The cryptocurrency industry is facing a crisis of trust due to Binance's recent listing of problematic tokens GoPlus (GPS) and RedStone (RED).

Written by: Alvis

In the crypto world of 2025, it was supposed to be a utopia of technological innovation, but it has instead turned into a bloody history of retail investors. As the industry leader, Binance's recent "token quality drama" can be described as a magical realism blockbuster—just after being stabbed in the back by the airdrop of RedStone (RED), it was then slapped in the face by the violent sell-off of GoPlus (GPS).

Today, let's delve into the absurd script behind this drama and see how the exchange's "carefully selected" label has turned into "serious issues."

Prologue: The Collapse of the Safety Myth—GoPlus's 72-Hour Death Spiral

On March 4, 2025, Binance grandly listed GoPlus Security (GPS), claiming to be the "leader in Web3 security." The project team is like the Avengers of the blockchain world: former head of 360 Security Browser, technical director of Ant Group, and co-founder of Delphy prediction market. Just looking at their resumes, one might think they are building the Noah's Ark of the blockchain world.

The moment the token was listed, the price surged from $0.13 to $0.20, and retail investors seemed to see a new hundredfold token beckoning them. But the following plot was even more thrilling than "Squid Game"—the price plummeted 75% in free fall within 72 hours, hitting a low of $0.05. This was not a token listing; it was clearly a high-altitude parachute jump without a parachute for retail investors.

Act One: The Bloody Harvest Behind the Data

After Binance announced the listing of GPS, the price shot up from $0.13 to $0.20, triggering many short positions, and then the price began a cliff-like decline after reaching $0.20, dropping to a low of $0.05 within 72 hours, a decrease of 75%. Many questioned insider trading, as the contract open interest revealed that the main force was using news to pump and dump for harvesting.

Subsequently, the GoPlus project team released a statement claiming that the team was not aware of the listing news in advance.

Ironically, GPS, which emphasizes "security," had no effective price protection mechanism for its own token, and the community criticized it as "the most dangerous trap in the security sector."

