Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

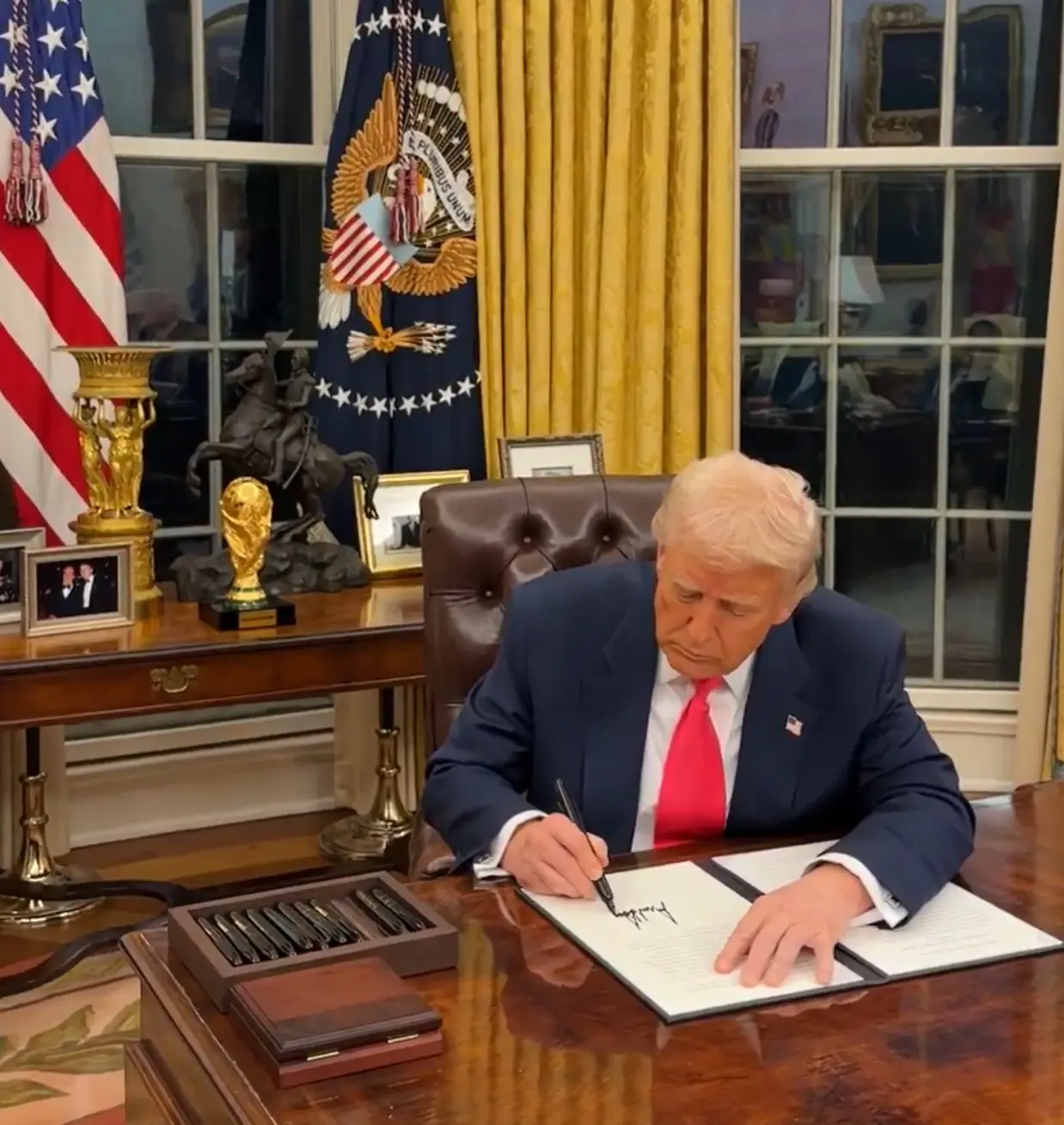

This morning, President Trump signed an executive order to establish a strategic Bitcoin reserve and a U.S. digital asset reserve.

The White House AI and crypto czar David Sacks pointed out that over the past decade, the U.S. government has sold approximately 195,000 Bitcoins, generating only $366 million in revenue. If these Bitcoins had been held long-term, their current value would exceed $17 billion.

