Author: DappRadar

Translated by: Felix, PANews

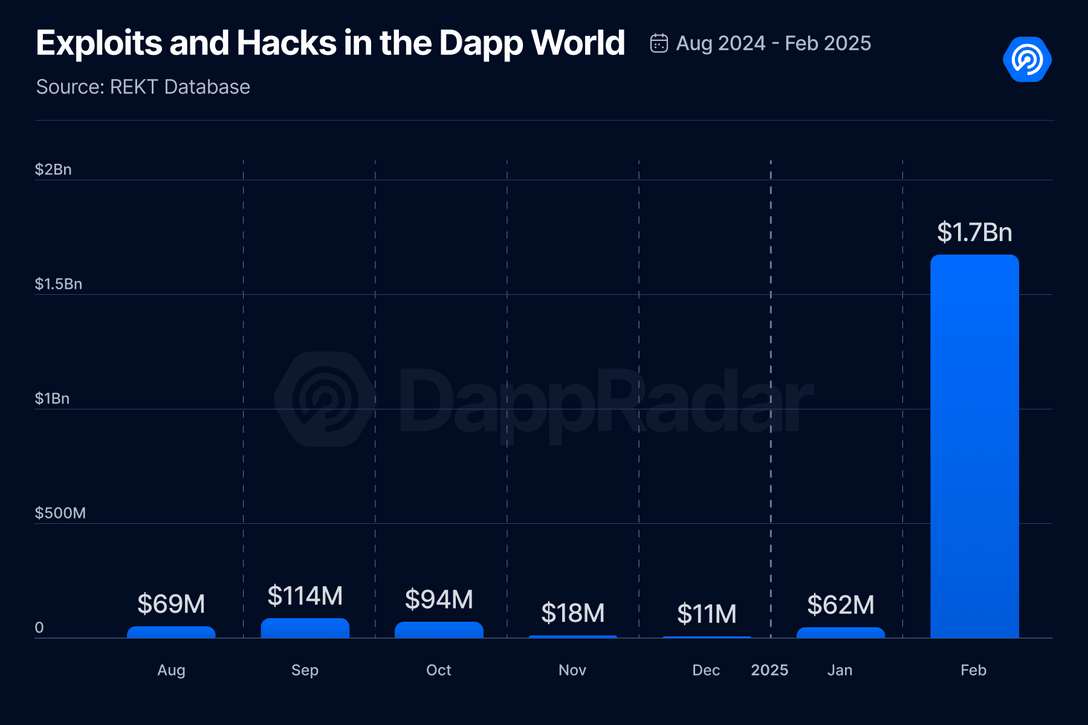

In February, the Web3 trend shifted. Despite a slight overall decline in activity, AI, gaming, and social dapps continued to grow. DeFi faced a sharp decline, and although AI-driven and sports-related NFTs showed strong momentum, overall NFT trading volume decreased. The month also set a record for crypto hacks, highlighting the need for enhanced security measures.

Key Points

- Dapp activity cooled, with daily unique active wallets (dUAW) down 8% to 24 million, but users in AI, social, and NFTs increased.

