1. Bitcoin Market

From March 3 to March 9, 2025, the specific trends of Bitcoin are as follows:

March 3: Policy Favorable News Drives Bitcoin to Surge Temporarily, Followed by Significant Correction

In the early hours of March 3, the price of Bitcoin suddenly surged from $85,199 to $94,598, an increase of over 11%. The main driving force behind this spike was Trump's expression of recognition for Bitcoin and Ethereum on social media, mentioning that crypto assets might become part of national reserves. This news quickly ignited market sentiment, pushing Bitcoin's price to a short-term high of $94,727.

However, as the market digested the positive news, sentiment gradually returned to rationality. The price oscillated back down to $91,271, briefly rebounding to $93,513 before entering a stepwise decline starting at 10 PM: Phase One: a drop from $93,611 to $89,803; Phase Two: a further decline to $85,509; Phase Three: a minimum drop to $82,969, effectively erasing the short-term gains.

March 4: Market Consolidates with Short-term Drop Below $82,000

After the significant adjustment on the previous day, the market entered a short-term consolidation phase. Bitcoin traded within the range of $82,500 - $84,300, briefly dipping to $81,947 but quickly rebounding above $82,500, indicating strong support in that area.

March 5: Bitcoin Strongly Rebounds, Breaking Through $90,000

As market sentiment gradually recovered and buying power increased, Bitcoin's price quickly rose from $82,408 to $88,371. Although it slightly corrected to $86,669, the overall upward trend remained intact, further breaking through $90,768, and finally consolidating around $87,925.

March 6: Upward Movement Stalls, Oscillating Correction

Bitcoin's price encountered resistance around $92,678, leading to intense competition between bulls and bears. Due to insufficient upward momentum in the market, the price entered a phase of oscillating correction, ultimately falling back to around $88,629.

March 7: Sharp Short-term Drop Followed by Stabilization, $85,000 Support Remains Strong

Bitcoin initially rose to $90,562 in the morning but quickly fell to $85,496 as selling pressure intensified. Although it briefly approached the critical support level of $85,000, this level remained solid without a significant breakdown. Subsequently, Bitcoin quickly rebounded to $88,763 and oscillated upward to $90,921, with notable short-term market fluctuations.

March 8: Intense Bull-Bear Clash, Price Returns to Around $86,000

Bitcoin's price significantly dropped to $86,713 during the day, followed by a rebound that peaked at $88,549. However, as the battle between bulls and bears intensified, the price fell back to $85,995, with market volatility noticeably slowing down, and the oscillation range gradually narrowing, ultimately stabilizing around $86,000 as market watchfulness increased.

March 9: Volatility Converges, Market Awaits New Driving Factors

Bitcoin continued its narrow consolidation trend, with further contraction in volatility, trading within the range of $85,780 to $86,480. The overall market stabilized, lacking a clear directional trend in the short term, with investors generally awaiting new market catalysts or policy guidance.

Overall, Bitcoin exhibited a roller-coaster trend this week, reflecting the market's high sensitivity to macro news while also indicating instability in short-term liquidity.

Bitcoin Price Trends (2025/03/03-2025/03/09)

2. Market Dynamics and Macro Background

Capital Flow

(1) Capital Flow: Whale Holdings and Exchange Movements

March 3-5: During Bitcoin's rise to $94,000, on-chain data showed a significant increase in exchange deposits, with whales and early holders taking profits at the peak, leading to a rise in short-term selling pressure.

March 5-7: As prices corrected, net outflows of Bitcoin from exchanges increased again, indicating that long-term investors (HODLers) might be accumulating at lower levels, and the market entered a repricing phase.

In the derivatives market:

March 3: The open interest (OI) of BTC perpetual contracts surged, indicating a large influx of capital into long positions. However, excessive long leverage led to a sharp market correction, triggering significant liquidations.

March 6-7: The long-short position ratio tended to balance, and the market entered a phase of oscillating consolidation.

(2) Trading Depth and Market Sentiment

The Fear and Greed Index briefly surpassed 85 (extreme greed) on March 3, then fell to around 60 (neutral to optimistic) due to the correction, indicating that market sentiment returned to rationality after a rapid surge.

March 6-7: The market's buy-sell depth became more balanced, speculative sentiment weakened, and more capital began to focus on support levels and macro risks.

