Original Author: TechFlow

Welcome to another day of decline.

Today, the crypto market is shrouded in gloom, with Bitcoin (BTC) prices once again under pressure, briefly falling below $84,000, with a daily decline of nearly 3%.

Amid the turmoil of internal and external troubles in the industry, negative news continues to pour in: practitioners are leaving in droves, scandals involving project teams and market makers have emerged, and KOLs are publicly tearing each other apart over unfair profit distribution, leading to a near collapse of market trust.

The chill is beginning to spread to every retail investor.

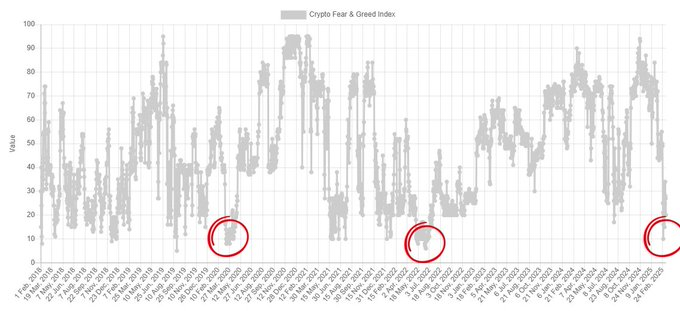

Data shows that the current level of fear in the market is reminiscent of the COVID crash in 2020 and the market bottom in 2022, with the fear index reaching 20, indicating an extreme state of fear;

Meanwhile, the recent announcement by the U.S. to establish a Bitcoin reserve has rekindled hope among some investors.

As a barometer of the crypto market, looking at the BTC price, it seems to have risen significantly compared to a few years ago, appearing more like a bull market; however, if we consider the recent fluctuations, it feels more like a bear market.

So, is it the prelude to a bear market or a golden pit for a bull market?

Faced with severe price volatility and uncertainty, what should we do? Let's listen to the diverse opinions of domestic and foreign traders, KOLs, and industry influencers to analyze market trends and see what they have to say.

Waiting and Observing

"What are you doing?"

"I'm waiting for Godot."

"When will he come? I don't know. He told me he would come, and to wait for him here." --- "Waiting for Godot"

Samuel Beckett's classic play "Waiting for Godot" tells the story of Vladimir and Estragon waiting endlessly by a desolate roadside for "Godot"—an uncertain presence that never appears.

For retail investors, this Godot is BTC.

In the current climate of severe BTC price fluctuations and pervasive fear, some people have chosen to wait and observe.

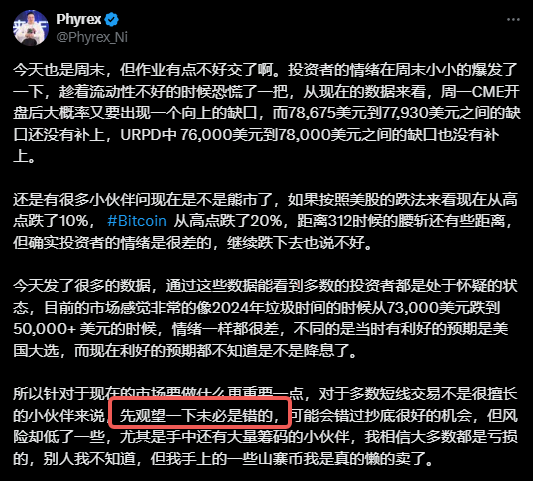

For instance, Ni Da @Phyrex_Ni believes that everyone should remain patient and wait for market signals to avoid acting blindly.

In his latest analysis, he clearly states that for ordinary investors who are not skilled in short-term trading, waiting may be the safest choice. He believes that BTC is currently in a "garbage time" phase, similar to the slump from $73,000 to $50,000 in 2024, where market sentiment is extremely low and lacks clear positive drivers in the short term.

As for why to wait, the reason lies in the extreme uncertainty of the market.

