Let's keep the weekend homework simple. I basically didn't look at any information or the market today. I had a good sleep and took a day to rest. My physical fatigue has long been recovered, but my mental fatigue still needs some more rest. There are always friends asking me if I still have a good outlook for Q1. To be honest, I have basically achieved my expectations for Q1, but not in the way I imagined.

Trump did indeed pause the new tax again a day after implementing it, but this time the market did not rebound like it did in January. Trump successfully held the White House crypto summit, where he expressed his belief in #Bitcoin as a strategic reserve and announced the concept of cryptocurrency reserves. However, the market not only did not rise but instead fell again, as market expectations were still a bit high, and Trump did not meet those expectations.

The ceasefire between Russia and Ukraine is still under discussion, and Powell's speech has also bled a bit for inflation and the economy, but the market just doesn't buy it. It's like a girl who has been repeatedly deceived by a scumbag; she no longer trusts anything this man says. Friends who bought $SOL, $ADA, and $XRP at high prices want to seek justice but have no place to go, waiting confidently for a strategic reserve that turned out to be just Trump's casual remarks.

There's an old saying: you guessed the beginning but not the end. There are actually quite a few positives for Q1, and there are many opportunities, but it is indeed too trusting of the person providing the good news. Currently, the only thing we can expect for Q1 might be the dot plot on March 20, but after the dot plot, it will still be a game between recession and inflation. The trend is already hard to predict, and the difficulty of making money in this market may be even higher. However, even so, if viewed from a long-term holding perspective, I still think BTC has a good opportunity, but it may take a longer time. As for other unexpected cryptocurrencies, it will be even harder.

Based on the way U.S. stocks are falling, it might really be a bear market, but in reality, BTC's decline is currently much better than that of U.S. stocks. By the close on Friday, U.S. stocks had already fallen below the levels after September 12, while BTC had only fallen below the gains since Trump's election. From this perspective, BTC's strategic reserve has indeed cushioned its decline somewhat.

It's hard to say whether we are at the bottom now. The main reason is still unclear whether there will be an economic recession in 2025 or 2026. If there is indeed a recession, it might be a good thing, as completing the final drop is also the best time to buy the dip. On the contrary, in the current situation, whether to buy or not is a frustrating matter. For long-term BTC supporters, reducing leverage and buying spot at low prices may not be wrong, but for most who are looking forward to an altcoin season, even if BTC has a phase of explosive growth, it may not bring much strength to altcoins.

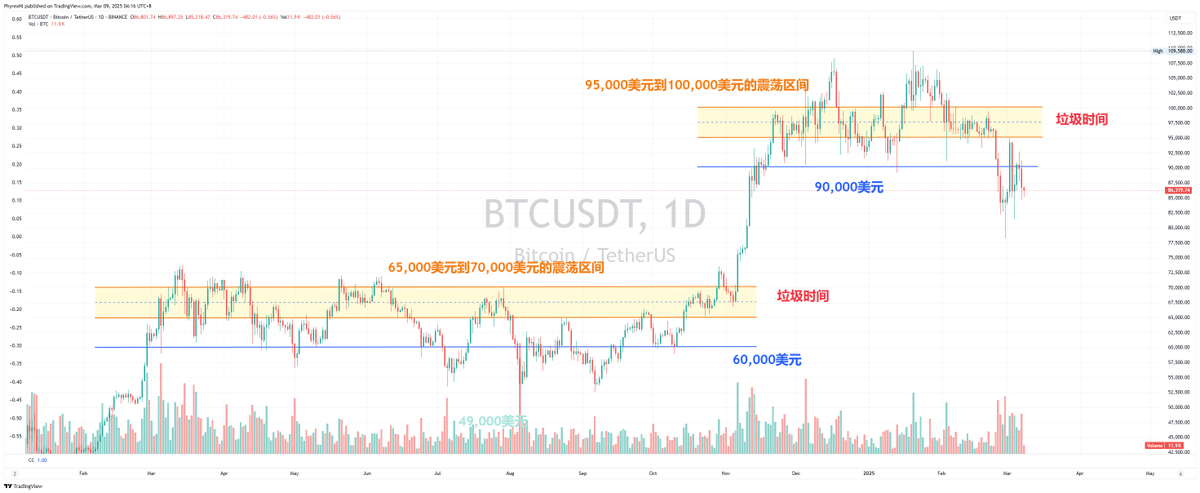

The current garbage time is very similar to the garbage time in 2024, but the expectation for 2024 is the election, while the expectation for 2025 is either recession or interest rate cuts.

Looking back at BTC's own data, after the farce on Friday, the turnover rate has decreased, which is normal. The entire market may return to a trend of continued fluctuations in the short term, as the actual expected positives are temporarily not visible. The story of strategic reserves has come to an end, while the story of state reserves may take some more time.