Technical Analysis

(1) Key Support and Resistance

Resistance Levels: $94,000 (March 3 high), $92,500 (March 6 high)

Support Levels: $85,500 (March 7 low), $82,500 (March 4 low)

(2) Indicator Analysis

RSI (Relative Strength Index):

On March 3, it surged above 75 (overbought zone), then fell back to around 45 (neutral), indicating that the market entered a correction phase after experiencing FOMO (fear of missing out).

It reached the overbought zone above 70 on March 5, then fell back to around 60, showing a weakening buying power.

MA (Moving Average):

The short-term 5-day moving average rose sharply on March 3 but subsequently crossed below the 20-day moving average, indicating significant short-term correction pressure.

The 200-day moving average remains upward, indicating that the long-term trend is still bullish.

MACD (Moving Average Convergence Divergence):

A golden cross formed on March 3, but bullish momentum weakened afterward, and a death cross formed on March 5, indicating a short-term oscillating consolidation trend.

Macro Background and Industry News

(1) Macroeconomic Factors

U.S. Economic Data:

The ISM Services PMI released on March 4 exceeded expectations, showing that the U.S. economy remains resilient. The market expects the Federal Reserve will not cut rates prematurely, putting short-term pressure on liquidity and affecting Bitcoin's price correction.

Federal Reserve Policy:

Federal Reserve officials did not clearly support an early rate cut in their speeches on March 6, leading to a cooling of market expectations for easing policies, with funds flowing back to traditional markets, putting some selling pressure on the crypto market.

(2) Industry News

Trump's Cryptocurrency Statement (March 3)

Trump expressed support for Bitcoin and Ethereum, suggesting that cryptocurrencies could become national strategic reserve assets. This statement triggered a brief FOMO in the market, pushing BTC prices higher.

Bitcoin ETF Fund Flow (March 5)

The inflow of funds into spot Bitcoin ETFs slowed this week, indicating that institutional capital took profits at high levels, creating some pressure on short-term market sentiment.

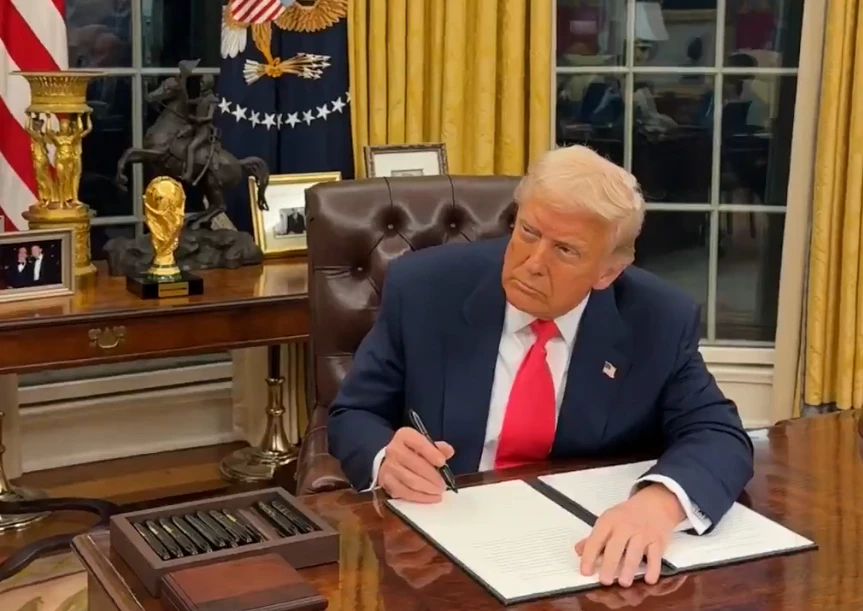

Trump Signs Executive Order to Establish Strategic Bitcoin Reserves (March 6)

Trump signed an executive order to establish strategic Bitcoin reserves, seen as "digital Fort Knox for digital gold." However, this order only involves accumulating existing confiscated assets rather than direct purchases, disappointing the market.

Summary and Outlook

Short-term Outlook (1-2 Weeks)

Market Trend: Bitcoin is expected to oscillate in the range of $85,000 - $92,000 in the short term, awaiting new macro signals or capital inflows to drive a breakout.

