Each of the stablecoin protocols, including Ethena, Resolv, Sky, Frax, Usual, Ondo, and Level, employs unique mechanisms to generate yield.

Written by: Nemi

Translated by: Luffy, Foresight News

Ethena popularized the concept of yield-generating stablecoins with sUSDe, sparking widespread interest but also criticism due to counterparty risk or negative financing rate risk. Despite these concerns, the market capitalization of USDe has now reached $5.8 billion, with a solid product-market fit, demonstrating its potential for scaling within the crypto ecosystem.

The success of sUSDe has also paved the way for the rise of new yield-generating stablecoins, each employing different methods to generate yield, offering unique risk-return characteristics. This diversification provides opportunities for capital allocation, whether through risk management or optimizing returns based on market conditions.

Each of the stablecoin protocols, including Resolv, Sky, Frax, Usual, Ondo, and Level, employs unique mechanisms to generate yield. In this article, we will explore how they operate, the associated risks, and potential returns.

Ethena's sUSDe

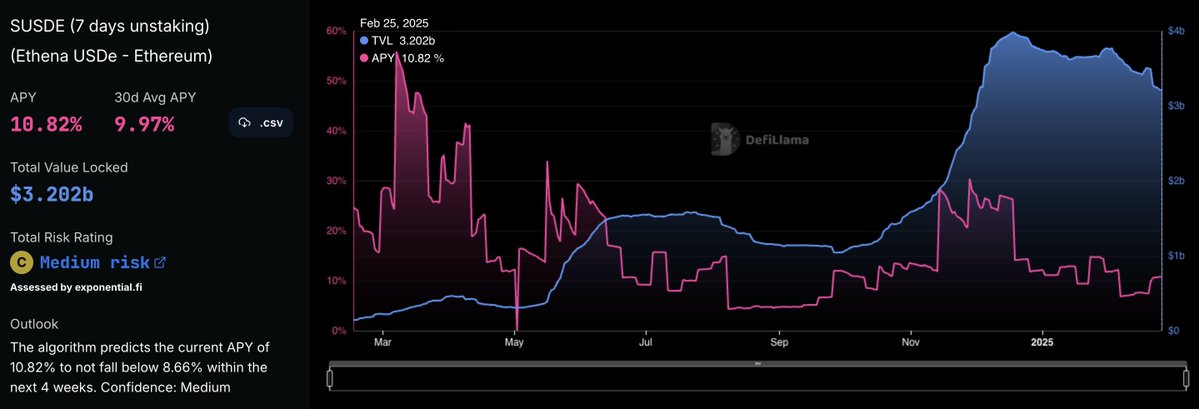

Historical annualized yield of sUSDe

Ethena's sUSDe is the yield-generating version of USDe, offering a wide range of yields since its launch, with a minimum annualized yield of 4.3% and a maximum of 55.8%.

USDe maintains its peg to the dollar through automated delta-neutral hedging, ensuring that fluctuations in the supporting asset prices are offset by corresponding changes in the hedge. Since these assets can be perfectly hedged with equally sized short positions, USDe operates at a 1:1 collateralization ratio without the need for over-collateralization.

sUSDe is the yield-accumulating version of USDe, requiring users to stake USDe to earn yield. Ethena's yield primarily comes from short positions in perpetual futures, which incur financing rates on exchanges. Additionally, staking rewards from stETH provide an extra source of returns for sUSDe.

In 2024, the average financing rate for Bitcoin is 11%, while Ethereum's financing rate is 12.6%, bringing the average annualized yield for sUSDe to 18%.

Distribution of supporting assets for USDe

As of now, sUSDe offers a yield of 10.82%, with Ethena's risk rating on exponential.fi being "C":

Low collateral risk, primarily due to the involvement of liquidity-staking derivatives (LSDs).

Significant reliance on off-chain computations, introducing additional complexity.

Dependence on Proof-of-Stake validators, with potential slashing risks that could lead to partial losses of staked assets.

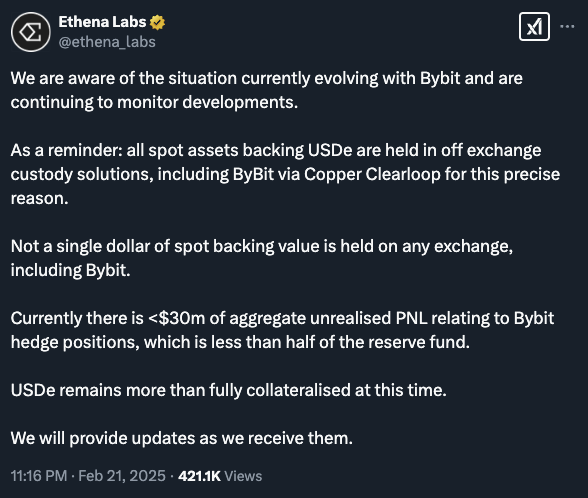

Notably, following the Bybit hacking incident, Ethena responded with transparency, ensuring that USDe remains over-collateralized, with its supporting assets securely stored in off-exchange custodial solutions.