Sacks bluntly stated, "This is the cost of the American taxpayer not having a long-term strategy!"

So, how exactly does the crypto strategic reserve work? How will this policy affect the market? Let's take a look at the different interpretations in the market.

Two Reserves: One Can Actively Increase Holdings, One Purely Stores

President Trump's executive order involves two different concepts—Strategic Reserve and Digital Asset Stockpile.

Bitcoin Strategic Reserve: This reserve will consist solely of Bitcoin. It will be made up of approximately 200,000 Bitcoins currently held by the U.S. government, which were seized through criminal or civil asset forfeiture procedures. The government will conduct a comprehensive audit of these assets.

Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick are authorized to explore additional ways to acquire Bitcoin, provided it does not increase the taxpayer burden.

Digital Asset Stockpile: This involves other digital assets (excluding Bitcoin) obtained through criminal or civil asset forfeiture procedures. For example, Ethereum (ETH), Ripple (XRP), Cardano (ADA), Solana (SOL), etc. The digital asset stockpile will specifically manage these assets.

Core Differences:

- Bitcoin Strategic Reserve: The government may seek budget-neutral ways to acquire additional Bitcoin.

- Digital Asset Stockpile: The government will not actively purchase these assets, only manage digital assets obtained through forfeiture procedures.

Market Interpretation: Bitcoin Drops Sharply, Is It Positive or Negative?

Upon the announcement, Bitcoin's price briefly fell by over 5%. Market opinions have diverged significantly; one side believes this will initiate a global Bitcoin reserve race, which is a long-term positive; the other side feels the policy's impact is less than expected, leading to market disappointment.

Optimists: This Will Change Everything!

Bitwise Research Director stated that the true significance of the U.S. establishing a strategic Bitcoin reserve lies in:

- Other countries will buy Bitcoin;

- Wealth managers have no excuses;

- Financial institutions have no excuses;

- Pension/donation funds have no excuses;

- Concerns about the U.S. selling Bitcoin will disappear;

- The U.S. may buy more Bitcoin;

- The likelihood of states purchasing Bitcoin increases;

- The possibility of the government banning Bitcoin is zero.

“This will change everything. Looking ahead, this is just the beginning.”

Crypto KOL @bitfool1 likened this initiative to a “nuclear bomb-level positive”:

- From the U.S. government holding Bitcoin to countries around the world competing to buy it, this is a long-term evolutionary process;

- Bitcoin is established as a global reserve asset similar to gold, and its value will undergo a historic re-evaluation.

Crypto KOL @0xNing0x offered another interpretation:

- The establishment of a national Bitcoin reserve is essentially to maintain the dollar's hegemony;

- The Trump administration may redesign the rules of the crypto market, incorporating it into the dollar system's bubble regulation mechanism;

- The market needs to digest overly optimistic expectations in the short term, but in the long run, the new order of the crypto market led by the U.S. may become the core driving factor for the next wave of growth.

Pessimists: Market Disproven, Short-Term Expectations Fall Short

Crypto KOL AB Kuai.Dong remarked, “This is very Trump-like, but also a bit pessimistic.” He worries that the government's holding of Bitcoin may turn into some sort of fiscal strategy, and it is uncertain whether more radical measures will be taken in the future.

Capriole Investments CEO Charles Edwards bluntly stated that the market's disappointment stems from:

- The market originally expected the government to actively purchase more Bitcoin, but the actual policy did not involve large-scale acquisitions;

- The likelihood of the U.S. government directly purchasing Bitcoin in 2025 has significantly decreased, with short-term positives not materializing.

There are also views suggesting that the U.S. may increase enforcement against offshore exchanges and large holding institutions to strengthen its control over the market. As the "Trump effect" on the market gradually fades, the anticipated policy catalysts are also diminishing, and the crypto industry may enter a new phase. In the next 1-2 years, under a relatively relaxed regulatory environment, application-layer innovations are expected to encounter more opportunities, and the industry's focus will shift from policy games to actual implementation and growth.

Short-term volatility, long-term profound impact. The U.S. government's acknowledgment of Bitcoin's strategic value means that the legitimacy of the crypto market, the process of institutionalization, and the global competition have only just begun. This could be a historic turning point, and the real impact will gradually emerge in the coming years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。