Key Points

The total market capitalization of global cryptocurrencies is $2.78 trillion, down from $3.24 trillion last week, representing a decline of 14.2% this week. As of the time of writing, the net asset value of the U.S. Bitcoin spot ETF is $98.483 billion, with a cumulative net inflow of approximately $36.142 billion and a net outflow of $799 million this week; the net asset value of the U.S. Ethereum spot ETF is $7.762 billion, with a cumulative net inflow of approximately $2.699 billion and a net outflow of $120 million this week.

The total market capitalization of stablecoins is $235 billion, with USDT having a market cap of $142.5 billion, accounting for 60.64% of the total stablecoin market cap; followed by USDC with a market cap of $56.4 billion, accounting for 24% of the total stablecoin market cap; and DAI with a market cap of $5.36 billion, accounting for 2.28% of the total stablecoin market cap.

According to DeFiLlama data, the total TVL (Total Value Locked) in DeFi this week is $90.4 billion, down 14.6% from last week. By public chain classification, the top three public chains by TVL are Ethereum with a share of 52.17%; Solana with a share of 7.47%; and Bitcoin with a share of 5.86%.

From on-chain data, the overall transaction volume of public chains is on a downward trend this week, with SOL showing a significant decline of 67.34% compared to last week. The overall change in transaction fees this week is not significant, with SUI transaction fees increasing by 20.5% compared to last week. In terms of daily active addresses, the overall public chains are also on a downward trend; in terms of TVL, ETH shows a significant downward trend, down 15.34% from last week; the total TVL of Ethereum Layer 2 is $31.09 billion, down 17.6% overall from last week.

Innovative projects to watch: Optimum is a full-chain expansion solution with team members from MIT and Harvard. Investors in the angel round include Polychain CTO, DeFiance Capital founder, Polygon co-founder, Jump Crypto managing partner, etc.; Billions is a digital identity verification platform that utilizes zero-knowledge proof technology, aiming to provide a scalable and secure way to verify the identities of humans and artificial intelligence; smoothiedotfun: DeFAI-type project, where users can achieve automated research and trading using Smoothies, currently still in a very early stage.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Ratio 2

3. ETF Inflow and Outflow Data 4

4. ETH/BTC and ETH/USD Exchange Rates 5

5. Decentralized Finance (DeFi) 6

7. Stablecoin Market Cap and Issuance 10

II. Hot Money Trends This Week 11

1. Top Five VC Coins and Meme Coins This Week 11

1. Major Industry Events This Week 13

2. Major Upcoming Events Next Week 13

3. Important Investments and Financing from Last Week 14

I. Market Overview

1. Total Market Capitalization of Cryptocurrencies / Bitcoin Market Cap Ratio

The total market capitalization of global cryptocurrencies is $2.78 trillion, down from $3.24 trillion last week, representing a decline of 14.2%.