To ensure transparency, Ethena conducts monthly custodial snapshots, clearly displaying the status of USDe's supporting assets. The snapshot report as of January 30, 2025, shows:

USDe supply: $5.739 billion

Copper custodial assets: $2.573 billion

Ceffu custodial assets: $3.045 billion

Cobo custodial assets: $5.08 million

Coinbase Web3 wallet assets: $100 million

Assets in the minting/redemption process: $30 million

Total supporting assets: $5.753 billion

Reserve fund: $60.41 million

Total supporting assets including the reserve fund as a percentage of USDe: 101.30%

This further reinforces USDe's over-collateralized status and Ethena's commitment to transparency.

Sky's sUSDS

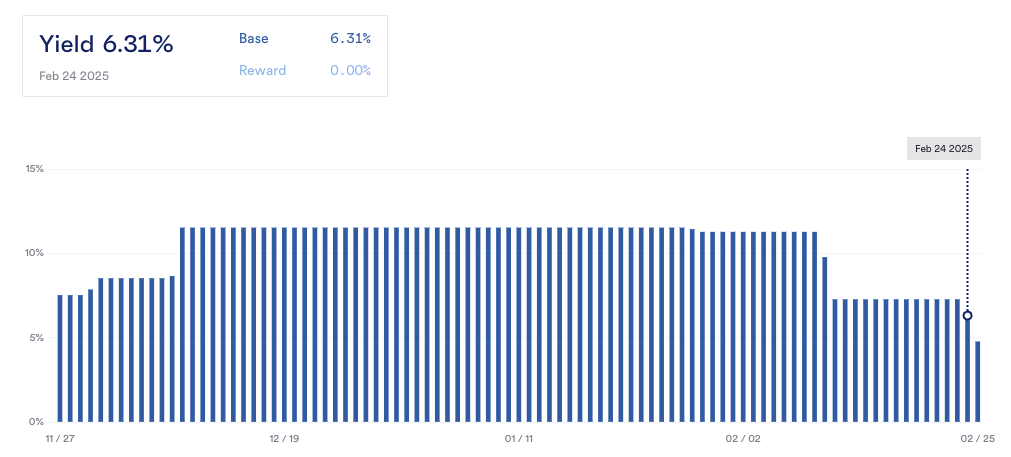

Return rate of sUSDS

The Sky protocol (formerly MakerDAO) offers a yield of 6.5% through its Sky Savings Rate (SSR) module. Users can stake USDS to receive sUSDS, which automatically accumulates value over time.

Collateral and Security

USDS is backed by a mix of crypto assets (ETH, wstETH, WBTC) and real-world assets (RWAs) such as U.S. Treasury bonds, achieving a collateralization ratio of 229.6%, providing high security.

Sources of Yield

The yield for sUSDS comes from multiple sources:

Borrowing stability fees: Borrowers of USDS pay stability fees, which are redistributed to sUSDS holders.

Liquidation fees: Fees generated from liquidating under-collateralized USDS loans are also partially distributed to sUSDS holders.

Investments in real-world assets: The protocol generates income through investments in Treasury bonds and high-yield bonds, enhancing the Sky Savings Rate.

Risk Status

Sky has a risk rating of "B" on exponential.fi, with most risks related to systemic vulnerabilities in the underlying blockchain, protocol, or assets.

By holding sUSDS, users gain access to a diversified yield mechanism, achieving stable value accumulation over time.

Usual's USD0++

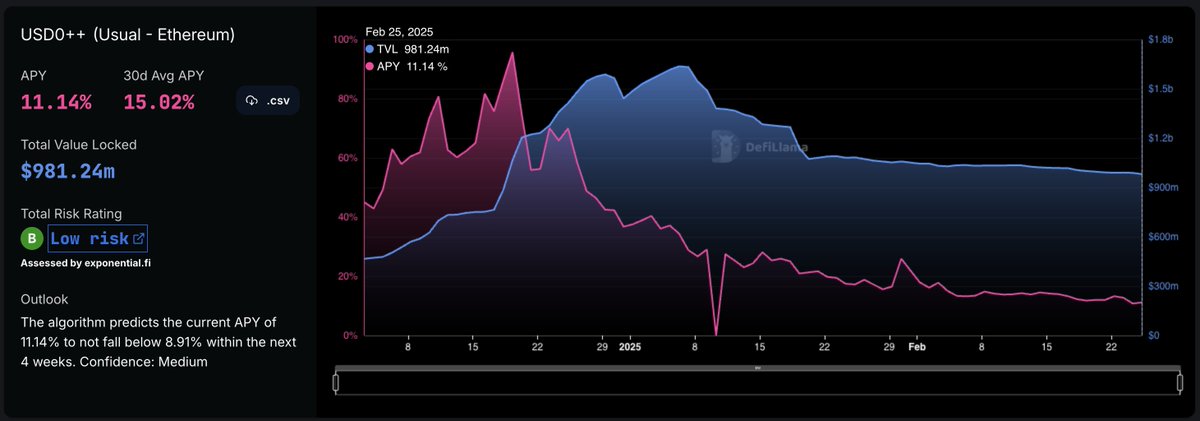

Historical annualized yield of USD0++

Usual gained significant market attention last December but lost user trust after suddenly changing the redemption ratio of USD0++ from 1:1 to 0.87:1.

How USD0 and USD0++ Work

USD0: The first liquidity deposit token (LDT) launched by Usual, backed 1:1 by ultra-short-term real-world assets.

USD0++: The staked version of USD0, with a 4-year lock-up period, serving as a liquidity-staking token (LST). It distributes yield through daily coupon payments in USUAL tokens. The yield varies based on the market price of USUAL, but USD0++ guarantees a minimum yield equivalent to the risk-free rate.