Phyrex points out that the current BTC price has fallen below $84,000, with investor sentiment repeatedly battered, the positive effects of strategic reserves fading, expectations from the U.S. elections turning negative, and macroeconomic data (such as CPI, PPI, and the Fed's dot plot) still dominating the narrative. Coupled with the recent decline in U.S. stocks and trade war (tariff) pressures, the crypto market may face further volatility, making it highly risky to rush into bottom-fishing or increasing positions.

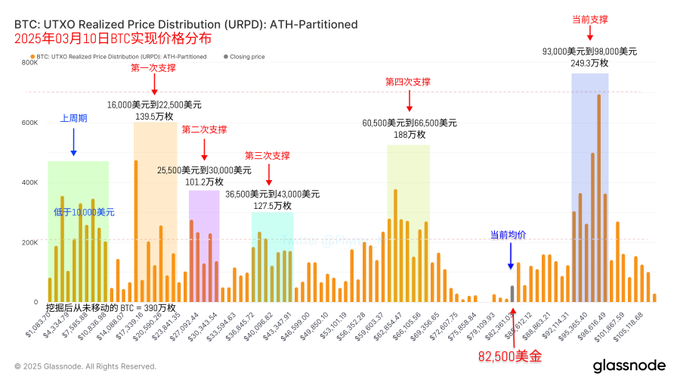

Data supports this viewpoint.

Unrealized profit distribution data shows that there is an unfilled price gap between $76,000 and $78,000, which may serve as a short-term support area; the dense chip area between $93,000 and $98,000 has lost its support.

Another key data insight is that the BTC turnover rate in the last 24 hours is low, so the price drop is not due to a large number of users selling off.

Considering these factors, while bottom-fishing may be attractive, the risks and returns need to be carefully weighed.

Bullish on the Golden Pit

In a downturn, there are always bloodied chips, and optimistic individuals believe that BTC is currently at a phase low, making it worth increasing positions or even bottom-fishing.

- @neso: Current price is a golden pit

Well-known KOL @neso clearly states in his analysis that the current price of BTC is in a "golden pit," representing an excellent opportunity for long-term investors.

"The U.S. stock market and the crypto market are both experiencing a wave of hot money withdrawal, which may have been driven by the prospect of Trump returning to power, flowing into hot assets like Nvidia and BTC. After Trump's return, due to policy uncertainty, this hot money began to withdraw, resulting in a nearly 30% pullback. However, for crypto, we are actually in the best policy environment since its inception; the current pullback is clearly collateral damage, and from a long-term perspective, it is a golden pit."

This viewpoint is not without merit.

The recent announcement by the U.S. to establish a Bitcoin reserve, the White House crypto summit, and the SEC's withdrawal of the SAB 121 accounting rule mark the arrival of the best policy environment in the history of the crypto industry.

Although in the short term, the market feels that these policy stimuli are not strong enough, if you recall the tough days of the crypto industry in the past, things have certainly improved significantly.

The introduction of more policies may provide a solid foundation for the long-term rise of BTC.

Additionally, the 30% pullback in BTC is described as "collateral damage," mainly dragged down by U.S. stocks and macroeconomic factors (such as trade wars and monetary policy tightening), rather than fundamental issues within the crypto industry itself. Historical data (such as the bottom of the bear market in 2022 and the rebound after the COVID crash in 2020) shows that similar pullbacks often represent long-term buying opportunities.

- @Trader_S18: Long at 81,000

Trader @Trader_S18 takes a more direct approach, posting on X based on recent market trends:

"Based on the recent market's wide fluctuations between 80,000 and 100,000, I went long at 81,200 this morning."

He believes that BTC's recent price has formed a wide fluctuation range between $80,000 and $100,000, and the current price drop to $81,200 is close to the lower limit, offering a high risk-reward ratio suitable for going long.

According to the four-hour candlestick chart and trading volume data, there may be support around $81,000, providing a technical basis for short-term long positions.