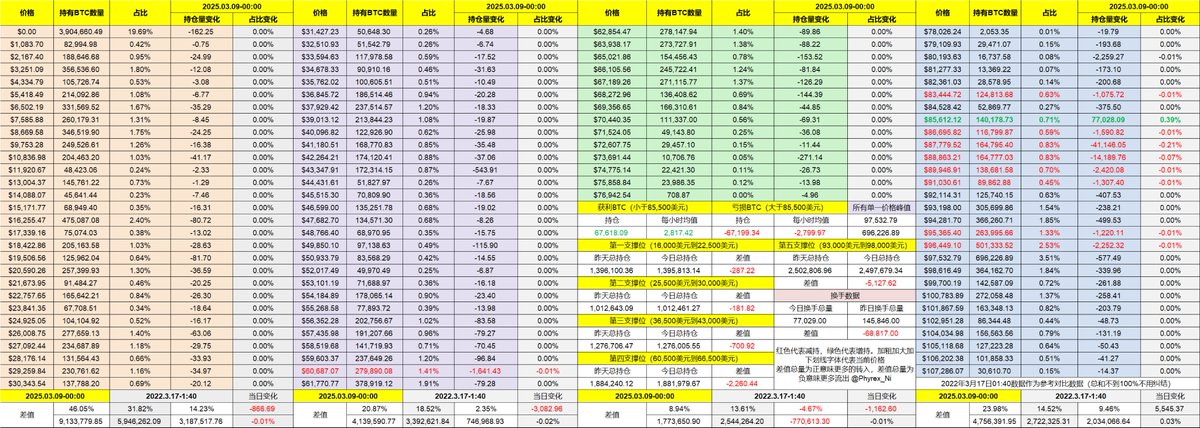

From the turnover data, short-term investors have also begun to lower their flags and cease operations, which is similar to the garbage time in 2024. Recently, more of those leaving the market in the last 24 hours are short-term investors who are at a loss, possibly due to the failure of their speculative expectations. This group of investors has already left at a loss, while earlier profit-taking investors are starting a new hibernation.

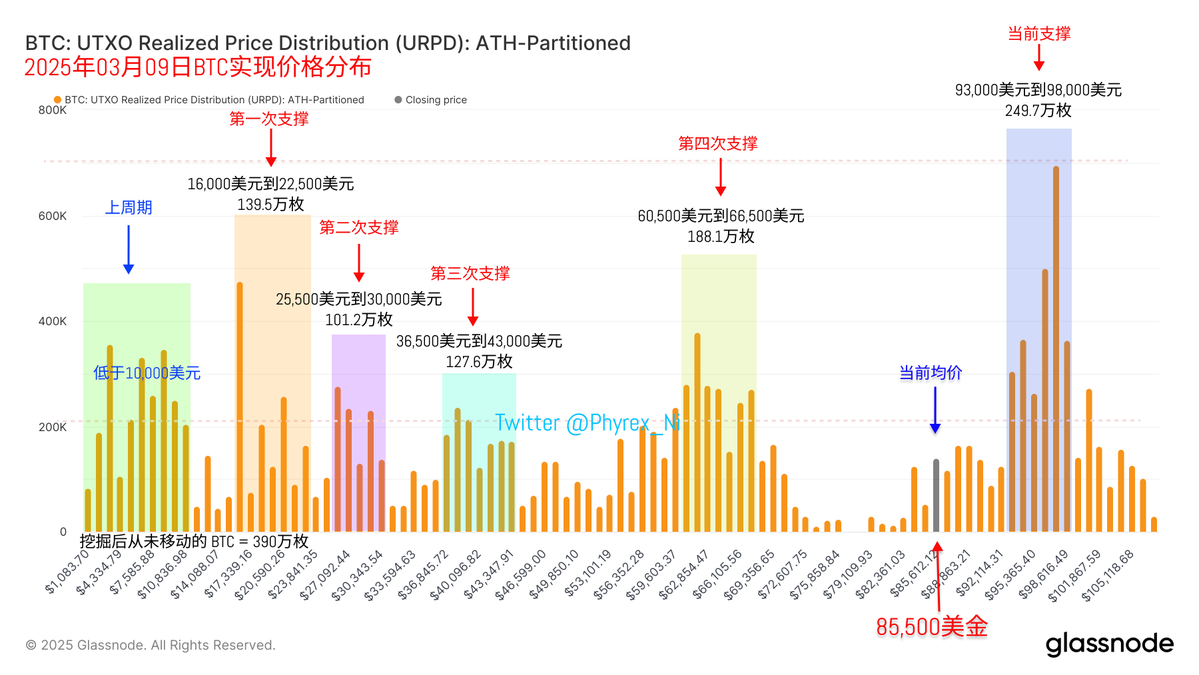

This kind of washout method is also the most challenging time for investors, especially for early investors. Whether to join the panic selling ranks is a measure of significant price changes. At least from now on, there are no signs of panic selling in the support level formed by the dense chips between $93,000 and $98,000. There is still nearly 2.5 million BTC accumulated in this range, and the lack of large-scale exits from this portion of chips will relatively reduce the pressure on prices.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。