Yield and Risk Considerations

At the time of writing, USD0++ offers a yield of 11.14%, peaking at an annualized yield of 95.7% on December 19, 2024.

However, the lock-up structure and dual exit mechanism introduce liquidity and price stability risks.

Consequently, exponential.fi rates the Usual protocol as "B," highlighting potential concerns regarding accessibility and price stability.

While USD0++ offers competitive returns, its complex structure and recent changes in the redemption ratio raise concerns about liquidity risk and protocol stability.

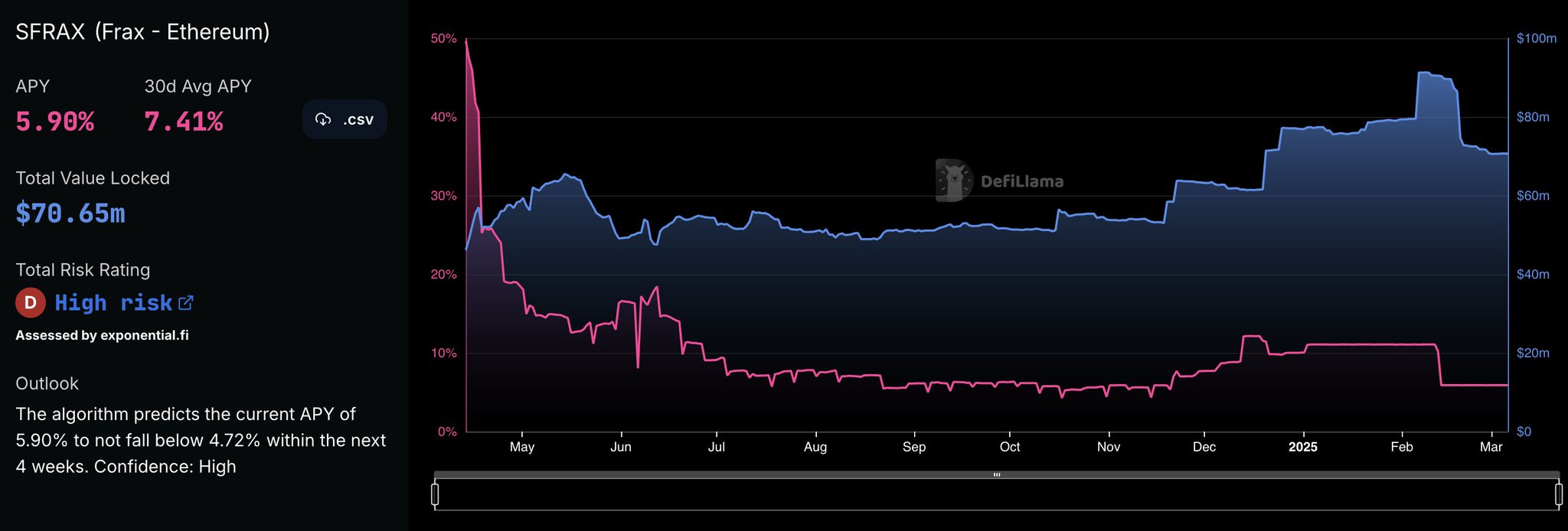

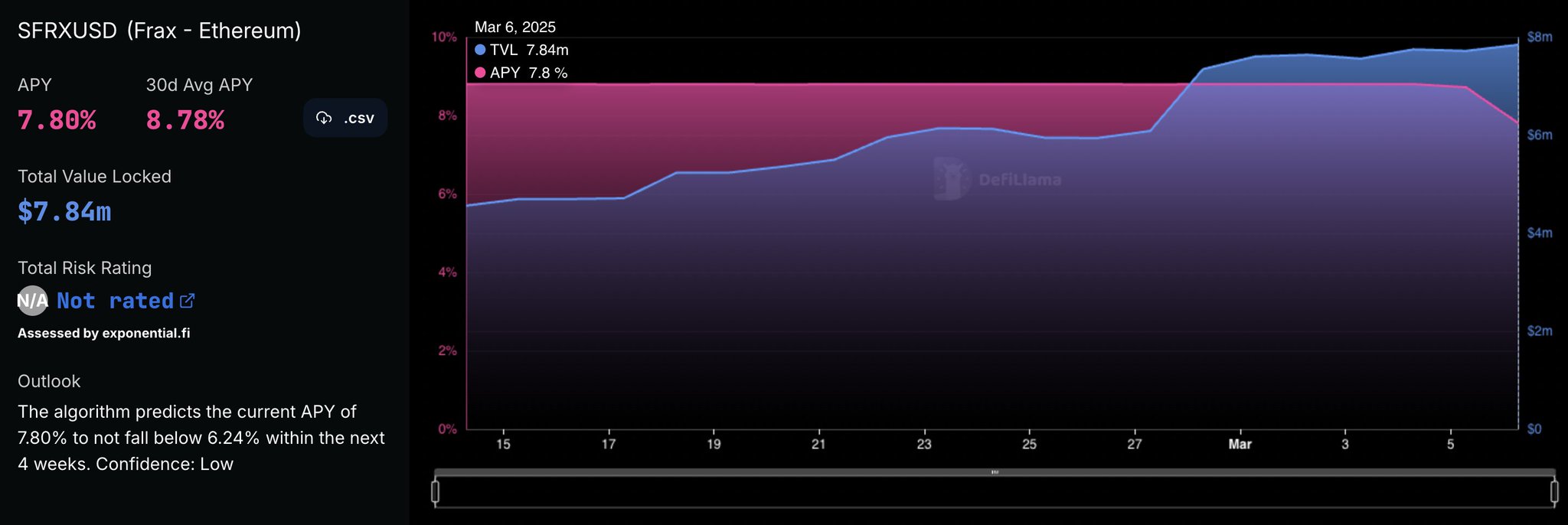

Frax Finance's sfrxUSD

Historical yield of sfrxUSD (formerly sFRAX)

Frax Finance is a decentralized finance (DeFi) protocol that pioneered a partially algorithmic stablecoin model aimed at creating a scalable and decentralized stablecoin ecosystem.