Of course, the long strategy of the trader may be more suitable for experienced short-term traders; the entry point of $81,200 is indeed close to technical support, but the risks are also evident: if the market continues to dip to the $76,000-$78,000 area, it may trigger stop-losses.

For ordinary players looking to bottom-fish at the current price level, let's hope this isn't a wait for a "cut" in long positions.

75000 Exit Strategy

Additionally, there is a viewpoint suggesting that around $75,000 will be a key price area for BTC that requires close attention.

- Arthur Hayes: $70,000 - $75,000 market may experience drastic changes

According to his post and related trend data, Bitcoin's price has retreated from its peak in March 2025, falling below $81,000 and may further test $78,000 or even $75,000.

Hayes' analysis indicates that if Bitcoin's price falls into the $70,000-$75,000 range, due to a concentration of a large number of open interest options contracts in this range, the market may experience drastic price fluctuations.

Here, Hayes refers to the Bitcoin options market, where a large number of open interest (OI) contracts have strike prices concentrated in the $70,000 to $75,000 range. This means many traders or investors have purchased Bitcoin call options or put options with strike prices set in this range.

When Bitcoin's price approaches or enters the $70,000-$75,000 range, these open options contracts may trigger large-scale trading activity. If the options are close to their expiration date and Bitcoin's price is near these strike prices, holders may choose to exercise the options (buy or sell Bitcoin), or market participants may hedge risks by closing positions.

This could lead to significant volatility in Bitcoin's price (sharp rises or falls).

A large concentration of OI at a certain price range indicates that the market may face liquidity pressure. If many traders simultaneously attempt to buy or sell Bitcoin to hedge or close options, it could lead to rapid price fluctuations, even causing a "squeeze" phenomenon.

Therefore, Hayes' warning suggests that investors may need to prepare for drastic price fluctuations and consider whether to "buy the dip" or wait for a more stable price range.

- Eugene NgAhSio: Let's talk again at $75,000

Trader Eugene Ng Ah Sio stated in a TG group that he is not in a hurry to trade at the current price level. Eugene reiterated that, as previously mentioned, the $75,000 price level is the only level he is currently interested in.

Some Bullish Indicators

If you simply need some psychological comfort or motivation, you might want to look at these bullish indicators.