Key Focus Points:

Whether the support at $85,000 - $86,000 remains solid

Whether $92,500 can be broken to confirm a new round of upward movement

The release of U.S. CPI (inflation data) on March 13, which may affect Federal Reserve policy expectations and subsequently impact BTC trends.

Medium to Long-term Outlook (1-3 Months)

Technical Aspects: Bitcoin's long-term moving averages remain upward, and the overall bullish trend remains unchanged, but the short term may require more time for consolidation.

Market Structure: Institutional capital continues to focus on Bitcoin, with ETF holdings steadily increasing, indicating potential for upward movement in the coming months.

Macroeconomic Factors: If the Federal Reserve releases clearer signals for rate cuts, it may drive BTC to experience a stronger upward trend in the second quarter.

3. Hash Rate Changes

From March 3 to March 9, 2025, the Bitcoin network hash rate exhibited significant fluctuations, reflecting the dynamic adjustments of miner computing power and the impact of market conditions. On March 3, the hash rate surged from 650.51 EH/s to 859.31 EH/s. It then experienced a volatile decline on March 4, dropping to a low of 741.64 EH/s, but quickly rebounded to 814.15 EH/s, showing some short-term volatility. On March 5, the computing power further fluctuated, first dropping to 748.62 EH/s, then rising to 812.17 EH/s, but again dipping to 717.95 EH/s, indicating ongoing adjustments in miner behavior. On March 6, the Bitcoin network's computing power entered a rapid growth phase, with the hash rate climbing to 768.85 EH/s, 918.33 EH/s, and finally reaching 964.16 EH/s, marking a peak for this cycle. However, on March 7, the network's computing power corrected, with the hash rate falling back to 728.29 EH/s, followed by a brief rebound to 802.39 EH/s. On March 8, the hash rate dipped again to 716.83 EH/s but soon entered a new upward trend. As of March 9, the hash rate continued to rise, with the latest data reaching 868.36 EH/s, indicating that miner computing power is gradually recovering to higher levels.

Overall, the significant fluctuations in Bitcoin's hash rate this week may be influenced by miner profitability, changes in energy costs, and expectations for mining difficulty adjustments. Future trends will need to focus on further changes in market conditions and hash rate distribution.

Hash Rate Data of the Bitcoin Network

4. Mining Revenue

From March 3 to March 9, 2025, Bitcoin miners' earnings were influenced by multiple factors, including Bitcoin price fluctuations, mining difficulty adjustments, and market sentiment.

Bitcoin Price Trends:

As of the time of writing on March 9, 2025, the price of Bitcoin was $86,066. In the past 24 hours, the price increased by 0.06%. The volatility in Bitcoin prices has a direct impact on miners' earnings.

Miner Earnings and Mining Costs:

The decline in Bitcoin prices and the rise in mining costs have put pressure on miners' earnings. According to a report from JPMorgan, in February, Bitcoin miners earned an average of $54,300 per EH/s daily from block rewards, a decrease of 5% from the previous month.

Miner Behavior:

Despite the decline in earnings, on-chain data shows that Bitcoin miners have not engaged in selling since February 28, 2025. This may indicate that miners remain confident in the market outlook and choose to hold Bitcoin while waiting for prices to rebound.

Market Sentiment and Future Outlook:

Market analysts suggest that during a bull market, miners should not sell Bitcoin too early to avoid missing potential gains. However, miners' profitability will still be affected by Bitcoin price trends, mining difficulty adjustments, and energy costs.

Overall, from March 3 to March 9, 2025, Bitcoin miners' earnings were impacted by price fluctuations and cost pressures, but miners remain cautiously optimistic about the market outlook.

