After the MEME craze subsided, the on-chain transaction volume on the Solana chain plummeted by over 90%; the staking yield of validator nodes at 7%-8% has sucked liquidity like a black hole, and lending protocols are struggling under yield suppression.

Written by: Frank, PANews

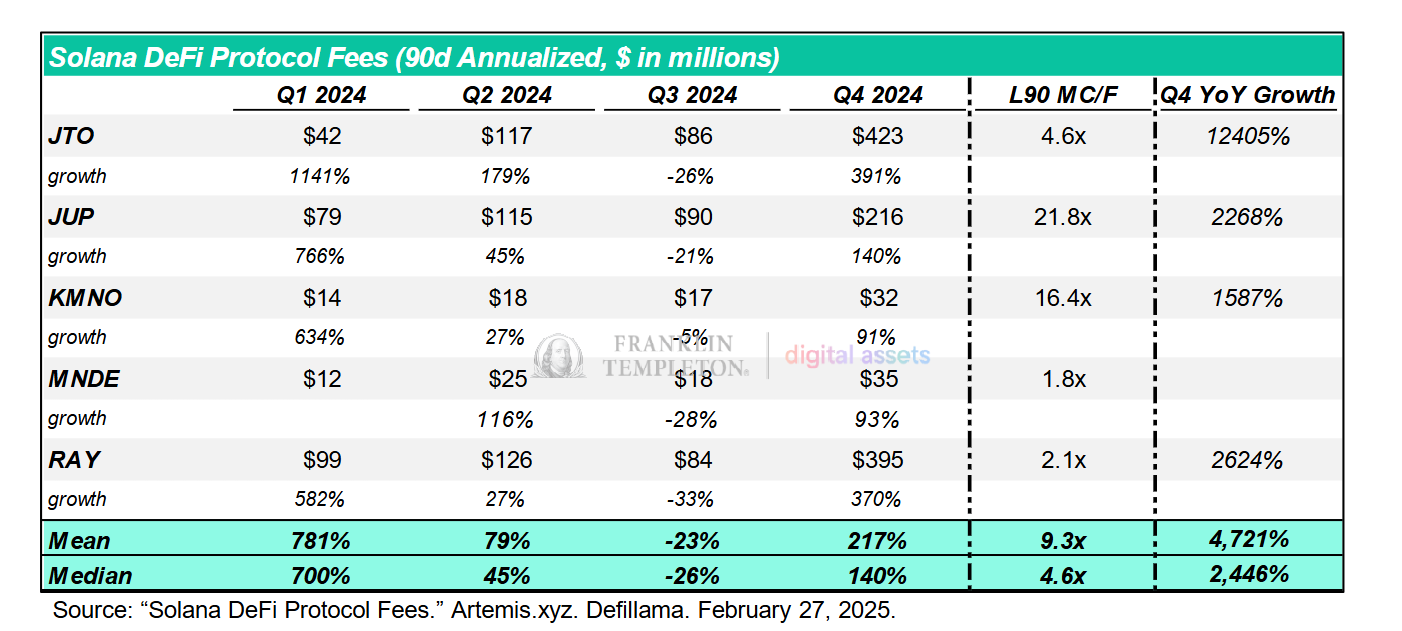

Traditional financial giant Franklin Templeton recently released a survey report on the Solana DeFi ecosystem, which pointed out that although Solana's DeFi business far exceeds Ethereum in terms of transaction volume growth and protocol revenue, its related token market value is severely undervalued. Data shows that the average growth rate of leading DeFi projects on Solana in 2024 is as high as 2446% (compared to only 150% for Ethereum), with a market cap-to-revenue ratio of only 4.6 times (Ethereum's is 18.1 times), making it seem like a value pit.

However, while the market focuses on Solana DEX's impressive achievement of capturing 53% of the total network transaction volume, the "other side" of its ecosystem is turbulent. After the MEME craze faded, on-chain transaction volume plummeted by over 90%; the staking yield of validator nodes at 7%-8% has drained liquidity, and lending protocols are struggling under yield suppression. Behind this value reassessment game triggered by data paradoxes, Solana's DeFi ecosystem stands at a critical crossroads—should it continue to play the role of "crypto Nasdaq," or risk transforming into an all-encompassing financial protocol arena? The upcoming vote on the SIMD-0228 inflation reduction proposal may determine the ultimate direction of this ecological revolution.