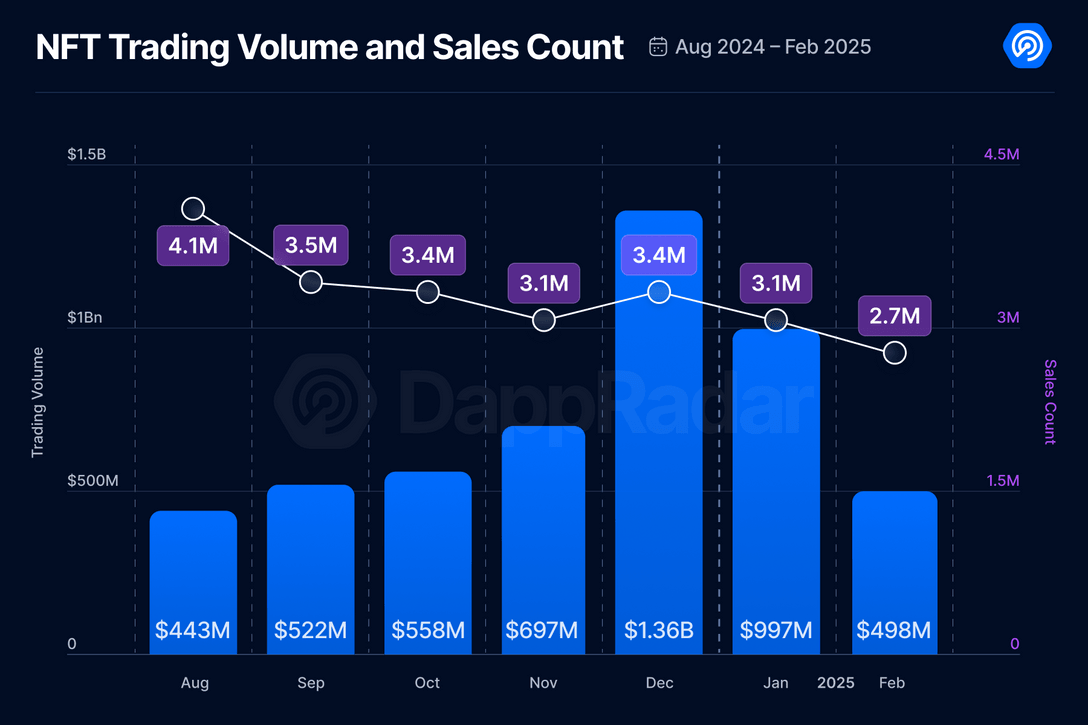

- NFT trading volume plummeted 50% to $498 million, reflecting a broader market slump, but AI-driven and sports-related NFTs showed strong momentum.

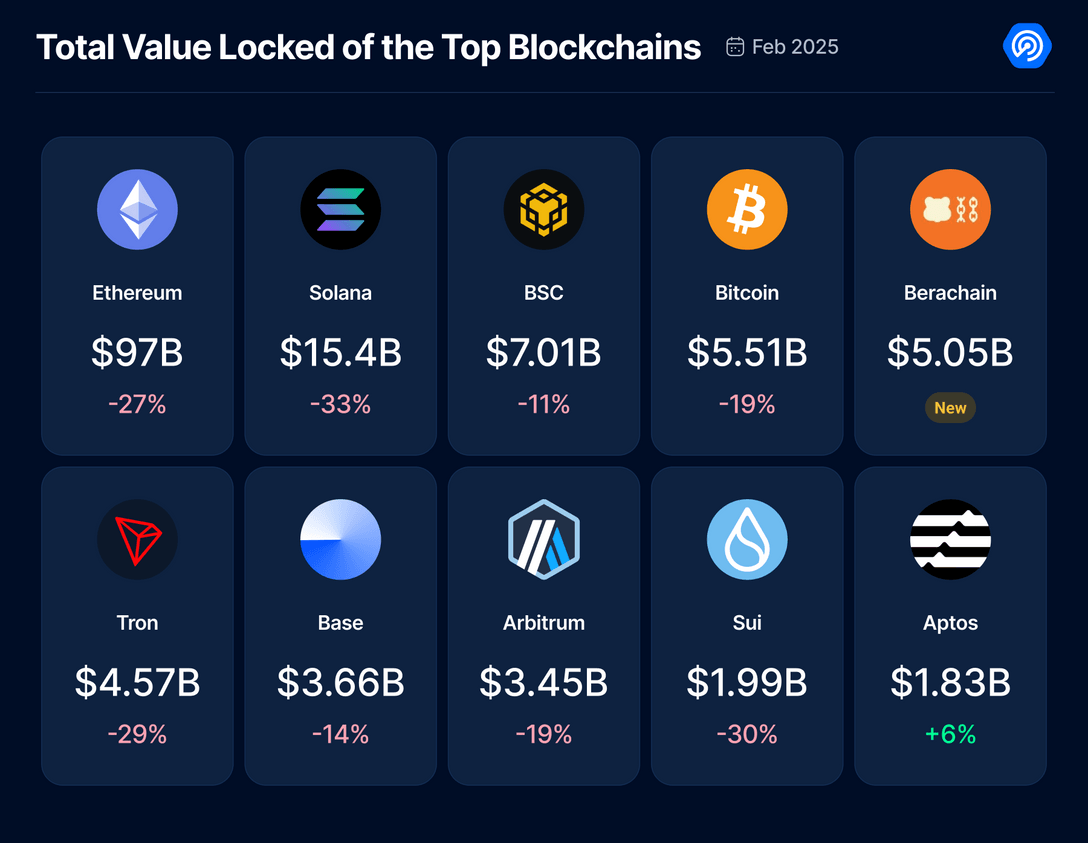

- DeFi experienced a significant decline, with TVL shrinking from $217 billion to $168 billion, led by Ethereum and Solana due to capital outflows and liquidity shifts.

- Berachain became the fastest-growing DeFi chain, with a TVL of $5.05 billion.

