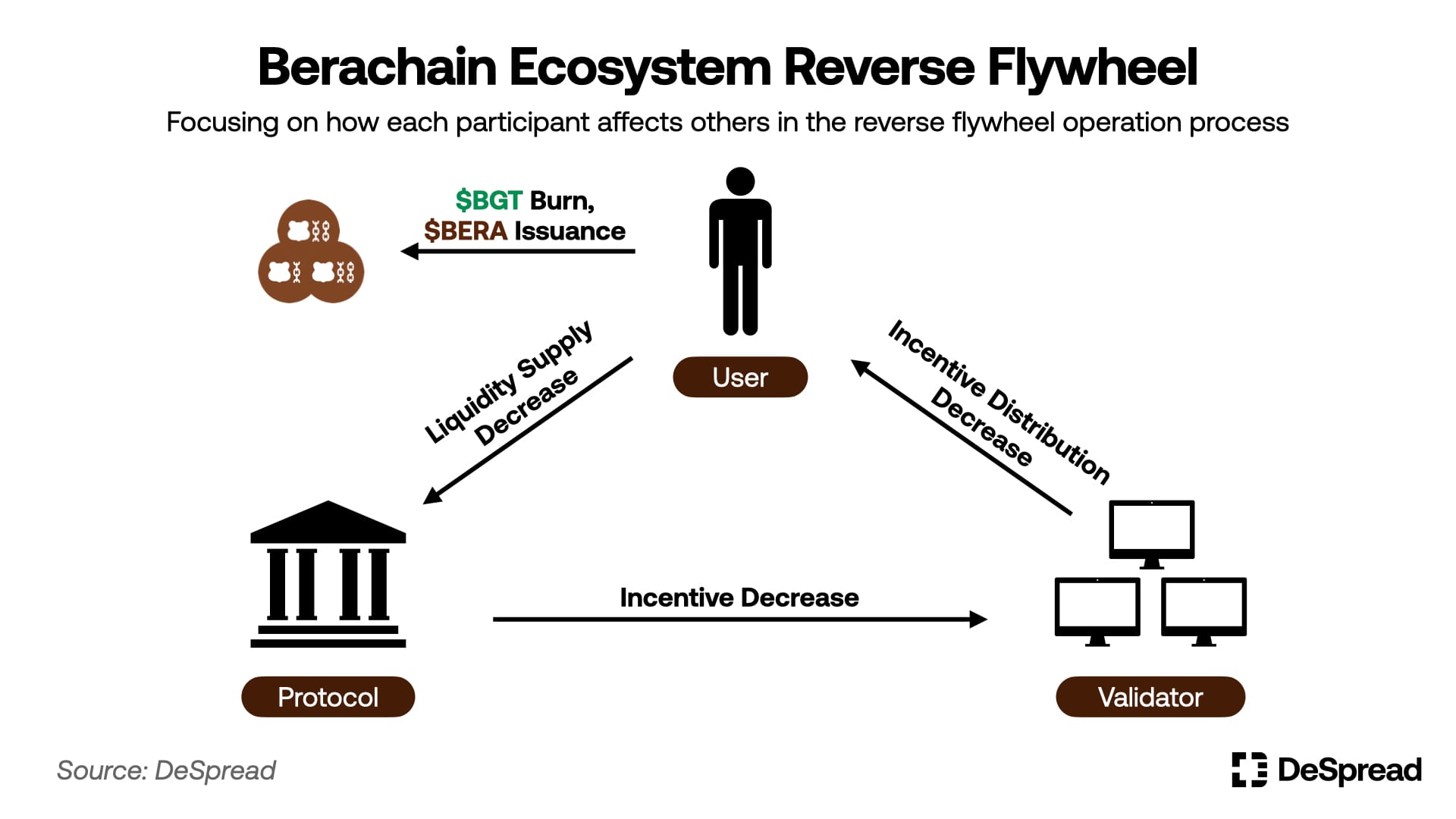

From a long-term perspective, the challenge faced by Berachain is to develop strategies for increasing network fees while continuously expanding the ecosystem, in order to address the potential reverse flywheel effect caused by inflation.

Author: Tranks, Research Analyst at DeSpread

This article does not cover the basic information about Berachain. If you are new to Berachain, it is recommended to read the following articles before reading this one.

1. Introduction

As the meme coin market fades, interest in DeFi is gradually increasing. In this trend, the Berachain ecosystem, which has low token volatility and offers high yields, is also beginning to attract new users.

