I. Outlook

1. Summary of Macroeconomic Aspects and Future Predictions

Last week, the U.S. stock market experienced significant volatility. The S&P 500 and Nasdaq indices have completely retraced all gains since last year's election day. The Federal Reserve's Beige Book released last Wednesday indicated a slight uptick in overall economic activity in the U.S. since mid-January. However, corporate pessimism about the future is on the rise, primarily due to increasing uncertainties brought about by the Trump administration, especially regarding tariffs.

In the future, the U.S. economy faces multiple challenges, including insufficient consumer momentum, poor employment data, and an expanding trade deficit. In the coming months, policy decisions and the global economic situation will have a significant impact on the U.S. economy.

2. Market Movements and Warnings in the Cryptocurrency Industry

The cryptocurrency market also experienced significant volatility last week, with regulatory policies and macroeconomic factors continuing to influence market trends. Although the U.S. policy-level "cryptocurrency strategic reserve" briefly boosted the market, the impact on the cryptocurrency market is relatively limited in the short term since the Bitcoin reserve policy does not involve new purchases. Against the backdrop of the ongoing accumulation of U.S. government debt, the likelihood of incremental funds flowing into the cryptocurrency market in the short term is also relatively low. Bitcoin and Ethereum once again tested the $80,000 and $2,000 thresholds, respectively, and investors should remain vigilant about the possibility of new lows.

3. Industry and Sector Hotspots

Electron Labs is a general-purpose ZK (zero-knowledge) proof aggregation layer based on Ethereum, utilizing light clients and zero-knowledge proofs to maintain decentralization; Orochi Network raised $12 million, leveraging the powerful capabilities of zero-knowledge proofs (ZKP) to provide solutions for some of the most pressing challenges facing the future of internet decentralization; the Depin platform Spheron Network, backed by Filecoin, promotes efficient deployment and scaling of applications by providing users with instant access to scalable GPU resources.

II. Market Hotspot Sectors and Potential Projects of the Week

- Performance of Potential Sectors

1.1. Analyzing How Electron Labs, Focusing on ZK Proof Aggregation Layers, Reduces Costs Through Decentralization

Core of Electron Labs: Quantum

ZK (zero-knowledge) proofs have become a disruptive technology capable of achieving infinite scalability and playing a key role in transforming Ethereum into a global settlement layer. Although proof schemes are continuously evolving and providing faster proof generation times, verification costs remain an unresolved bottleneck.

Challenges Faced:

The high verification costs on Ethereum present two main challenges that must be overcome to fully realize the potential of ZK proofs:

Low-frequency proof submissions: Protocols enabled by ZK are limited in the frequency of on-chain proof submissions, as the costs of the protocol increase linearly with the number of submitted proofs. Even low-frequency periodic submissions can see costs soar to millions of dollars, as can be clearly seen in the Dune dashboard.

Independence in proof scheme selection: Protocols enabled by ZK are restricted in their choice of proof schemes that best suit their use cases. Certain proof schemes, such as Groth16, are subsidized through precompilation, resulting in lower verification costs compared to other protocols. This lack of flexibility limits the space for innovation and optimization.

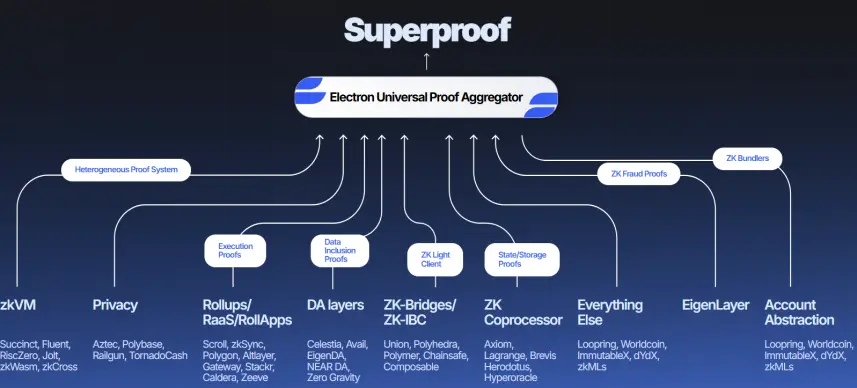

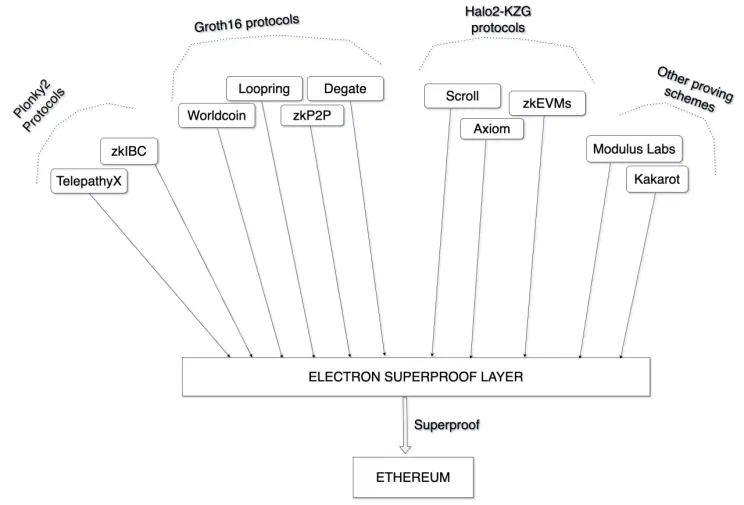

Quantum is an aggregation layer that utilizes zk-recursive technology to aggregate proofs from different protocols and proof schemes, ultimately forming a single super proof. This super proof is then verified on Ethereum, allowing verification costs to be amortized across various protocols, thus achieving low-cost verification for individual protocols.