Key Components of Frax

frxUSD stablecoin: Initially a hybrid model, frxUSD is partially backed by collateral assets (e.g., USDC) and partially by algorithmic mechanisms. Over time, it has transitioned to a stablecoin fully backed by collateral assets, relying on on-chain assets to maintain stability.

Frax Shares (FXS): The governance and value accumulation token of the Frax ecosystem.

Price stability mechanism: frxUSD maintains its peg to $1 through collateral reserves, algorithmic controls, and diversified income streams.

How Yield is Generated

sfrxUSD (staked frxUSD) generates yield by leveraging Frax Finance's native sources of income, primarily Frax Bonds (FXBs) and the Frax Lending AMO. The protocol stakes frxUSD in FXBs, which provide fixed returns, and deploys funds into lending markets such as Fraxlend, Aave, and Compound to earn interest.

Additionally, Frax's fund management optimizes stablecoin reserves and yield strategies to ensure sustainable returns. As a flexible supply asset, sfrxUSD appreciates in value relative to frxUSD over time, allowing holders to earn passive income while maintaining composability in decentralized finance integrations.

Security and Stability

Despite having a rating of "D" on exponential.fi, the protocol employs robust risk control measures to mitigate threats such as oracle price manipulation and negative feedback loops.

Frax actively manages yield optimizers and conducts open market operations to regulate the supply of frxUSD, ensuring its peg to $1 even during market volatility. Currently, sfrxUSD offers a yield of 8.80%.

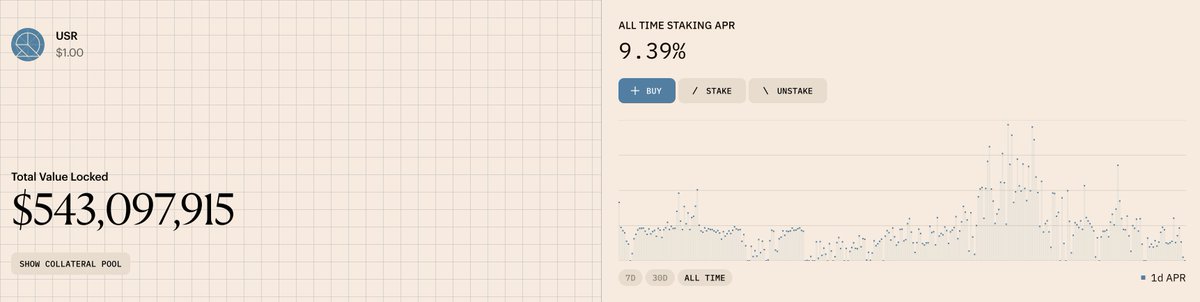

Resolv's USR

Resolv also employs a delta-neutral strategy to generate yield.

USR is a stablecoin designed to be independent of real-world asset risks, utilizing the crypto-native currency market to obtain yield. Unlike traditional stablecoins, USR is backed by ETH and its derivatives, employing a delta-neutral strategy to hedge against volatility in the crypto market.

However, given the inherent risks of delta-neutral strategies, Resolv introduces a scalable tokenized protection layer, known as the Resolv liquidity pool, which absorbs these risks while providing leveraged yield farming opportunities.

Key features of USR and Resolv:

ETH-backed stability: Fully collateralized by ETH and liquidity-staking tokens (LSTs), hedging price fluctuations through short positions in perpetual futures.

Minting and redemption: Users can mint or redeem USR at a 1:1 ratio using liquidity collateral assets, ensuring seamless access and stability.

Resolv liquidity pool: An over-collateralized insurance pool that enhances long-term stability and risk protection.

Staking and yield: While USR itself does not accumulate yield, users can stake USR to earn yield through stUSR, currently offering an annualized yield of 5.74% for 7-day staking.

By integrating a robust model and dedicated insurance pool, Resolv ensures safety, flexibility, and resilience in turbulent markets, making USR a stable, reliable, and efficient medium of exchange in decentralized finance.

Ondo's USDY

USDY offers a yield of 4.35%.

Ondo Finance's USDY is a tokenized secured note backed by short-term U.S. Treasury bonds and bank deposits. It aims to combine the accessibility of stablecoins with high-quality, yield-generating assets, providing a compliant way for non-U.S. investors to gain dollar-denominated returns.

Collateral and Security

USDY is backed by the following assets:

Short-term U.S. Treasury bonds: Highly liquid, low-risk government securities.

Bank demand deposits: Enhanced liquidity for timely redemptions.

Bankruptcy isolation structure: USDY is issued by Ondo USDY LLC, a legal entity independent of Ondo Finance, ensuring that token holders are the sole creditors in the event of financial issues.