5. Energy Costs and Mining Efficiency

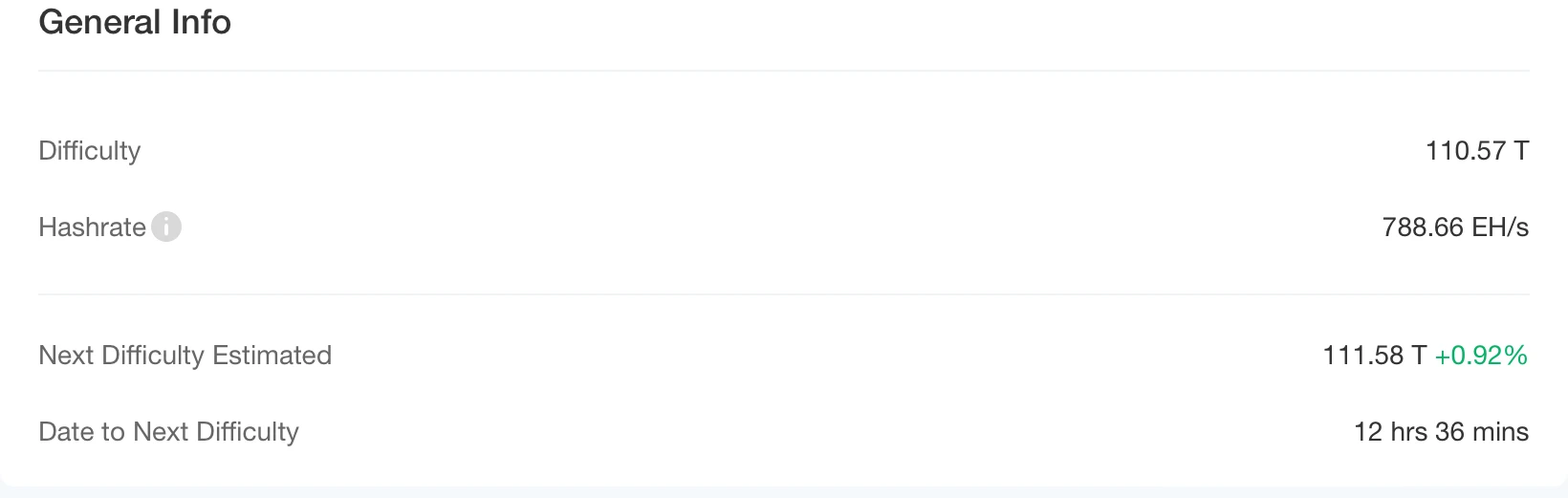

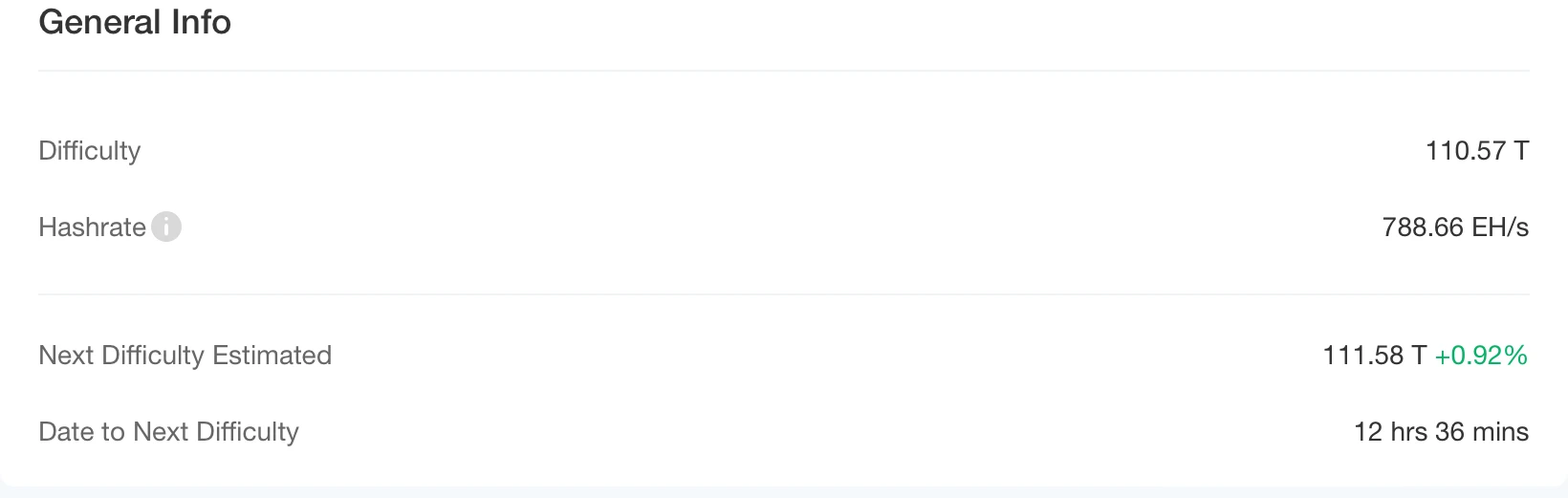

According to CloverPool data, as of March 9, 2025, the total network hash rate was approximately 788.66 EH/s, with a mining difficulty of 110.57T. At the time of writing, the next Bitcoin mining difficulty is expected to increase by 1.29% to 111.58T in 12 hours (previously forecasted at 0.92%). As the difficulty adjustment occurs, miners' operational efficiency is also optimized, affecting overall energy consumption.

According to the latest estimates from MacroMicro, the current total production cost of Bitcoin is approximately $87,470.91, with a Mining Cost-to-Price Ratio of 1.01, indicating that the market price of Bitcoin is roughly equal to its production cost, even slightly above it. In this context, some high-cost miners face profitability pressures, especially those relying on high electricity prices and using inefficient mining machines (such as Antminer S19 and older models), who may suspend operations or sell their machines due to excessive costs. If market prices remain low, miners may further reduce hash rates, leading to a decline in overall network hash rate, which in turn affects future mining difficulty adjustments.

Meanwhile, the Bitcoin hash price has also been severely impacted. According to Bitcoin.com News, the hash price dropped from $56.73/PH/s last month to $49.81/PH/s, indicating a significant decrease in miners' earnings per unit of computing power. Additionally, although miners earned $1.24 billion in February 2025, the profit outlook for March is not optimistic; unless BTC prices or transaction fees see a significant increase, the pressure on miners will continue to mount.

Due to the current relatively low market prices, miners have reduced BTC sales, choosing to hold their coins while waiting for prices to rebound to mitigate loss risks. Crypto analyst Ali Martinez pointed out on the X platform that since February 28, there has been no large-scale selling behavior among miners, further validating their holding strategy.

Improving Mining Efficiency and Energy Optimization