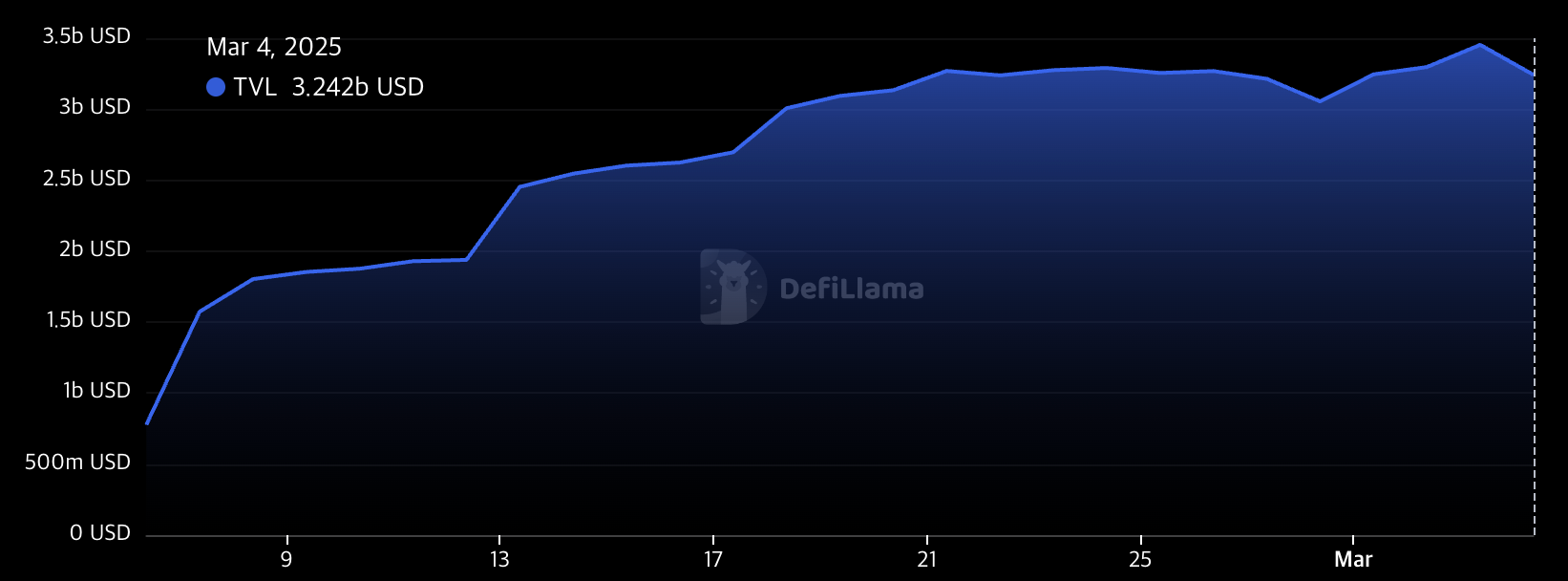

From the launch of the Berachain mainnet on February 6, 2025, to the writing of this article on March 4, Berachain's TVL has steadily risen to $3.2 billion, surpassing Base in the overall TVL rankings, reaching sixth place overall.

Berachain TVL Trend; Source: Defi Llama

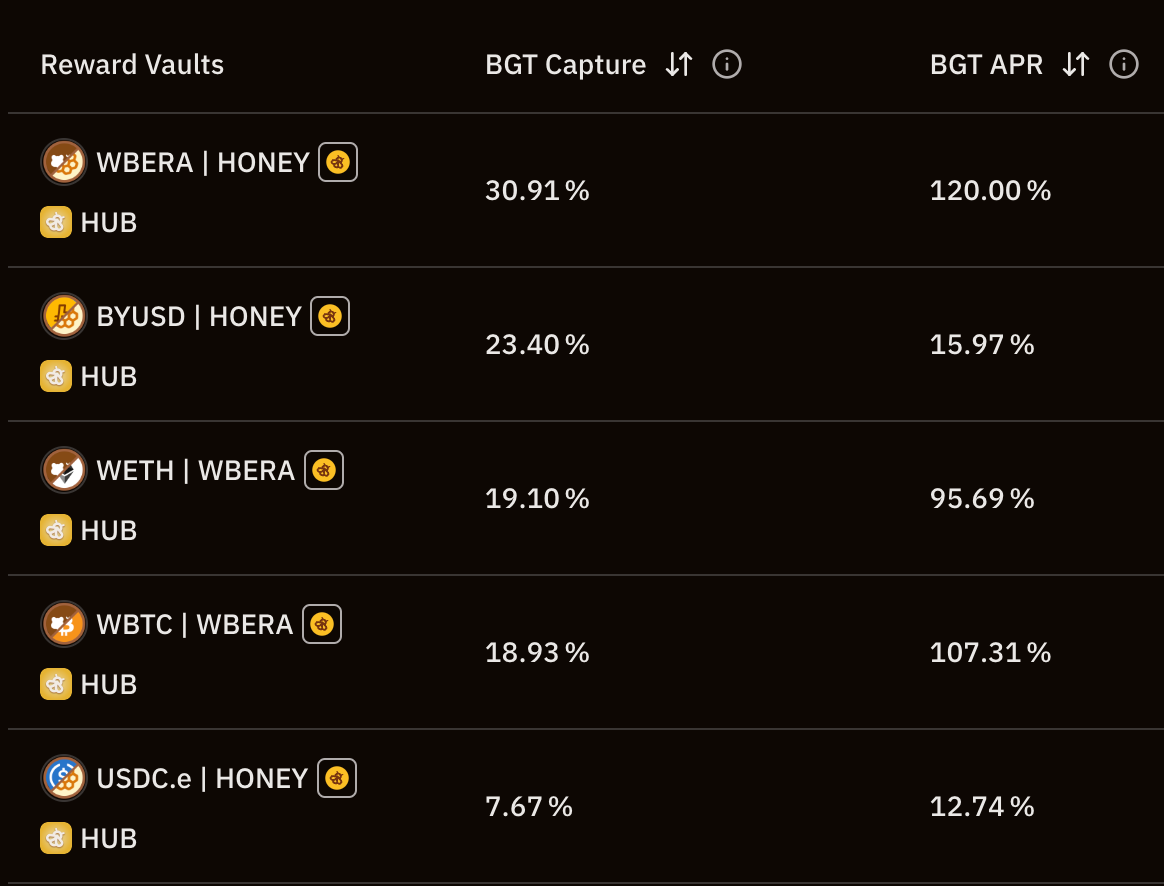

Core projects in the ecosystem, such as Kodiak, Yeet, and Ramen Finance, have been preparing since the Berachain testnet phase and have been launched one after another after the mainnet went live. However, these ecosystem protocols have not yet registered in the reward vault for issuing $BGT, and currently, liquidity can only be provided to five liquidity pools within BeraSwap to earn $BGT.

