Market Overview

Overall Market Situation

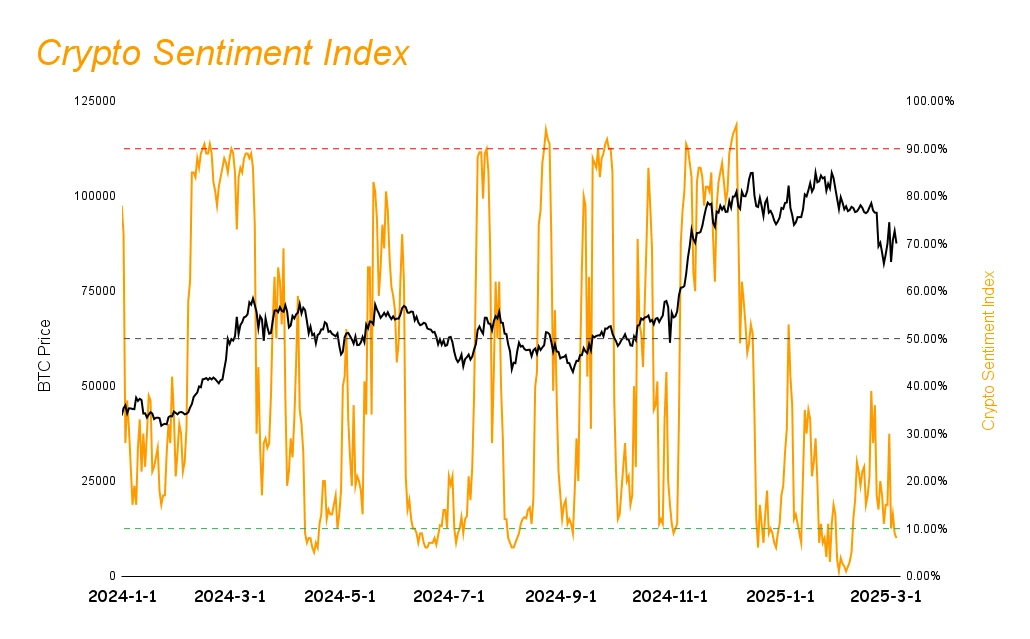

This week, the cryptocurrency market is in a trend of fluctuating decline, with the market sentiment index dropping from 11% to 8%. The market capitalization of stablecoins has begun to show rapid growth (USDT reached 142.7 billion, USDC reached 57.2 billion, with increases of 0.49% and 2.32% respectively), indicating that institutional funds are re-entering the market, primarily driven by the increase in U.S. funds. After experiencing declines over the past two weeks, U.S. investors have started to re-enter the market; although the release of data and the publication of the Federal Reserve's peeling book have gradually alleviated concerns about a U.S. economic recession, and the market has begun to price in three interest rate cuts by the Federal Reserve this year starting in May, it has not eased market sentiment. Instead, recent policy fluctuations have triggered strong volatility in Bitcoin prices, leading to increased panic in market sentiment, with Altcoins generally underperforming the benchmark index.

Predictions for Next Week

- Bullish Targets: BTC, S, AAVE, BERA

BTC: Recently, BTC and the crypto industry have been in a weak trend, mainly due to: macro factors such as the implementation of Trump's tariff policy leading to market investors' concerns about rising U.S. inflation rates and declining GDP expectations, which may trigger a short-term economic recession, the suspension of the U.S.-Ukraine mineral agreement, and uncertainty regarding future interest rate cuts by the Federal Reserve. In terms of BTC itself, the price has remained high for the past two months, with some long-term holders and whales gradually selling off at high prices. However, there have been no new positive developments or subsequent capital injections in the market, and Trump's signed Bitcoin strategic reserve fell short of market expectations, resulting in a significant recent decline in BTC prices. This sharp drop has caused panic selling among market users, along with continuous selling by institutions led by BlackRock. The bullish reasons are mainly twofold: there have been some macro changes, as the release of data and the Federal Reserve's peeling book have gradually alleviated concerns about a U.S. economic recession, and the market has begun to price in three interest rate cuts by the Federal Reserve this year starting in May; regarding BTC itself, after a rapid decline, panic selling occurred, and on-chain data shows that most holders did not sell during this drop and have begun to gradually absorb chips, thus being optimistic about BTC's performance next week.