Some leading mining companies are enhancing mining efficiency through technological optimization. For example, CleanSpark achieved an average mining machine efficiency of 17.07 J/Th in February 2025, with an average daily output of 22.30 BTC. Additionally, an increasing number of miners are turning to renewable energy to lower energy costs and reduce carbon footprints. Currently, the use of clean energy sources such as hydropower, solar, and wind energy in global Bitcoin mining activities is gradually increasing, becoming an industry trend.

However, the recent continuous rise in Bitcoin's overall network hash rate and mining difficulty has led to increased mining costs, further compressing profit margins. In this context, miners are actively adopting strategies to improve mining machine efficiency, optimize energy structures, and utilize renewable energy to address the increasingly severe challenges of energy costs and environmental issues.

Bitcoin Mining Difficulty Data

6. Policy and Regulatory News

As of March 8, 2025, the latest developments in Bitcoin reserve legislation across U.S. states

Federal Level:

On March 5, U.S. President Donald Trump signed an executive order announcing the establishment of a strategic Bitcoin reserve and hosted the first cryptocurrency summit that day to officially launch the reserve plan. This move may encourage more states to legislate in support of Bitcoin reserves.

Key Points:

Reserve Source: The reserve will consist of Bitcoin obtained by the federal government through criminal or civil asset forfeiture procedures, and the government will not purchase Bitcoin on the open market.

Asset Verification: The executive order requires a comprehensive accounting of the digital assets held by the federal government to clarify the current quantity and status of Bitcoin held.

Fiscal Impact: The President emphasized that establishing this reserve will not increase the fiscal deficit or debt and will not use taxpayer funds.

Latest Developments by State:

1. Texas

On March 7, the Strategic Bitcoin Reserve Bill (SB 21) passed in the state Senate with a vote of 25 in favor and 5 against.

On March 9, Texas officially created a Bitcoin Reserve Fund, becoming the first state-owned crypto fund in U.S. history.

2. New Hampshire

On March 6, the New Hampshire House Business Committee passed the Bitcoin Reserve Bill (HB 302) with a vote of 16 to 1, and the bill is now entering the full House voting stage.