Reward Vaults List; Source: Berahub

Users can provide liquidity to the BeraSwap liquidity pool, receive LP tokens, and then deposit them into protocols like Infrared and Stride that support the liquidity of $BGT, and use the received liquidated $BGT tokens in other DeFi protocols. Additionally, users can also deposit the same LP tokens into the liquidity aggregator Beradrome to earn Beradrome's native token $BERO, and by staking $BERA, they can earn rewards accumulated in Beradrome, thus implementing various ecosystem participation strategies.

Furthermore, the first phase of Berachain governance (Governance Phase 1) began on February 26, requesting the registration of reward vaults for ecosystem protocols. As these requests are integrated into the protocols and rewards are paid to validators, the gameplay of Berachain's ecosystem is expected to become more diversified. In this process, the role of $BGT, which has the authority to receive rewards and distribute network rewards, will become increasingly important, and the flywheel based on PoL (Proof of Liquidity) structure will also be activated, leading to more users and liquidity flowing into Berachain.

In this article, we will examine Berachain's flywheel structure in detail to assist new users in managing risks and discuss the potential risks of the Berachain flywheel and preventive measures.

2. Understanding the Berachain Flywheel

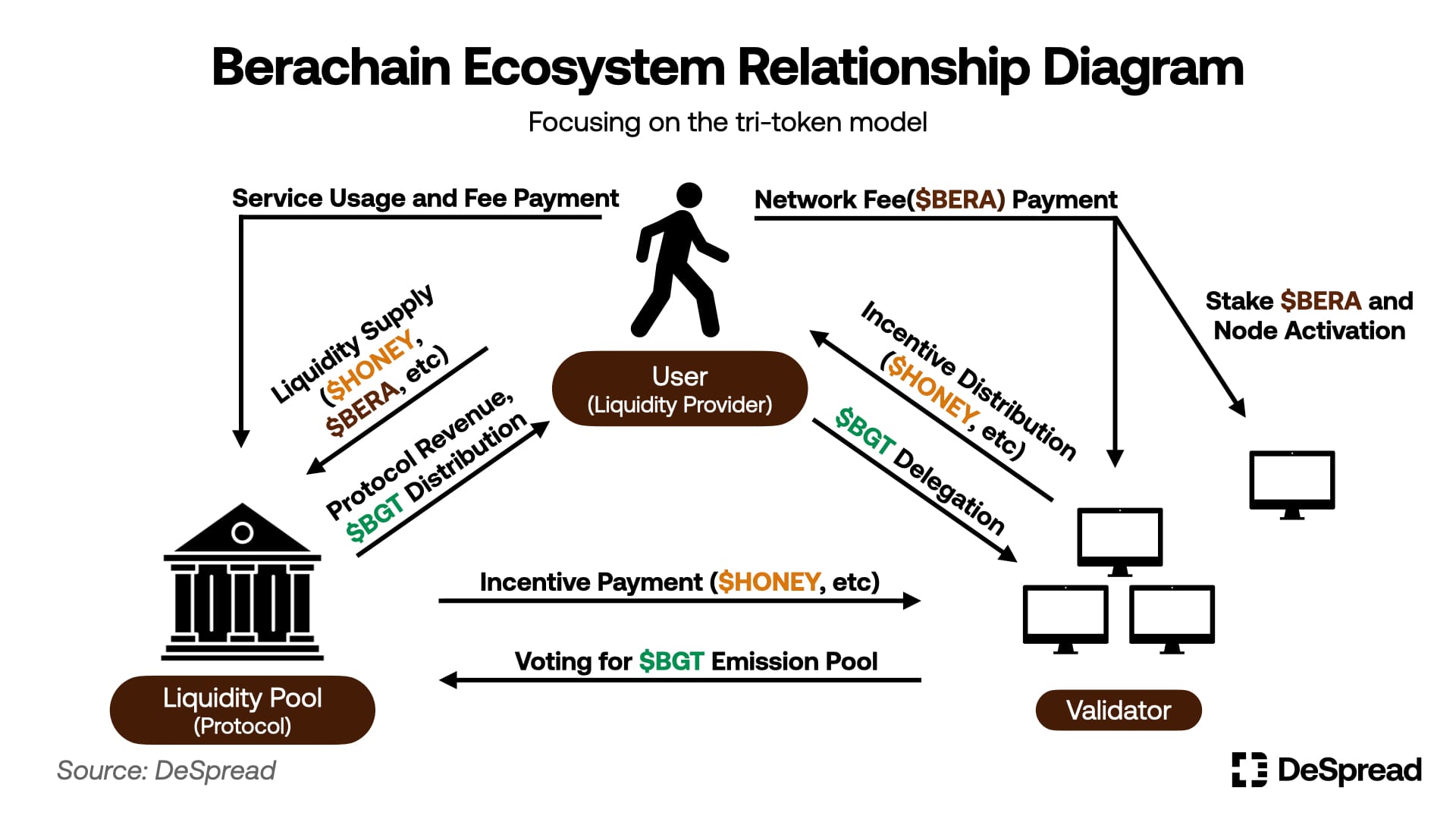

Berachain adopts a PoL structure, where network participants such as validators, ecosystem protocols, and liquidity providers must propose and provide value to each other.

