On January 23 at 16:00, the AiCoin Research Institute will discuss [Grid Trading Strategy], which is a highly suitable automated trading tool for volatile markets! The host has been running a grid for 60 days, and the profit curve is steadily rising. Although the capital is not large, they are already sprinting down the path to financial freedom! Without further ado, let's get straight to the point!

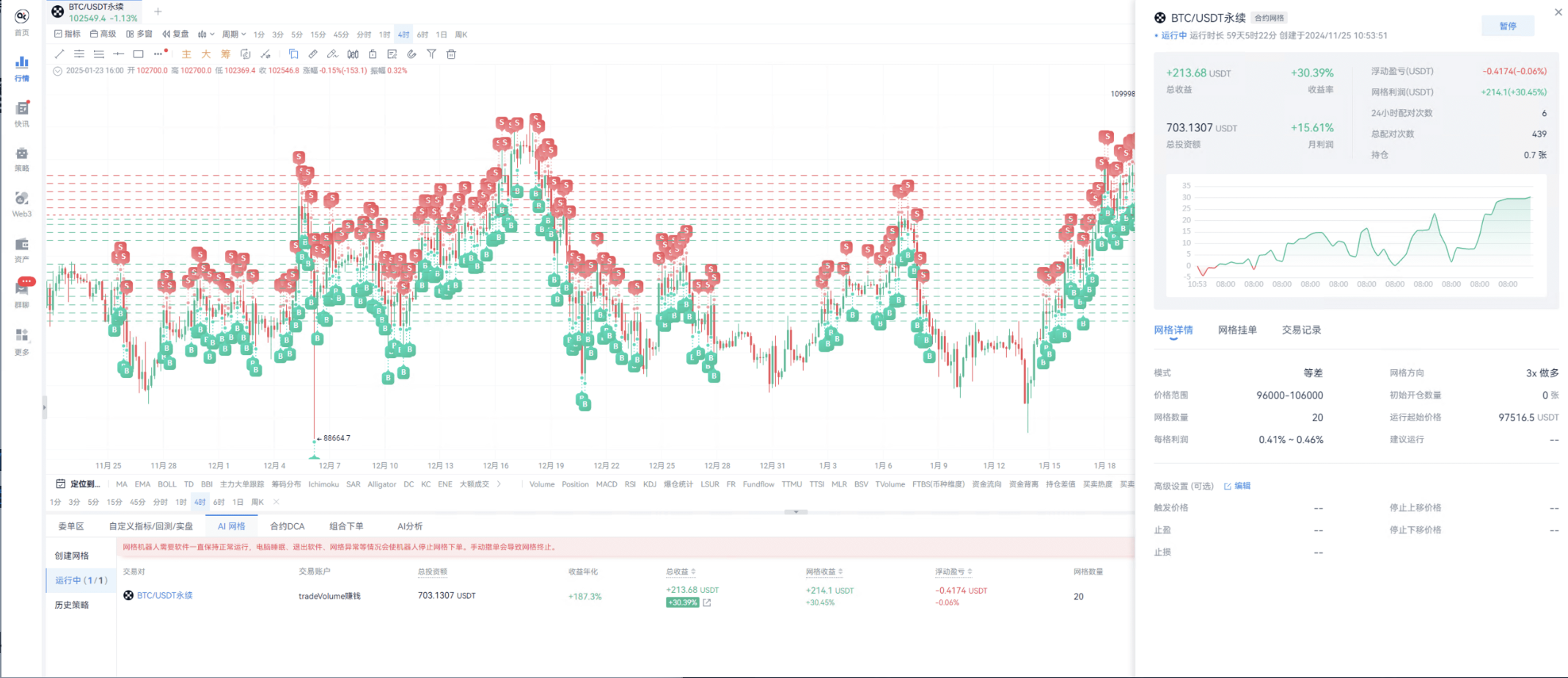

First, let's take a look at the host's grid practice. The host's grid range is from 96,000 to 106,000, with fully automated trading and a grid count of 20. From the profit curve, the overall profit is upward, but there will be profit drawdowns during declines. However, the advantage of grid trading is that it can capture multiple low-buy high-sell opportunities in a volatile market, which is very helpful for increasing personal trading volume and leveling up on exchanges.