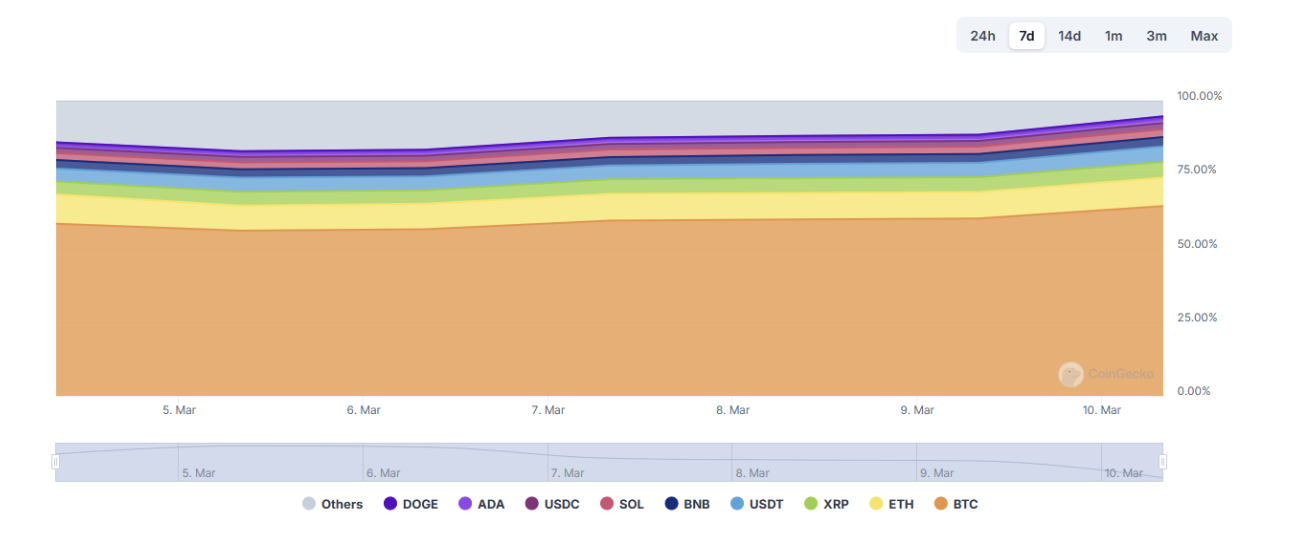

Data Source: cryptorank

As of the time of writing, Bitcoin's market cap is $1.61 trillion, accounting for 57.85% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $235 billion, accounting for 8.45% of the total cryptocurrency market cap.

Data Source: coingeck

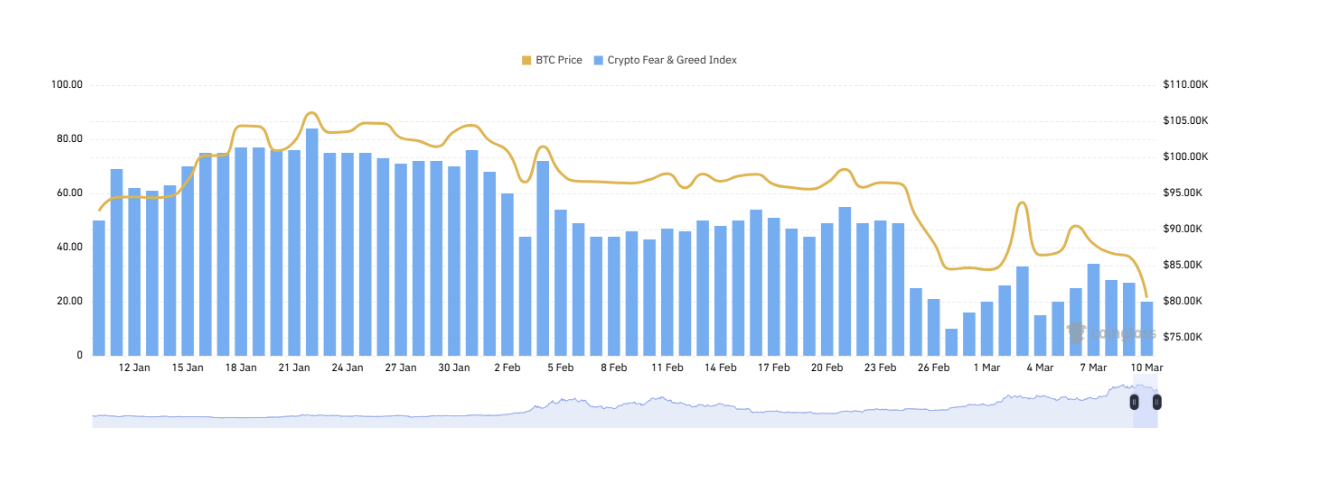

2. Fear Index

The cryptocurrency fear index is 20, indicating extreme fear.