Key contents of the bill:

Allows the state treasurer to invest 5% of the state fund in digital assets (currently only Bitcoin meets the market capitalization standard).

The original options for stablecoins and staking investments were removed, and the investment cap was reduced from 10% to 5%.

The state treasurer stated that if the bill passes, an investment plan will be considered.

The passage of this bill coincides with President Trump's announcement of the establishment of a national-level crypto strategic reserve, and market experts predict that this reserve may primarily consist of Bitcoin.

3. Utah

Recently passed Bitcoin-related legislation, but it does not include the strategic reserve component.

4. Arizona

Considered likely to be the first to pass Bitcoin strategic reserve legislation.

5. Other States

Montana, Wyoming, North Dakota, South Dakota, and Pennsylvania have all rejected related legislative proposals.

Overall Trend

Currently, multiple states in the U.S. are accelerating the advancement of Bitcoin reserve legislation, with Texas, New Hampshire, and North Carolina making faster progress.

With the federal government launching a strategic Bitcoin reserve, it is expected that more states will re-examine related bills and expedite the legislative process.

Related Images

U.S. Treasury Sanctions 49 Bitcoin and Monero Addresses Linked to Dark Web Market Nemesis

On March 5, news broke that the U.S. Treasury's Office of Foreign Assets Control (OFAC) has added 49 cryptocurrency addresses to its sanctions list, controlled by Iranian citizen Behrouz Parsarad, who is accused of being the administrator of the dark web market Nemesis. The sanctioned addresses include 44 Bitcoin and 5 Monero addresses.

Before its shutdown, Nemesis had 30,000 active users and facilitated nearly $30 million in drug transactions over three years. According to OFAC, Parsarad profited millions of dollars by charging users transaction fees and is suspected of laundering money for drug traffickers and cybercriminals. Nemesis dealt in a wide range of illegal goods, including drugs, personal identity data, forged documents, ransomware, and cybercrime tools (such as phishing attacks and DDoS tools).

Florida Republican Representative Commits to Including Bitcoin in State Financial Reserves

On March 5, news emerged that Matthew Sigel, Director of Digital Asset Research at VanEck, disclosed that Florida Republican Representative and gubernatorial candidate Byron Donalds promised on Fox News to support including Bitcoin in the state reserves. Donalds proactively stated, "Digital assets have found a home in Miami-Dade County. We hope to continue developing on this framework. For the state's investment portfolio, I would like to include Bitcoin as part of the state financial portfolio."

Donalds emphasized that Bitcoin has proven to be an excellent store of value and wealth, and including it in the state balance sheet would help address potential economic storms in the future. He also stated, "Florida will become a global financial center, not just for the U.S., but for the entire world."

7. Mining News

Belarusian President Orders Development of Cryptocurrency Mining to Utilize Surplus Electricity for Revenue

On March 5, news reported that Belarusian President Alexander Lukashenko has instructed the new Minister of Energy to develop the country's cryptocurrency mining industry to fully utilize surplus electricity resources. This decision comes as Lukashenko forms a new government, and he emphasized that the current priority is to upgrade the national 5,700-kilometer power grid to meet the growing electricity demands of households and economic activities.

U.S. Authorities Release Some Seized Mining Machines, Industry Insiders Report Many Devices Still Detained

On March 6, news emerged that U.S. authorities have begun releasing some previously seized Chinese-manufactured cryptocurrency mining machines. Industry insiders revealed that up to 10,000 mining machines had been detained at various U.S. ports of entry. Taras Kulyk, CEO of Synteq Digital, stated that thousands of devices have been released, but he noted that some U.S. Customs and Border Protection (CBP) officials are making it difficult for the crypto industry, causing serious challenges for miners.

Although some mining machines have been released, Ethan Vera, COO of Luxor Technology, stated that most devices remain detained. He also revealed that U.S. authorities had expressed concerns about the radio frequency emissions of the mining machines, but the industry generally believes these allegations are unfounded.

8. Bitcoin-Related News

Global Corporate and National Bitcoin Holdings (Weekly Statistics)

Corporate Holdings

Metaplanet (Japan)

March 3: Increased holdings by 156 BTC, total holdings reached 2,391 BTC.

March 5: Further increased holdings by 497 BTC, total holdings rose to 2,888 BTC.