- AI-driven dapp adoption surged, with some platforms seeing growth rates exceeding 700%, solidifying AI's dominance as the fastest-growing area in Web3.

- February saw a record amount stolen in crypto hacks, reaching $1.5 billion, primarily due to the Bybit exchange breach ($1.4 billion), marking the largest attack in history.

Web3 Activity Declines, but AI, NFTs, and Social Areas Rise Against the Trend

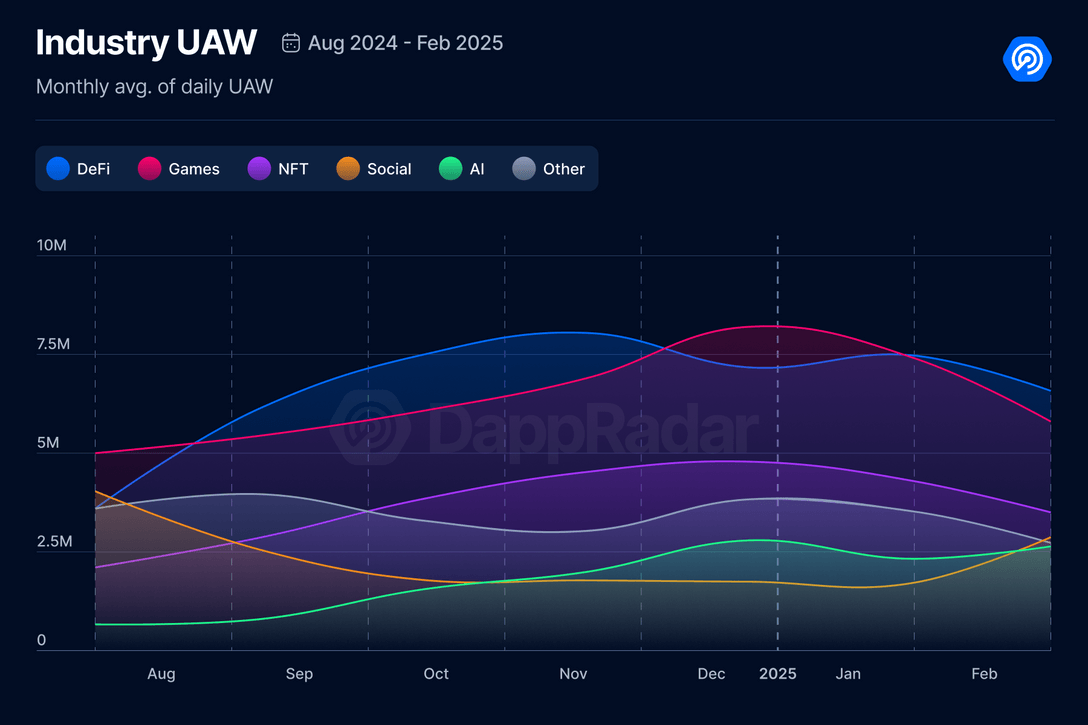

Following a strong surge in January, Dapp activity slightly cooled in February. The estimated total number of daily unique active wallets (dUAW) across all tracked dapps decreased by 8%, stabilizing around 24 million.