If:

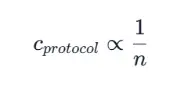

n is the number of protocols using Quantum at any given time,

the cost borne by a single protocol is .

The obvious relationship is:

Low-frequency proof submissions:

Since Quantum provides cheaper verification for individual protocols, protocols can submit proofs more frequently. Protocols can increase the proof submission frequency by nnn times, while the total cost borne by the protocol remains unchanged.

Independence in proof scheme selection:

The Quantum protocol decouples the verification cost from the proof scheme used by the protocol. Therefore, as long as the Quantum aggregation layer supports it, protocols can independently choose any proof scheme.

Commentary

Electron Labs is a general-purpose ZK (zero-knowledge) proof aggregation layer based on Ethereum, utilizing light clients and zero-knowledge proofs to maintain decentralization. By using UPA, Electron integrates proofs from multiple sources into a super proof, effectively reducing costs for each use case.

1.2. Characteristics of Orochi Network, which Raised $12 Million Using ZKP+MPC to Address Scalability, Privacy, and Data Integrity

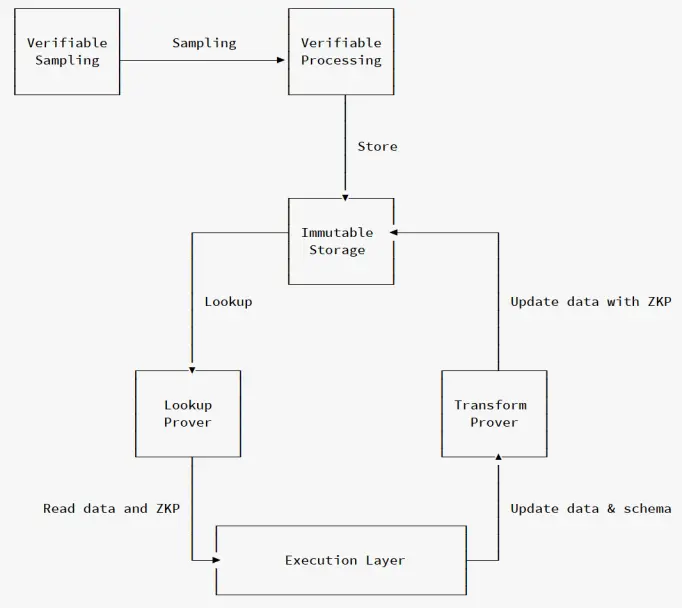

Orochi Network: Verifiable Data Infrastructure

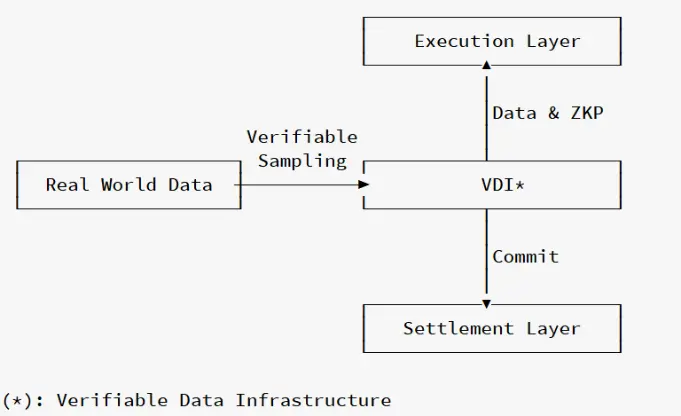

Orochi Network, as the first verifiable data infrastructure, emphasizes secure and verifiable data processing using zero-knowledge proofs (ZKP). The ZKP focus of the network is particularly suitable for application platforms that require high levels of privacy, security, and decentralization. Here are the key features and potential of Orochi based on the ZKP approach:

Native ZK Data Rollups: Unlike other data availability layers, Orochi Network natively supports ZKP and executes rollups on the data. This allows for efficient on-chain verification of data through a concise proof, thereby enhancing the scalability and privacy of decentralized applications.

Verifiable Data Pipeline: Orochi Network does not only focus on data availability. Orochi provides cryptographic proofs at every step of data processing—from sampling to storage and retrieval. Orochi's solution relies solely on cryptographic protocols, helping to reduce reliance on third parties and transforming real-world data into provable data that can be read and verified by smart contracts.

Utilization of Merkle Directed Acyclic Graph (Merkle DAG): Orochi Network employs Merkle DAG technology, offering potential advantages in scalability and performance compared to traditional blockchain structures.

Concise Hybrid aBFT Consensus: This consensus mechanism allows for asynchronous final confirmation of states, potentially improving efficiency compared to synchronous methods used by some competitors.

Proof System Independence: Orochi Network can be compatible with various ZKP systems, such as Plonky3, Halo2, Nova, and Pickles, providing developers with the flexibility to choose the proof system that best meets their needs.

Blockchain Independence: Orochi Network aims to enhance interoperability between different blockchains by leveraging ZKP, potentially achieving integration with multiple blockchain platforms.