3. ETF Inflow and Outflow Data

As of the time of writing, the net asset value of the U.S. Bitcoin spot ETF is $98.483 billion, with a cumulative net inflow of approximately $36.142 billion and a net outflow of $799 million this week; the net asset value of the U.S. Ethereum spot ETF is $7.762 billion, with a cumulative net inflow of approximately $2.699 billion and a net outflow of $120 million this week.

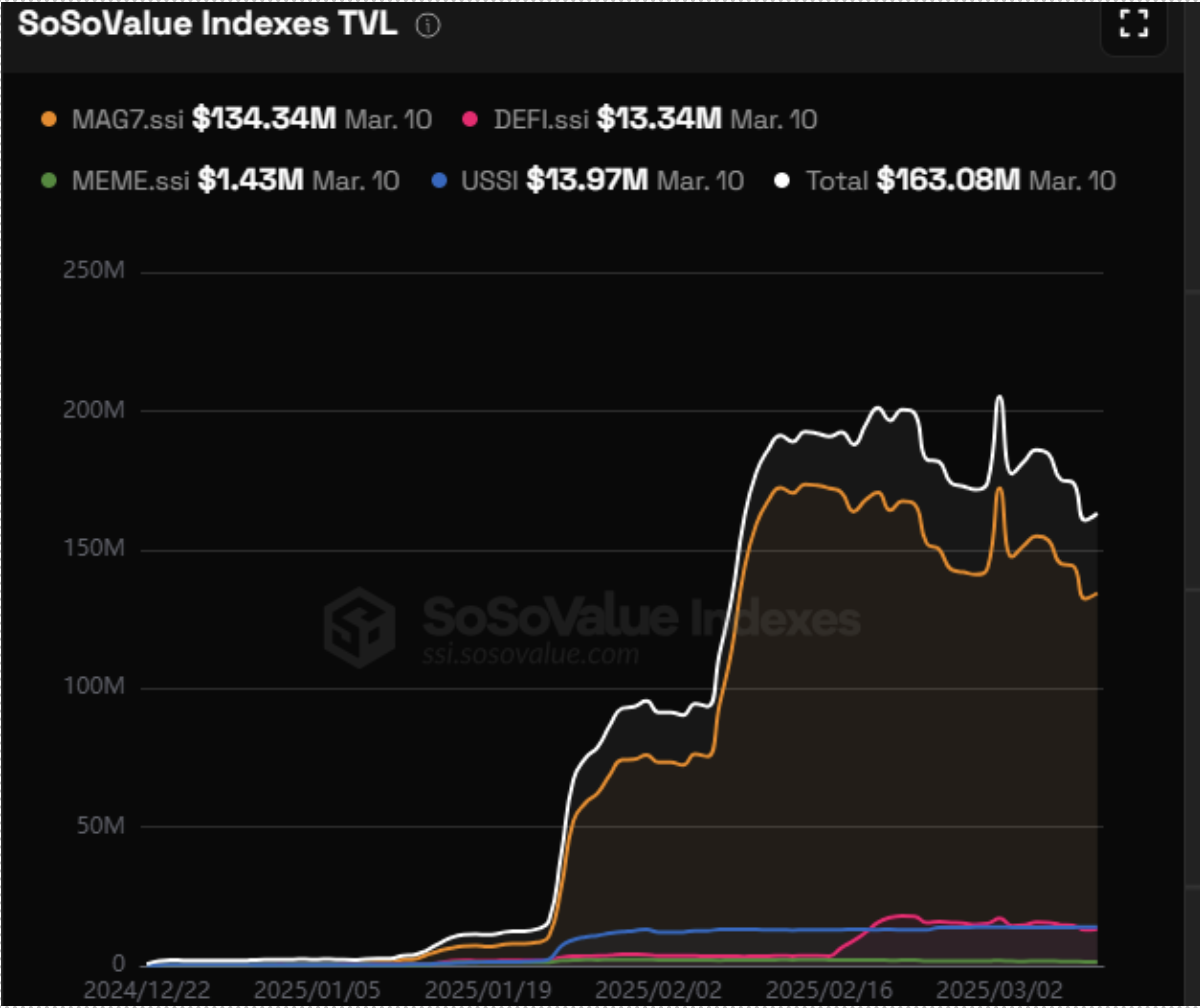

Data Source: sosovalue

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $2,046, historical highest price $4,878, down approximately 58.1% from the highest price.