Solana DEX Transaction Volume Accounts for Half of the Network

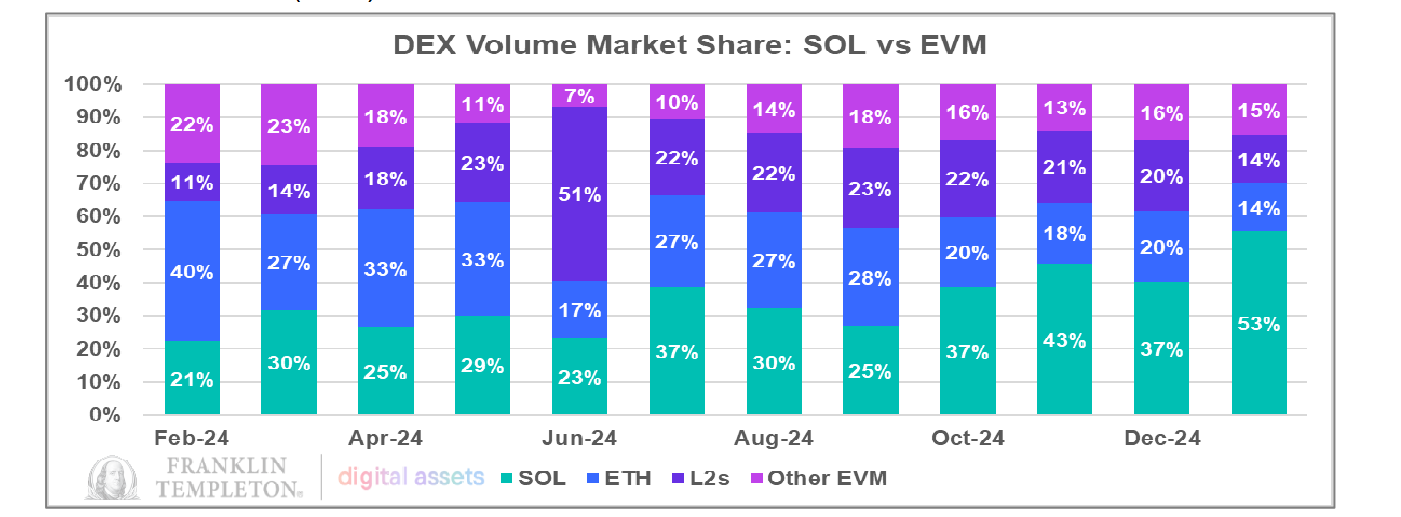

In Franklin Templeton's report, the main argument revolves around Solana's DEX market share. In fact, Solana's DEX transaction volume has indeed achieved remarkable results over the past year.

In January, Solana's DEX transaction volume surpassed that of Ethereum's DEX and the total transaction volume of all DEXs based on the Ethereum Virtual Machine (EVM), accounting for 53% of the total network.