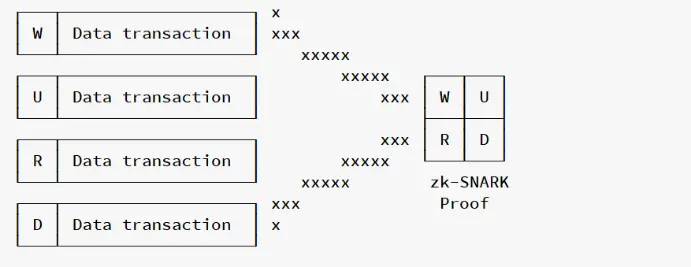

zk-SNARK, as a concise proof, is used for on-chain and off-chain interoperability; it establishes cryptographic verification. Orochi also leverages this advantage to execute interactions between layers. Orochi's verifiable data infrastructure natively supports ZKP, and for each blockchain, Orochi will use the most suitable commitment scheme and ZKP for that platform. This approach will significantly enhance performance and compatibility.

Verifiable Data Pipeline

Orochi not only natively supports ZKP but also generates cryptographic proofs of data integrity. We have addressed one of the most challenging issues: the inability to prove real-world data to smart contracts and decentralized applications (dApps). The verifiable data pipeline opens the door to the future of provable data.

ZK Data Rollups

Users have already witnessed the practical application of ZK-Rollups. Many projects are utilizing ZKP to build ZK-Rollups, successfully bundling thousands of transactions or execution results into a concise proof for efficient on-chain verification. Orochi adopts this feature of ZK-Rollups and applies it to data processing.

Commentary

Orochi Network's verifiable data infrastructure is an important step towards a more secure, scalable, and user-friendly Web3. By leveraging the powerful capabilities of zero-knowledge proofs (ZKP), the verifiable data infrastructure provides solutions to some of the most pressing challenges facing the future of internet decentralization.

Essentially, our product suite, based on innovative verifiable data infrastructure, lays the foundation for building a secure, scalable, and user-friendly decentralized application future network. By addressing the limitations of current decentralized applications (dApps), Orochi Network has the potential to unlock the true potential of Web3, paving the way for a more decentralized and empowering online experience for everyone.

1.3. Analyzing How Spheron Network, Backed by Filecoin, Promotes Efficient Deployment and Scaling of Applications by Providing Users with Instant Access to Scalable GPU Resources

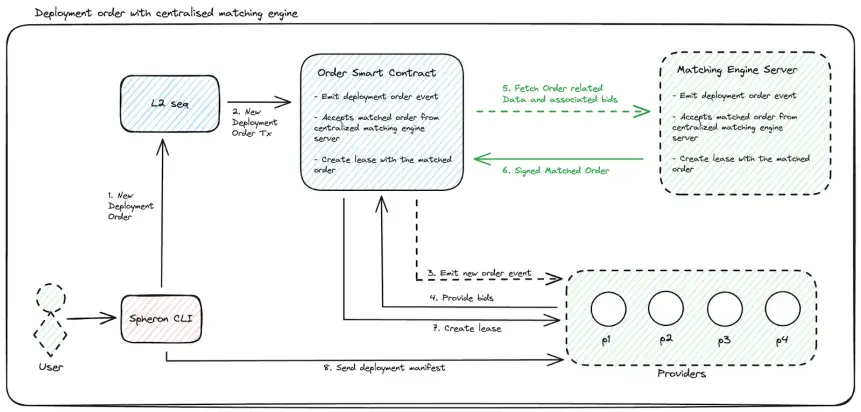

Spheron's decentralized computing network (DCN) creates an efficient, secure, and seamless ecosystem by connecting GPU providers with high-performance computing users (such as those involved in machine learning, scientific simulations, and CGI rendering tasks) who need additional computing power. GPU providers can earn passive income by contributing their unused processing capacity to the network. The DCN features an on-chain supply market for trading and allocating resources, driven by a transparent economic system powered by a native token framework, and utilizes the Arbitrum Layer 2 chain to enhance scalability and efficiency. Key components include supplier nodes that contribute computing resources, a matching engine for allocating requests, and a payment system to ensure secure and transparent transactions. The DCN intelligently manages resource allocation, ensuring that all participating GPUs achieve optimal performance and longevity.

Deployment Order Workflow

The architecture centers around the matching engine, which is a critical component of the network. This engine processes order details and supplier bids, selecting the best supplier for each deployment based on specific parameters listed in Section X. Once a match is made, the order smart contract initiates a lease with the selected supplier. Subsequently, the user transmits the deployment manifest to the supplier via an MTLS connection, initiating the workload deployment. Upon completion, the user can verify the deployment status and access all relevant deployment details, such as connection URLs and port mappings.

Matching Mechanism: Facilitating Decentralized Resource Allocation

In the ecosystem of the decentralized computing network, the matching mechanism is a crucial component responsible for dynamically allocating computing resources between demand (deployment requests) and supply (supplier nodes).

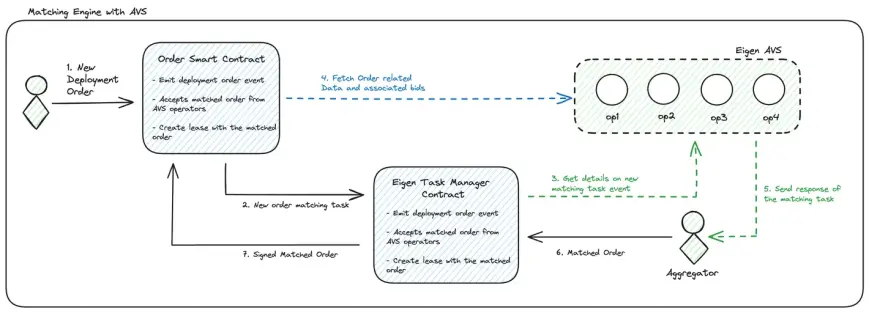

The following describes the operational dynamics of the matching engine, economic incentives, and the complex consensus parameters that define its functionality.

