The core innovation of Flyingtulip lies in the introduction of an intelligent trading protocol based on adaptive curve technology.

Written by: DaPangDun

AC @AndreCronjeTech updated the phrase "Founder @flyingtulip_" in his profile, so I went to investigate what exactly Flyingtulip is.

Positioning

In the introduction on the official website, it is defined as the next generation DeFi platform: an intelligent trading protocol that adapts to market conditions, providing better execution, higher returns, and integrated DeFi on a single platform.

Next generation DeFi, this description is exciting.

I have always been curious about what next generation DeFi really is.

I have consulted many experienced DeFi users, but I have not received a clear answer. Can we see what AC has provided through Flyingtulip?

Technical Highlights

From the official website and Twitter, we can gather the following technical highlights about the project:

2.1 Adaptive Curve Technology

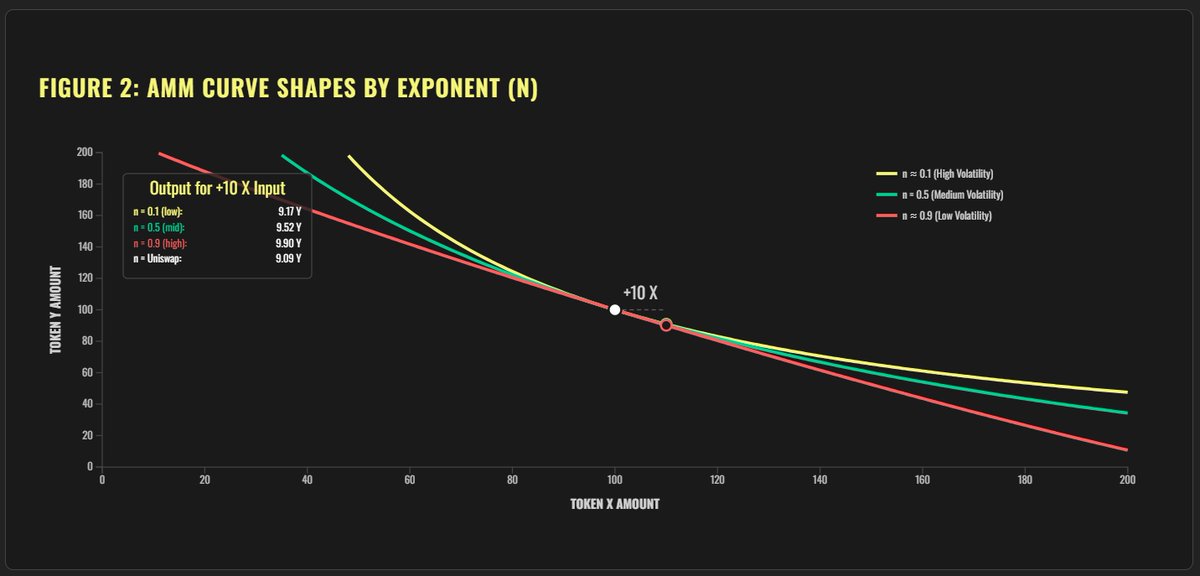

Unlike conventional AMMs, dynamic AMMs introduce time-weighted volatility, where the system automatically adjusts curve parameters based on volatility to improve liquidity efficiency and minimize impermanent loss.

In the theoretical diagram:

In a low volatility market, the curve approaches X+Y=K.

In a high volatility market, the curve approaches X*Y=K.

The changes brought by this technology include: lower slippage for traders and reduced impermanent loss in low volatility conditions.

In high volatility situations, although there may be greater impermanent loss than Uniswap V3 in the early stages, due to higher fee income during the transition period, its performance will be roughly comparable to Uniswap V3, and the adjustment of positions can be executed automatically.

2.2 AMM-based LTV Model

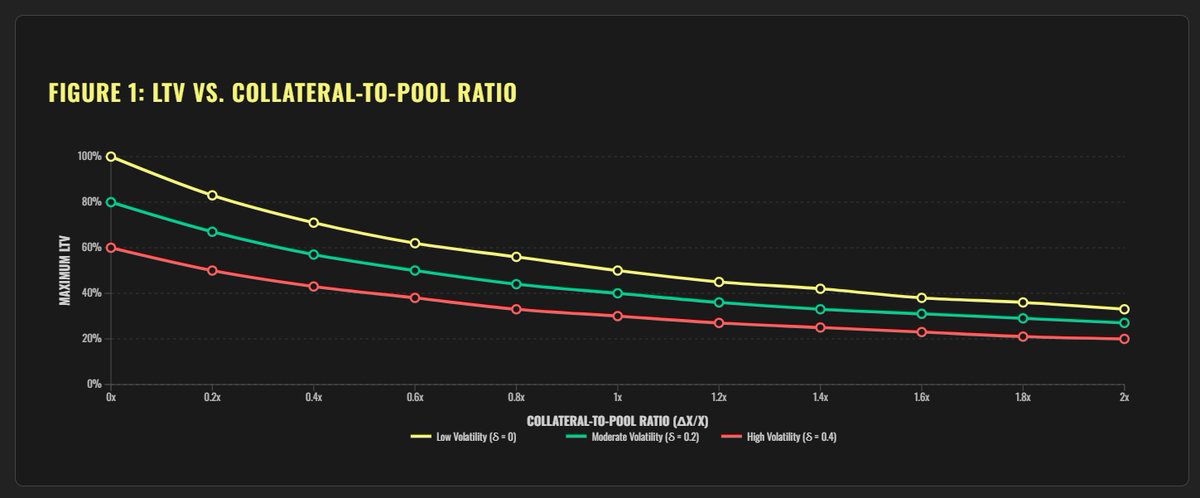

In traditional lending models, an asset is assessed with a fixed LTV, while in this model, the core idea is:

The loan-to-value ratio must be dynamically constrained by market depth and asset risk.

Specifically: the LTV of low volatility assets may be very high, even close to 100%, while the LTV of high volatility assets is reduced, which can decrease the overall system risk caused by new loans.

As volatility increases or the expected borrowing scale rises, the safe LTV area continuously shrinks.

2.3 One-stop DeFi

Given the above models, spot, leverage, and perpetual can be concentrated in a single AMM protocol without needing to be stored in different protocols, effectively solving the problem of fragmented liquidity.

2.4 Other Technical Points

Of course, there are other optimization points, which I will briefly summarize:

Dynamic Fees: Not fixed fees, but dynamically adjusted based on volatility.

More Revenue Sources: Because LPs can be utilized in more areas, naturally leading to greater returns…

Overall, AC attempts to connect most aspects of DeFi with an AMM that automatically adjusts based on volatility, which not only enhances user experience (low slippage, low impermanent loss, high fees) but also significantly promotes asset liquidity and improves asset utilization. The product is not yet available, but I am looking forward to it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。