In the index section, you can search directly or search in the market - index.

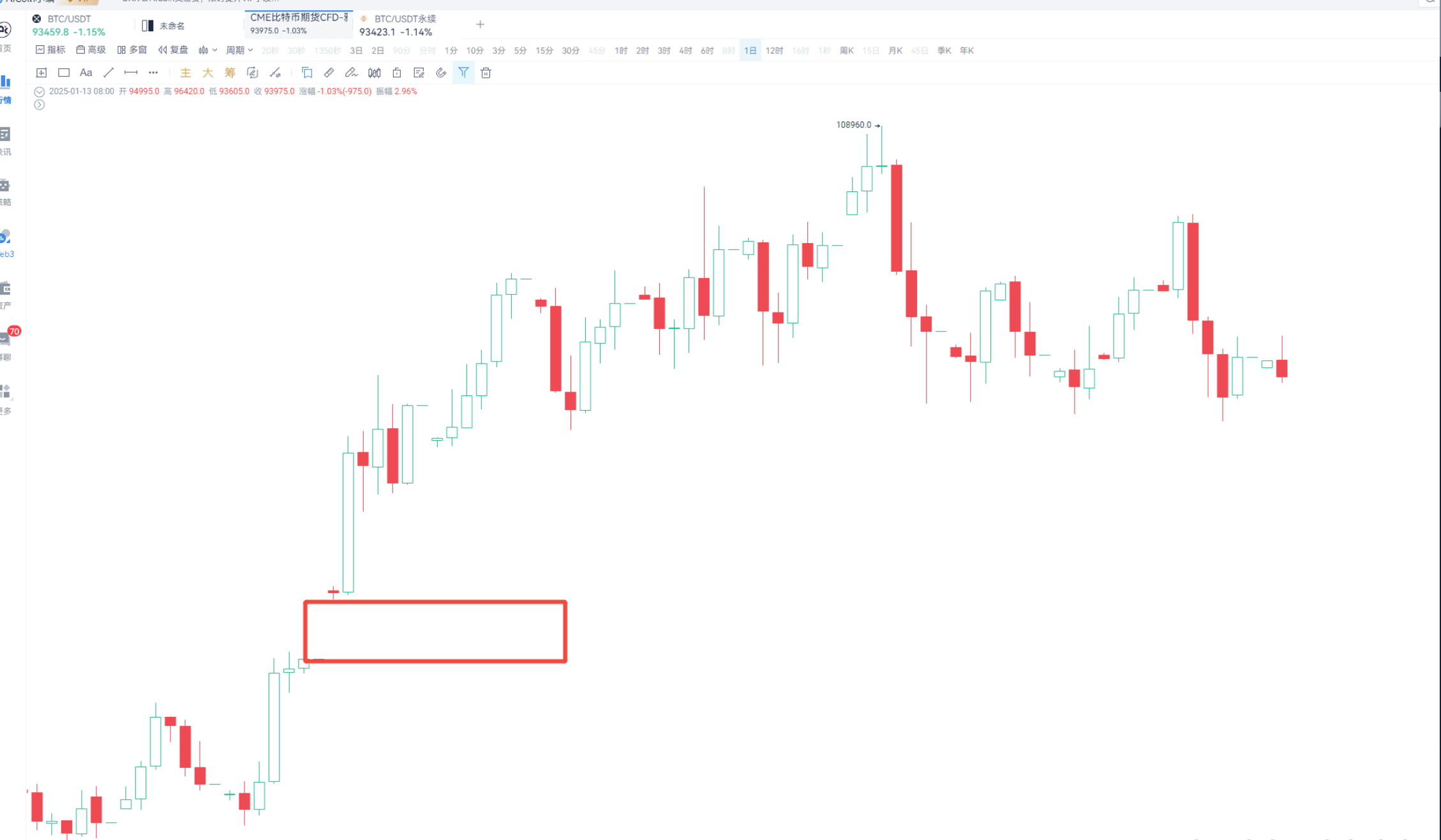

Why do these gaps occur? Mainly because the CME futures market has fixed trading hours every day (UTC 23:00-22:00), while the cryptocurrency market operates 24/7. Therefore, during the CME's off-hours, Bitcoin price fluctuations can easily create these gaps.