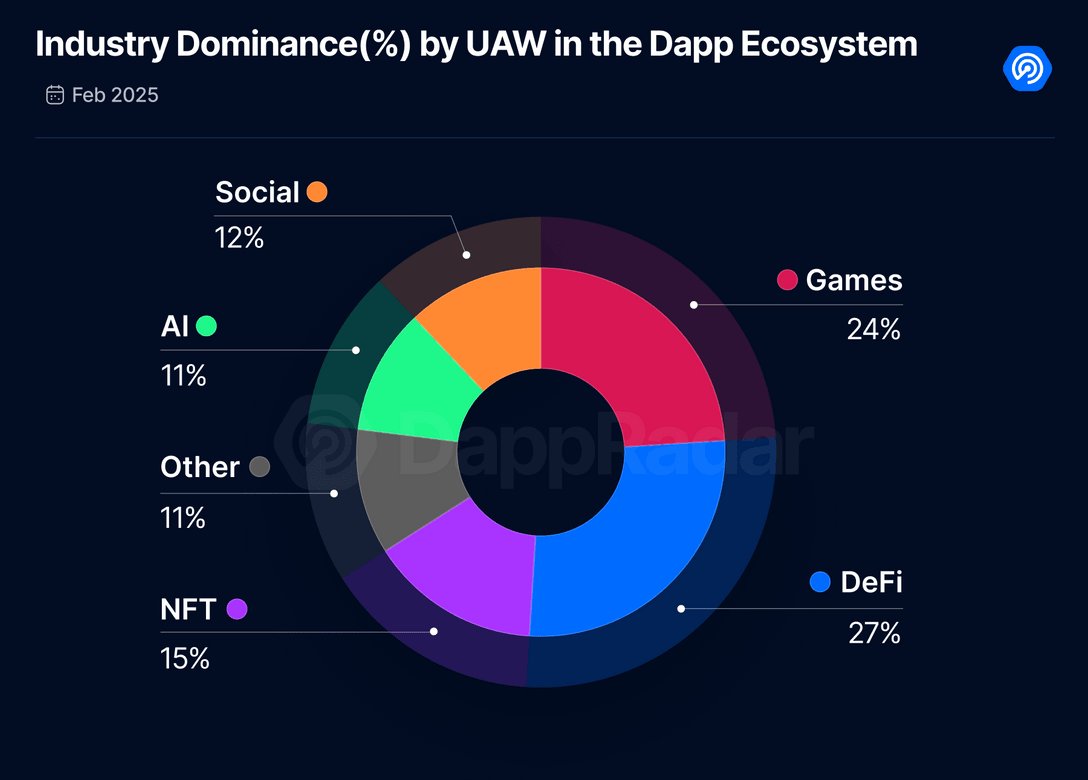

Despite the overall decline in activity, DeFi remained dominant, holding the largest user share. Approximately 27% of active wallets in February were related to DeFi applications, reinforcing its position as the most used dapp category. However, not all sectors followed the downward trend, as social, NFT, and AI all saw growth, indicating a shift in user interest.

Social dapps grew by 9%, with daily unique active wallets (dUAW) reaching 2.8 million, while NFT activity increased by 6%, with 3.5 million users interacting with NFT platforms. AI once again emerged as the fastest-growing area, surging 16%, with dUAW reaching 2.6 million.

From a blockchain perspective, Solana maintained its lead in on-chain activity, boasting the most unique active wallets (UAW) and transaction volume. This sustained engagement reflects the growing appeal of gaming dapps and memecoins continuously launching on the network, positioning it at the center of emerging trends.

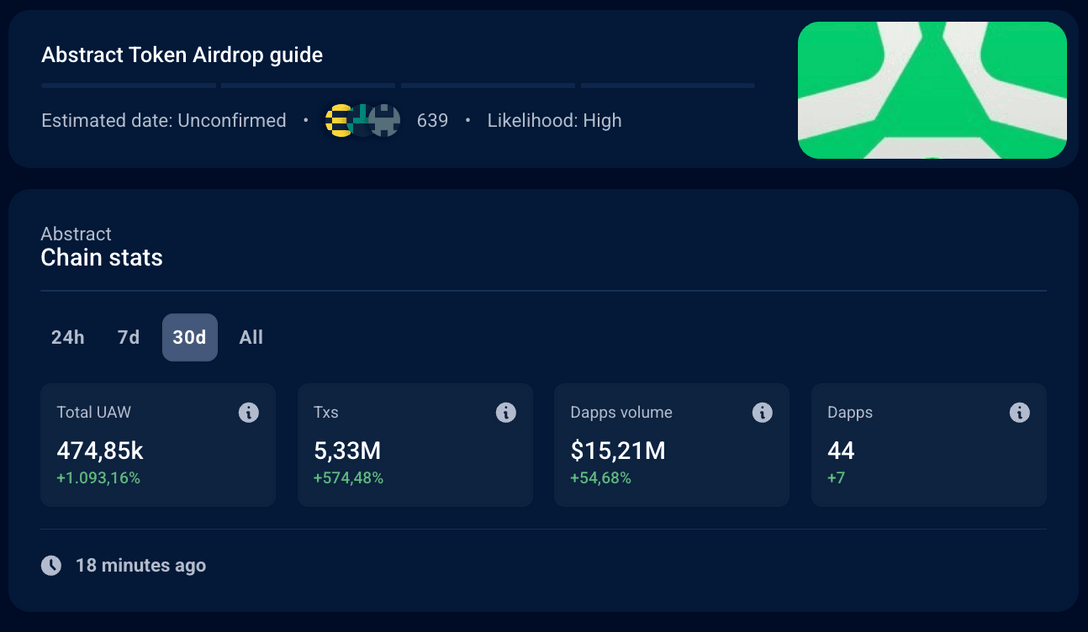

Abstract stood out, with UAW (unique active wallets) growing by 1093%.

