This morning at 08:15, U.S. President Trump officially signed the Strategic Bitcoin Reserve Executive Order. According to the full text of the executive order released by the White House, the U.S. Secretary of the Treasury will be responsible for establishing a dedicated office to manage and control the "Strategic Bitcoin Reserve" account, which will receive all bitcoins confiscated through criminal or civil asset forfeiture proceedings, and will also be used to pay civil fines imposed by government agencies.

In other words, the U.S. government is not actively purchasing bitcoins, but is instead consolidating bitcoins confiscated through judicial and regulatory processes into a strategic reserve, which creates a significant gap from market expectations.

Peter Chung, head of research at Presto Research, and Nick Ruck, director of LVRG Research, both stated that the release of this executive order has become a typical "sell the news" event. The market had originally anticipated that the U.S. government would directly and massively purchase bitcoins, but the final policy is merely an adjustment in the management of existing assets, which has reduced the market's buying pressure.

Solana co-founder Toly also pointed out that this executive order is not a bailout action for the U.S. government's crypto market, but rather further eliminates the regulatory uncertainty faced by the industry over the past four years.

As a result, after the news broke, mainstream crypto assets generally plummeted, with BTC instantly dropping over 6%, ETH falling by 5.6%, and mainstream coins like ADA and XRP crashing by over 10%!

However, market volatility is far from over! Tonight will see the release of non-farm payroll data and the White House Crypto Summit, which may further intensify market conditions.

Non-Farm Payroll Data: An Important Economic Indicator Affecting the Crypto Market

Non-farm payroll data is the "heartbeat monitor" of the U.S. economy, directly affecting the Federal Reserve's monetary policy, the U.S. dollar exchange rate, and consequently the price of bitcoin.

Currently, the market expects an increase of 160,000 non-farm jobs, higher than the previous value of 143,000, and bets that the unemployment rate will remain unchanged at 4.0%.

Three Possible Outcomes of Non-Farm Data and Their Market Impact:

- Above Expectations (>160,000): Strengthens interest rate hike expectations, a stronger dollar suppresses BTC;

- In Line with Expectations (Around 160,000): Market volatility eases, waiting for policy narrative;

- Below Expectations (<160,000): Eases interest rate cut expectations, a weaker dollar, BTC may rebound alongside gold.

But! Non-farm data has always been 'full of expectations, but reality is stark', so we need to be mentally prepared. Here are two indicators to share:

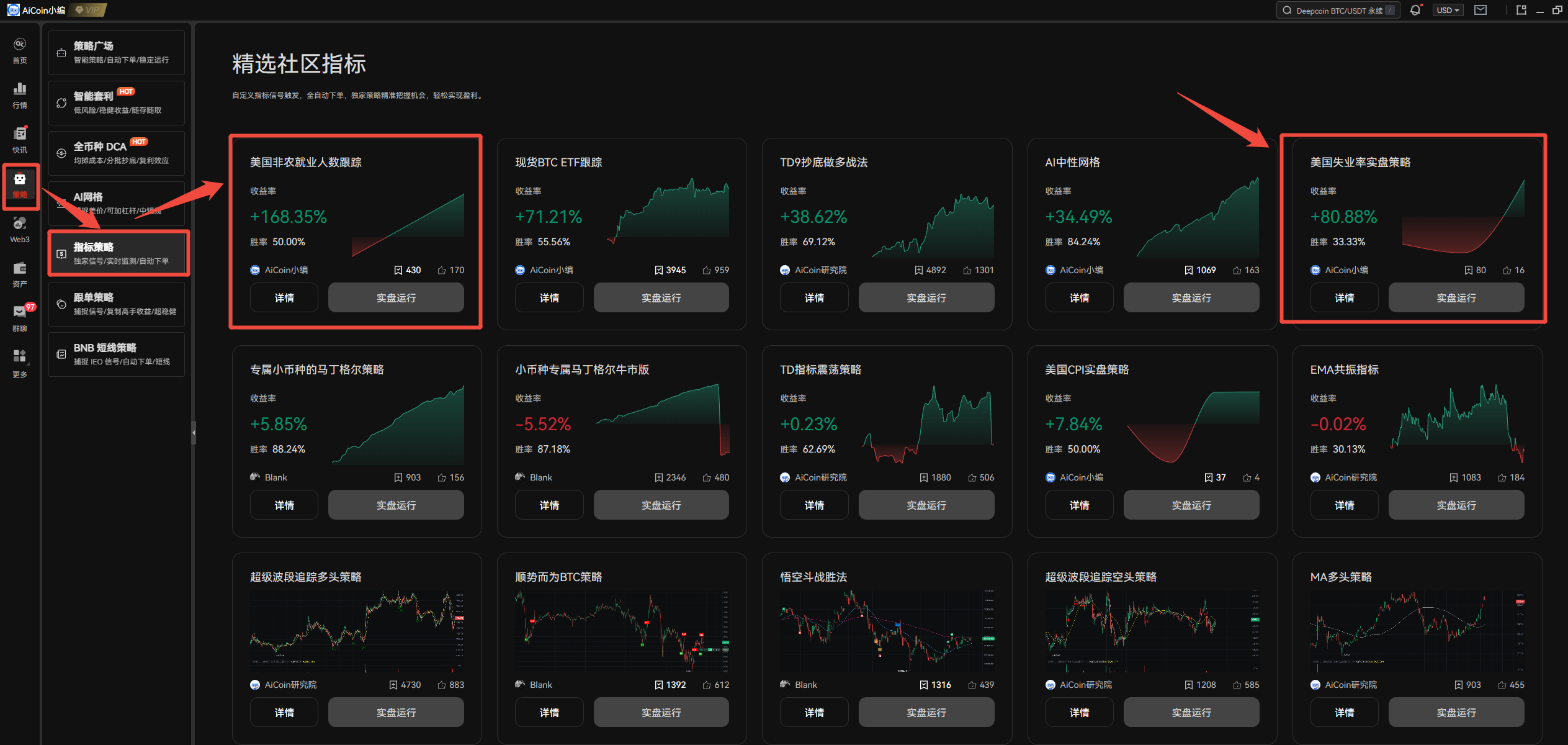

- U.S. Non-Farm Employment Tracking: https://www.aicoin.com/link/script-share/details?shareHash=wr5dAJybxaX2gJnP

- U.S. Unemployment Rate Real-Time Strategy: https://www.aicoin.com/link/script-share/details?shareHash=mJVbv2Mn75kBaDd2

These two custom indicators are derived from comparisons of past data and expected values, supporting alerts and real-time trading (automatic orders), with no closing instructions, only opening positions, and customizable take profit and stop loss on the real-time trading page.

Note: Strategies are for reference only; please consider your own situation when using them!!!

White House Cryptocurrency Summit: A Policy Barometer

Compared to the short-term non-farm data, the White House Crypto Summit may be a more critical market barometer.

Why is the White House suddenly interested in cryptocurrencies?

In simple terms, the government is eyeing the money and regulatory power in the crypto market.

Do you think they care about innovation? No, they are more concerned about taxes, money laundering risks, and financial stability!

Reports suggest that the topics include digital payment innovation, the construction of crypto data centers, and planning for the bitcoin mining industry.

Additionally, there are rumors that the Trump administration plans to introduce a zero capital gains tax policy, exempting taxes on crypto assets held for more than a year.

Overall, if the summit releases positive news, bitcoin could soar to $100,000, but if policies tighten, the market could see significant losses.

Non-Farm vs. Crypto Summit, Which Has a Greater Impact?

The directions of their impacts differ, but the summit's influence may be more profound. On one hand, the impact of non-farm data is generally short-term, while the content mentioned at the summit can be speculated on for the long term; on the other hand, the levels are different, as non-farm data is a routine release, and this data is unlikely to change the expectations for rate cuts in March and May, but the participants of the summit are high-profile figures, especially with government officials attending, which has a significant impact.

- If non-farm data exceeds expectations, interest rate hike expectations will rise, the dollar will strengthen, and the crypto market may come under pressure.

- However, if the crypto summit releases positive news, it may offset the negative impact of non-farm data and even trigger a 'policy bull market'!

Although the impact of the narrative is unknown, it is certain that during the release of major data and policy meetings, market volatility will intensify, so it is advisable to pay attention to the following two key indicators:

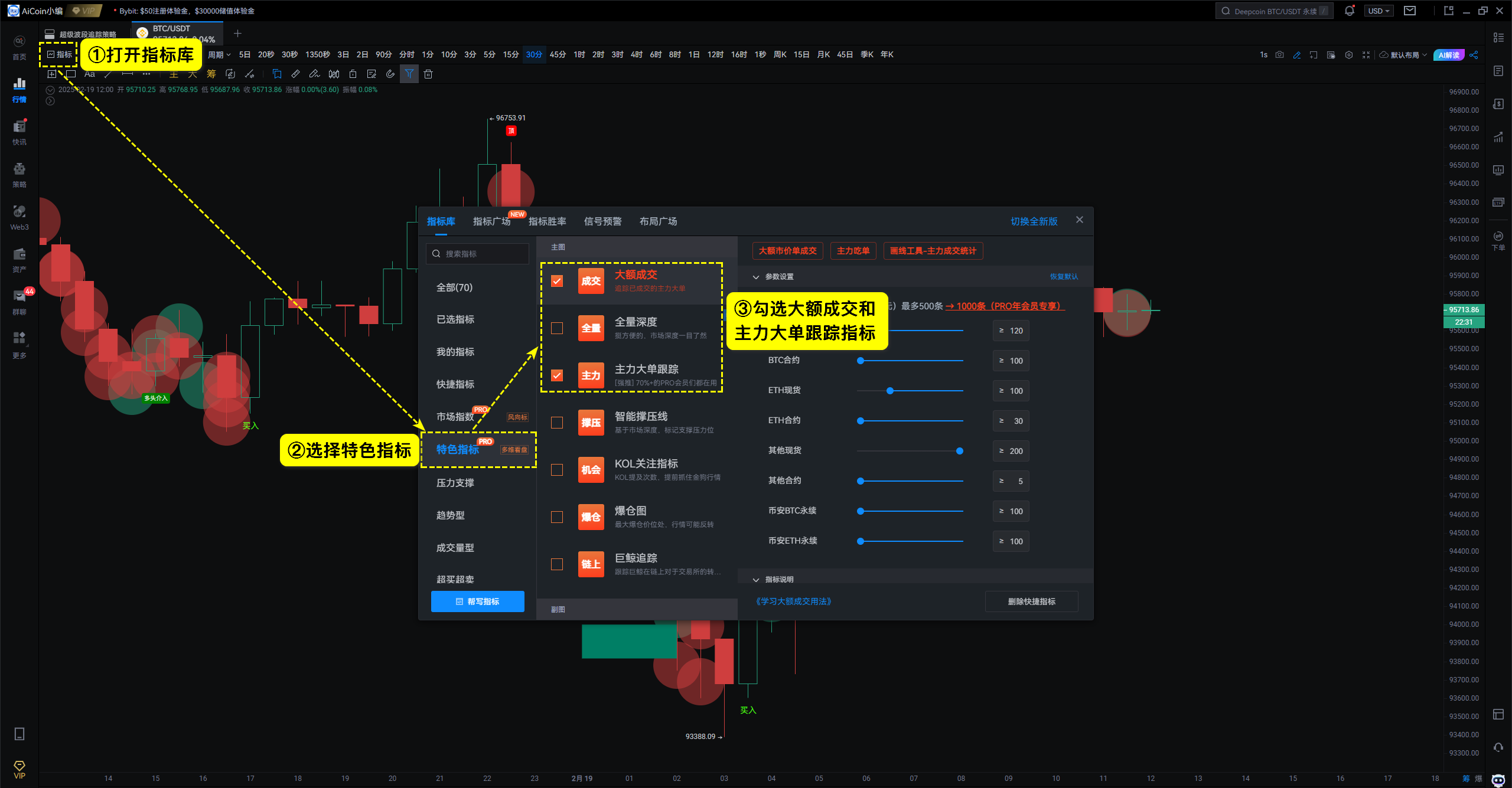

1. Tracking Large Orders

Tracking large orders focuses on the order behavior of major players. Once the major players place orders in the market, AiCoin can immediately capture this and provide information on the position, direction, and amount of the major orders, which will ultimately be displayed on the K-line, making it very clear.

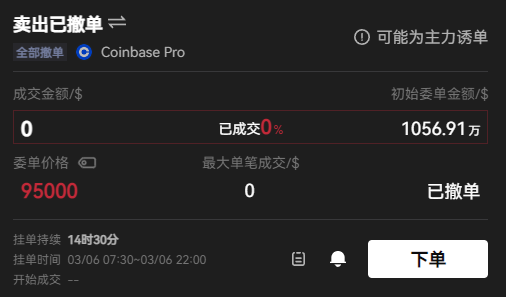

The order behavior of major funds can reveal market intentions in advance. For example, before the recent bitcoin crash, major funds on Coinbase and Binance had placed large sell orders at $95,000, revealing two key signals:

- $95,000 is the ideal exit point for major players, and bitcoin may test this price level.

- These are large spot sell orders, with no leverage; if executed, they will become a strong resistance level.

However, after the BTC crash, major funds quickly withdrew their orders, indicating a change in major sentiment.

2. Large Transactions

The AiCoin large transaction indicator can track the market transactions of major players in real-time, making it very suitable for monitoring major sell-off or buy-in behaviors.