Operational Dynamics of the Matching Operator

Spheron employs an AVS-based architecture for the matching engine, leveraging the economic and Ethereum-included trust provided by the Eigen Layer AVS protocol. Due to the ETH re-staking mechanism, this protocol is economically trustworthy and achieves decentralization through a broad network of ETH validator operators. When users initiate new deployment requests on Spheron's L2 chain, they execute a function on the deployment order smart contract, triggering an ORDER_CREATED event. Suppliers listen for this event and submit their bids to the deployment order smart contract.

Once all bids are collected, the matching engine begins selecting suppliers based on predefined matching parameters. Once the selection is complete, the matching engine creates an on-chain transaction, marking the selected supplier and creating a lease contract for the matched order, triggering a CREATE_LEASE event. Users can verify the lease contract and send the deployment manifest, containing all configurations and keys, to the matched supplier, who listens and begins server deployment on their cluster.

Matching Parameters for Supplier Selection

The consensus mechanism at the core of the matching node is designed to evaluate multiple parameters to determine the best supplier node for each deployment request:

Region / Availability Zone: Prioritizes geographic proximity to reduce latency and comply with data residency regulations.

Price Differentials: Ensures economic efficiency by matching deployment budgets with competitive supplier bids.

Uptime / Availability: Prioritizes suppliers with a reliable track record.

Reputation: Considers the supplier's historical performance and network standing.

Resource Availability: Assesses the supplier's current capacity to meet deployment needs.

Penalties: Considers penalties imposed on suppliers for contract violations or failures.

Staking: The higher the staking amount, the greater the likelihood of the supplier being selected. This mechanism ensures that suppliers who commit more to the network have more opportunities to participate and earn income.

Randomness: Introduces elements of uncertainty to prevent deterministic bias in the selection process.

These parameters are processed through a robust algorithm, ultimately selecting supplier nodes that meet the deployment specifications. The matching node executes on-chain transactions (CREATE_LEASE), formally recording the allocation and initiating the deployment process.

Commentary

Spheron supports a wide range of applications by providing accessible and cost-effective GPU resources. Here are some potential use cases:

Training and deploying large language models (LLMs) and other compute-intensive AI models.

Conducting compute-intensive research in fields such as computer vision, natural language processing, and scientific simulations.

Developing and testing AI-driven applications and services without significant upfront hardware investments.

On-demand scaling of computing resources for data processing, rendering, and other GPU-accelerated workloads.

Enabling individuals and small organizations to participate in the development and deployment of cutting-edge AI and machine learning solutions.

2. Detailed Overview of Projects to Watch This Week

2.1. In-Depth Look at Across Protocol Mechanism, Funded Over $50 Million, Led by Paradigm with Coinbase and Multicoin Participating, for EVM-Compatible Cross-Chain Bridges

Introduction

Across is an intent-driven interoperability protocol. It is currently the only cross-chain intent protocol in a production environment that can transfer value in the fastest and lowest-cost manner while avoiding the security compromises of traditional bridging technologies.

Technical Analysis

Intent Architecture of Across

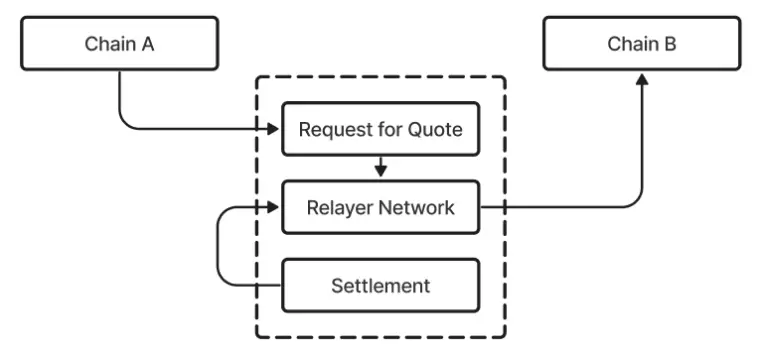

The intent-based architecture of Across can be simplified into a three-layer system:

Quote Request Mechanism: Users express their desired goals without specifying the technical steps to achieve those goals.

Competitive Relay Network: A decentralized third-party network where multiple relay nodes compete to execute these orders.

Settlement Layer: Hosts the funds input by users, executes verification, and pays relay nodes upon successful completion of the intent.

Across's intent-based architecture provides a range of products for end-users and developers:

Across Bridge dApp: A bridging dApp for end-users that offers the lowest fees and fastest cross-chain asset transfer speeds.

Across Bridge for Developers: Easily integrates Across's instant, low-cost liquidity into any application through an easy-to-use REST API. This allows users to seamlessly transfer assets without leaving your application, or even fully abstract the bridging process, enabling users to interact directly with your application from any chain.

Across Settlement: The only production-ready, modular settlement layer designed to facilitate the realization of cross-chain intents. It supports custom use cases that require more than Across Bridge integration, such as cross-chain token swaps and new quote request auction designs.

Architecture Details

The cross-chain intent architecture of Across can be simplified into a three-layer system: a quote request mechanism for storing user intents, allowing a competitive relay network to bid, claim, and fulfill these orders, and finally a settlement layer for verifying the completion of intents and paying relay nodes.