ETHBTC: Currently at 0.025011, historical highest at 0.1238.

5. Decentralized Finance (DeFi)

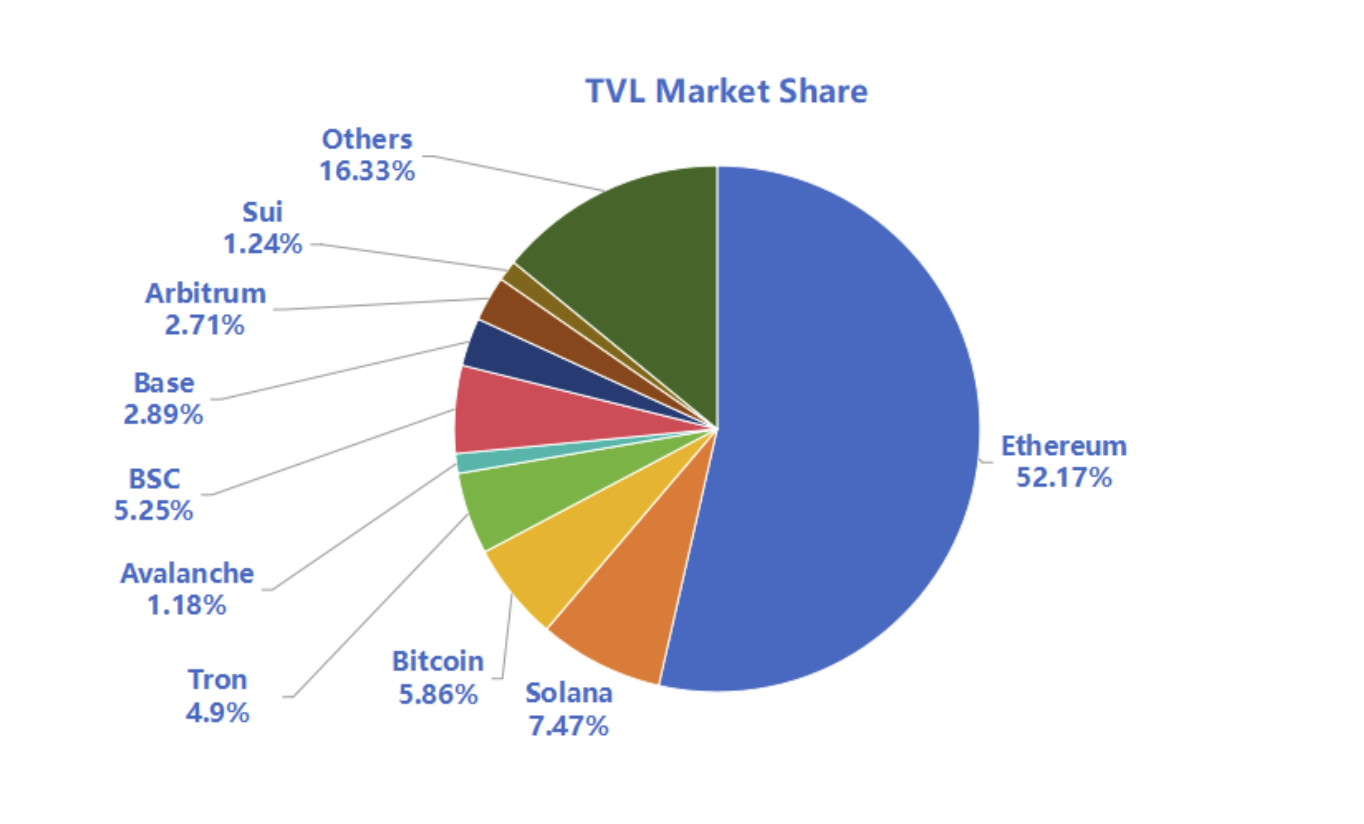

According to DeFiLlama data, the total TVL in DeFi this week is $90.4 billion, down 14.6% from last week.