Each participant in the network forms a state of incentive alignment, where the growth and decline of each role are directly related to one another. When each participant positively impacts others, the following virtuous flywheel operates:

As the ecosystem grows and expands, the incentives paid to validators by the protocol will also increase.

As the rewards distributed to $BGT holders increase, the demand for acquiring $BGT through providing liquidity will rise, while the demand for burning $BGT will decrease, leading to a reduction in the issuance of $BERA.

As liquidity supply increases, the overall ecosystem will grow and expand.

When this virtuous flywheel operates, the price of $BERA, the TVL of ecosystem protocols, and the overall profits of the ecosystem will increase, allowing all ecosystem participants to benefit. However, for the flywheel to operate smoothly, the following three conditions must be met:

Losses from protocol reward expenditures: Profits obtained from the protocol's expenditure on rewards and guaranteeing liquidity.

Volatility risk exposed by purchasing/holding ecosystem tokens: Profits from providing liquidity in $BGT.

Volatility risk exposed by holding $BERA: Profits from rewards obtained by delegating $BGT.

When all the above conditions are met, the flywheel will begin to operate. Once activated, each condition will positively influence the others, allowing the flywheel effect to continue spinning, while the robustness and strength of the flywheel depend on the degree to which the conditions are met.

This flywheel structure of Berachain appears to be a unique feature and advantage not found in other PoS structures, but when one of the conditions cannot be met for specific reasons (and cannot be restored in the short term), these conditions will begin to negatively impact each other, causing the flywheel to operate in reverse as follows:

As the ecosystem contracts, the rewards paid to validators by the protocol decrease.

As the rewards distributed to $BGT holders decrease, the demand for acquiring $BGT through providing liquidity decreases, while the demand for burning $BGT increases, leading to an increase in the issuance of $BERA.

As liquidity supply decreases, the ecosystem contracts.

In this reverse flywheel state, the price of $BERA, the TVL of ecosystem protocols, and the overall profits of the ecosystem will decrease until the conditions for the flywheel to operate are met again.

If we only consider the internal demand within the ecosystem in the short term, 1) it is expected that many protocols seeking to issue their own tokens as rewards will emerge; 2) since the $BGT emissions have just begun, the farming efficiency of each $BGT is very high, thus the demand for providing liquidity and accumulating $BGT will be relatively high.

For these reasons, the flywheel is likely to operate in the early stages of the mainnet launch, but factors such as macro market trends and investment trends in other industries will also affect the operational status of the flywheel, making it difficult to assert whether the flywheel will successfully operate.

Next, we will explore several potential risk factors and scenarios that could trigger a reverse flywheel during the operation of the flywheel.

3. Reverse Flywheel Scenarios

3.1. $BERA Collapse

$BERA plays the following key roles in the Berachain ecosystem:

Staking for running nodes

Guaranteeing the minimum value of $BGT

Serving as a deposit asset in various liquidity pools

Therefore, the downward trend in the value of $BERA can also be seen as a weakening of network security, a decrease in the minimum value of $BGT, and a reduction in ecosystem liquidity. For participants in the Berachain network, the role of the price of $BERA is more critical than the role played by the mainnet token price in other networks.

When the flywheel operates smoothly, even if the price of $BERA fluctuates downwards to some extent, if the incentive yield can be maintained, demand for $BERA can continue to be generated. Conversely, a decline in the value of $BERA may negatively impact ecosystem protocols, reduce incentive yields, and trigger user demand for burning $BGT to exchange for $BERA, or for removing $BERA supplied to liquidity pools and selling it on the market. This could be the starting point for a reverse flywheel, leading to a further decline in the value of $BERA.

Therefore, we should pay special attention to the following situations:

