Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

Another new day begins, and another round of sharp declines.

According to OKX market data, BTC once fell below 77,000 USDT (dropping to a low of 76,600 USDT), getting closer to the 70,000 level that BitMEX co-founder Arthur Hayes has been calling for a long time. As of around 9:15 (same below), it is currently reported at 77,451 USDT, with a 24-hour decline of 4.46%.

In terms of altcoins, phrases like “unbearable to watch” and “blood flowing like a river” that have been overused in the past few days are no longer sufficient to describe the dire situation. As an old investor who has experienced the last round of bull-bear transitions, I personally feel that the overall sentiment of altcoins is worse than when ETH hit bottom at 881 USDT in 2022.

ETH dropped to a low of 1,752 USDT today, currently reported at 1,809 USDT, with a 24-hour decline of 10.87%;

SOL dropped to a low of 112 USDT, currently reported at 115.85 USDT, with a 24-hour decline of 8.49%;

Other altcoins and on-chain memes need not be mentioned, as most popular altcoins have set new historical lows.

Data from Alternative shows that today’s fear and greed index is reported at 24, still in a state of “extreme fear.”

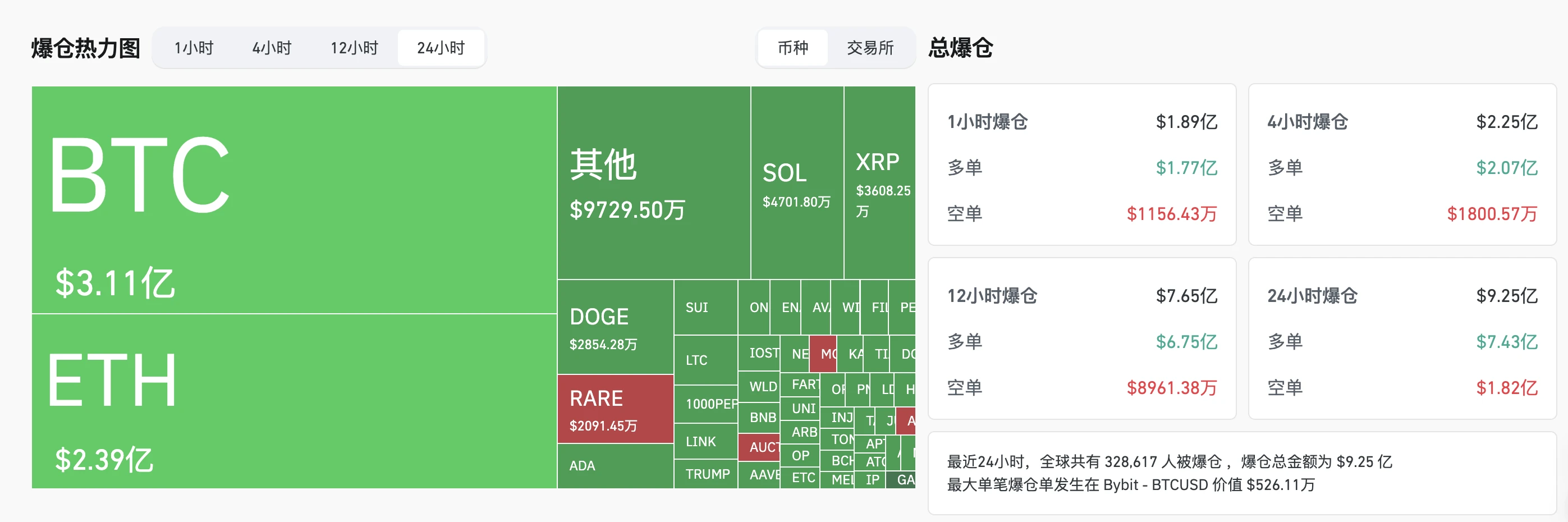

In terms of derivatives data, Coinglass shows that in the past 24 hours, the entire network has seen liquidations of 925 million US dollars, with the vast majority being long liquidations, amounting to 743 million US dollars. In terms of cryptocurrencies, BTC saw liquidations of 311 million US dollars, and ETH saw liquidations of 239 million US dollars.