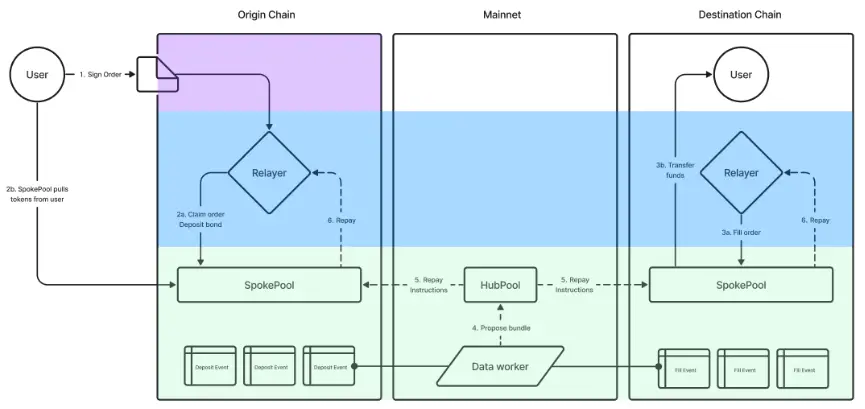

Below is the planned architecture diagram of Across after implementing quote request auctions (RFQ price auctions) to support gas-free orders and cross-chain swaps:

Users Request Quotes to Meet Their Intents

Users receive quotes from relay nodes to fulfill their orders and sign the quote (without on-chain transactions).

Relay Network Fulfills User Orders

(a) Relay nodes claim orders and execute signed orders (b), bringing the transaction on-chain, with the user's assets being hosted in the SpokePool. The structure of Across orders can be found in the intent lifecycle of Across.

(a) Relay nodes call fillRelayV3 to trade using their own assets on the target SpokePool (b), with these assets subsequently transferred to the user account. In this step, relay nodes also need to specify which chain to use for reward payments. The choice of reward chain affects the proportion of relay node fees paid to liquidity providers.

Settlement System Verifies Fills and Pays Relay Nodes

Within a 60-minute window, Dataworkers obtain deposit events and match them with valid fill events (i.e., fills that meet the intent order requirements). All valid fill events are aggregated into a relay node reward "bundle" and optimistically submitted for verification.

If no disputes arise during the challenge period, Dataworkers execute the bundle on the HubPool and route the payment instructions to the respective SpokePools to pay the relay nodes.

Relay nodes will receive their rewards shortly thereafter.

Modular Intent Settlement Layer

The RFQ system can and will exist outside of Across, with mechanisms different from Across RFQ.

Across implements a specific type of RFQ for Across Bridge, but any other auction mechanism capable of generating transactions or signing orders recognized by Across SpokePool can be supported within Across's settlement layer.

Relay nodes compete to fill intent order flows and are located outside of Across.

Risk Labs (the team building Across) develops and operates an open-source relay node implementation that supports Across Bridge and other intent systems, accelerating the expansion of the relay node network.

Relay nodes subscribe to and fill orders from multiple systems, providing different services (such as transferring the same asset and cross-chain swaps) and different profit motives.

Settlement is a core function and advantage of the Across architecture.

Across can accept any order flow based on cross-chain intents and provide settlement (custody, verification, and reward payment). Orders only need to be convertible into a structure recognized by SpokePools. Across settlement offers two core advantages, ultimately leading to better intent fulfillment execution for both users and relay nodes:

Aggregation and Optimistic Verification: As described in steps 4-6 of the above diagram, the Across settlement system aggregates valid fill events offline to create a reward bundle, which is then optimistically verified through UMA's optimistic oracle. This verification and payment mechanism allows the gas costs for reward payments to scale at O(1) rather than O(N) as the number of fills increases. This saves an order of magnitude in gas costs compared to other methods, ultimately providing better pricing for users and more profit for relay nodes.

Relay Node Cross-Chain Management: Through Across's settlement architecture, reward payments can be made on the relay node's chain, reducing the overhead and complexity of managing cross-chain positions. This lowers costs for relay nodes, thereby providing better pricing and execution for end users. Enabled by Across's Hub and Spoke model, passive LPs provide loans to relay nodes, bearing the time value risk, while funds are rebalanced through the protocol's standardized bridging.

Intent Lifecycle in Across

Across is not only used directly by end users but can also be utilized by other protocols to ensure that their users' intents are fulfilled. The intent structure and lifecycle described below are general enough to serve as a settlement and communication layer for many use cases.

Initiation

The initiation process consists of three basic steps:

Calling depositV3: Call depositV3 on the SpokePool. This call can be initiated directly by the user or by another smart contract system on behalf of the user. The chain initiating this call is referred to as the original chain of the intent, which specifies the target chain where the user wishes to receive the output.

User Funds Injected into SpokePool: The user's funds are injected into the SpokePool and held in custody until the intent is fulfilled, at which point they can be released. Since cross-chain intents are not atomic, user funds must be held in custody until the Relayer safely fulfills the intent.

SpokePool Emits V3FundsDeposited Event: Relayers can subscribe to this event to identify intents they can fulfill.

These steps form a primitive mechanism that can adapt to almost any system requiring cross-chain transfers. For example, this design allows for gasless order systems, where users only need to sign the order, and the Relayer brings it on-chain. In such systems, the Relayer can pre-select through off-chain auctions, thereby minimizing costs for users.

Filling

After initiation, the Relayer must fulfill the user's intent. This process involves three different actions:

Calling fillV3Relay: Call fillV3Relay on the SpokePool contract of the target chain. In this call, the Relayer specifies which chain they wish to receive the user's input tokens on. The LP fees charged by Across for the input tokens depend on this choice. Typically, if the Relayer chooses to receive the input tokens on the chain where the user deposited the tokens, the fees are minimal (if not zero).

Intent Marked as Filled: The SpokePool marks the intent as filled, preventing a second Relayer from filling the same intent.

SpokePool Emits FilledV3Relay Event: These events can be used to track the status of intents being settled in the system and to track the fulfillment of each filled intent.