3.1.1. Large-scale $BERA Unlocking

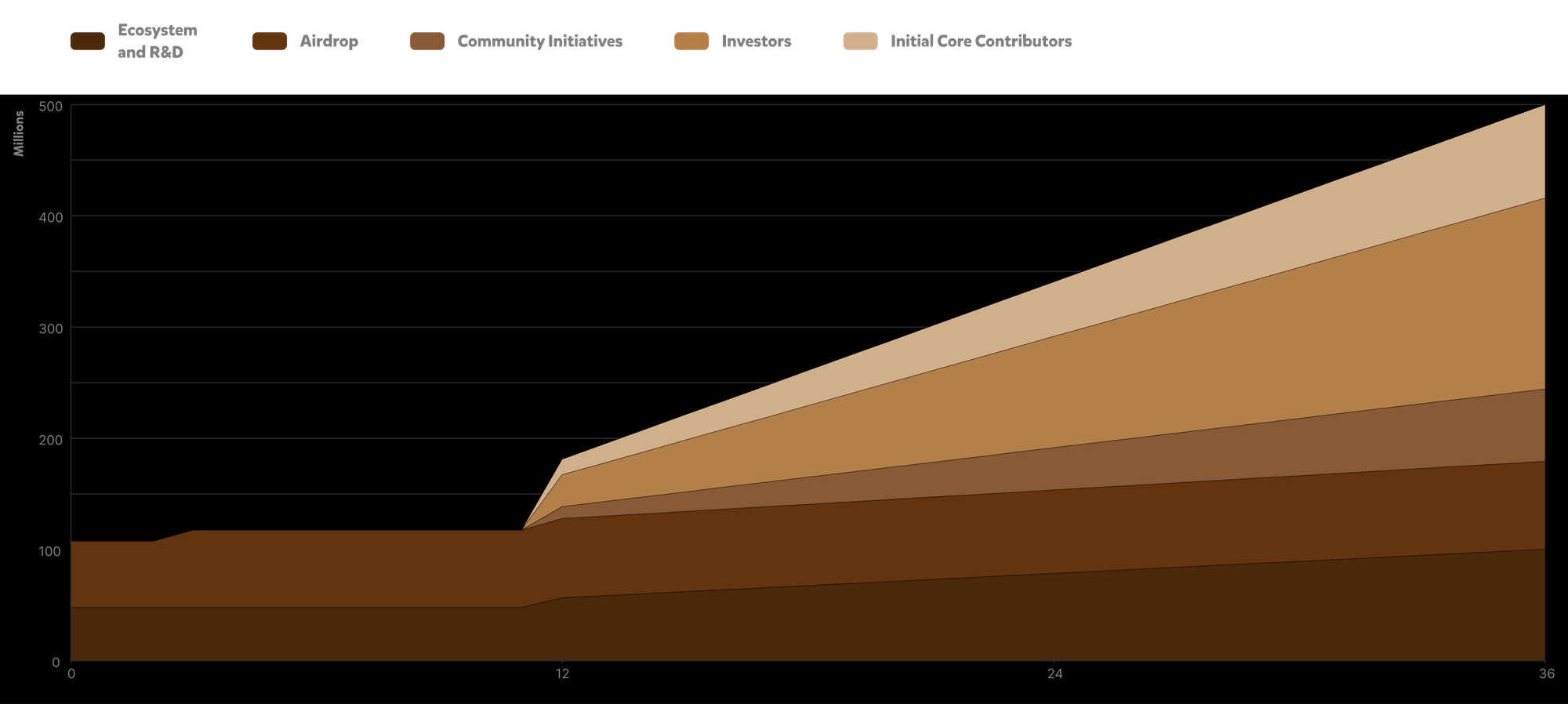

In addition to the $BERA issued through $BGT burning, there is also a planned $BERA unlocking schedule, with a total issuance of 500M. The unlocking timeline is as follows:

$BERA Unlock Schedule; Source: Berachain Docs

The linear unlocking plan for investors, early core contributors, and independent community allocations will begin in February 2026, one year after the mainnet launch. Before this, factors that may trigger market sell-off pressure in the short term due to the increase in $BERA circulation include:

Allocations received by protocols and communities through the RFB plan (approximately 2.04% of the total issuance)

Quotas allocated through the Boyco plan (approximately 2% of the total issuance)

Among them, the amount allocated to users by protocols and communities through the RFB plan must have a distribution period of at least 6 months, and since the distribution timing varies for each protocol, it is expected that there will not be significant sell-off pressure on the market in the short term.

However, the allocation amount from Boyco is expected to be distributed in about 2 months, and the method will be similar to the current airdrop. In this case, approximately 2% of the total issuance of $BERA will be supplied to the market, which may cause sell-off pressure. Additionally, assets deposited in the Boyco plan will also be unlocked when $BERA is distributed in the airdrop, potentially leading to a reduction in liquidity within the ecosystem. This will create a favorable environment to trigger a reverse flywheel, causing both the price of $BERA and ecosystem liquidity to decline simultaneously.

Therefore, it will be crucial to observe whether the ecosystem can establish an attractive flywheel before the Boyco plan ends to effectively absorb the released $BERA and liquidity into the market.

3.1.2. Large-scale Exit and Panic Selling by $BGT Holders

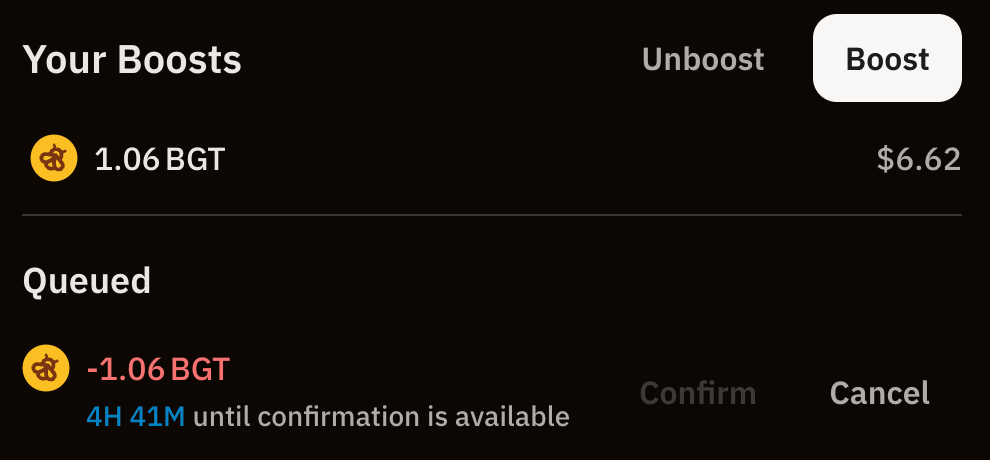

To obtain $BGT, users must deposit liquidity into liquidity pools that can issue BGT rewards and commit sufficient time. However, through the Redeem feature on BeraHub, users can burn their delegated $BGT at any time to receive $BERA for sale, with an unlocking time of about 5 hours.