Popular dapps: Changes in Web3 Adoption Trends

By analyzing the most active dapps in February, several key trends emerge, highlighting the evolving landscape of Web3.

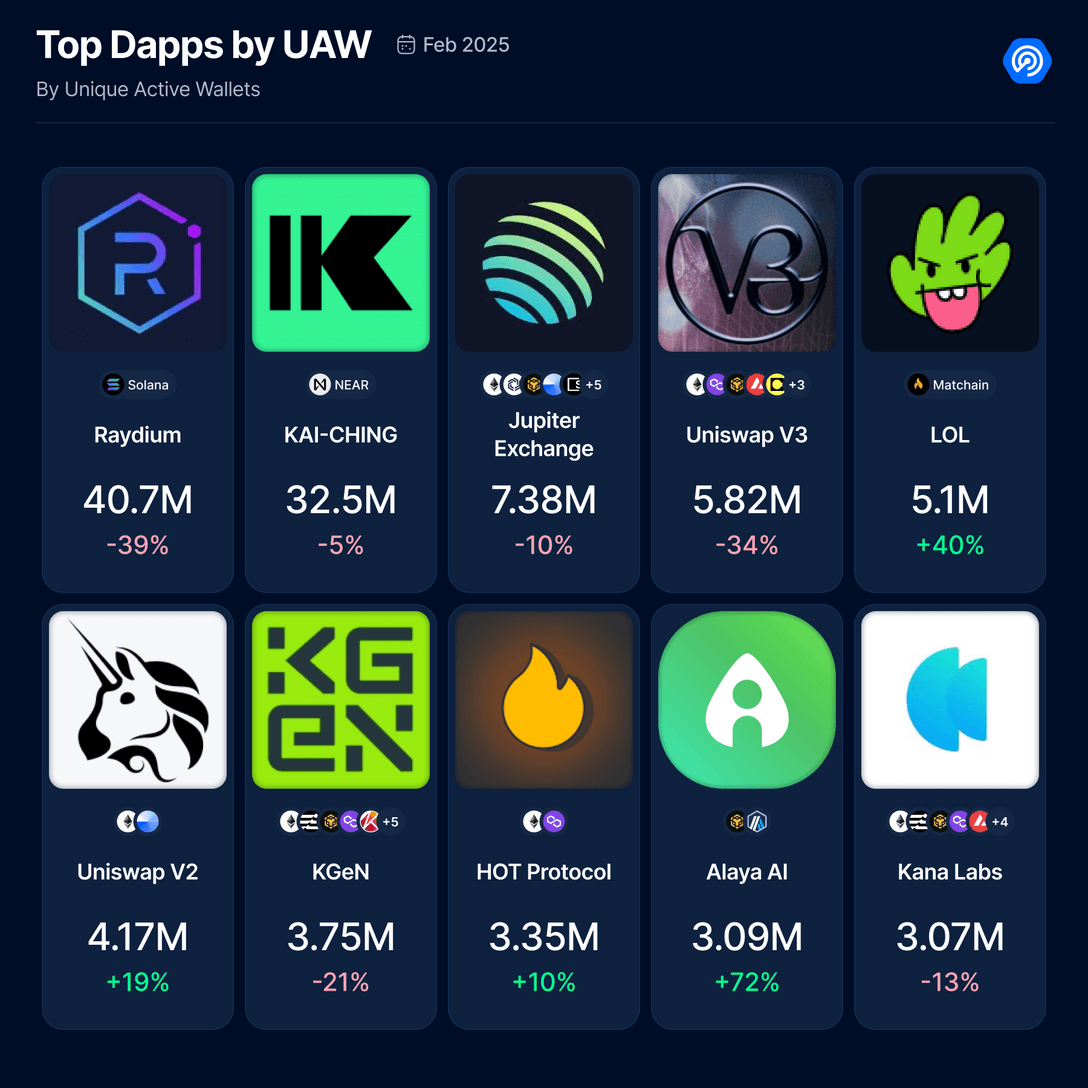

Solana and NEAR continued to dominate in user activity, maintaining their lead despite slight fluctuations. Their dapps consistently attract a large user base, solidifying their status as the preferred platforms for developers and users.

Gaming and AI are becoming the most vibrant sectors, with significant increases in adoption rates. The gaming dapp LOL saw a 40% increase in UAW (unique active wallets), while Alaya AI grew by 72%, highlighting the increasing demand for AI-driven Web3 experiences and interactive gaming platforms.

In DeFi, user behavior indicates a shift in priorities. The usage of Uniswap V3 declined, while activity on Uniswap V2 increased, suggesting that traders are optimizing for cost efficiency in their transactions.