How Yield is Generated

USDY generates yield through short-term U.S. Treasury bonds, providing returns of over 4%. The yield accumulates automatically without the need for manual claims. USDY comes in two forms: the accumulating version (USDY), where the price of each token rises as yield accumulates; and the elastic supply version (rUSDY), which maintains a peg to $1.00 but distributes yield by increasing the token balance of holders. For example, if the price of USDY rises from $1.00 to $1.01, rUSDY holders receive more tokens instead of a price change.

Level's slvlUSD

Translator's note: The author of this article works for Level.

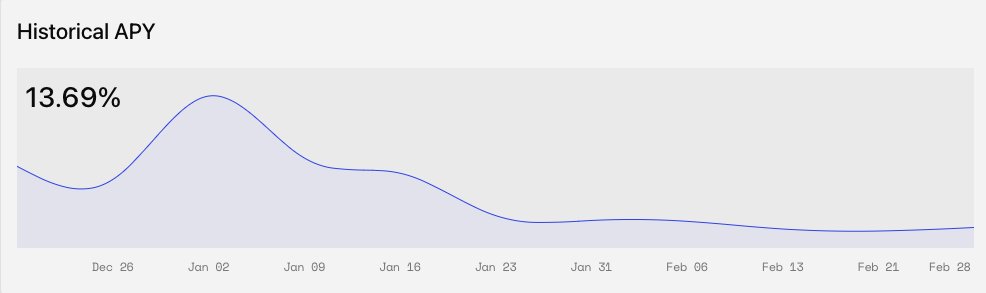

Historical annualized yield of slvlUSD

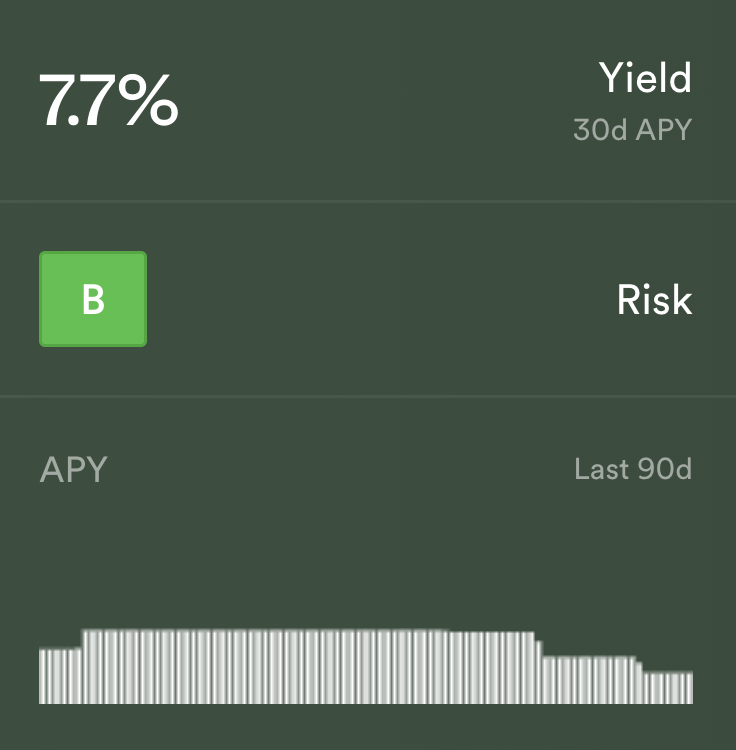

Level is a decentralized stablecoin protocol supported by Dragonfly and Polychain. The lvlUSD stablecoin issued by Level allows users to earn yield from various crypto-native sources, including lending protocols and re-staking.

lvlUSD is a stablecoin backed by USDC and USDT, which are deposited into Aave to generate base yield. The aUSDT and aUSDC receipt tokens are then re-staked in Symbiotic, maintaining a stable economic security pool while protecting the decentralized network. Level aims to layer additional re-staking yield on top of the base yield, while the Symbiotic points accumulated through staking are returned to users.

lvlUSD holders can stake lvlUSD to receive slvlUSD, earning on-chain yield, currently at a rate of 13.69%. This yield is calculated based on the income allocated to slvlUSD divided by the daily average market value of slvlUSD since the last yield distribution, compounded annually.