The risk point of grid trading is that if the market shows a one-sided trend, it may break the grid. But the host is very smart and only trades major currencies like BTC, as Bitcoin usually oscillates within a range for a long time before showing a one-sided trend. Even if the current grid of 96,000 to 106,000 is broken, the host can stop and adjust the next round of the grid. For example, a few days ago, the host considered trying ETH, as ETH has been oscillating between 2,000 and 4,000, providing significant grid opportunities.

In fact, before the 96,000 to 106,000 range, the host had run another grid with a range of 85,000 to 95,000. However, that time it only lasted 9 days before encountering a violent surge, leading to a grid break, which is why the host readjusted to a new grid. A special reminder: the host runs a long grid, only executing long and flat operations. If there is a one-sided downward market and insufficient funds, losses or even liquidation may occur. Therefore, grid trading is not a one-time solution; it requires checking the market every few days and counting the profits. If a one-sided decline occurs, the host will readjust the grid, possibly changing it to a downward or neutral grid.

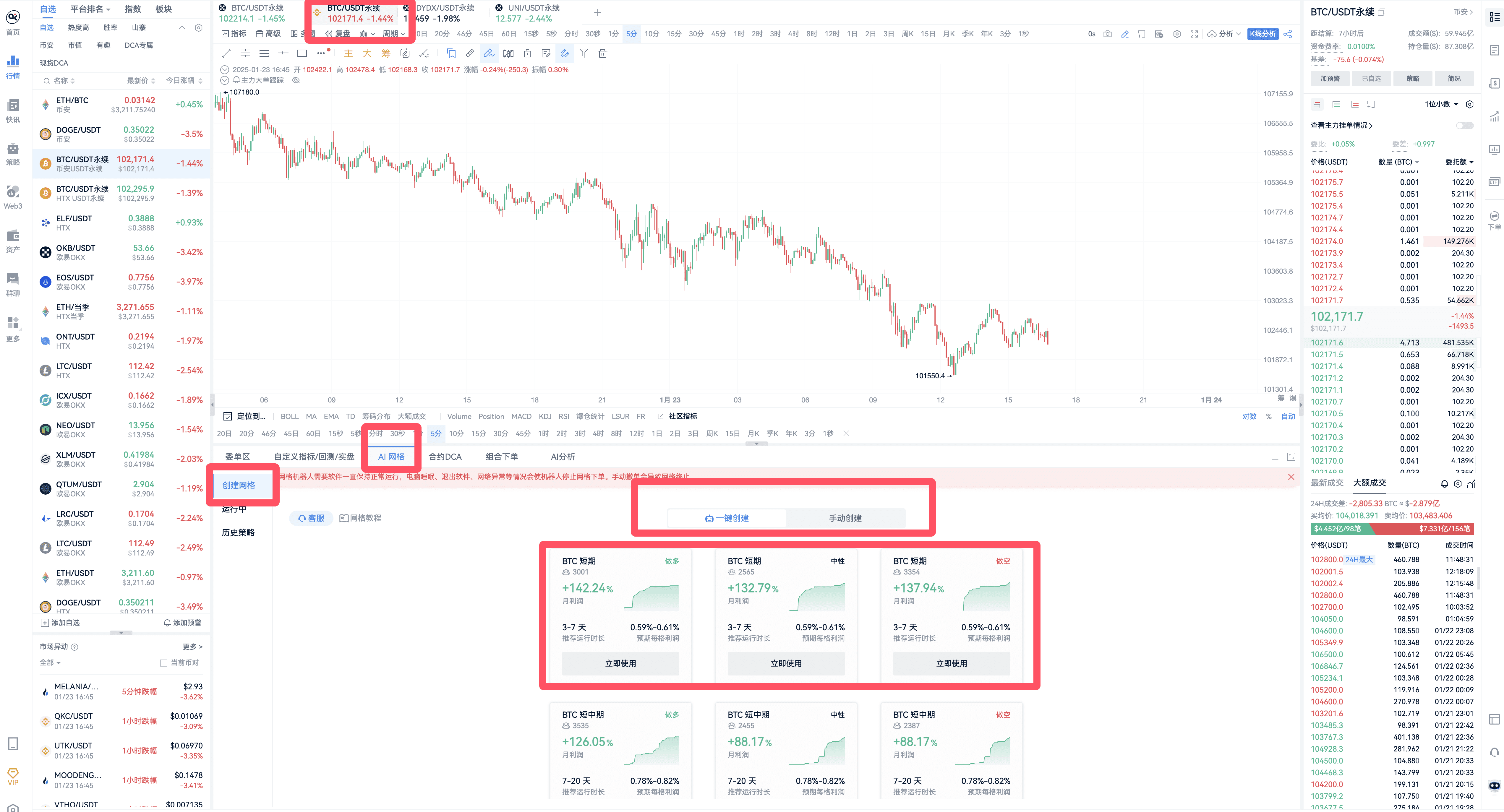

AiCoin's tools offer various grid types, including long grids, neutral grids, and short grids, allowing users to create them manually based on their needs. In fact, grid trading is not that complicated; you don't necessarily need a quantitative team to participate. After listening to the host's principle analysis, you can also open a grid on AiCoin and become an expert!

Next, let's discuss the principles of grid trading in detail. Grid trading is a strategy used in the cryptocurrency spot market that profits from price fluctuations by pre-setting buy and sell orders in a grid above and below the current market price. Whether you hold positions for the long term or short term, grid trading can help you achieve automated trading, saving time and effort.

The benefits of using grid trading are numerous:

Automated Trading: Operates fully automatically 24/7 without manual intervention;

Strategic Profitability: Buy low and sell high within a set price range, capturing profits in volatile markets;

Risk Management: Supports stop-loss and take-profit settings to reduce risk;

Intelligent Parameters: Easily formulate grid strategies through historical trading data backtesting.