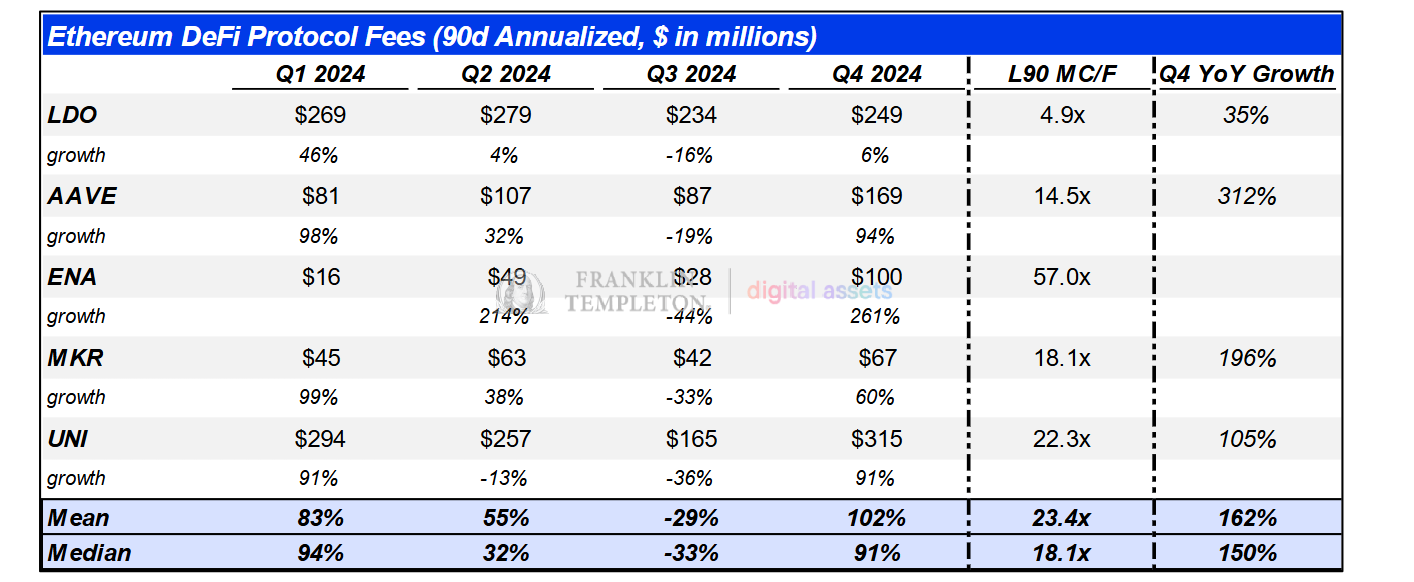

By comparing the top DeFi projects on Solana and Ethereum, it can be seen that the average growth rate of Solana's top five DeFi projects in 2024 reached 2446%, while Ethereum's average growth was only 150%. In terms of market cap-to-revenue ratio, Ethereum's average ratio is 18.1 times, while Solana's is 4.6 times. From this perspective, Solana's DeFi projects indeed have better advantages in terms of revenue and transaction volume. However, whether this indicates that Solana's DeFi is undervalued and whether the upcoming DeFi development can become the main theme still requires further understanding of the ecological characteristics of both.

Choosing Ecological Positioning: Trading Center or Universal Bank?

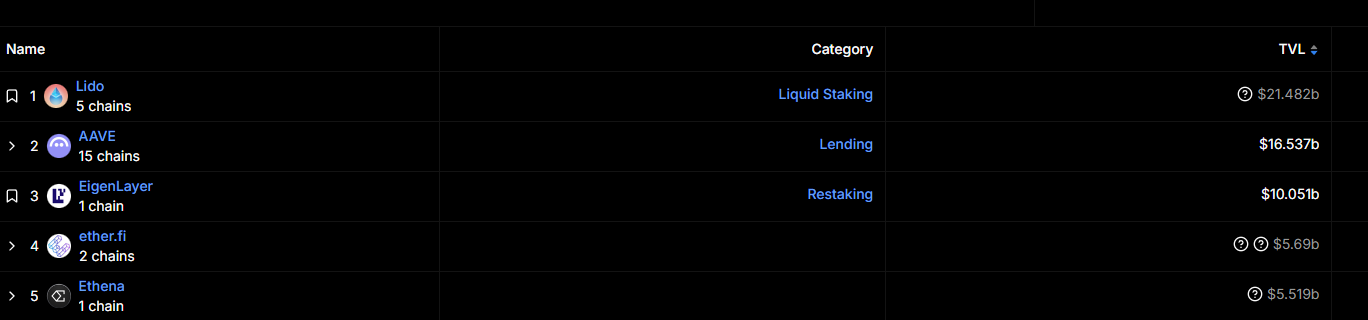

In comparing the DeFi protocols of Ethereum and Solana, it can be observed that the top five DeFi projects on Ethereum are almost all focused on staking and lending.

On the Solana chain, the top five projects by TVL are mostly aggregators or DEXs. Clearly, trading is the main theme on Solana.

From this perspective, if both are compared to financial institutions, Ethereum resembles a bank, while Solana resembles a securities exchange. One primarily engages in credit business, while the other focuses on trading, indicating a significant difference in positioning.

However, currently, both seem to be facing considerable issues. Ethereum, which focuses on credit, has encountered problems in maintaining value. Meanwhile, Solana, which primarily engages in trading, is clearly experiencing a trend of market liquidity contraction.