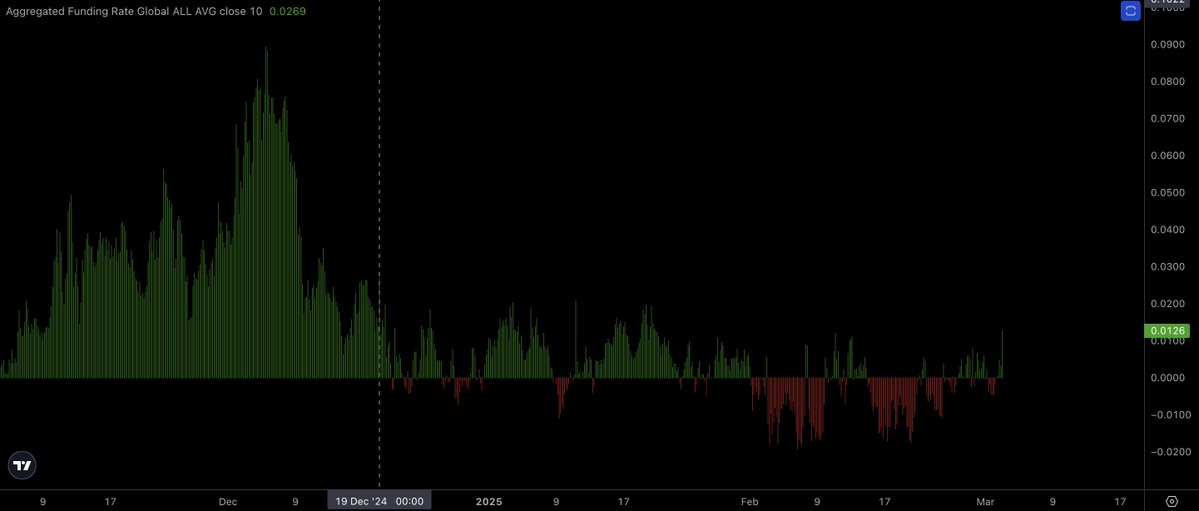

How Stablecoin Yields Change with the Market

Stablecoin yields typically fluctuate with market sentiment, reflecting the dynamic changes of bull and bear market cycles. A clear example is Ethena's sUSDe, which derives part of its yield from shorting assets like Ethereum and collecting financing rates. In a bull market, as traders build long positions, financing rates rise, increasing the yield of sUSDe. Conversely, in a bear market, financing rates turn negative, reducing the yield generated. This correlation highlights how yield-generating stablecoins are influenced by market trends, making their returns dynamic rather than fixed.

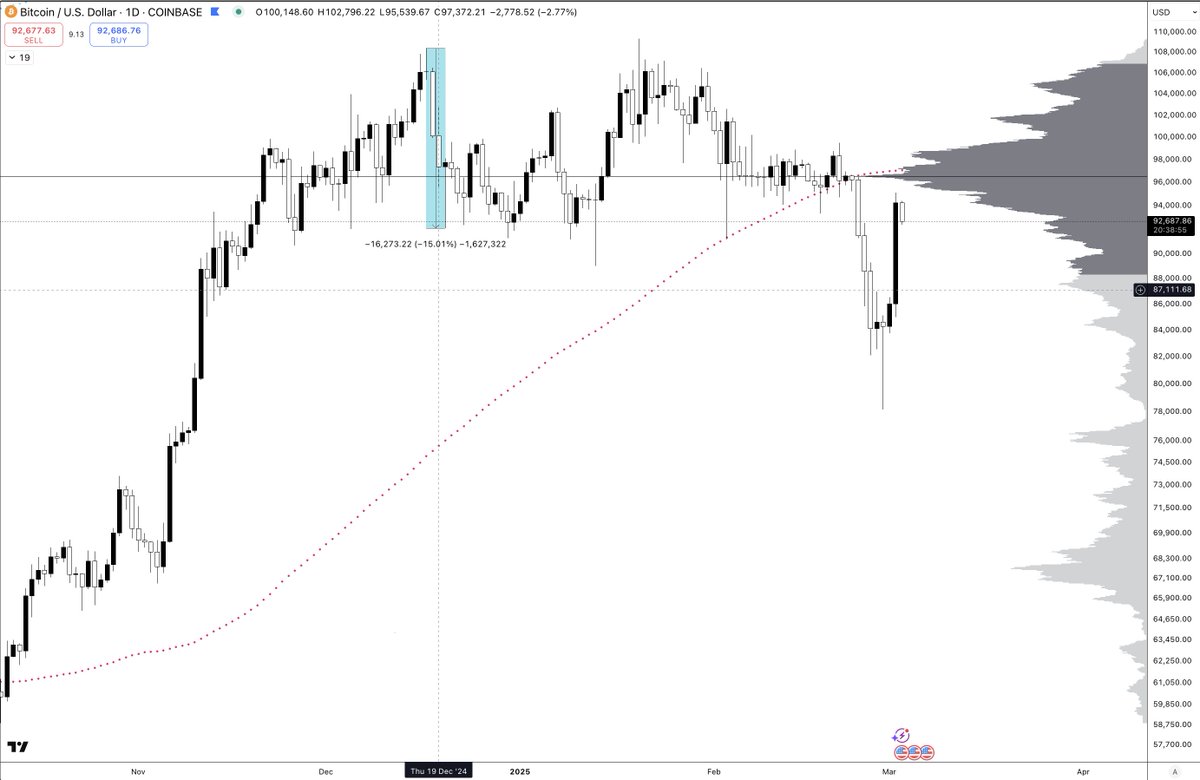

The above chart shows the composite financing rates of various crypto assets from early November to now. It is evident that after December 9, 2024, financing rates significantly declined, with rates being negative for an extended period in February, indicating that traders were primarily shorting the market. This prolonged negative financing rate suggests an increase in bearish sentiment, with short sellers paying fees to maintain their positions.