Act Two: Insider Doubts and Market Maker's Dark War

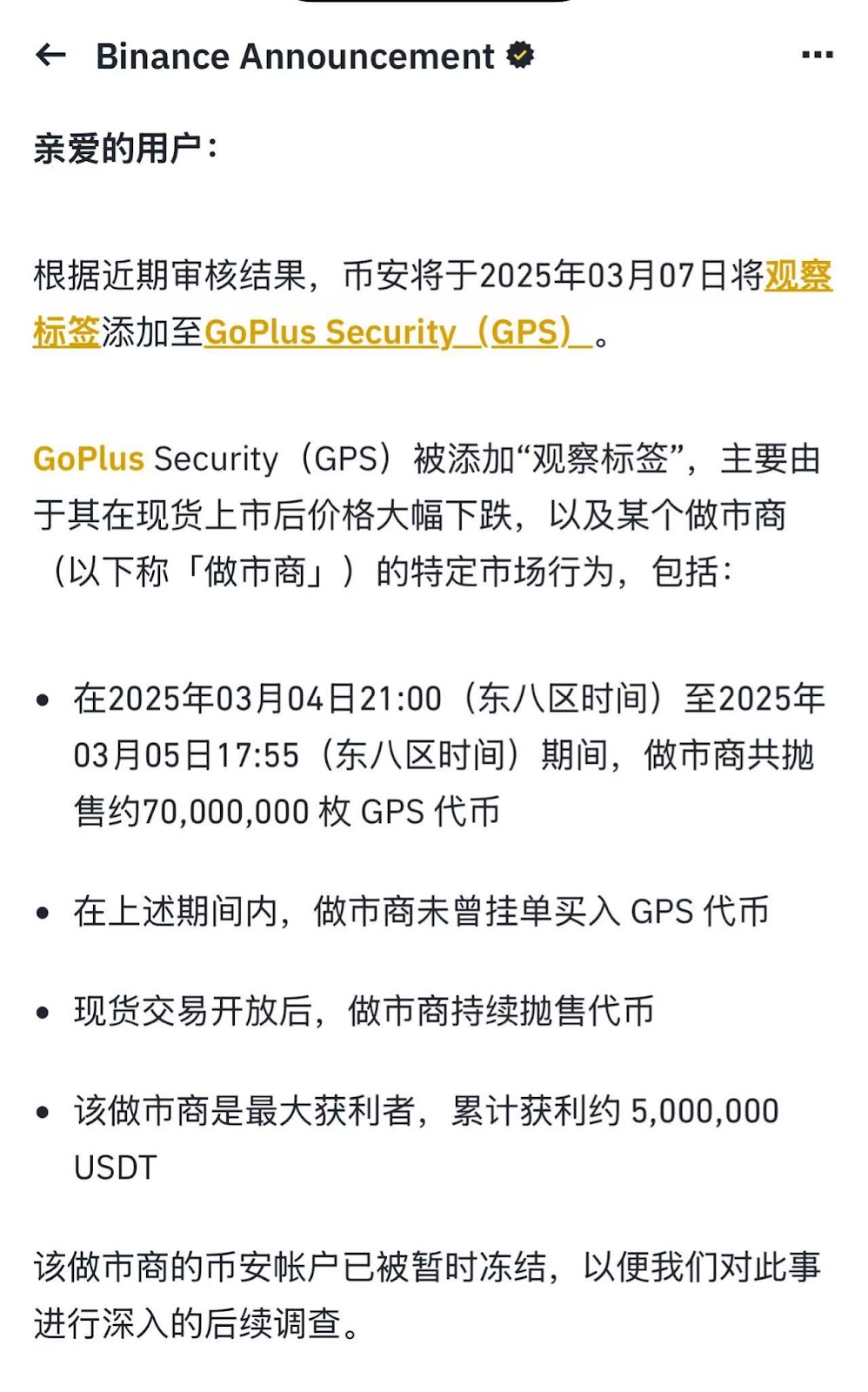

Binance then announced that the crash was due to "malicious selling by market makers." After spot trading was opened, a certain market maker sold approximately 70 million GPS tokens, making a profit of about 5 million USDT, and that market maker's account has now been frozen.

After Binance's announcement, GPS briefly dropped to $0.042 before starting a wild surge, reaching a high of $0.068, currently reported at $0.061.

However, trading data revealed deeper contradictions:

The fatal coincidence of the timeline: On March 7 at 17:00, Binance announced that GPS would be placed under observation (negative news), but at 16:55, the open interest for short positions surged by 82% (from $5.3 million to $9.6 million), accurately predicting a 15% crash just 15 minutes later. This kind of "foreknowledge" operation was questioned as insiders using information asymmetry for arbitrage.

Liquidity manipulation: When GPS was launched, the liquidity pool depth was 30% below expectations, and market makers created a false prosperity through "wash trading" before dumping. This method is reminiscent of the "Meme coin harvesting incident" on Binance in 2024.

Act Three: The Collapse of Trust and Ecological Backlash

The community discovered that the GPS crash was not an isolated incident. Among the projects listed by Binance in the past six months, 68% of tokens saw a drop of over 40% in the first week, and the "high listing fees" (rumored to exceed $5 million) have given rise to a gray industrial chain of "paid listing - pump - dump."

A user on platform X bluntly stated: "Binance's careful selection has become a tool for VC exits, with retail investors becoming the 'fuel' for each round of buying."

Interlude: RedStone Airdrop—A Carefully Designed "PUA Game"

As the aftermath of GoPlus was still unfolding, Binance's listing of RedStone (RED) on March 6 reignited community anger. This project, claiming to be the "leader in multi-chain oracles," triggered an epic trust crisis due to sudden changes in airdrop rules.