Berachain requires an Unboost time of about 5 hours; Source: BeraHub

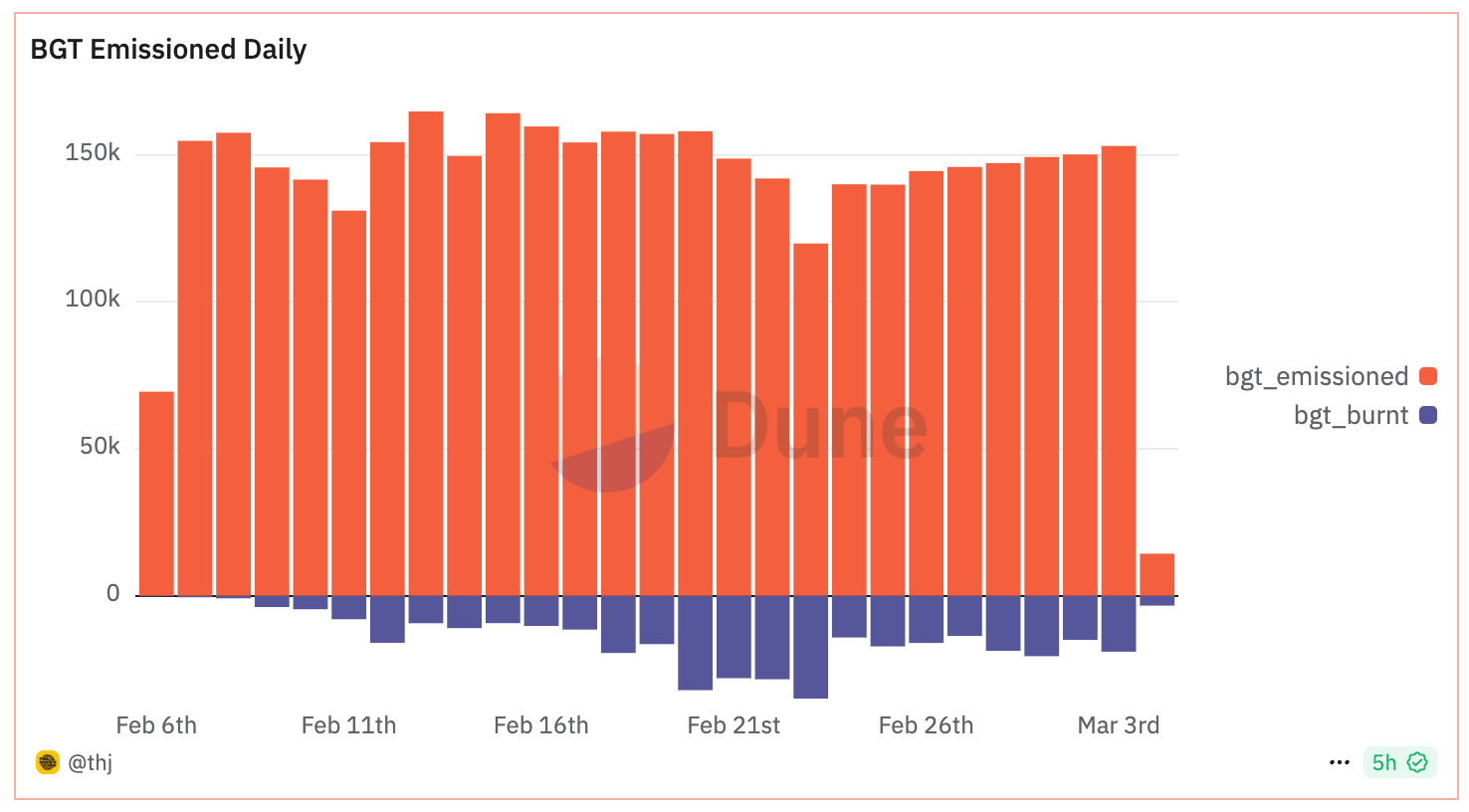

If users holding a large amount of $BGT exit the ecosystem simultaneously, the circulation of $BERA may increase rapidly. If the price of $BERA drops significantly in a short time as a result, it may trigger panic selling from other $BGT holders and users providing $BERA liquidity, leading to a larger decline. Therefore, it is essential to monitor the trend of $BGT burning to understand the current dynamics of the ecosystem.

$BGT Emission & Burn Trend; Source: @thj

Additionally, the trend of reward rates for providing liquidity and $BGT yield is the most critical factor determining the demand for $BGT burning and delegation. By continuously observing each trend, it is possible to predict potential risk scenarios mentioned above to some extent, as well as the likelihood of the flywheel recovering if large-scale $BGT burning occurs.

At the same time, the demand for liquidated $BGT tokens will increase with rising incentive rates, triggering price increases; conversely, as incentive rates decrease, demand will also decline, leading to price drops. Therefore, if it is difficult to grasp historical reward rates and $BGT yield data, one can estimate an approximate value by observing the premium trend of liquidated $BGT relative to $BERA, which reflects the intrinsic value of $BGT.

iBGT/BERA Price Chart; Source: Dex Screener

However, the price of liquidated $BGT tokens is influenced not only by the intrinsic value of $BGT but also by the incentive distribution methods of liquidity protocols and other protocol-related factors, so these factors should also be considered.

3.2. Inflation and Slowing Growth

In addition to the 500M $BERA distributed to network participants within three years of the mainnet launch, Berachain has an annual inflation rate of about 10% for $BGT. Although a portion of the network fees submitted by users will be burned, it is difficult to expect significant amounts to be burned since Berachain's main activity is depositing assets into liquidity pools and earning interest.

This means that even if Berachain establishes a positive flywheel three years after all $BERA unlocks, it will need to find ways to attract external capital inflows greater than the inflation rate to maintain it for a year.