S: Although S token ended its strong performance over the past few weeks and followed the market down this week, Sonic's fundamentals have not changed. Sonic's TVL is still on an upward trend this week, with an increase of 9.23%. The main DeFi projects on the Sonic chain also achieved growth this week. Additionally, the APY provided to users by DeFi on the Sonic chain has not decreased and remains at a high level. The liquidity pool based on S token in the main liquidity staking project Beets can achieve an APY of around 30%, which is roughly the same as last week's level. The average borrowing rate for users in Sonic's lending protocols is about 14%, up from 10% last week, indicating an increase in on-chain lending. Observations show that Sonic's daily revenue is $210,000, ranking sixth among all public chains, far exceeding other public chains with similar TVL. Since most of Sonic's projects are DeFi, it can be seen that DeFi activities on the Sonic chain are very frequent. Therefore, it can be concluded that the decline in S token prices this week is not due to issues with the project itself, but rather because it followed the market price trend. Since Sonic's fundamentals have not changed, its bullish logic still exists.

AAVE: This week, AAVE rose against the trend, with an increase of 21.38%, performing prominently among the top fifty tokens by market capitalization. Aave's TVL performance is also outstanding, with a growth rate of 5.86% this week, ranking second among the top twenty DeFi projects by TVL, only behind Infrared Finance on Berachain. Aave's popularity this week is mainly due to its optimized governance and token economic model (buyback tokens, increase staking rewards, optimize liquidity) and the White House's support for abolishing DeFi trading report rules, reducing compliance burdens and stimulating innovation. Although it is currently just a proposal, given Aave's strong financial position and supportive attitude towards innovation, this proposal should be achievable, and Aave's buyback proposal may spark a wave of buybacks in the DeFi industry, bringing some vitality to the currently quiet sector, so Aave's future development is very promising.

BERA: This week, the BERA token, like the S token, ended its strong performance over the past few weeks with a decline. However, Berachain's on-chain data and fundamentals have not changed, and all metrics have shown upward growth. This week, the TVL of leading DEX, Lending, and LSD projects in the Berachain ecosystem has slowed down, mainly driven by the growth of the LSD project Infrared Finance and the DEX project BEX, which achieved growth rates of 31.15% and 25.22% respectively. This is mainly because Infrared Finance has stabilized the APY of WBERA around 120%, and BEX has stabilized the APY of the stablecoin pool at around 16%. In the current market, investors are still in a state of panic, and the high stable returns are still very attractive to them. Meanwhile, the lending project Dolomite offers borrowers a rate as high as 48.08%, increasing demand for BERA. Therefore, it can be seen that the decline in BERA token prices is mainly due to the impact of the broader market environment, not because of changes in the Berachain project itself, so the logic for BERA token to rise still exists.

- Bearish Targets: APE, APT, MERL, TON

APE: APE is the governance and utility token for the Bored Ape community and related communities, used to authorize and incentivize the construction of decentralized communities at the forefront of web3. APE has also become a utility token or currency in web3 projects such as games and virtual worlds. It can be seen that APE mainly involves the NFT and Gamefi sectors. However, in this round of market conditions, most of the market share in the NFT and Gamefi sectors has been taken over by the Meme sector, and most projects in the NFT and Gamefi sectors have lost attention in the market, with a gradual decrease in users and almost no new capital entering. Therefore, ApeCoin, which benefited from the previous round of the metaverse and Gamefi boom, is now largely ignored. Additionally, APE tokens will unlock 15.37 million APE on March 16, accounting for 1.54% of the total locked amount. This is a significant unlock, mostly held by early VCs, and after the project loses vitality, most investment institutions will continue to sell tokens to recoup funds, leading to significant selling pressure on APE after this unlock.

APT: This week, Aptos performed relatively well mainly because Bitwise submitted an application for a spot Aptos ETF on March 5, creating some expectations for the future. However, Aptos is not among the cryptocurrencies announced by Trump for reserve status, so if details about establishing cryptocurrency reserves are announced at the White House's first crypto summit this Friday, the announced tokens will receive market attention in the short term, and funds and attention will shift from other projects. If this happens, it would not be favorable for Aptos, which is also a top public chain. Additionally, APT tokens will unlock 11.3 million APT on March 12, accounting for 1% of the total locked amount. The unlocked tokens are all held by institutions, which may lead to continued selling pressure, potentially exacerbated by the shift in attention and funds, increasing market investors' panic regarding APT.