By public chain classification, the top three public chains by TVL are Ethereum with a share of 52.17%; Solana with a share of 7.47%; and Bitcoin with a share of 5.86%.

Data Source: CoinW Research Institute, defillama

Data as of March 9, 2025

6 . On-Chain Data

Layer 1 Related Data

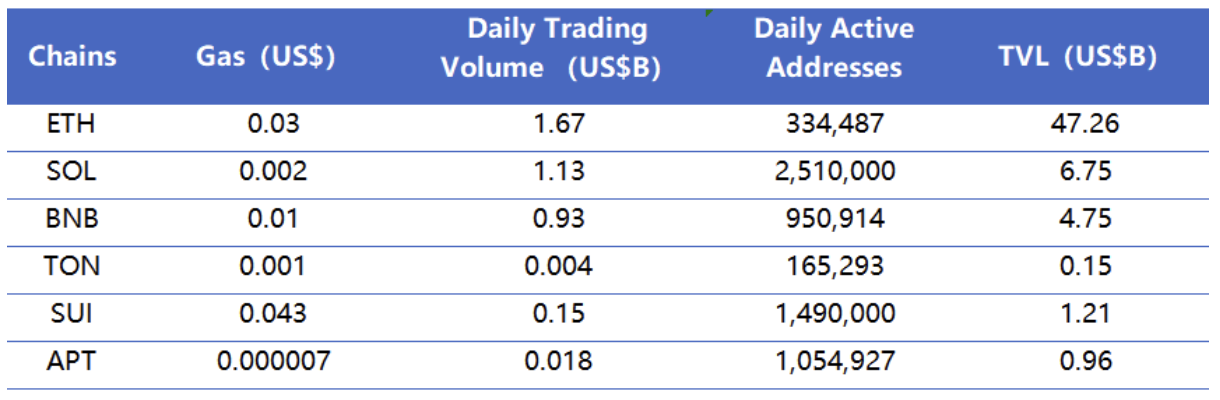

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily transaction volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of March 9, 2025

● Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, the overall transaction volume of public chains is on a downward trend, with SOL showing a significant decline of 67.34% compared to last week. The overall change in transaction fees this week is not significant, with SUI transaction fees increasing by 20.5% compared to last week.

● Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects the level of trust users have in the platform. In terms of daily active addresses, the overall public chains are on a downward trend; in terms of TVL, ETH shows a significant downward trend, down 15.34% from last week.

Layer 2 Related Data

● According to L2Beat data, the total TVL of Ethereum Layer 2 is $31.09 billion, down 17.6% overall from last week.

- Arbitrum and Base occupy the top positions with market shares of 32.61% and 30.05%, respectively, but both have seen a decline in overall share.

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market capitalization of stablecoins is $235 billion. Among them, USDT has a market cap of $142.5 billion, accounting for 60.64% of the total stablecoin market cap; followed by USDC with a market cap of $56.4 billion, accounting for 24% of the total stablecoin market cap; and DAI with a market cap of $5.36 billion, accounting for 2.28% of the total stablecoin market cap.

According to Whale Alert data, this week the USDC Treasury issued 1.17 billion USDC, with the total issuance of stablecoins this week down 35% compared to last week.

