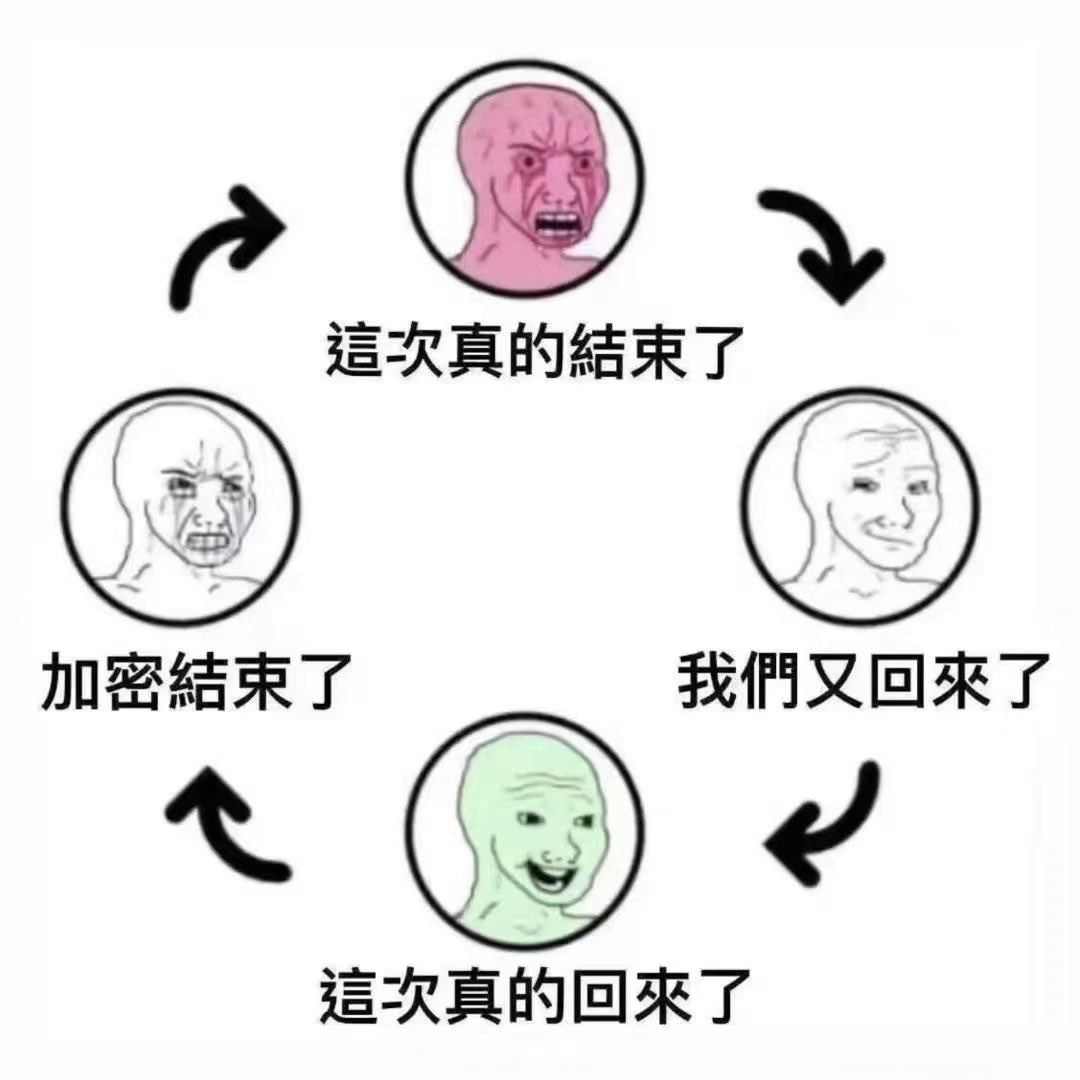

The market has risen too quickly, too well, and too smoothly, to the point where everyone has forgotten that a pullback is inevitable.

2017 was a one-sided bull market, with a significant pullback in April.

2020 was a crazy bull market, with a major pullback in March.

These are things we only understand after history has unfolded.

Your correct approach should be to not focus on short-term fluctuations, but to concentrate on your own response to the "pullback":

Should you add to your position if it breaks below the support level?

At what price level should you reduce your position during a rebound?

What is the maximum pullback you can tolerate?

Is the bottom line "70% position + 30% cash" or does it need adjustment?

Are we in a bear market? I don't know, but if you replace speculative thinking with a spot trading mindset and adopt a long-term perspective instead of a short-term one, Bitcoin will definitely experience a long bull run.

Those who only focus on the ups and downs during history are always picking sesame seeds while losing watermelons.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。