MERL: This week, Merlin's TVL saw a significant decline of 12.44%. From its TVL composition, the largest declines were mainly in its on-chain DEX, Restaking, and cross-chain projects, with MerlinSwap declining by 34.33% and Pell Network declining by 87.11%. The cross-chain project Meson's TVL is relatively small, so it is negligible. Since Merlin is a BTC-L2 and does not have a large ecosystem based on BTC-L2, mainly consisting of DEX, Lending, and Restaking projects, it can be seen that the decline in Merlin's TVL is due to a large-scale drop in its main ecosystem projects, with funds continuously withdrawing from Merlin. Additionally, considering that recent developments in BTC ecosystem projects have not been smooth and have not gained market attention, and due to the recent significant drop in BTC, many staked BTC have withdrawn from the protocol. However, this week, MERL's decline was not large, only -1.8%. Given the continuous outflow of funds from its on-chain ecosystem, it can be judged that it is highly likely to experience a corrective drop next week.

TON: This week, Toncoin's on-chain TVL saw a significant decline of 10.68%. From its on-chain TVL composition, almost all ecosystem projects' TVL have declined. Looking at its historical TVL line, Toncoin's TVL has been in a downward trend since last year, particularly after the popularity of on-chain mini-games based on Telegram, leading to a continuous withdrawal of funds. Additionally, in recent months, SocialFi projects have remained on the fringes of the entire crypto industry without creating any blockbuster projects, and as the popularity of on-chain mini-games wanes, the earning potential for users has diminished, even lower than that of ordinary DeFi projects' APY. Consequently, funds have been continuously exiting Toncoin. Coupled with the recent low sentiment in the crypto industry and a significant drop in TON prices, investors generally have a pessimistic outlook on Toncoin's on-chain ecosystem projects. Therefore, it can be judged that TON is likely to remain in a downward trend.

Market Sentiment Index Analysis

The market sentiment index has risen from 11% last week to 8%, entering a state of extreme fear.

Hot Sectors

Aave

- Current Status

This week, one of the leading DeFi projects, Aave, performed exceptionally well, ranking second in growth rate among the top twenty DeFi projects by TVL, only behind Infrared Finance on Berachain, with a growth rate of 5.86%. For a DeFi project with a TVL of $19.227 billion, a growth rate of over 5% is significant, and AAVE's price also saw an increase of 21.38%, performing prominently among the top fifty tokens by market capitalization.

- Reasons for Popularity

The reasons for Aave's popularity this week can be summarized in two points: First, Aave plans to optimize its ecosystem governance and token economic model through a series of proposals, including launching a "buy and allocate" plan, using excess protocol revenue to repurchase AAVE tokens at a scale of $1 million per week and injecting them into the ecosystem reserve, reducing circulating supply and enhancing token value; establishing the Umbrella mechanism and the Aave Financial Committee (AFC) to allocate part of the excess revenue to aToken stakers and optimize fund management; launching the Anti-GHO token to enhance rewards for StkAAVE and StkBPT stakers; terminating the LEND migration contract to recover $65 million in AAVE for injection into reserves; and adopting a hybrid model to optimize secondary liquidity management for greater liquidity at lower costs. Second, the White House supports the abolition of IRS rules regarding DeFi trading reports, reducing compliance burdens for DeFi projects while retaining decentralized characteristics, attracting capital and talent back, and stimulating a wave of innovation.

- Future Outlook

Aave is one of the iconic projects in the DeFi industry, and its every move may influence the future direction of the DeFi sector. Recently, the Crypto market has lacked innovation, with the AI industry leaning towards the Meme direction, and as the Meme wave recedes, the entire Crypto industry has remained in a sluggish state. Consequently, investors in the market have begun to focus less on various industry narratives and development paths and more on the real returns that projects provide to users, as real returns are ultimately the most important for users. This has led to a resurgence of high APY projects, such as Berachain and Sonic, which offer users high APYs to attract participation. Aave, however, has focused on the growth method of DeFi dividends. Due to Aave's monopolistic position in the lending sector in recent years, it has accumulated sufficient capital reserves, with Aave DAO's cash reserves reaching $115 million and the supply of GHO stablecoins exceeding $200 million. Therefore, Aave's buyback proposal demonstrates multiple advantages, including strong cash reserve support, a diversified income structure, and high-quality asset rewards. This has led market investors to believe that Aave can achieve very good development in the future, while also opening new growth points for various investors and project parties in the market. It is foreseeable that as current investors increasingly focus on the value capture ability of DeFi protocols, many DeFi projects will likely shift towards dividend or buyback models to enhance token value return capabilities.

At the same time, we can calculate from Aave's weekly buyback amount of $1 million that it will repurchase approximately $52 million worth of AAVE annually. With AAVE's current market capitalization at $3.165 billion, we can derive that Aave's price-to-earnings ratio is 60.86 times. Among the projects conducting buybacks, Maker is the most well-known and best-performing project in the industry. According to Maker's website, its current price-to-earnings ratio is 20.75.