II. Hot Money Trends This Week

1. Top Five VC Coins and Meme Coins This Week

The top five VC coins with the highest increase over the past week

The top five Meme coins with the highest increase over the past week

2. New Project Insights

Optimum: A full-chain expansion solution with team members from MIT and Harvard. Investors in the angel round include Polychain CTO, DeFiance Capital founder, Polygon co-founder, Jump Crypto managing partner, etc. Optimum is a high-performance memory infrastructure suitable for any blockchain, supported by RLNC, which can scale L1/L2 and enhance dapp performance and end-user UX.

Billions: Billions Network is a digital identity verification platform that utilizes zero-knowledge proof technology, aiming to provide a scalable and secure way to verify the identities of humans and artificial intelligence.

smoothiedotfun: A DeFAI-type project where users can achieve automated research and trading using Smoothies. It also helps crypto analysts to tokenize strategies and is currently still in a very early stage of development.

III. New Industry Dynamics

1. Major Industry Events This Week

RedStone announced changes to the RED airdrop selection process and distribution. In the first Miner airdrop, it allocated 5% of the total supply of RED, and it will additionally allocate 2% of the total supply of RED from ecosystem and data providers. Additional recipients are selected by expanding eligibility criteria and based on collected proof of participation, with the additional 2% airdrop opening for claims on March 7, 2025.

The modular DPoS network Elixir has launched the ELX airdrop check portal. Additionally, the official token economics have been released, with 41% of the total supply allocated to the community (8% for the first quarter airdrop, 21% for future airdrops/LP rewards, 12% for public network security rewards), 22% allocated to the DAO foundation, 15% to investors, 19% to core contributors, and 3% for liquidity.

Kaito AI announced that Succinct is the next Pre-TGE project selected from the Yapper Launchpad, and the Yapper leaderboard for Succinct will be announced soon.

Sony's Layer 2 network Soneium has distributed two types of OG NFTs to early users: the Soneium OG Badge (requiring at least 45 transactions) and the Soneium Premium OG Badge (requiring bridging 1 ETH or 2500 USDC or 70000 ASTR to the network). These can now be queried through block explorers like Blockscout, with on-chain data showing a total of 426,992 addresses holding the two types of OG NFTs.

Sui announced a partnership with the Trump family's crypto project WLFI, as part of this collaboration, WLFI will include SUI in its strategic token reserves, and WLFI and Sui have begun exploring product development opportunities.

2. Major Upcoming Events Next Week

The AI-driven Web3 interaction platform AlphaOS is collaborating with the decentralized crypto trading protocol Orca to launch a Trading Campaign that will last until March 11. During this period, users can trade Orca liquidity pools through AlphaOS to earn double AlphaOS points and have a chance to receive ORCA token airdrops. AlphaOS points will be converted into future airdrop rewards after the TGE in the first half of 2025.

The airdrop claim deadline for Pudgy Penguins token PENGU is March 15, 2025.

PancakeSwap announced it will shut down its simple staking product on March 10, 2025, and users need to withdraw their funds by that date.

3. Important Investments and Financing from Last Week

Flowdesk raised $102 million, with investors including HV Capital, Cathay Innovation, Eurazeo, and ISAI. Flowdesk is a digital asset service provider that offers crypto asset trading solutions and market-making services for Web3 players, including cryptocurrency token issuers. (March 4, 2025)

Metaplanet raised $87 million, with investors including EVO FUND. Metaplanet Inc. is a company listed on the Tokyo Stock Exchange (3350) that has begun a strategic transformation. By utilizing Bitcoin (BTC) as its primary treasury reserve asset, Metaplanet will leverage excess cash flow and implement value-added corporate governance strategies, including financial management strategies such as debt and equity financing, to further accumulate Bitcoin. (March 4, 2025)

Across Protocol raised $41 million, with investors including Paradigm, Coinbase Ventures, Bain Capital Crypto, Multicoin Capital, and Sina Habibian. Across is an optimistic-based cross-chain bridging protocol that allows users to execute transactions between chains almost instantly. (March 4, 2025)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。