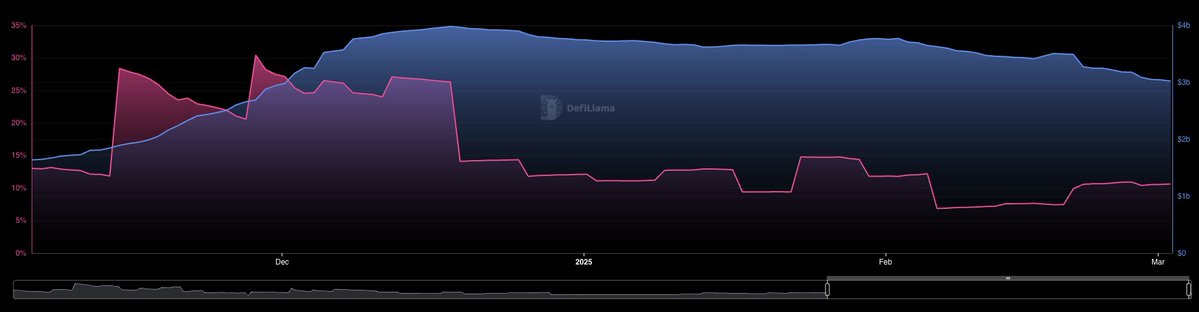

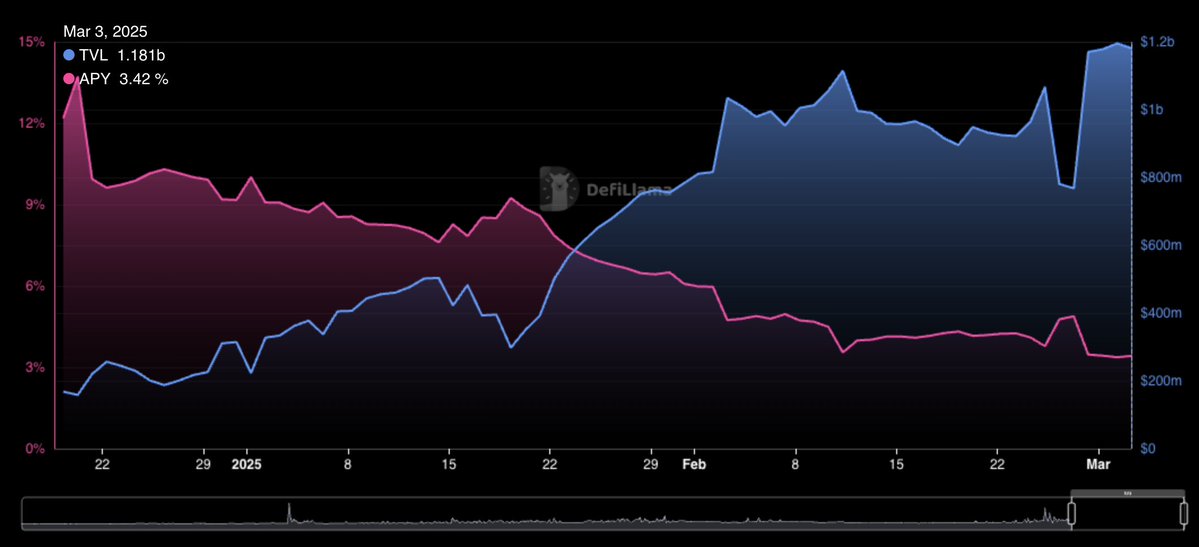

Changes in the yield of sUSDe since the end of 2024

During the same period, the yield of sUSDe (pink line) remained high until mid-December, after which it declined and stabilized between 7% and 15%. This trend underscores the correlation between market bull runs and the returns of some yield-generating stablecoins.

Similarly, slvlUSD, which generates yield by depositing USDT/USDC into Aave, is also affected by market sentiment. During bull markets, on-chain traders borrow more stablecoins to increase long exposure, driving up demand for stablecoins and thereby increasing the annualized yield of protocols like Level. This relationship further illustrates how decentralized finance stablecoin yields respond to market cycles, with increased lending activity providing higher returns for liquidity providers.

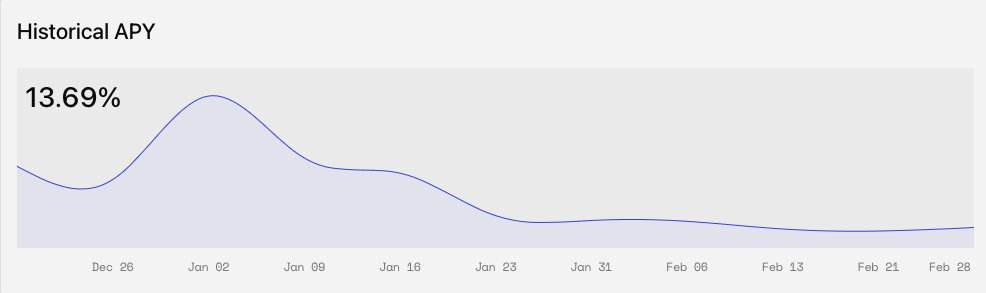

The chart shows the yield changes of USDC on Aave V3, peaking at 13.72% on December 20, 2024, before dropping to 3.42%. This reflects changes in market sentiment, with bull phases driving up lending yields, while bear periods see a decline in demand and returns.

The chart for slvlUSD also shows a similar trend, as its yield is partially related to the lending yield of USDC on Aave. Overall, during bear markets, the yields of yield-generating stablecoins tend to decrease, as most stablecoins rely on lending demand or financing rates, both of which weaken when market sentiment turns negative.

Since early December, the market has been fluctuating within a range or trending downward, as reflected in the charts for Bitcoin and other cryptocurrencies (excluding the top 10 by total market capitalization), directly impacting the yields of yield-generating stablecoins.