Note: Intents can have an exclusivity period during which a specific Relayer address has the sole right to execute the fill operation.

Slow Fill or Expiration (if not filled)

In the (rare) case that a fill does not occur, there are two fallback scenarios: expiration or slow fill.

Slow Fill means that the Across system itself completes the user's fill without requiring the Relayer to provide funds. It is called a slow fill because it requires Across to perform optimistic verification before execution, meaning the fill occurs several hours after initiation (much longer than typical fill times). Slow fills occur under the following conditions:

The input tokens and output tokens are the same asset.

Before the expiration time of the intent, requestV3SlowFill is called on the target chain.

The slow fill must be executed before any Relayer fill or the intent expiration.

If a slow fill cannot or does not occur, and the Relayer also does not fill the intent, the intent will expire. Like slow fills, this expiration process must also undergo optimistic verification, typically taking several hours. Once verification is complete, the user's funds will be refunded on the original chain.

Settlement

Once the intent is fulfilled, Across verifies the fulfillment and releases the input tokens to the Relayer. Across accomplishes this by periodically verifying a collection of intents. The overall process of generating, verifying, and executing the collection is as follows:

Determine a block range on each chain supporting Across. This block range extends from the end of the previous collection's range to the latest block chosen by the proposer.

Verify all fill or slow fill request events within that range, ensuring they match a deposit event on the original chain.

Aggregate all valid fills, slow fill requests, and intent expirations to determine the aggregate payments needed on each chain. These payments will be included in the collection.

If funds need to be transferred between chains for payments, those transfer instructions will be included in the collection.

These payments and transfers will be organized into a series of data structures known as a Merkle tree, the root of which will then be proposed to the HubPool chain along with a margin.

Once the proposal passes the challenge period without dispute, the execution of the collection can begin: these root nodes will be sent from the HubPool to the SpokePool of each chain through standardized bridging. Fund transfers executed according to the collection instructions will also occur at this step.

Once these root nodes arrive, anyone can execute them to complete the payments determined in step 3.

Summary

Across is an interoperability protocol powered by intents. It is the first cross-chain intent protocol in production today, capable of transferring value in the fastest and lowest-cost manner while offering better security trade-offs compared to traditional bridge designs.

Across's intent-based bridging introduces a new interoperability architecture that avoids the security barriers of third-party message bridging and is faster and more economical in practical applications than standard bridging. Across achieves this by inserting a third-party relayer that quickly satisfies user bridging requests using its own standard asset inventory, along with a settlement layer above standard bridging for slow verification and repayment to the relayer. In other words, Across's intent-based bridging separates the urgency of quickly meeting user demands from the need for eventual verification. Users and developers do not need to trade off trust and convenience between standard assets and representative assets: intent systems like Across provide a win-win solution.

III. Industry Data Analysis

1. Overall Market Performance

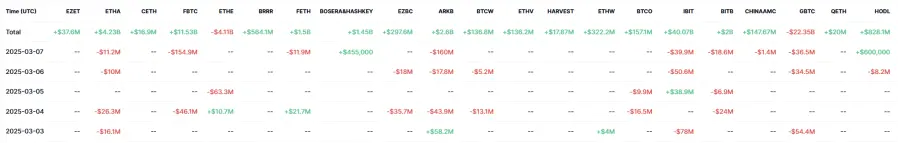

1.1 Spot BTC & ETH ETF

As of November 1 (Eastern Time), the total net outflow of Ethereum spot ETFs was $10.9256 million.

1.2. Spot BTC vs ETH Price Trends

BTC

Analysis

BTC failed to stabilize at $90,000 last week due to the positive news from Trump's crypto strategic reserves, and the deterioration of the fundamentals made the industry's positive stimuli ineffective. Currently, the wedge pattern spreading in the chart remains intact, so BTC may experience a rebound to the $87,000-$88,000 range this week or in the next two weeks before facing resistance and retreating to seek secondary support near $77,000. The $77,000 area is the upper bound of the upward continuation for the end of 2024, providing effective support. Therefore, if a stop occurs in this area, the probability of a strong rebound is high. Conversely, if it breaks through this support with volume, it may indicate that the price will seek the last support line at $73,700, the high point from the first half of last year. Of course, unless the fundamentals continue to deteriorate, the likelihood of the latter is very low. It is always necessary for users to take risk prevention measures.

ETH

Analysis

Last week, ETH experienced two tests of the $2,000 support level. Fortunately for the bulls, both tests were temporarily successful, and the $2,000 support can be viewed as effective strong support for now. The subsequent rebound should focus on the area around $2,330; if it faces pressure, there is a risk of a third bottoming out. If it breaks above, it can directly look towards the second resistance at $2,550. Given the recent market's sluggish fundamentals, it is difficult to reverse in the short term, so $2,550 is likely to be the peak of this week's rebound. However, for users holding spot positions and those waiting to enter, the current area is already a relatively low-cost accumulation zone, and a strategy of entering in batches can be considered.