Meanwhile, emerging chains are starting to gain attention, bringing new competition to the dapp industry. For example, Matchain has made a strong entry into the market, with LOL leading on that platform.

As Web3 continues to expand, these trends suggest that future decentralized applications will become more integrated into everyday digital life.

With New Chains Rising, DeFi Faces Market Volatility

In February, the DeFi sector experienced a sharp decline, with TVL plummeting from $217 billion to $168 billion. This drop reflects broader market volatility, capital outflows, and liquidity changes that have impacted both mainstream and emerging DeFi ecosystems.

The Ethereum network is the backbone of DeFi, with its TVL decreasing by 27% to $97 billion, still accounting for over 57% of total liquidity. The decline was primarily due to reduced liquidity in liquid staking protocols, which had previously been a major growth driver. Despite the market downturn, Ethereum's position remains unshakeable.

Solana saw the largest drop, with its TVL falling 33% to $15.4 billion. Following a strong January, this decline may be attributed to profit-taking and liquidity migrating to more stable DeFi options. Reduced user activity on protocols like Jupiter Exchange (UAW down 10%) and Raydium (UAW down 39%) further exacerbated the decline, indicating a decrease in trading volume and liquidity supply.

Meanwhile, Berachain emerged as one of the fastest-growing DeFi ecosystems, with a TVL of $5.05 billion. The rise of this chain is attributed to its liquidity proof model, which attracts users through profitable liquid staking and yield farming incentives. As users seek high returns amid a generally declining market, Berachain positions itself as a key player in the evolving DeFi landscape.

Other notable trends include BNB Chain and Tron, both playing critical roles in stablecoin-based DeFi. With stablecoin trading and lending continuing to support liquidity, BNB Chain's TVL maintained a relatively modest decline of 11%. However, Tron fell by 29%, indicating a decrease in demand for USDT trading and a general decline in on-chain stablecoin settlements. In stark contrast to the overall DeFi slump, Aptos stood out, with its TVL growing by 6% to $1.83 billion.

Fastest-Growing Area: Surge in AI dapps

For AI-driven dapps, February marked a significant milestone, as participation surged across multiple sectors, strengthening the increasingly synergistic relationship between AI and blockchain technology. Users are increasingly exploring social, gaming, and DeFi applications integrated with AI, driving a substantial rise in adoption rates. The number of unique active wallets (UAW) for AI-driven dapps skyrocketed, with some platforms experiencing growth of over 700% in a month, demonstrating the accelerating influence of AI in the decentralized space.

Among the standout applications, LOL became the most used AI dapp, attracting 5.1 million UAW, a 40% increase, thanks to its AI-driven interactive social features on Matchain. Meanwhile, Evermoon and UneMeta achieved growth rates of +988% and +551%, respectively, highlighting the increasing demand for AI-driven gaming and NFT platforms. AI-generated art and creative tools are also gaining popularity, with Fractal Visions seeing a growth rate of 721%, showcasing the rising trend of AI-generated NFTs.

The role of AI in financial and social applications is also expanding. Balance leverages AI to optimize financial decisions and community interactions, with its user base growing by 116% in February. While some platforms saw declines, such as Dmail Network (-22%) and MomoAI (-40%), the overall AI sector remains the fastest-growing category in Web3.

Market Slump Leads to NFT Market Setback, but AI and Sports Series Shine

The downturn in the crypto market has adversely affected the NFT sector. Although NFTs had shown signs of recovery in recent months, their momentum has slowed since the beginning of the year. In February, total NFT trading volume dropped to $498 million, a 50% decrease from the previous month. As expected, the correlation between cryptocurrency prices and NFT valuations remains strong, with market sentiment triggering fluctuations in trading activity.