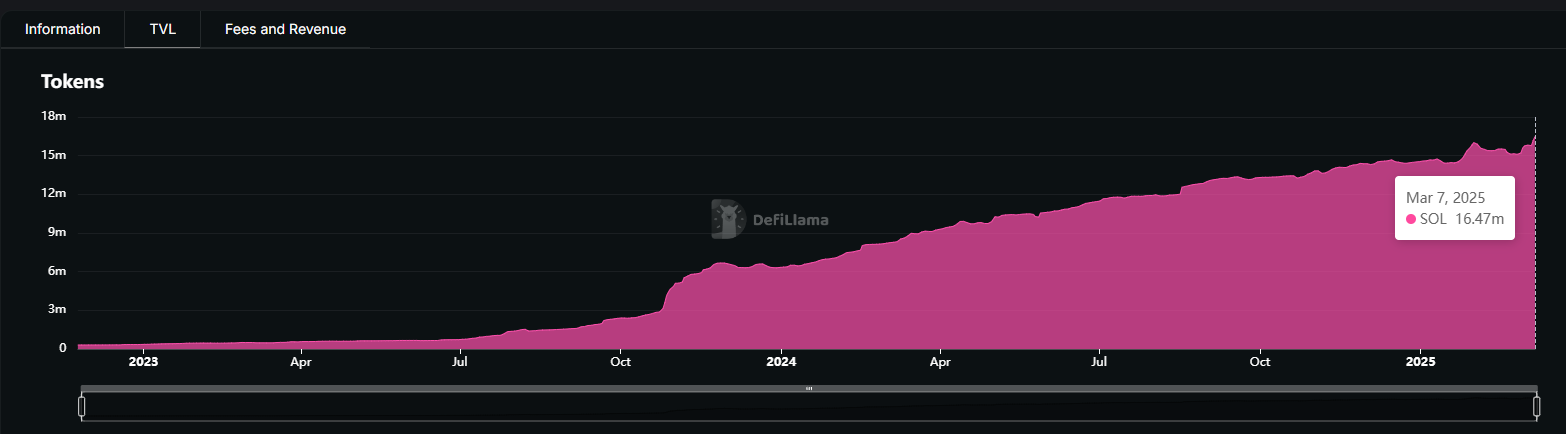

In light of the imbalance in ecological positioning, it may be a good choice for Solana to enhance its credit-related business. However, this transformation is fraught with challenges. The TVL on the Solana chain has dropped by 40% since January, but this decline is mainly due to the drop in SOL's price; in terms of the number of SOL, the change in on-chain TVL is not significant.

Since the issuance of personal tokens by Trump, the DEX transaction volume on the Solana chain has been on a downward trend. On January 18, the DEX transaction volume reached a historical high of $35 billion, but by March 7, it had fallen to $2 billion.

After the MEME Craze, Capital Competes for Staking Yields

Conversely, with the decline in SOL's price and the cooling of MEME coins, the number of tokens staked on-chain has actually been on the rise recently. Taking Jito, the top-ranked project by TVL, as an example, the amount of SOL participating in staking has consistently increased, with the total staked amount now reaching 16.47 million tokens, and it has been in a state of token inflow recently. Since January 1, 2025, the net inflow of staked SOL has increased by 12% year-on-year. Clearly, this growth in TVL mainly comes from token staking rather than active trading.