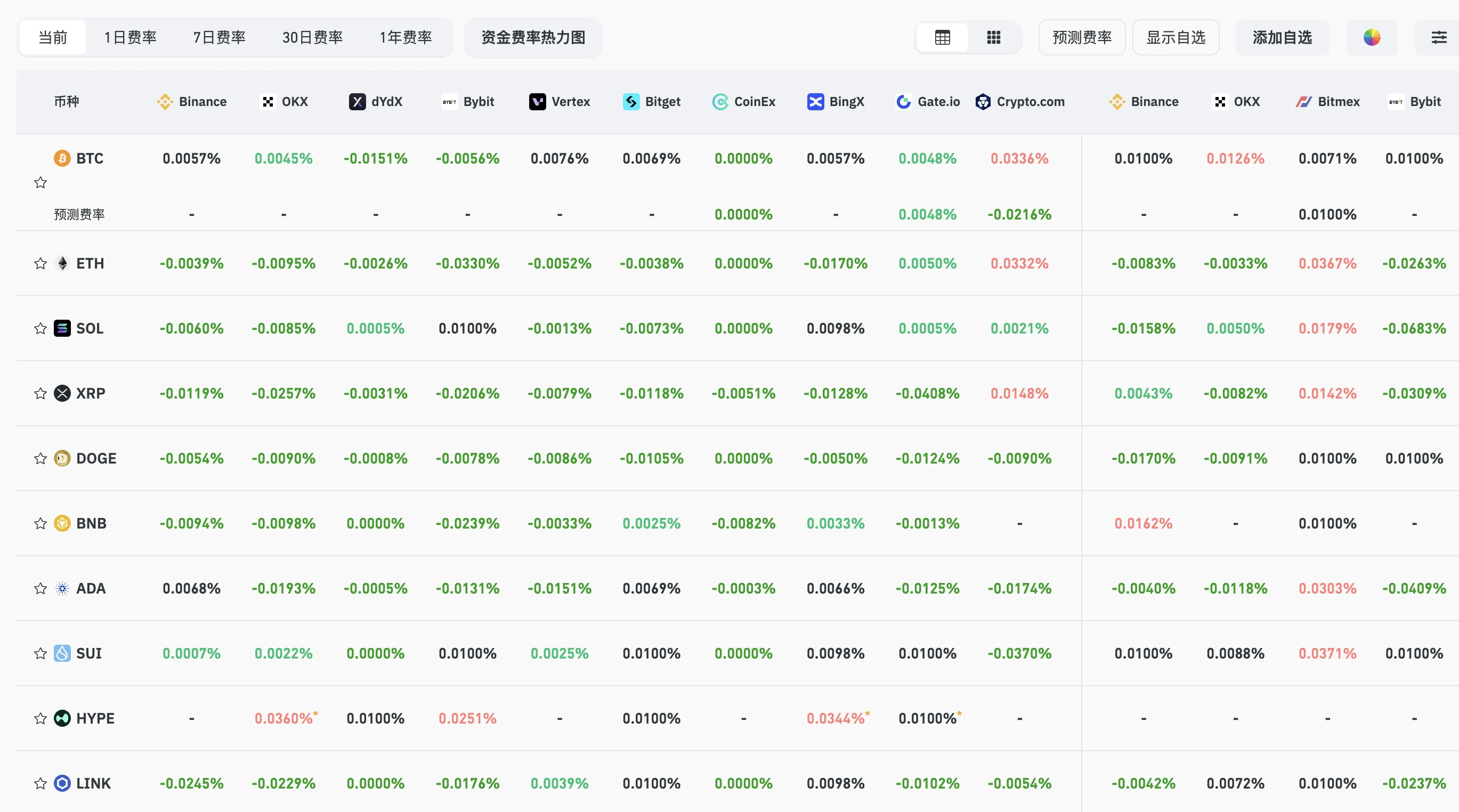

Additionally, the funding rates on major platforms have generally turned negative, indicating that the overall market has shifted to a bearish outlook.

Reasons for the sharp drop: recession ➡️ US stocks ➡️ cryptocurrency market

As the mainstreaming of cryptocurrencies progresses, the correlation between the market and US stocks has become increasingly strong — looking back at the market trends from last night to this morning, the cryptocurrency market has almost started to decline in sync with US stocks.

US stock market data shows that the Nasdaq index fell by 4%, the S&P 500 index fell by 2.7%, and the Dow Jones index fell by 2.08%; in terms of individual stocks, large tech stocks suffered heavy losses, with Tesla down over 15%, Nvidia down over 5%, Coinbase down over 17.58%, and Strategy down 16.68%.

Looking at market analysis, mainstream institutions seem to generally attribute the recent sharp decline in US stocks to expectations of an economic recession, and with the intensification of panic, the entire market appears to be shifting from risk assets to safe assets.

KobeissiLetter mentioned in its analysis report this morning: “The trade war is just an excuse. The real reason for the market decline is the sudden shift in risk appetite. In just a few days, we have gone from extreme greed to extreme fear. The positioning is so polarized that the market has turned in the completely opposite direction.”

This trend shift is also reflected within the cryptocurrency market.