Climax: From Liver Emperor to Abandoned Child

RedStone designed a three-season task on the Zealy platform, requiring users to complete complex operations such as "reading the white paper," "creating content," and "inviting friends," with point rules suggesting "effort = airdrop." However, when the airdrop opened on March 5, 98% of participants found their qualifications filtered out by the "Discord special role" threshold, with only 4,386 actual beneficiary addresses. Community statistics showed that a user completed 327 tasks but received nothing due to not obtaining the "Vein Master" title, while a certain KOL received 50,000 RED (worth $45,000) just for attending an offline meeting.

The Absurd K-Line of RED

Even more puzzling was that this time, RED introduced a "first three days of price limit" mechanism—if the price increased by 20%, trading would be suspended for 24 hours before reopening. This design seemed to take the market back to the early days of the A-share market 20 years ago, appearing quite outdated.

More critically, can this strategy really stabilize the market? After three days of lifting the ban, if market sentiment is high, won't the price be pushed to an unreachable height? Moreover, tokens are not stocks; besides CEX trading, the on-chain market is also active. Other CEXs will not sit idly by—if one platform suspends trading, others can still trade normally, which not only weakens its own competitiveness but also hands over topics, traffic, and user funds to competitors.

Binance's Awkward Role

Faced with the community's clamor to "delist scam projects," Binance first suspended RED trading but resumed it 24 hours later. This "lift high and put down lightly" attitude was interpreted as "wanting to maintain reputation while unwilling to give up listing fee revenue." More intriguingly, after RED was listed, the price plummeted from $1.46 to $0.89, mirroring the script of GPS—both accompanied by liquidity crises triggered by market makers withdrawing orders.

As of the time of writing, RED has fallen to $0.66.

Deep Game: Binance's "Selection Dilemma" and the Paradox of Crypto Governance

These two incidents expose three structural contradictions within the Binance ecosystem:

1. Failure of the Review Mechanism: From Technological Worship to Profit First

Binance once prided itself on "anonymous voting by the listing committee" and "seven-dimensional model for technical review," but the GPS case shows:

- Data bubble: The project team claimed "10,000 project integrations," but most were unimplemented API trials;

- Overvaluation: GPS's private placement round was valued at $230 million, while similar project CertiK was valued at only $110 million at the same time;

- Defects in token economics: Of the total supply of 10 billion GPS, over 40% is held by the team and early investors, creating natural selling pressure.

These loopholes were not scrutinized, but rather amplified by the narrative of being the "leader in the security sector." As CZ once admitted: "We cannot stop project teams from breaking promises after listing."

2. Market Maker Black Box: The Double-Edged Sword of Liquidity

Binance relies on market makers to provide liquidity but lacks constraints on their behavior. In the GPS incident, market makers harvested retail investors by "first pumping to attract follow-up buying, then dumping." This is no different from "mouse warehouses" in traditional finance. Binance's only response to the involved market makers was to "freeze accounts," without establishing a compensation mechanism, exposing the fragility of its risk control system.

3. The Entropy Increase Effect of Community Trust

The essence of the RedStone airdrop controversy is the collision between the ideals and realities of Web3 governance. The project team demands community contributions in the name of "decentralization," yet allocates benefits using centralized rules. When users discover that "effort is not as good as connections," consensus quickly collapses. This model of "harvesting with DAO narratives while allocating with CEX logic" is destroying the community ecosystem that Binance has painstakingly built.

Epilogue: After the Storm, Can We Really See the Rainbow?

The consecutive explosions of GoPlus and RedStone have pushed Binance to a crossroads. On one side is the urgent need for new narratives to support trading volume, and on the other is the increasingly awakened community power. When "Binance's careful selection" shifts from a quality label to a risk warning, and when users begin migrating to platforms like Bybit and Bitget, this once-industry giant must confront a question:

Is the essence of a cryptocurrency exchange a bridge of value or an accelerator of bubbles?

Perhaps the answer lies in CZ's past reflections: "If we cannot rebuild transparency, exchanges will ultimately become their own grave diggers."

And at this moment, the rain is pouring, and the rainbow is still beyond the horizon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。