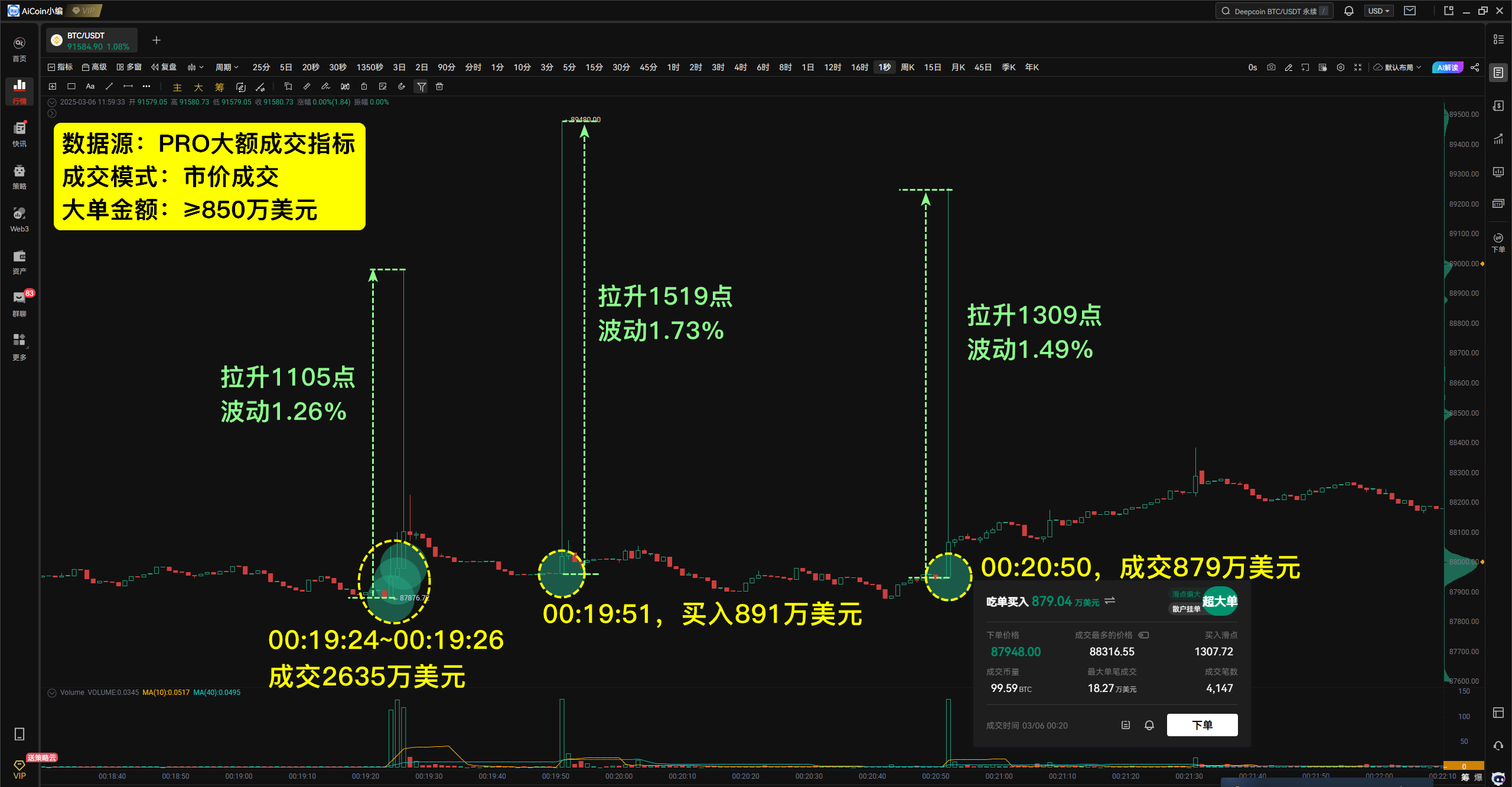

Typically, large market transactions can more intuitively reflect the true intentions of major players. For example, early yesterday morning, the Binance spot market saw major funds aggressively buying:

- 00:19:24—00:19:26: Major bought $26.35 million, BTC instantly surged by 1.26%

- 00:19:51: Major bought another $8.91 million, BTC violently surged by 1.73%

- 00:20:50: Major transaction of $8.79 million, BTC moved by 1.49%

These large transactions directly affect the short-term market trend, and with the crypto summit happening tonight, major funds are sure to take action.

Now upgrade to PRO to track major funds and seize market opportunities: https://www.aicoin.com/vip/chartpro

The above content is for sharing only and is for reference; it does not constitute any investment advice. If you have any questions, feel free to join the 【PRO CLUB】 group to discuss with the editor~

Please recognize AiCoin's official website: www.aicoin.com

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。