CME gaps are most commonly used to determine support and resistance

Gaps formed by upward jumps are support zones; gaps formed by downward jumps are resistance zones.

Next, let's talk about the trading value of CME gaps.

First, the gap range can serve as support and resistance levels. For example, an upward gap may find support when the price retraces to this range; conversely, a downward gap may encounter resistance when the price rebounds to this range. Additionally, gaps have an important characteristic: prices are likely to fill the gap. Filling the gap means that the price will return to the gap range.

Based on this characteristic, we can formulate a high buy low sell strategy. For instance, an upward gap is usually seen as a bullish signal. When the price retraces near the upper edge of the gap and has not completely filled it, if market sentiment remains bullish, one can consider buying. For example, suppose the CME's closing price on Friday is 90,000, and over the weekend, Bitcoin's price rises, causing the CME to open on Monday with a gap to 96,000. Then, a gap is formed between 90,000 and 96,000. If the price retraces to 94,800 but has not completely filled the gap, and market sentiment is bullish, one can buy at 94,800, targeting above $96,000.

My personal suggestion is to use it in conjunction with technical indicators that can determine trends, while also setting proper take-profit and stop-loss levels.

Similarly, downward gaps are usually seen as bearish signals. When the price rebounds near the lower edge of the gap and has not completely filled it, if market sentiment is bearish, one can consider selling. For example, if the CME's closing price on Friday is 90,000, and over the weekend, Bitcoin's price drops, causing the CME to open on Monday with a gap to 84,000, then a downward gap is formed between 90,000 and 84,000. If the price rebounds to 85,200 but has not completely filled the gap, and market sentiment is bearish, one can sell at 85,200, betting that the price will continue to fall.

If the gap is large and not filled in a short time, it is valid for the long term.

When combined with technical analysis, using CME gaps for high buy low sell strategies will have a higher success rate.