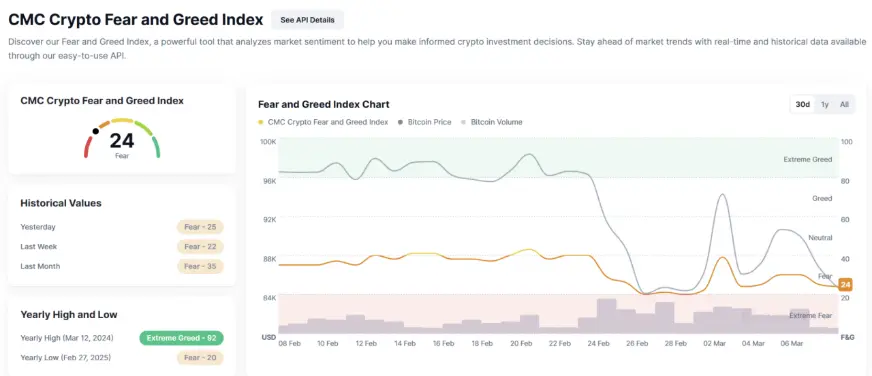

1.3. Fear & Greed Index

Analysis

Fundamental Factors Affecting Market Sentiment:

Regulatory Policy Changes: Recently, the government proposed establishing a strategic reserve for cryptocurrencies, including major cryptocurrencies such as Bitcoin, Ethereum, XRP, Solana, and Cardano. This initiative has sparked optimism and uncertainty in the market, with some investors expressing concerns about the implementation details and potential risks.

Market Volatility: Bitcoin's price has recently experienced significant fluctuations, partly due to changes in tariffs on risk assets following policy announcements. This volatility has increased market uncertainty, leading investors to become more cautious.

Political Donations and Regulatory Easing: Actions by cryptocurrency companies regarding political donations and regulatory easing have raised concerns about market stability and fairness. This uncertainty has intensified investors' fear sentiment.

Public Chain Data

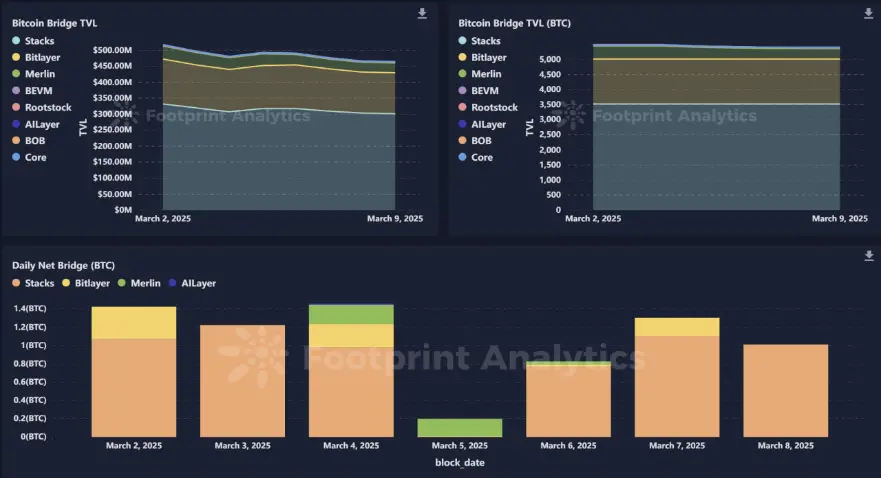

2.1. BTC Layer 2 Summary

Analysis

From March 3 to March 7, 2025, the Bitcoin Layer 2 (L2) ecosystem underwent the following significant changes:

BOB and Fireblocks Partnership: On March 3, the Layer-2 network BOB announced a partnership with leading crypto custody firm Fireblocks. This move allows over 2,000 Fireblocks users to participate in BOB's decentralized finance (DeFi) ecosystem, which has a total locked value of approximately $250 million. BOB aims to position Bitcoin as the foundational network for decentralized finance, planning to bridge other blockchains and use Bitcoin as a settlement layer.

Decrease in Bitcoin L2 Ecosystem Activity: As of March 6, activity in the Bitcoin Layer 2 ecosystem has significantly decreased. Monthly updates indicate that the ecosystem has experienced a prolonged stagnation period, reflecting a decline in the development and participation of Bitcoin's second-layer solutions.

2.2. EVM & Non-EVM Layer 1 Summary

Analysis

EVM Layer 1 Blockchains:

Monad Testnet Launch: Monad, a high-performance EVM-compatible Layer 1 blockchain, launched its testnet on February 19, 2025. This launch aims to provide a platform that competes with Ethereum and Solana, offering high speed and scalability while maintaining compatibility with the Ethereum ecosystem.

Orderly Integration with Monad: On February 19, 2025, Orderly (a permissionless liquidity layer) announced its integration with Monad. This collaboration ensures that projects within the Monad ecosystem (including decentralized exchanges) can access deep liquidity, thereby enhancing the DeFi ecosystem on Monad.

Shardeum Incentive Testnet Concludes: Shardeum, an EVM-based sharded Layer 1 blockchain, successfully concluded its incentive testnet. The testnet attracted over 106,000 users and 18,000 validators, showcasing Shardeum's potential in scalability and decentralization.

Non-EVM Layer 1 Blockchains:

Lombard Finance Integration with Sui: On March 6, 2025, Lombard Finance announced the launch of its liquid-staked Bitcoin token (LBTC) on the Sui blockchain. This marks the first integration of LBTC with a non-EVM blockchain, expanding the use of Bitcoin as collateral in DeFi applications beyond EVM-compatible platforms.

Aptos Proposal to Integrate Aave Protocol: In mid-2024, the Aptos Foundation proposed integrating the Aave Protocol V3 into its mainnet. This move seeks community feedback, and if approved, it will be the first deployment of the Aave liquidity protocol on a non-EVM blockchain, potentially expanding Aave's influence and functionality.

2.3. EVM Layer 2 Summary

Analysis

Based on developments from March 3 to March 7, 2025, the main progress and events in the Ethereum Layer 2 network are summarized as follows:

- Mekong Testnet Decommissioned

The Ethereum team announced the official decommissioning of the Mekong Testnet on March 7, 2025. This testnet was originally used for wallet developers and stakers to test features related to the Pectra upgrade. With the Pectra upgrade already activated on the Sepolia and Holesky testnets, the official recommendation is for developers to migrate to the Sepolia testnet, while stakers can choose the Holesky or Ephemery testnets for validator lifecycle testing.

