Global liquidity is an important factor influencing Bitcoin prices. Its cyclical volatility and lagging effects reveal market trends more than absolute values. The current recovery in liquidity may drive Bitcoin prices up by the end of March.

Author: Bitcoin Magazine Pro

Translation: Blockchain in Plain Language

The price trend of Bitcoin is usually analyzed through on-chain data, technical indicators, and macroeconomic trends. However, a severely underestimated yet extremely important factor is Global Liquidity. Many investors may not fully utilize this indicator and may even misunderstand how it affects Bitcoin's cyclical trends.

1. The Impact of Global Liquidity on Bitcoin

With the rising discussions about global liquidity on platforms like Twitter (X) and analysts' in-depth interpretations of liquidity data, understanding the relationship between global liquidity and Bitcoin prices has become a must for traders and long-term investors. However, recent trends have deviated from traditional expectations, indicating that the market may require a more nuanced analytical perspective.

Global M2 money supply refers to the total of all liquid currencies, including cash, demand deposits, and easily convertible quasi-money assets.

When global M2 expands, capital typically flows into high-yield assets, including Bitcoin, stocks, and commodities, driving prices up.

Conversely, when M2 contracts, market liquidity tightens, and risk assets often face downward valuation pressure.

In the current market environment, the traditional relationship between liquidity and asset prices may be changing, which poses higher understanding requirements for investors.

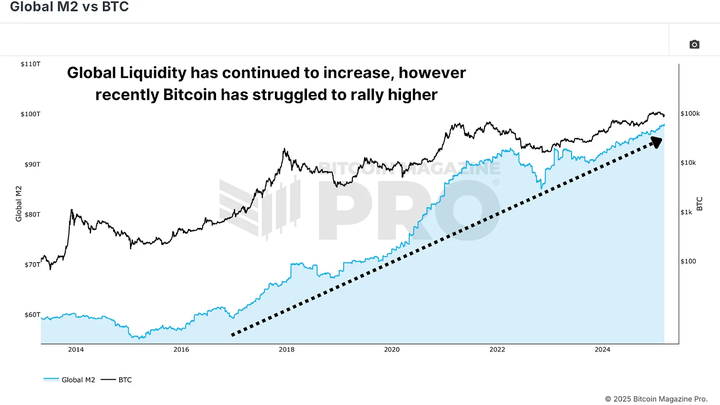

Figure 1: Global liquidity is rising, but Bitcoin prices have recently declinedHistorical Trends: Divergence Between Bitcoin Prices and Global M2 Trends

In the past, Bitcoin prices typically rose with the expansion of global M2 money supply and faced pressure during liquidity contractions. However, in this cycle, we have observed a notable divergence: despite the continuous growth of global M2, Bitcoin's price trend has shown inconsistency.

2. Year-on-Year Changes: A More Accurate Measure of Liquidity

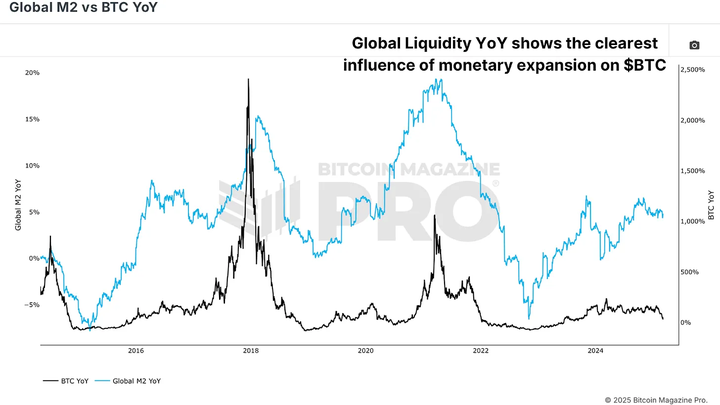

Instead of merely focusing on the absolute value of global M2, a more insightful approach is to analyze its year-on-year change rate (YoY). This indicator reflects the speed of liquidity expansion or contraction, thereby revealing a clearer connection between Bitcoin price performance and liquidity.

When we compare Bitcoin's year-on-year return (YoY Return) with the year-on-year change in global M2 (M2 YoY Change), we find that the correlation between the two significantly strengthens.

Bitcoin's strongest bull market phases often occur during periods of rapid liquidity expansion.

Liquidity contraction typically precedes Bitcoin price corrections or prolonged consolidation.

This finding suggests that investors need to pay more attention to the changes in the growth rate of global liquidity, rather than just the absolute level of liquidity.

Figure 2: The annual change rate of global liquidity can more clearly reveal liquidity cyclesFor example, during the consolidation phase of Bitcoin in early 2025, global M2 steadily grew, but its growth rate tended to stabilize. Only when the M2 expansion rate significantly accelerates can Bitcoin potentially break through new highs.

- The Lagging Effect of Liquidity

Another key observation is that the impact of global liquidity on Bitcoin is not instantaneous. Research shows that Bitcoin prices typically lag behind changes in global liquidity by about 10 weeks.

If we shift the global liquidity indicator forward by 10 weeks, the correlation with Bitcoin's price trend significantly enhances.

Further optimization reveals that the most accurate lag period is about 56 to 60 days, or approximately 2 months.

This lagging effect means that investors need to consider the time delay when analyzing the impact of liquidity on Bitcoin, rather than just focusing on the current liquidity level.

Figure 3: The strongest correlation occurs when liquidity data lags by two months- Bitcoin Outlook

For most of 2025, global liquidity entered a consolidation phase, following a strong expansion at the end of 2024 that propelled Bitcoin to new highs. This liquidity consolidation period coincided with Bitcoin's consolidation and correction to around $80,000.

However, if historical trends continue to hold, the recent recovery in global liquidity is expected to bring about a new round of increases in Bitcoin prices around the end of March.

Figure 4: Liquidity is surging, but Bitcoin may still need a few weeks to truly benefit- Conclusion

Global Liquidity is an important macro indicator for predicting Bitcoin trends. However, rather than relying on static M2 data, a more effective approach is to focus on the rate of change of M2 and understand that Bitcoin prices typically lag by about two months.

As the global economic environment changes and central banks adjust monetary policies, Bitcoin prices will continue to be influenced by liquidity trends. The coming weeks are crucial—if global liquidity continues to accelerate, Bitcoin may experience a significant market movement.

Article link: https://www.hellobtc.com/kp/du/03/5704.html

Source: https://bmpro.substack.com/p/the-global-liquidity-influence-on?utmsource=%2Finbox&utmmedium=reader2

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。