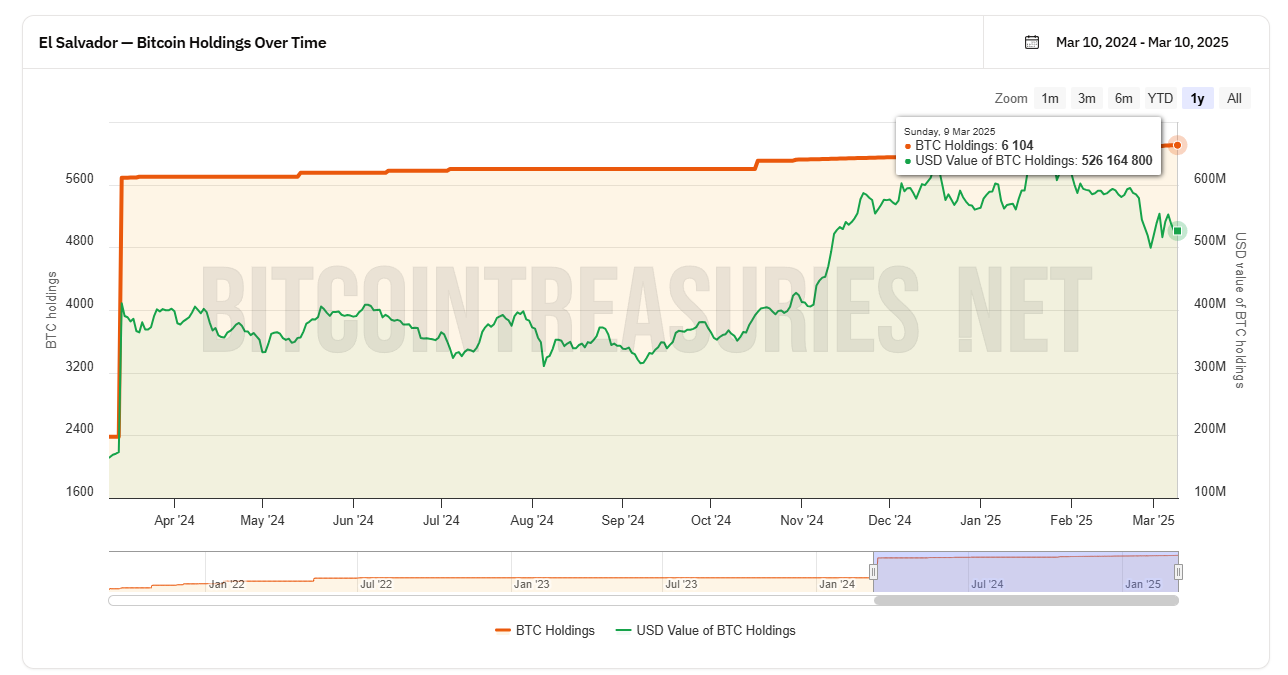

First, the country of El Salvador has added 5 more #BTC today, bringing its total holdings to 6,111 BTC; the chart shows that El Salvador is clearly a steadfast DCA (dollar-cost averaging) player, buying small amounts consistently.

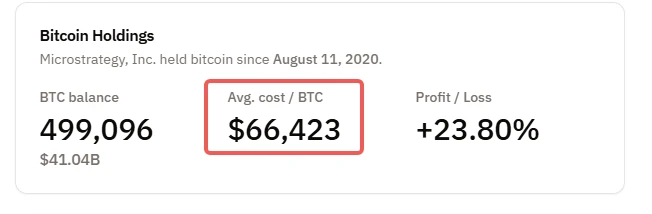

Another dead bull, MicroStrategy, goes without saying, has made several large purchases of BTC from the end of last year to the beginning of this year.

Its CEO, Michael Saylor, was recently photographed looking frustrated while attending a meeting called by Trump, perhaps he is the one who hopes BTC will keep rising.

But don't worry, data shows that MicroStrategy's average holding cost is around $66,000, and they haven't lost to the cost line yet.

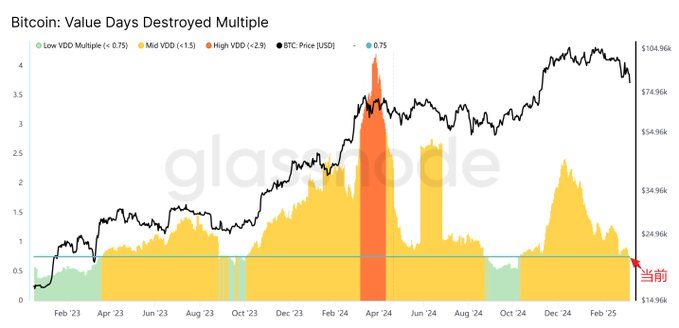

Additionally, according to on-chain data analysis, the current BTC VDD Multiple has entered the bottom range, approaching historical lows (such as below -2.9). This is similar to the market lows during the bear market in 2022 and after the COVID crash in 2020, indicating that the market is in a state of extreme fear and low liquidity.

Combined with the recent drop in BTC price from $90,000 by about 20% to below $84,000, and the lack of a significant increase in exchange trading volume, the VDD indicator shows that investors are reluctant to sell and that chips are concentrated, which may trigger a rebound in the short term.

The VDD Multiple is calculated by dividing the short-term (usually 30 days) VDD average by the long-term (usually 365 days) VDD average, resulting in a ratio. This ratio reflects the comparison between recent spending speed and the annual average spending speed, used to identify cyclical highs and lows in the Bitcoin market.

Finally, in the unpredictable volatility of the market, the aforementioned viewpoints can only serve as references. I still believe that caution is the key to longevity; it is better to miss out than to lose principal.

The price may still be there, but positions must not be lost.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。