Berachain's founder Smokey The Bera mentioned in an interview with Bell Curve that they are developing a dynamic inflation model that will change based on the reward rates for distributing $BGT to address the above issue.

While this feature may help control the acceleration of the flywheel and contribute to sustainability, as long as "inflation" persists, leading to a decline in the price of $BERA and a reverse flywheel of ecosystem contraction at certain stages is unavoidable. Therefore, even from a long-term perspective, it is essential to continuously monitor the several ecosystem indicators mentioned above to diagnose the current state of the ecosystem.

Additionally, in Berachain, simply holding $BERA in the long term without utilizing it within the ecosystem is an inefficient investment strategy that will not recover the value diluted by "inflation." Therefore, for users looking to build positions with $BERA, it is crucial to deposit it into ecosystem protocols to actively generate interest.

If users wish to establish stable positions in the ecosystem in the long term, conservatively using assets less affected by flywheel prices (such as $BTC, $ETH, stablecoins, etc.) to accumulate $BGT or engage in compound deposit operations may be effective methods.

3.3. Monopoly on $BGT

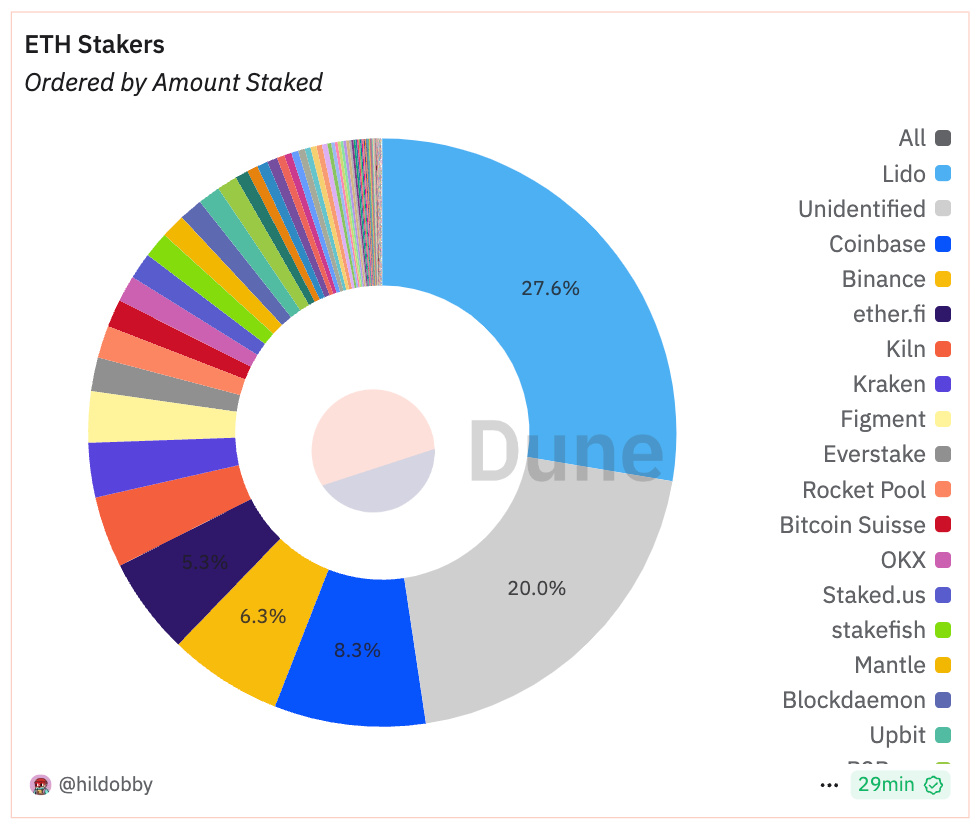

In most recently launched mainnets that adopt PoS structures, entities with larger stakes can earn more network rewards. This can lead to the consolidation of validator share ratios and pose risks of network centralization.

Validator Staking Market Share in the Ethereum Network; Source: @hildobby

As a network created by modifying the basic PoS structure, Berachain has also experienced this phenomenon. Furthermore, in Berachain, validators holding a large amount of $BGT can directly intervene in the ecosystem and unilaterally design structures that benefit themselves, leading to $BGT monopolization and a greater risk of network token monopoly compared to other PoS-based networks.

To prevent this issue, the team has limited the $BERA stake cap that affects block creation rights to 10M and introduced a method where boosting inefficiently increases with the number of $BGT representation votes determining the generation of each block. However, these limitations can be circumvented by operating multiple nodes distributed by a single entity or through collusion among multiple validators.