According to Metaplanet's announcement, the company completed a large-scale exercise of stock subscription rights for Series 13 and 14 through a third-party directed issuance, raising approximately 12.97 billion yen (about 87 million USD). Metaplanet plans to use these funds to continue increasing its Bitcoin holdings to strengthen its digital asset investment strategy.

Boyaa Interactive (Hong Kong)

March 2: Increased holdings by 100 BTC at an average price of $79,500.

Total holdings increased to 3,350 BTC, with an average holding price of $58,627.

Canaan Creative (China)

As of December 31, 2024, total Bitcoin holdings were 1,355 BTC.

Mining hash rate in February reached 0.93 EH/s, with an expected revenue of $89 million in Q4 2024.

MicroCloud Hologram (USA)

Plans to purchase up to $200 million in Bitcoin and cryptocurrency-related securities derivatives.

Holds $303 million in cash reserves, planning to invest in BTC-related technology development.

Meliuz (Brazil)

March 7: Announced the company's official entry into the Bitcoin market as part of a new financial management strategy.

The board approved allocating up to 10% of cash reserves to BTC.

First acquisition: Purchased 45.72 BTC, totaling $4.1 million, at an average price of $90,296.

Fold (USA)

March 9: Bitcoin service company Fold announced the addition of 475 BTC to its treasury, valued at approximately $41 million.

Total holdings exceed 1,485 BTC, valued at about $130 million at current prices.

National Holdings

El Salvador

March 4: Increased holdings by 5 BTC, total holdings surpassed 6,100 BTC, valued at approximately $507 million.

March 5: Further increased holdings by 1 BTC, current holdings at 6,101.18 BTC.

In the past 7 days, increased holdings by 13 BTC, and in the past 30 days, increased holdings by 45 BTC, with a total value exceeding $520 million.

Coinbase Co-founder: Bitcoin is the optimal choice for strategic reserves, a crypto market cap index could be launched to maintain fairness

On March 3, Coinbase co-founder and CEO Brian Armstrong commented on social media regarding "Trump's push for a cryptocurrency reserve plan," stating that Bitcoin may be the best choice for asset allocation in strategic reserves. As a successor to gold, Bitcoin has the simplest and clearest narrative. If people want more variety, a market cap-weighted index of crypto assets could be created to maintain fairness. However, choosing only Bitcoin may be the simplest option.

Gemini Co-founder: Bitcoin is the only asset that meets the standards for a value reserve asset

On March 4, Gemini co-founder Cameron Winklevoss expressed excitement about the cryptocurrency strategic reserve plan on social media but was surprised by the digital assets being considered. Bitcoin is the only asset that meets the standards for a value reserve asset, and perhaps Ethereum also qualifies. Digital gold and digital oil. This is similar to the U.S. physical reserves (such as the Kentucky vault, New York Federal Reserve Bank, etc.) and oil (strategic petroleum reserves). Other assets may meet this standard in the future, but it is a very high bar.

Related Images

Analysis: Bitcoin may reach $125,000 by year-end, altcoins may perform even better

On March 6, CK Zheng, founder of cryptocurrency hedge fund ZX Squared Capital, stated that Bitcoin (BTC) could reach $125,000 by the end of the year, but other cryptocurrencies may perform even better. Despite the apparent effectiveness of U.S. tariff policies on Mexico and Canada, Zheng expects Bitcoin will not fall below $75,000. He stated, "The market is quite volatile in the short term, but for long-term investors, this is a good opportunity to allocate Bitcoin."

Zheng pointed out in an interview with CoinDesk: "There is a correlation between Bitcoin and altcoins, but I believe Bitcoin's market dominance will decline. If you want the cryptocurrency ecosystem to truly develop, you cannot have 60% of the market value concentrated in Bitcoin."

Zheng believes: "New policies and regulations will drive a lot of innovative ideas and shake up the cryptocurrency industry. Although it may take some time to manifest—possibly through 2025 and 2026." ZX Squared Capital is optimistic about cryptocurrencies like Ethereum (ETH) and Solana (SOL), believing they will benefit from a new wave of innovation, especially projects that combine artificial intelligence and cryptocurrency. Zheng emphasized that these smart contract blockchains need to continuously improve throughput to remain attractive (for Solana) or regain leadership (for Ethereum).