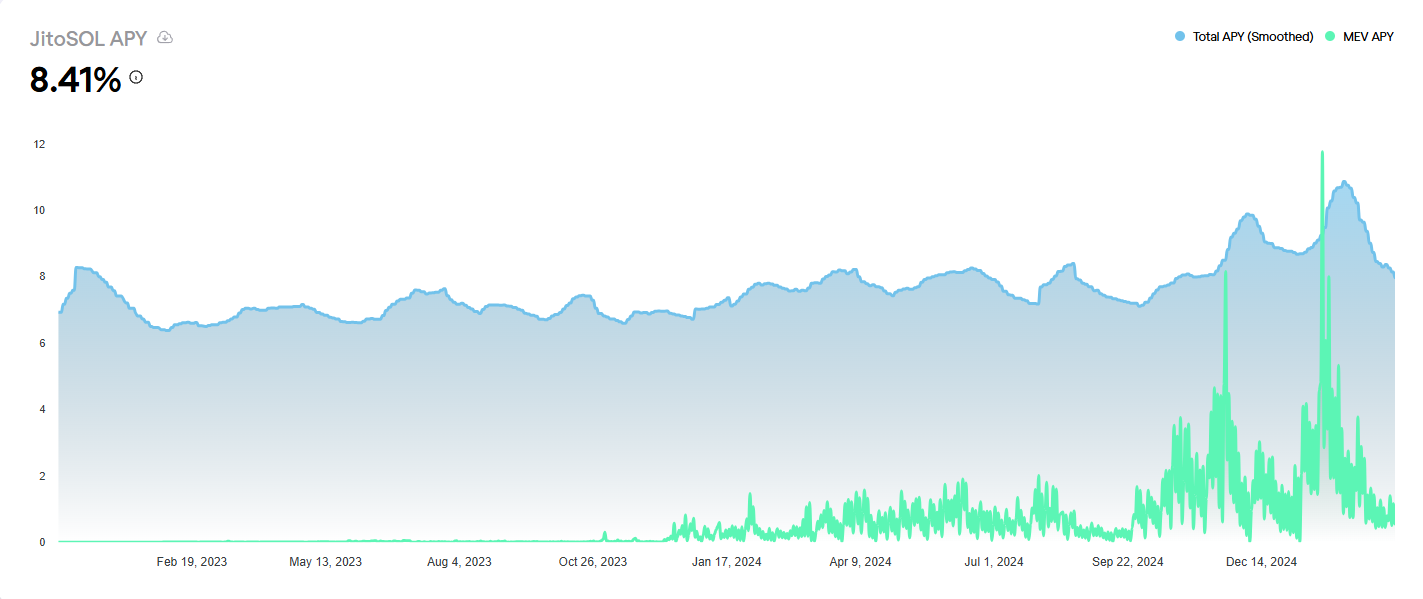

However, this asset growth does not seem to flow into lending protocols but rather continues to be directed towards the staking yields of validators. Even though the staking yields of validators are on the decline, they still attract a large portion of SOL token TVL.

According to data from Jito, since February, the APY of JitoSOL has been on a downward trend, along with a decline in the total number of bundled transactions and priority fee income across the network. As of March 7, the APY of JitoSOL has dropped to 8.41%. However, compared to other categories of staking yields on Kamino, it is still at least 3 percentage points higher.

8% Validator Yields Suppress DeFi Liquidity, SIMD-0228 Proposal Aims to Unravel the Deadlock

In fact, the staking yield of nodes on the Solana chain has generally remained around 7%-8%. This is higher than the yields typically offered by other types of DeFi protocols. This is why a large amount of funds on the Solana chain choose to stake with various validator nodes rather than invest in lending protocols like Kamino.

Recently, the Solana chain launched the SIMD-0228 proposal, attempting to reduce the annual issuance of SOL by 80% through dynamic adjustments to the inflation rate, while also adjusting the staking yield downwards to encourage funds to flow into other DeFi. (Related reading: Solana's Inflation Revolution: SIMD-0228 Proposal Sparks Community Controversy, Hidden "Death Spiral" Risks Behind 80% Issuance Reduction)

According to the simulation results of the new proposal, if the staking amount remains the same, the on-chain staking yield will drop to 1.41%, a decrease of 80%. Therefore, the vast majority of funds may withdraw from validator staking and choose other DeFi yield products.

However, there is a logical issue here: the best way to promote funds flowing into DeFi should be to increase the yields of other DeFi products, rather than lowering the yields of existing staking products. It should be noted that once funds are withdrawn from validator nodes, they do not necessarily have to remain within the Solana ecosystem; given the profit-seeking nature of capital, it is more likely that they will seek higher-yield products.

By comparing several of the largest TVL products on the ETH chain, such as AAVE and Lido, it can be seen that the annualized yields of mainstream assets generally range from 1.5% to 3.7%. In contrast, Kamino on the Solana chain still has a certain yield advantage.

However, for large amounts of capital, another important consideration is the depth of liquidity. Currently, Ethereum remains the largest reservoir of funds among all public chains. As of March 7, Ethereum's TVL share is still 52%, occupying half of the market. Solana's TVL share is approximately 7.53%. The project with the highest TVL on the Solana chain is Jito, with a TVL of about $2.32 billion, which ranks only 13th in the Ethereum ecosystem.

At present, Solana's DeFi still needs to rely on high yields. The SVM and re-staking platform Solayer recently announced the launch of native SOL staking, with direct yields reaching around 12%. However, according to PANews observations, this high yield is still obtained through a combination of validator staking methods.

If the SIMD-0228 proposal is implemented, DeFi protocols that rely on validator staking yields may face the "run risk" of capital withdrawal. After all, these major high-yield products are primarily achieved through validator staking.

In the evolution of Solana's DeFi ecosystem, although the brief peak of DEX transaction volume confirms the explosive power of its technical architecture, the negative coupling relationship between staking yields and DeFi development hangs over the ecosystem like the sword of Damocles. The SIMD-0228 proposal attempts to cut this deadlock, but the forced yield reset may trigger a more complex on-chain butterfly effect than expected. Lily Liu, chair of the Solana Foundation, expressed concerns about this proposal on the X platform, stating that "the 0228 proposal is too much of a half-baked product," which could lead to more uncertainty.

From the perspective of ecological strategic depth, Solana needs to build not only a re-anchoring of the yield curve but also a revolution in the underlying value capture mechanism. When validator staking transforms from a yield fortress into a liquidity hub, or when lending protocols can create composite yield models that go beyond simple staking, Solana may truly unlock the value closed loop of DeFi. After all, true ecological prosperity does not lie in the numerical accumulation of funds in staking pools, but in the perpetual cycle of capital formed between lending, derivatives, and combination strategies—this may be the "Goldbach conjecture" that the "Ethereum killers" need to collectively solve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。