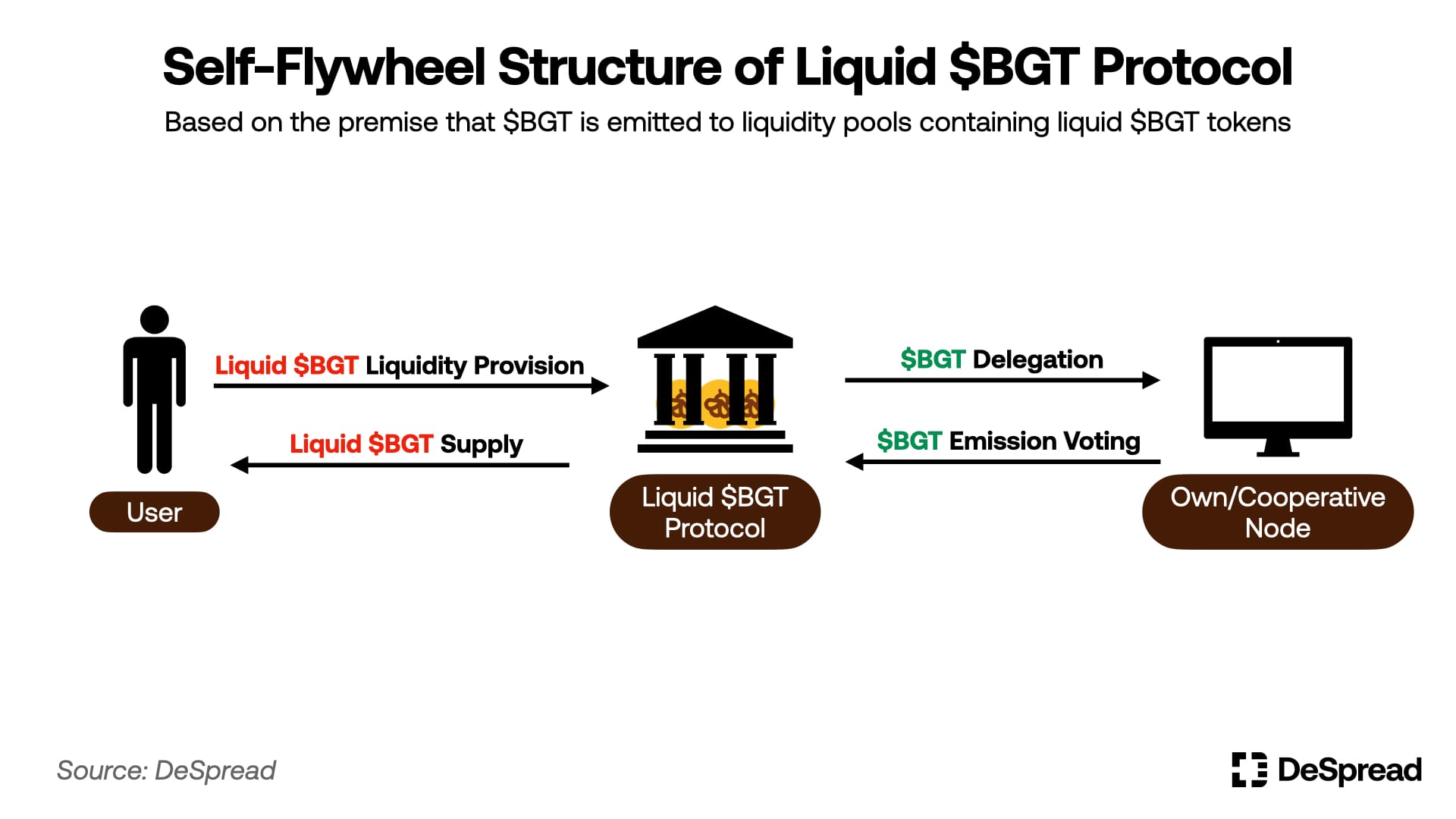

In particular, liquidity $BGT protocols have advantages in attracting liquidity for the Berachain reward treasury, as the potential value of "liquidity" is high. Users can deposit the liquidity received from users into the reward treasury to directly accumulate $BGT. Additionally, by returning the $BGT to the nodes they operate or collaborate with, these protocols can obtain a large amount of $BGT emission voting rights without negotiating with other ecosystem entities.

If these protocols additionally emit $BGT voting rights into liquidity pools containing liquidated $BGT tokens, the liquidity $BGT protocols can establish their independent flywheel, increasing the demand for liquidity provided to the protocols, even without paying separate rewards.

In this case, the flywheel of the liquidated $BGT protocol itself will become as powerful as the ratio of $BGT held by the protocol to the total $BGT issued within the ecosystem. If multiple liquidated $BGT protocols acquire large amounts of $BGT in the aforementioned manner and continuously pursue increasing the liquidity provision demand for their own liquidated $BGT tokens, it may suppress the liquidity enhancement of other protocols, hinder the launch and development of new protocols, thereby limiting the diversification of the ecosystem, ultimately leading to a contraction in ecosystem scale and triggering a reverse flywheel.

As mentioned earlier, structural constraints on $BGT monopolization can be implemented through the operational mechanisms of the protocols, but it is difficult to completely block it. Therefore, the most reliable method to prevent specific entities from monopolizing the ecosystem is to reach a consensus among participants on the sustainability of the ecosystem before the monopolistic structure solidifies, and to maintain continuous attention and effort from the community towards this consensus.

4. Summary

So far, we have explored how the flywheel of Berachain operates, its operational conditions, and the scenarios of reverse flywheels. In addition to the possibilities presented in this article, if the three conditions driving the flywheel cannot be met, the reverse flywheel will also operate. Therefore, it is crucial to continuously monitor network and ecosystem indicators to assess the operational status of the flywheel in Berachain.

Moreover, the unfamiliar PoL mechanism and various forms of DeFi protocols utilizing this mechanism are combining to create complex derivatives and synthetic assets that are difficult to intuitively understand. Therefore, users need to proactively understand their holding structures and be aware of the overlapping risks of structure and security in advance.

From a long-term perspective, the challenge facing Berachain is to develop strategies to increase network fees while continuously expanding the ecosystem, in response to the potential for reverse flywheels caused by inflation. It is necessary to closely monitor whether consumer applications such as Perp DEX or on-chain games can settle in the ecosystem to generate genuine user traffic that exceeds "simple deposits."

I hope this article can clearly help users understand the Berachain ecosystem and effectively respond when the reverse flywheel arrives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。