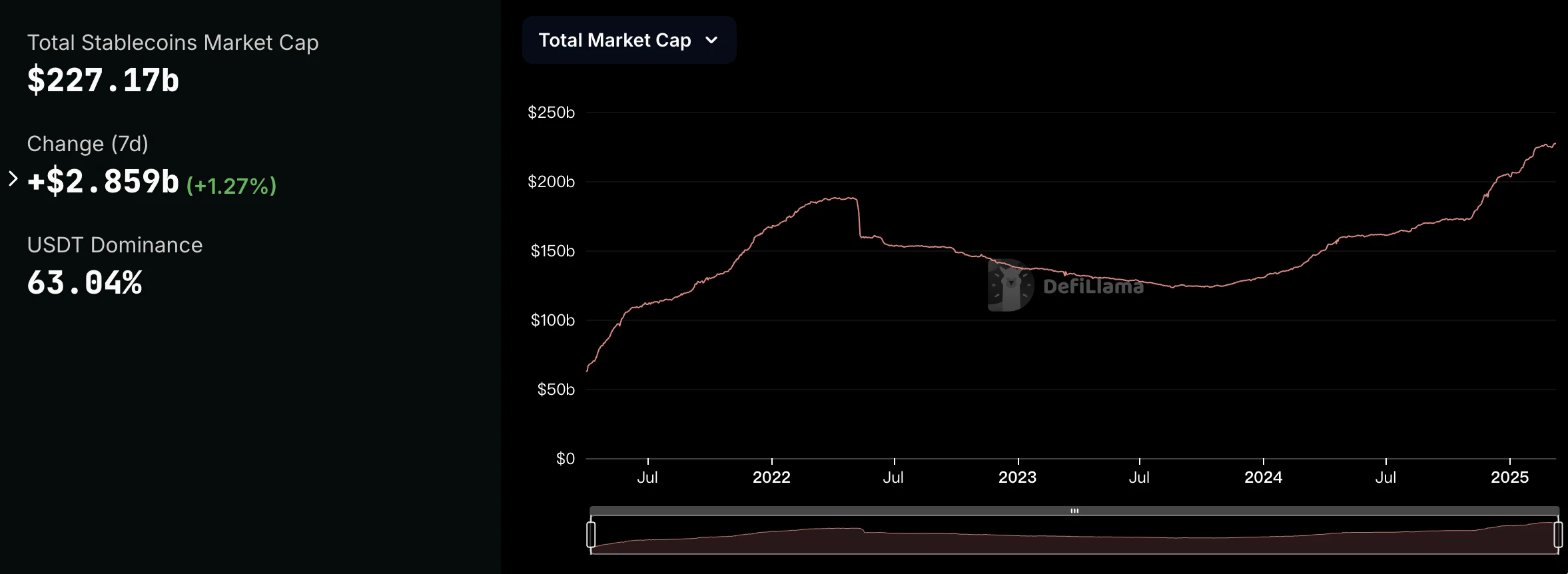

Data from Defillama shows that the total supply of stablecoins across the network has reached 227.11 billion, a new historical high, while the stablecoin deposit scale in the Aave lending market is also at a historical high — interpreted positively, this means that funds in the market are still abundant; conversely, it suggests that the trading appetite for funds seems extremely low, and large holders currently seem more inclined to “collect rent” and observe in DeFi.

How do institutions/experts predict the future market?

Has the correction ended? What will the future market look like? Although the current market is filled with various uncertainties, combining the predictions of leading institutions/experts about the future market seems to capture some operational trends.

BitMEX co-founder Arthur Hayes, who has been bearish for a long time, reiterated this morning his prediction that BTC will bottom out at 70,000, and suggested that retail investors should “buy heavily” after major central banks shift to easing policies.

Be patient! BTC is likely to bottom out around 70,000 US dollars. A drop of 36% from the historical high of 110,000 US dollars is very normal in a bull market. Then, we need to see the stock market ($SPX and $NDX) enter free fall. After that, the “puppets” of traditional financial markets (TradFi muppets) will also collapse. Then, we will see the Federal Reserve (Fed), the People's Bank of China (PBOC), the European Central Bank (ECB), and the Bank of Japan (BOJ) all begin easing policies to stimulate their respective countries.

Finally, you can go all in. Traders may try to catch the bottom, but if you are risk-averse, you can wait until the central banks start easing before investing more. You may not catch the lowest point, but you also won’t be mentally tortured by prolonged sideways movement and potential unrealized losses.

Raoul Pal, founder and CEO of RealVision, predicted on X that given M2 is returning to high levels, this round of correction may be nearing its end.

These growing pains will eventually pass… In the fourth quarter of 2024, due to a strong dollar and rising interest rates, cryptocurrencies have been affected by liquidity tightening. This trend is almost over, financial conditions are rapidly easing, and M2 is returning to new highs. This is just a regular adjustment…

In summary, based on the predictions of several leading figures, this round of correction seems to have entered its later stage, and the downward space may be limited… However, in such a fragile structure with extreme volatility, please operate cautiously, keep your powder dry, and restrain leverage, as staying at the table is the only way to have a chance to laugh last.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。