Reactions to Trump's establishment of a strategic Bitcoin reserve

Bitwise CIO: Long-term bullish for Bitcoin, but short-term market reactions are uncertain.

Coinbase executive: Expects this move to reduce Bitcoin selling pressure by about $18 billion.

Bitwise research director: The establishment of a Bitcoin reserve in the U.S. will drive global purchases, reduce market concerns, and eliminate the possibility of the government banning Bitcoin.

Trader analysis: Market reaction is below expectations; traders are disappointed that reserve funds come from seized assets rather than government purchases, reducing the expected buying pressure.

Solana co-founder: This executive order is not a government bailout but rather removes regulatory uncertainty; stablecoin legislation and banking withdrawal guidelines are still needed.

Grayscale research director: Bitcoin appreciation does not rely on U.S. reserves; the growth in adoption rates is sufficient to drive price increases.

Michael Saylor: Retweeted a photo of Trump signing the Bitcoin reserve executive order, stating it will go down in history as a turning point in financial and geopolitical landscapes.

Standard Chartered analyst: The U.S. could purchase Bitcoin in a budget-neutral manner by selling gold or using currency stabilization funds.

David Sacks: Bitcoin is scarce and valuable, holding strategic significance as a reserve asset; discussions about selling gold for Bitcoin have not yet occurred, but budget-neutral purchases are being considered.

Offchain Labs CEO: The U.S. crypto reserve should focus on Bitcoin to avoid regulatory complexities, but Arbitrum is also worth attention.

3AC co-founder Zhu Su: The establishment of a strategic Bitcoin reserve in the U.S. sends an important signal, positioning Bitcoin as a digital bearer asset similar to gold, no longer seen as a "dollar challenger."

Related Images

U.S. Treasury Secretary Yellen: We will observe the progress of any future Bitcoin acquisitions

On March 7, U.S. Treasury Secretary Yellen stated: "We strongly support leading the development of cryptocurrencies globally. Bitcoin needs to be brought domestically. We will observe the progress of any future Bitcoin acquisitions, and the first step is to prevent the government from selling Bitcoin."

IMF: El Salvador's current Bitcoin purchases do not constitute a default; loan agreement expected to take effect on April 30

On March 9, the International Monetary Fund (IMF) stated that El Salvador's current purchases of Bitcoin do not violate the terms of the previously signed loan agreement, but consultations will be held on this matter. The agreement was passed on January 29 and published in the official gazette the next day, expected to take effect on April 30. Previously, the IMF released details of a $1.4 billion loan agreement, requiring El Salvador's public sector not to voluntarily accumulate Bitcoin and restricting the government from issuing any debt or tokenized instruments linked to Bitcoin. However, El Salvador President Nayib Bukele emphasized that regardless of any demands from the IMF, the government will not stop purchasing Bitcoin, stating that even when Bitcoin faced skepticism in its early days, they did not give up, and they will continue to increase their holdings now and in the future.

Analysis: Trump administration strengthens Bitcoin's position, altcoins face regulatory uncertainty

On March 9, trader Eugene Ng Ah Sio recommended an analysis article about the White House cryptocurrency summit on social media, calling it an "excellent analysis." The article focused on the Trump administration's latest cryptocurrency policies, which reinforce Bitcoin's dominance and propose the concept of a "digital Fort Knox," planning to convert seized crypto assets into BTC, further solidifying its "digital gold" attributes.

According to the analysis, the policy mainly ensures that the crypto industry is no longer suppressed, including stopping bank crackdowns and providing some regulatory clarity, but does not prioritize the development of the crypto industry and does not address areas like payments and DeFi. Meanwhile, altcoins (such as XRP, ADA, SOL) have not received explicit support, and future regulations remain uncertain.

Additionally, members of the Trump family have previously voiced support for altcoins and hinted at possibly promoting a "crypto tax exemption" policy, but Trump advisor David Sacks denied this claim, emphasizing that crypto policies will not favor specific tokens. The market expects that if divisions within the Trump team increase, future policies may still be subject to adjustments.

White House: The U.S. will become the world's Bitcoin superpower

On March 9, the White House posted on X, stating that the U.S. will become the world's Bitcoin superpower. The golden age of America has begun!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。