Thus, from the comparison between Aave and Maker, it can be concluded that Aave's price-to-earnings ratio is significantly higher than that of Maker. Therefore, while Aave is currently assigned high expectations by the market, the cost-effectiveness of purchasing AAVE is far lower than that of MKR.

Berachain

- Current Status

This week, the entire market is in a trend of fluctuating decline, with most of the top ten projects by TVL experiencing declines. Among them, Berachain had the largest increase, reaching 17.21%. However, compared to other public chains, achieving several weeks of net growth in the currently pessimistic Crypto industry environment itself indicates its strong performance, with a TVL of $3.449 billion, ranking sixth among all public chains by TVL. However, the price of its token BERA experienced a correction this week, with a decline of 12.94%.

- Reasons for Popularity

This week, the TVL growth rates of leading DEX, Lending, and LSD projects in the Berachain ecosystem have all slowed down, with the main growth coming from the LSD project Infrared Finance and the DEX project BEX, which achieved growth rates of 31.15% and 25.22% respectively. This is mainly because Infrared Finance has stabilized the APY of WBERA around 120%, and BEX has stabilized the APY of the stablecoin pool at around 16%. In the current market, investors are still in a state of panic, and the high stable returns are very attractive to them. Meanwhile, the lending project Dolomite offers borrowers a rate as high as 48.08%, increasing demand for BERA.

- Future Outlook

From the reasons for Berachain's popularity, we can conclude that the main reason is that Berachain's on-chain DeFi projects are increasing APY to attract users, allowing on-chain users to achieve higher returns in the currently unstable market, thus achieving the goal of attracting traffic to the Berachain chain. It can be seen that for a blockchain ecosystem to achieve efficient growth, the key lies in driving the positive cycle of the economic flywheel. Berachain's core strategy revolves around the DeFi sector, empowering on-chain assets through a dual drive of staking and liquidity release, enabling them to generate compound returns in scenarios such as DEX, lending, and asset management, thereby achieving the goal of "staking as productivity." Specifically, the on-chain ecosystem needs to form a sustainable growth cycle through the path of "staking lock-up → liquidity release → DeFi empowerment → token appreciation → user return → re-staking → developer aggregation." However, once new user funds are insufficient to cover arbitrage selling pressure, the decline in BERA token prices will lead to a decrease in yields, triggering arbitrageurs to exit and negatively impacting the ecosystem. Nevertheless, this week, Berachain has also faced a downward trend in the Crypto industry, first stabilizing the APY provided to users, ensuring that users' yields exceed the decline in their tokens, allowing arbitrage users to continue making profits. Additionally, Berachain's founder has stated that to reduce supply, they have been "buying back that portion of the seed round and subsequent A round and other rounds of supply." Therefore, from Berachain's development perspective, it is crucial to continuously monitor the APY performance of Berachain's on-chain DeFi projects, as the level of APY directly reflects the vitality and development potential of the ecosystem. As a project with real returns, Berachain's lifeblood and barometer are the changes in its APY and TVL.

From the largest staking project on the Berachain chain, Infrared Finance, we can see that Infrared Finance's TVL is $1.844 billion, of which the TVL related to the BERA token is only $182 million. BERA's current circulating market value is approximately $721 million, accounting for about 25.24% of the circulating ratio. Additionally, considering other staking projects on-chain, it can be concluded that approximately 30% of the circulating market value of BERA tokens is staked on the Berachain chain. A staking ratio of around 30% can be considered relatively low in non-PoS chains. Furthermore, the number of BERA staked on the Berachain chain is rising at a 45° angle, so we can foresee that more BERA will enter staking on the Berachain chain in the future, thereby reducing the circulating supply of BERA, which is very promising for Berachain's future.

