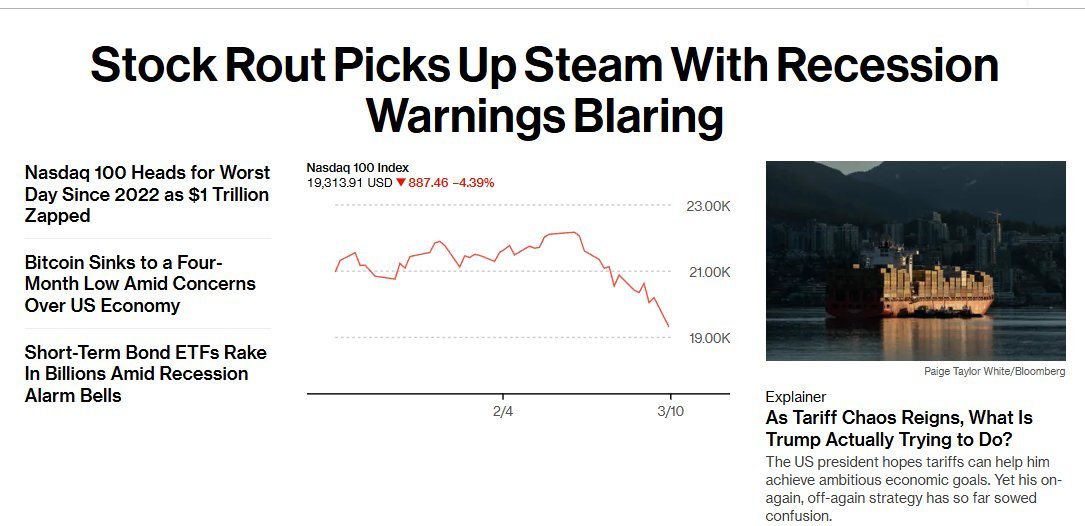

Some friends say that the recent sharp decline is not entirely due to tariffs, but in reality, we cannot blame everything on tariffs. However, tariffs are indeed one of the reasons that triggered recession expectations. In the early stages of the decline, GDPNow projected a positive GDP for the U.S. in the first quarter of 2025, but as the risk market had already dropped significantly, the expectation turned negative.

Now the U.S. has entered a trading recession, but ironically, employment in the U.S. remains very strong, and there are currently no significant signs of economic contraction. Yet investors are still able to provide reasons for expecting an economic recession.

So what reasons lead investors to believe that the economy will fall into recession?

The primary answer must be the Federal Reserve's management of monetary policy. In simple terms, the Federal Reserve is unwilling to quickly cut interest rates. The expectation of increased tariffs was already anticipated by the end of 2024, but most investors did not realize that tariffs would come so unexpectedly, especially when inflation is still high. The increase in tariffs effectively reduces American households' income and, in reality, lowers GDP.

Moreover, the expectation of rising inflation has led the market to signal danger regarding the Federal Reserve's interest rate cuts, and this signal has been amplified by GDPNow data. Following this, Trump himself stated that the U.S. economy might enter a period of overheating, which heightened investors' panic.

According to Trump's viewpoint, tariffs should be increased before tax cuts to stimulate the U.S. economy, so we will have to see when he decides to release the tax cut carrot.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。