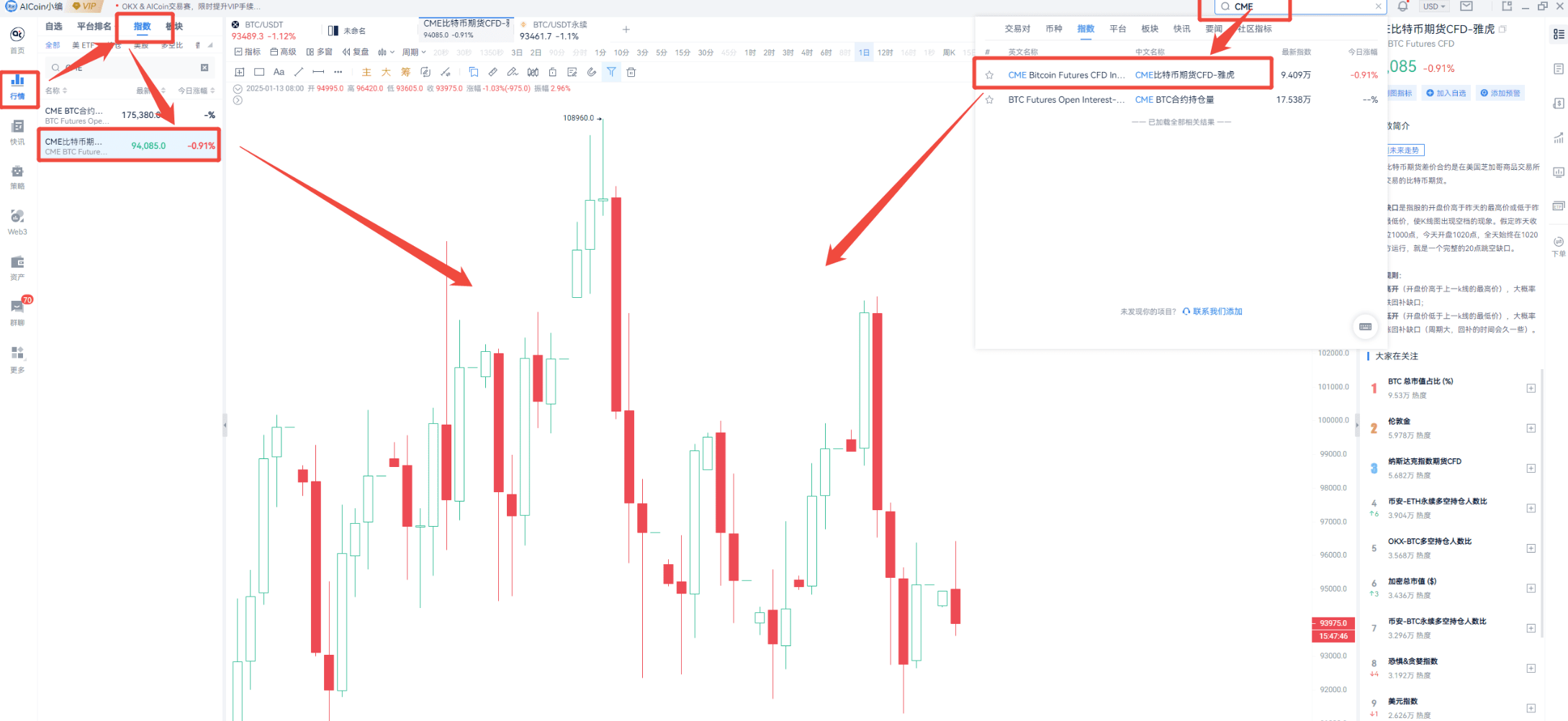

The content shared earlier may be a bit confusing, but that's okay; the CME gap patterns can be monitored using custom indicators.

As shown, the red arrows indicate downward gap patterns, while the green arrows indicate upward gap patterns.

This is a warning indicator because the index data currently does not support displaying custom indicator signals, and the main purpose of identifying CME gaps is actually to recognize opportunities in BTC.

This indicator can display CME gap signals on the BTC candlestick page!