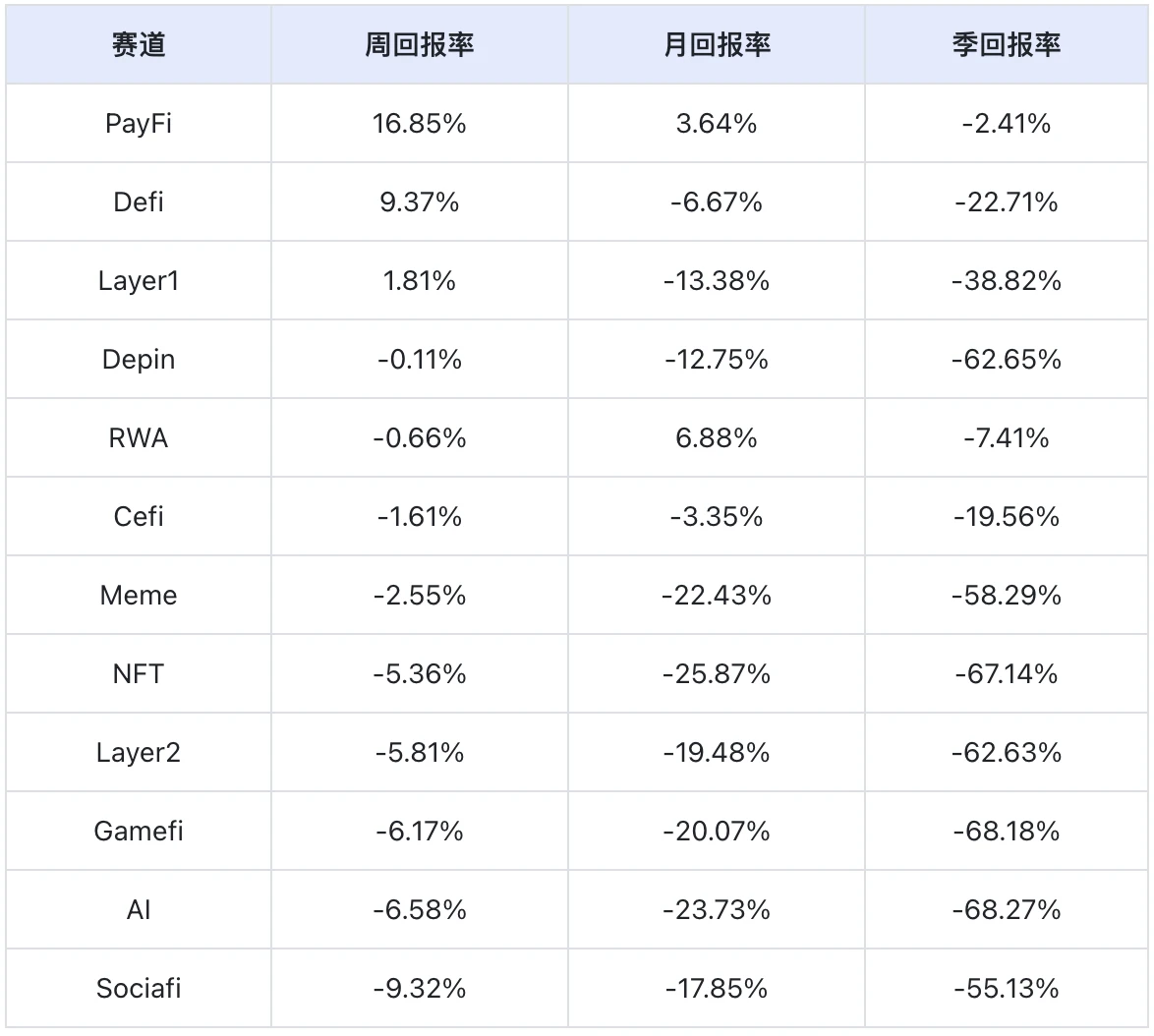

Overall Market Overview

Data Source: SoSoValue

According to weekly return rates, the Sociafi sector performed the best, while the Sociafi sector performed the worst.

PayFi Sector: In the PayFi sector, XRP, LTC, and XLM account for a large proportion, totaling 95.07%, with their respective price changes this week being 18.96%, -18.47%, and 6.23%, making the PayFi sector perform the best.

Sociafi Sector: In the Sociafi sector, TON and CHZ account for a large proportion, totaling 94.39%, with their respective declines this week being -10.68% and -2.31%, leading to the worst performance of the entire Sociafi sector.

Upcoming Major Crypto Events Next Week

Wednesday (March 12): U.S. February End Seasonally Adjusted CPI Year-on-Year

Thursday (March 13): Web3 Amsterdam 2025

Summary

Overall, this week the crypto market has shown a complex pattern amid fluctuations and panic sentiment. Although stablecoin capital inflow and the solid fundamentals of some hot sectors have provided some support, the market overall remains affected by macro policy uncertainties and insufficient investor confidence. Looking ahead, projects like BTC, AAVE, and Berachain, with their fundamental advantages and innovative strategies, are expected to become market highlights. Investors need to continuously monitor on-chain data, macro policy trends, and the upcoming unlocking events for their further impact on market sentiment to seize potential opportunities and mitigate risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。