Based on the latest candlestick trends, trading volume, large fund movements, and key technical indicators, we will analyze Bitcoin's short-term trend from multiple perspectives and make predictions for today's movement.

1. Candlestick Pattern Analysis

Recent Trend Review

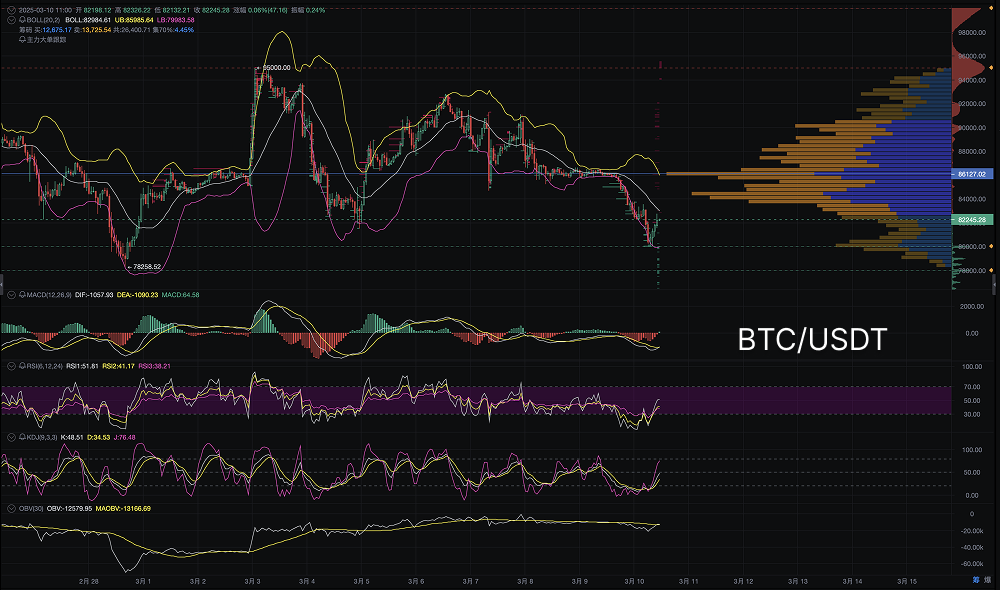

Bitcoin has experienced a rapid decline over the past few days, with the price briefly falling below the support level of 78,256.52, followed by a slight rebound.

During the decline, the candlesticks showed a series of long bearish candles, indicating heavy selling pressure in the market.

On the morning of March 10, the price rebounded to 82,264.03 but has not yet broken through the key resistance level of 86,127.02.

Support and Resistance

- Major support levels: $80,000 (round number, psychological support) and 78,256.52 (previous low).

- Major resistance levels: 82,500-83,000 (short-term rebound pressure), 86,127.02 (high trading volume area).

The price is currently showing signs of a short-term bottoming out at a low level, but a reversal has not yet been established, and it remains in a downtrend.

2. Large Fund Movements (Order Flow & Volume Profile)

Capital Flow

From the volume profile, there is significant trading activity in the $86,000-88,000 range, indicating that this area is a key battleground for bulls and bears, making it difficult to break through.

In the $80,000-82,500 range, trading volume has increased, suggesting that some funds are stepping in here, but there are no strong reversal signals yet.

Large Transaction Monitoring

Recently, there have been multiple large sell orders in the market, indicating that institutions or large funds are still offloading, and the short-term market may face further adjustment risks.

However, in the $78,500-80,000 range, a certain scale of buy orders has also been observed, showing that some funds are beginning to buy the dip.

3. Technical Indicator Analysis

Bollinger Bands

The price is near the lower Bollinger Band and has shown a brief rebound, indicating short-term overselling, but it has not escaped the downtrend.

Upper band resistance level: 88,624.68, lower band support level: 79,926.07, middle band resistance level: 84,275.17.

MACD (Trend Momentum)

DIF (-1138.19) is below DEA (-1087.25), and the MACD histogram remains negative, but the green bars have narrowed, indicating that bearish strength is weakening. There is still no clear golden cross signal, and the strength of the short-term rebound is in doubt.

RSI (Relative Strength Index)

RSI is at 51.95, not yet breaking through the strong zone of 60-70, and market sentiment remains cautious.

The RSI has started to rebound after falling below 50, indicating a certain demand for short-term repair, but the trend has not completely reversed.

KDJ (Short-term Momentum)

K value (41.67), D value (27.74), J value (69.53) show oversold rebound signals, but the trend is still unclear.

OBV (On-Balance Volume)

OBV remains at a low level, indicating that market funds have not fully returned.

4. Today's Trend Prediction

Short-term Forecast

- High probability of a short-term rebound: After the price fell to around 78,256.52, there was some support, and it may test 82,500-83,000 in the short term.

- Trend not fully reversed: If it cannot break through 86,127.02, it may continue to test 80,000 or even 78,000.

- Watch trading volume: If the volume does not increase during the rebound, it may just be a technical repair with limited rebound height.

Trading Strategy Suggestions

Short-term traders

- Aggressive strategy: Buy near 80,000, target 82,500-83,000, stop loss at 78,500.

- Conservative strategy: Consider going long only after breaking through 86,127.02.

Medium to long-term investors

If the price stabilizes at 80,000, consider building positions in batches. If it falls below 78,000, be cautious and wait for a lower buying point.

5. Market Sentiment and Risk Factors

Macroeconomic Factors

- The Federal Reserve's interest rate policy and market liquidity conditions continue to affect Bitcoin's trend.

- Recent market risk aversion has increased, which may put some pressure on the crypto market.

On-chain Data

Need to monitor the inflow of stablecoins; if market funds continue to flow out, the strength of the rebound may be limited.

Technical Rebound vs. Reversal

The current rebound has not confirmed a trend reversal, and we still need to observe whether trading volume and momentum indicators improve further.

Summary

There is a demand for a short-term rebound, but it has not completely escaped the downtrend; watch the resistance levels of 82,500-83,000. If it breaks through 86,127.02, consider further bullish positions; otherwise, there is still a risk of a pullback. In trading, short-term strategies can consider buying low and selling high, while medium-term strategies should remain cautious, focusing on market fund flows and changes in trading volume.

Disclaimer: The above content is for reference only and does not constitute investment advice.

AiCoin official website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group chat: Customer Service Yingying, Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。