Miracles do not bloom on easy paths. Perhaps behind all the choices that are not favored and not attempted, there are unseen possibilities and unknowns that were never designed. The unknown instills fear, sparks curiosity, and thus proves your courage and builds your confidence. When there seems to be no way out, it forces you to soar, and that is the miracle!

Yesterday, the overall market trend was a fluctuating decline. After the market surged to around 93,000 in the morning, it began to oscillate downwards, continuing until this morning. The market first surged above 91,000, then quickly dropped to around 84,700, resulting in another round of up-and-down price action. In terms of operations yesterday, the plan for Bitcoin was to short near 93,000, but it ultimately did not reach that position. Ethereum finally dropped to around 2,100, yielding a decent profit.

Today, Trump signed an executive order on Bitcoin strategic reserves. However, according to insider reports, the reserves will likely not be acquired through additional purchases or taxpayer money, but rather through confiscation and other means. According to this statement, although the government will not purchase more Bitcoin on the open market, the U.S. taking the lead in strategic reserves at least sets a good example for other countries. If other countries follow suit or adopt more aggressive methods for reserves, it would be a significant positive development. Additionally, reserving confiscated Bitcoin also reduces the likelihood of the U.S. and other governments selling confiscated cryptocurrencies on the market, effectively decreasing selling pressure, which is a positive attitude towards the market. Whether this will encourage more countries to emulate this approach in the future is also something to look forward to.

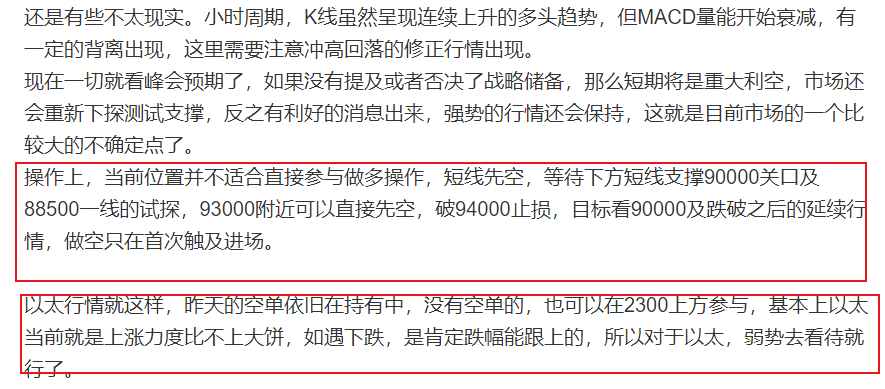

After a round of market decline, the current technical chart shows that Bitcoin formed a double top near 93,000 yesterday and has since retreated. Combined with the weekly candlestick's doji indicating a high and subsequent drop, the market has broken below the midline this week. Currently, the four-hour candlestick chart shows a downward arrangement, indicating a weak trend. After dipping to around 84,700, it is in an oversold rebound, but the current rebound strength is insufficient to recover the losses, forming a wave-like downward structure. Breaking below the lower boundary indicates an acceleration structure, and further space will be released today, with the next target approaching around 82,000. Additionally, the MACD bearish volume is gradually increasing, indicating a clear early bearish cycle. The moving average pattern shows a clear downward expansion. Although there is some demand for a slight rebound in the short term, the smaller cycles remain in a weak rhythm, making it more prudent to plan short positions around the rebound highs!

Today, being Friday, there is also a non-farm payroll data release reflecting the economic situation. From the data perspective, the previous non-farm value was 143,000, and the market forecast is 160,000. If the actual value falls within this range, Bitcoin is likely to rise first and then fall. If the actual value is close to the previous value, it will be bullish for Bitcoin, leading to a slight increase. If the actual value leans towards the forecast value, it will be bearish for Bitcoin. The specifics will depend on the actual value, of course, data is not absolute. Additionally, subsequent speeches regarding the Federal Reserve's interest rate cut expectations are quite important. Overall, after the March non-farm data, it is likely to show a pattern of rising first and then falling.

In terms of operations, based on the current market, it is advisable to plan short positions around the short-term resistance area of 89,000-90,000, with a stop loss at 91,000 and a target of gradually looking towards 86,000-83,000.

Ethereum continues to show weakness, with the price action forming a double bearish candlestick pattern after a high and retreat. Currently, it is undergoing a second wave of decline. If the previous high is considered the first wave, then the high point of yesterday around 2,319 can be regarded as the second wave down. Today, we look for further bearish space to be released. The operation remains primarily short; those who have not taken profits on previous shorts should continue to hold. For those without shorts, consider entering again around 2,220, adding to positions at 2,320, with a stop loss at 2,400 and a target looking for a break below 2,000.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time, making the information potentially outdated. Specific operations should follow real-time strategies. Feel free to contact us for market discussions.】

Scan to follow!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。