- Pectra Upgrade Mainnet Countdown

The Ethereum Pectra upgrade is scheduled to launch on the mainnet in March 2025, following the successful hard forks on the Sepolia and Holesky testnets in February. This upgrade includes several improvement proposals (EIPs), focusing on:

Enhancing user experience (e.g., account abstraction optimization);

Increasing the validator staking cap from 32 ETH to 2,048 ETH;

Improving deposit and exit mechanisms.

If the testnet runs smoothly, the mainnet upgrade will proceed in March, further optimizing network efficiency and functionality.

- Linea Token Plan Disclosure

The Layer 2 network Linea, incubated by Consensys, revealed plans to launch a native token in early 2025, with a specific date possibly in late Q1 or early Q2. After the token release, Linea will be managed by a non-profit association aimed at promoting ecological governance and community participation.

- Industry Event Preview: Based Rollup Summit

Although the summit is scheduled for March 10 (slightly later than the user-specified timeframe), the preparatory dynamics are noteworthy. The Based Rollup Summit, hosted by Taiko, will gather Ethereum co-founder Vitalik Buterin, founders of several L2 projects, and investment institutions to discuss cutting-edge developments in Rollup technology.

IV. Macroeconomic Data Review and Key Data Release Points for Next Week

In February, the U.S. adjusted non-farm payrolls increased by 151,000, below the market expectation of 160,000. The unemployment rate unexpectedly rose to 4.1%, the highest level since November of last year. The report indicates that federal government employment decreased by 10,000 in February; however, due to an increase in local government employment, the overall government employment rose by 11,000. Analysts pointed out that the impact of DOGE layoffs may not fully manifest for several months. Additionally, related surveys show that American workers are currently experiencing high levels of anxiety.

Important macroeconomic data points for this week (March 10-14) include:

March 12: U.S. February unadjusted CPI year-on-year

March 13: U.S. initial jobless claims for the week ending March 8; U.S. February PPI year-on-year

V. Regulatory Policies

This week, regulatory movements in the cryptocurrency industry centered around the U.S., as Trump announced that the U.S. would establish Bitcoin reserves and other cryptocurrency reserves, holding a related crypto meeting at the White House. The market initially rose on the news but subsequently fell, indicating that the outlook for favorable regulatory policies is unclear, and people are still waiting for more concrete measures, including details on regulation and when Trump's discussions supporting cryptocurrencies will be realized to what extent.

U.S.: Cryptocurrency Reserve Plan Unveiled

Establishment of strategic reserves and inventories for cryptocurrencies

The executive order signed by Trump includes two parts: a cryptocurrency strategic reserve and an inventory. The strategic reserve will only contain BTC (the digital asset with the highest value storage), using approximately 200,000 tokens held by the government through criminal and civil forfeiture over the years. The other part includes a digital asset reserve containing assets other than Bitcoin, which may include XRP, ADA, ETH, and SOL (announced by the president last weekend) as well as potentially other assets. The main difference between reserves and inventories is that the government will not actively seek ways to purchase more inventory assets.

Before August or through stablecoin legislation

Trump reiterated the previously signed executive order regarding cryptocurrency asset reserves at the White House crypto summit, stating that the Treasury and Commerce Departments will explore new avenues to accumulate more Bitcoin for the reserves, provided that taxpayers do not incur any costs. Trump indicated that the House and Senate are expected to pass stablecoin legislation before the "August recess."

White House supports repeal of cryptocurrency broker reporting rules

According to the Administrative Policy Statement released by the White House Office of Management and Budget (OMB), the U.S. government supports S.J. Res. 3, a bill initiated by Senator Ted Cruz and others, aimed at overturning the IRS's reporting rules for total revenue from digital asset sales by brokers. This rule was originally proposed by the Biden administration at the end of 2024, expanding the definition of brokers to include software related to DeFi protocols and requiring some DeFi users to report total revenue from crypto transactions and taxpayer information. The White House believes this regulation improperly increases the compliance burden on U.S. DeFi businesses, hinders innovation, and raises privacy concerns.

DOJ collaborates with Europe to crack down on crypto exchange Garantex

The U.S. Department of Justice announced coordinated actions with Germany and Finland to disrupt and dismantle the online infrastructure used to operate Garantex, a cryptocurrency exchange that facilitates money laundering and sanctions violations for transnational criminal organizations (including terrorist groups). Since April 2019, Garantex has processed at least $96 billion in cryptocurrency transactions.

Vietnam: Establishing Cryptocurrency Legal Framework by End of March

The Vietnamese government plans to launch a legal framework for digital assets by the end of March to promote economic growth. Prime Minister Phạm Minh Chính has signed Directive No. 05, requiring the Ministry of Finance (MOF) and the State Bank of Vietnam (SBV) to formulate and submit a cryptocurrency regulatory plan by the end of this month.

Thailand: Police Raid Five Cryptocurrency Companies

The Economic Crime Suppression Division (ECD) of Thailand recently raided five unlicensed cryptocurrency companies located in Bangkok, Nakhon Pathom, and Samut Prakan, arresting 11 individuals involved. This operation targeted illegal cryptocurrency trading activities, with the companies involved having an annual trading volume of up to 1 billion Thai Baht (approximately $29.3 million). Police seized six computers and related evidence on-site, and those arrested included company executives and regular employees.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。