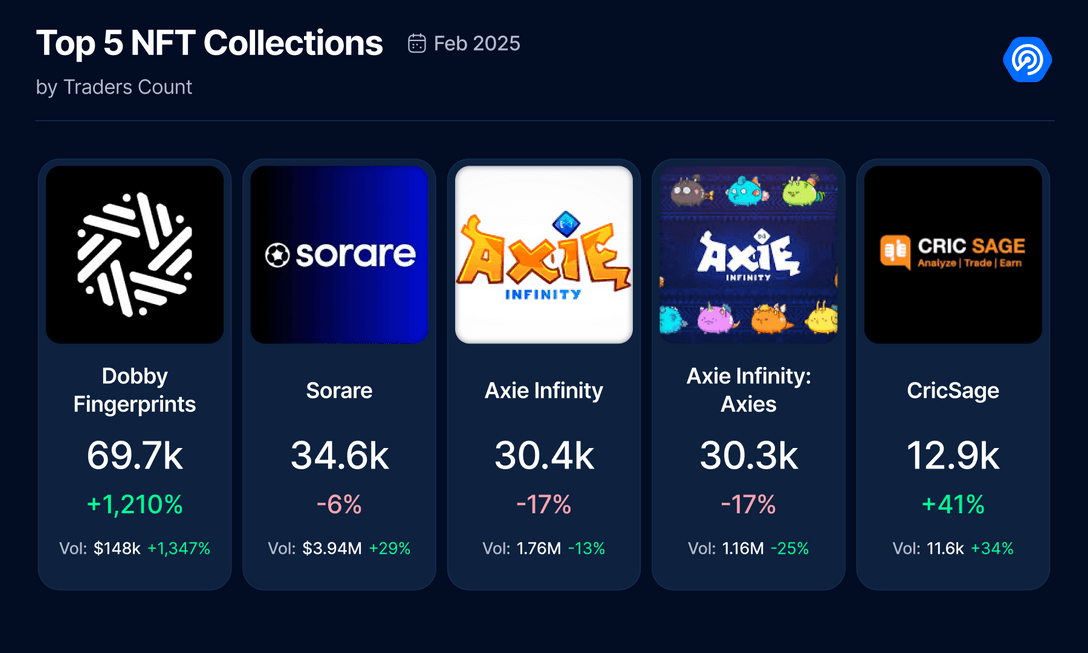

Despite the market downturn, Pudgy Penguins remains one of the most active NFT series. Although its trading volume has decreased, the number of transactions has increased by 25%, indicating strong trading activity at lower prices. Meanwhile, Doodles saw a significant increase in trading volume, thanks to its announcement of launching a new token, DOOD, on Solana.

A new leader in the NFT space is Kaito Genesis, an AI series powered by Kaito AI, a digital asset search engine aimed at democratizing crypto information. The series, launched in December 2024, consists of 1,500 unique NFTs on Ethereum and saw a substantial rise in February, with a floor price reaching a historic high of 7.65 ETH. This surge was primarily driven by strategic partnerships, including collaboration with the Azuki NFT team to integrate AI capabilities into their ecosystem.

Another standout project this month is Courtyard's Tokenized Collectibles, an innovative initiative connecting physical collectibles with digital assets. Developed by Courtyard.io, the platform allows collectors to tokenize real-world items by storing them in a vault operated by Brink and minting them as NFTs on Polygon. This fusion of tangible and digital assets represents a unique development in the NFT space, catering to both traditional collectors and Web3 enthusiasts.

In addition to the broader AI trend dominating Web3, AI is increasingly being integrated into NFT projects, marking a shift towards more dynamic, interactive, and practical digital assets.

Alongside AI, sports-related NFTs have solidified their position as a dominant category. Sorare continues to thrive as a long-time leader in the sports NFT space. However, new competitor CricSage offers a cricket-based opinion trading platform. This interactive approach to sports NFTs is sparking new engagement, particularly within cricket-loving communities.