However, new solutions are emerging to alleviate the issue of declining yields, particularly with the help of Pendle's solution. By purchasing Pendle's PT, users can lock in a fixed yield while holding the underlying asset, effectively shorting variable yields as a hedge. Additionally, Pendle's Boros will allow for long or short positions on financing rates, enabling protocols like Ethena to hedge against the risk of declining financing rates, providing users with more stable and competitive yields.

Conclusion

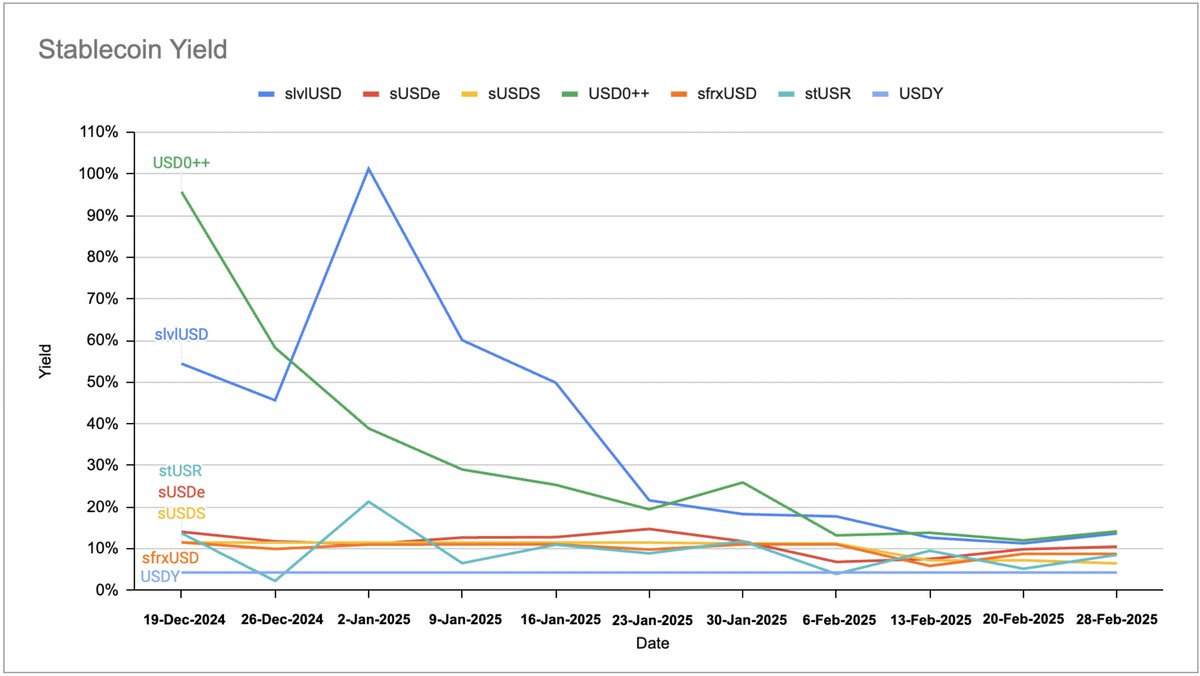

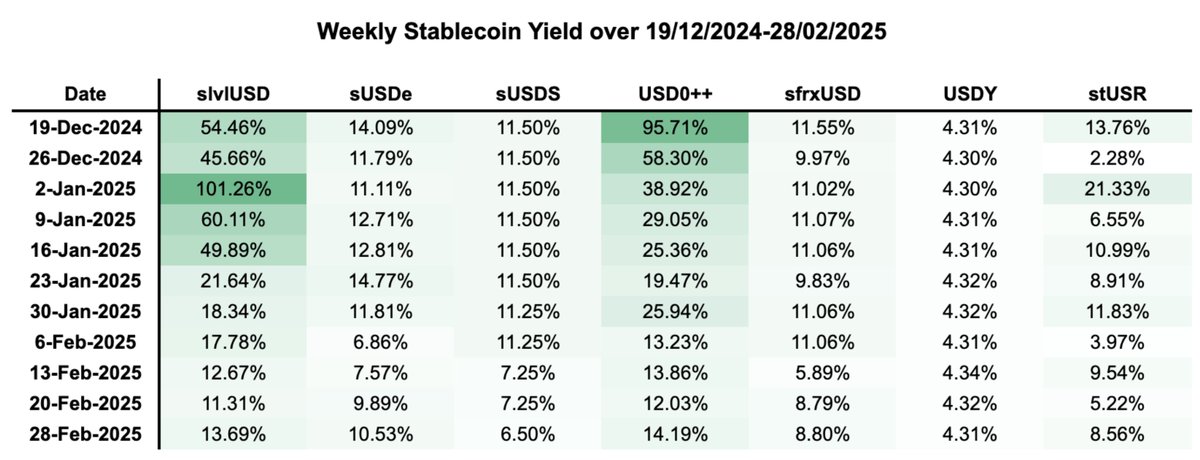

Annualized rates for 7 yield-generating stablecoins from December 19, 2024, to February 28, 2025.

Yield-generating stablecoins are significantly influenced by broader market sentiment, and the yields of the 7 stablecoins analyzed in this article are all on a downward trend.

Yields of 7 yield-generating stablecoins over the past 11 weeks.

If bullish sentiment returns, increasing demand for stablecoin lending and a shift to positive market financing rates, the returns of yield-generating stablecoins may rise.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。