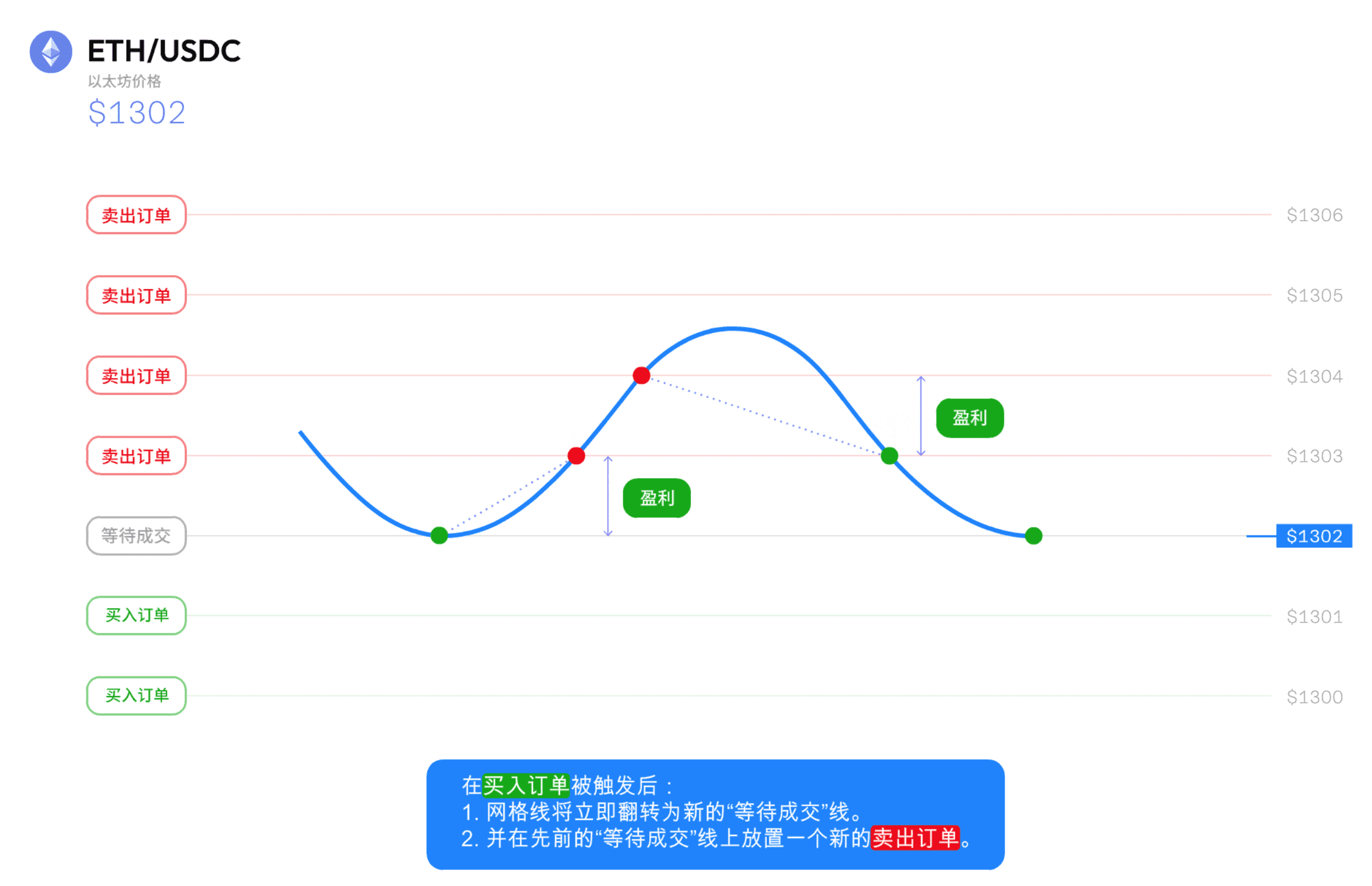

For example, you can customize grid strategy parameters based on your preferences, such as price range, initial investment, number of grids, and quantity per grid. The grid count refers to how many portions the funds are divided into, for instance, into 7 portions.

When the price hits the grid line, a trade is triggered. For example, if the price triggers the first buy line, the buy order is executed;

Then, as the price rises, it triggers the sell line, and the sell order is executed. This way, through one low buy and high sell, you achieve profit.

Then, as the price rises, it triggers the sell line, and the sell order is executed. This way, through one low buy and high sell, you achieve profit. The only thing to keep in mind with grid trading is to ensure that the current market price is within the price range you set. If the price breaks through the range, you can respond by setting a stop-loss or manually stopping the loss.

If you want to experience grid trading, you can start with 100 USDT. In AiCoin's tools, you can create a grid with one click or manually set parameters. The neutral grid is particularly suitable for sideways volatile markets; for example, BTC has been oscillating between 90,000 and 110,000 for a long time, making it very suitable for running a grid.

Our grid range is 10,000 USDT, and if Bitcoin breaks above 110,000 or below 90,000, the host will rebuild a new grid. Therefore, grid trading requires checking every few days to see if it is profitable and how much profit is made. The amount of capital invested and the grid range will determine how the tool operates according to your settings.

Finally, when using the grid bot, it is essential to maintain a long-term investment mindset. The goal of grid trading is to obtain small and stable profits over a period, rather than making quick large profits. Importantly, choose investment projects that suit you and invest amounts that you can afford to risk. Additionally, when using AiCoin's PC client, ensure that the client remains running.

The above are some insights from the host's use of the grid tool, shared with everyone! If you are interested in grid trading, feel free to download the AiCoin client and personally experience this automated trading tool!

Finally, I recommend reading the following articles to help you better understand CME gaps and other trading strategies:

For more live content, please follow AiCoin's “AiCoin - Leading Data Market and Intelligent Tool Platform” section, and feel free to download AiCoin - Leading Data Market and Intelligent Tool Platform

Risk Warning: The content of this article is for educational purposes only and does not constitute investment advice. Trading should be done with caution, and profits and losses are at your own risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。