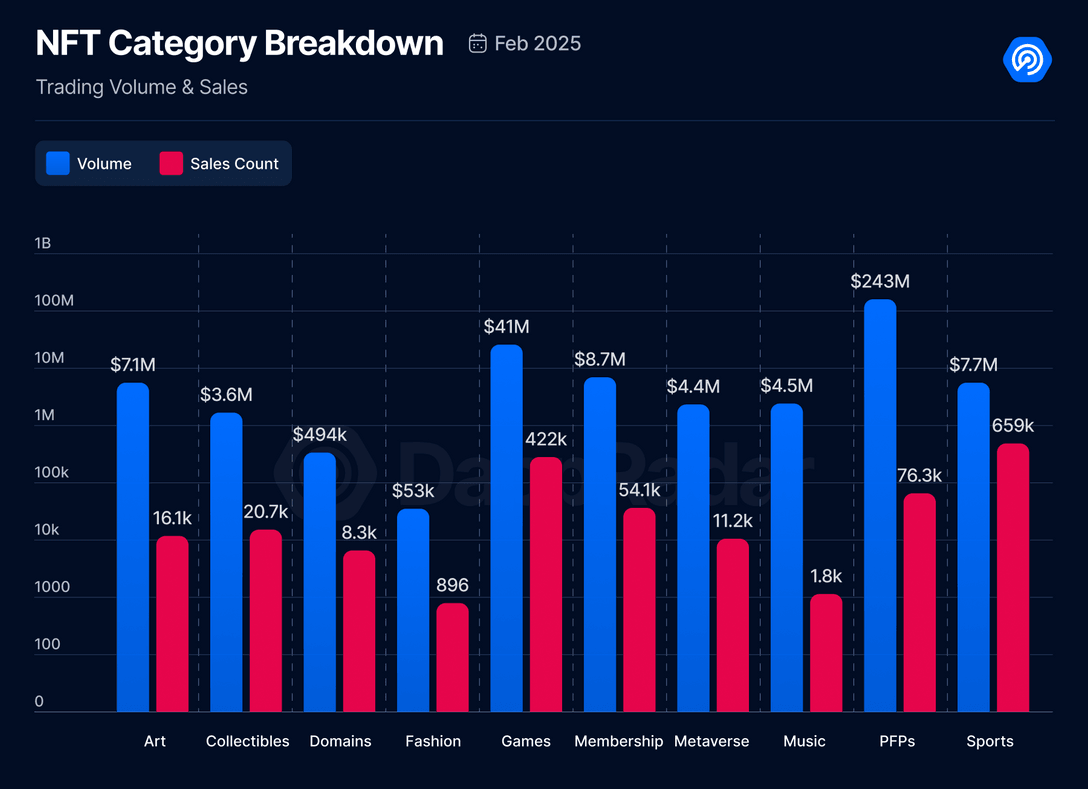

Analyzing the NFT categories with the highest trading volume in February provides deeper insights into market trends:

- Profile Picture (PFP) NFTs led in trading volume, generating $243 million from 76,385 transactions, with 99% of trades occurring on Ethereum.

- Gaming NFTs ranked second, with a trading volume of $41 million and 421,853 assets traded, primarily on ImmutableX (72%).

- Sports NFTs achieved a total of 659,097 transactions and $7.7 million in trading volume, with 98% of activity occurring on Starkware.

The evolving landscape indicates that while speculative trading may fluctuate, NFTs with strong utility, engagement, and real-world applications will drive long-term adoption of Web3.

Record Month for Crypto Hacks

February became one of the most destructive months in crypto security history, with decentralized platforms suffering losses of $1.5 billion. This figure highlights the persistent vulnerabilities in Web3 security.

The primary cause of this record loss was the hacking of the Bybit exchange, where the North Korean Lazarus Group exploited a multi-signature vulnerability to steal approximately $1.4 billion in cryptocurrency. This attack has now surpassed the Ronin Bridge exploit of 2022, becoming the largest DeFi-related theft to date. The breach has sent shockwaves through the entire industry, reigniting concerns over the security of multi-signatures and centralized operational risks within exchanges and DeFi platforms.

In addition to Bybit, several other dapps fell victim to vulnerabilities in February. The zkLend lending protocol lost $9.5 million due to a mathematical error, exposing critical flaws in the protocol's design. Meanwhile, Ionic Money was hacked for $8.6 million in a fake token collateral scam, further highlighting the ongoing risks associated with DeFi lending platforms.

Interestingly, almost all of these hacks stemmed from off-chain vulnerabilities rather than on-chain ones. Attackers exploited social engineering tactics, compromised user interfaces, and malicious developers to gain unauthorized access, further proving that Web3 security extends far beyond smart contract audits. The large-scale attacks in February have once again called for the implementation of comprehensive security measures, urging platforms to prioritize operational security, multi-signature protection, and enhanced UI safeguards beyond traditional smart contract audits.

As the Web3 landscape continues to evolve, these events serve as a warning: even the most advanced blockchain ecosystems are susceptible to complex attacks. Strengthening security protocols, improving private key governance, and conducting broader risk assessments are crucial for safeguarding the future of decentralized finance.

Conclusion

February showcased the dynamic and unpredictable nature of the Web3 landscape. While the industry faces challenges—from the slump in NFT trading to security breaches—innovation continues to bring new opportunities. The rise of AI-driven dapps, the resilience of gaming and DeFi ecosystems, and the emergence of new chains highlight the industry's adaptability and ongoing expansion.

As we move forward, security, sustainability, and user-driven innovation remain paramount. The Web3 space is rapidly evolving, and each challenge presents a lesson that strengthens the foundation of decentralized technology. Whether through enhanced security measures, more intuitive AI integration, or the continued growth of community-driven projects, the decentralized future is being written one block at a time.

Related Reading: BitMart Research Institute VIP Insights | February Crypto Market Review

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。