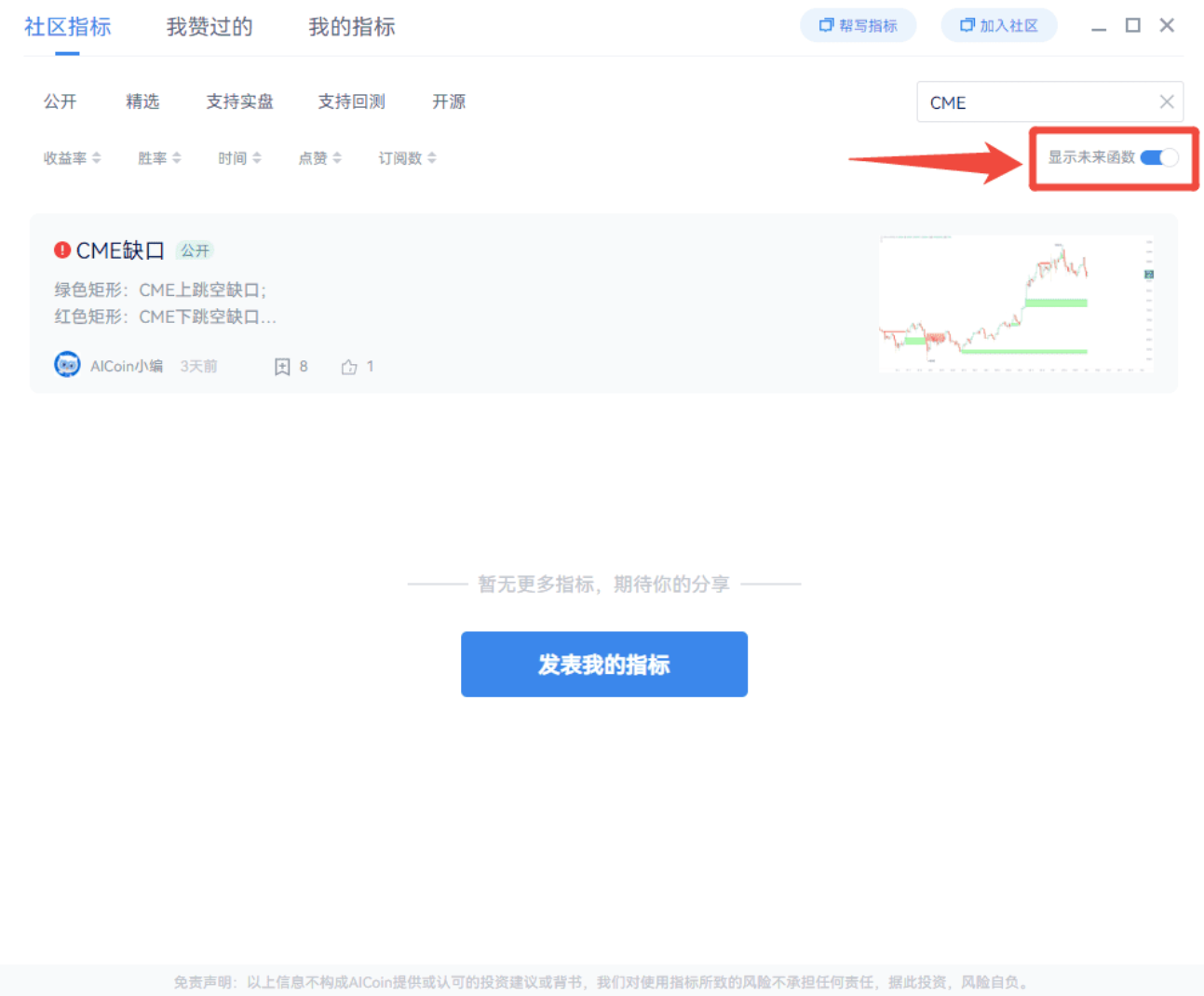

However, simply displaying gap signals is not perfect, as we actually want gaps that have not been filled.

Therefore, there is an advanced version of the gap indicator.

This indicator retrieves data since June 2024 and will plot the gap formation until the gap is filled.

Interested friends can customize the 【CME Gap】 indicator I released, which is a signal display + warning indicator, not including real-time functions: it can be subscribed to in the community indicators https://www.aicoin.com/link/script-share/details?shareHash=8ZNanNA77A45gM9b.

This indicator requires the use of the security function to obtain CME index data, so when searching, you need to enable "Show Future Functions," otherwise, it won't show up!

Of course, relying solely on gap signals is not enough; it is essential to combine them with trend indicators to confirm direction. For example, MACD golden crosses, RSI overbought/oversold conditions, and moving average resistance are all excellent auxiliary tools. Additionally, the size and period of the gap are also very important. Gaps on larger timeframes (such as weekly levels) have a higher probability of being filled, while short-term gaps may close quickly. Finally, always set proper take-profit and stop-loss levels to avoid risks from extreme market conditions.

In summary, CME gaps are a very practical tool, especially when used in conjunction with trend indicators, which can significantly increase the success rate. If you have substantial capital and want to make steady profits, you can try AICoin's arbitrage tools and AI grid tools, which are frequently recommended in our live broadcasts.

Finally, I recommend reading the following articles to help you better understand CME gaps and other trading strategies:

- “TD Indicator Profit Rules”

- “TD, BOLL, and Other Indicator Mixing Strategies”

For more live broadcast insights, please follow AICoin's “AICoin - Leading Data Market, Smart Tools Platform” section, and feel free to download AICoin - Leading Data Market, Smart Tools Platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。