The First Step of the Product: Insight into True Needs

Written by: Deep Tide TechFlow

As March ushers in spring, the crypto world seems to have briefly entered winter, with investors taking the time to reflect on the gains and losses of this cycle.

In summary, this is a short-cycle bull market that belongs solely to the blockchain, with the Pionex small players thriving while the old VC people are disheartened.

Although the Solana Meme season is not as vibrant as before, liquidity that has tasted sweetness on-chain finds it hard to return to exchanges for slow cultivation. On-chain has become a collective consensus, just waiting for a new narrative to ignite a new on-chain summer.

Why has the purely on-chain market continued to explode from last year to now?

On one hand, it is certainly the peers, namely the VC coins, whose high valuations and low circulation have squeezed the survival and profit space of retail investors. Rather than becoming someone else's exit liquidity, it is better to simply give up and start a new game, with the meme wave following closely behind.

On the other hand, the explosion of on-chain assets has also replenished on-chain liquidity, gradually filling its liquidity gap.

Despite the widespread criticism of memes lacking actual value support, the high frequency of transactions has forced the improvement of infrastructure such as wallets, DEXs, and TG bots. The new infrastructure represented by OKX WEB3 optimizes user experience and liquidity, accelerating the on-chain process, just as the OKX wallet once supported BRC20 inscriptions, ushering in the spring of inscriptions.

Today, OKX DEX has become one of the core infrastructures for on-chain trading, and we will use it as a case study to dissect the logic behind this product.

Truly Understanding On-Chain Needs

The first step of the product: Insight into true needs.

Whether on Twitter (X) or in some meme communities, one can often find members of the OKX WEB3 team, who are all "degens," with many personally participating in on-chain trading to gain real market feedback.

In addition, the OKX WEB3 team has specifically established a product experience officer community to continuously collect bugs and suggestions.

With rich first-line on-chain experience, they are very "receptive" and continuously absorb feedback from the outside, allowing the OKX WEB3 team to see the essence of on-chain trading early on: What money is made on-chain?

Whether large funds are turning to on-chain due to distrust in centralized exchanges like FTX and Mt. Gox, or retail investors are seeking profits through quick in-and-out trades, airdrop farming, and DeFi mining, the business logic of on-chain trading points to one core—trading volume and trading frequency.

Especially in the meme coin market, wild fluctuations are the norm, and the cost of transaction fees is not important to players; the key is whether one can buy and sell quickly to realize arbitrage.

Based on the above insights, the OKX DEX Aggregator has found its demand path and built its advantages from four major dimensions.

In my view, these are also the four major standards for measuring an on-chain product. Note that they are not on the same level but have different levels of importance.

Security: The Foundation

Whether DEX or CEX, security is the number one priority, the foundation of everything.

Here, security is not just about ensuring safe transactions; it also needs to help users identify "dangerous assets."

Token Level: Automatically scan token contracts for vulnerabilities, identify high-risk projects like rug pulls and inflation traps, intercepting problematic tokens before users do.

Interaction Level: Sandbox simulation of authorized contracts to predict potential asset transfer risks after authorization.

Speed: The Killer Feature

On-chain, speed is paramount. OKX's core advantage lies in the X Routing algorithm, which compares liquidity pool prices across multiple DEXs and chains, splits orders, considers price, slippage, and network fees, thereby selecting the optimal route to reduce transaction delays.

Convenience: Mobile First

A subjective evaluation is that the OKX WEB3 mobile app currently represents the pinnacle of Web3 product experience for the Chinese community, which is also its biggest moat.

Wallet-DEX-Exchange Integration: Users do not need to switch between different interfaces, simplifying complex operations to a thumb's touch.

Market Dynamics: Intuitively displays market dynamics and automatically marks buy and sell points.

Optimal Pricing: Save Money On-Chain

As a DEX aggregator, OKX DEX Aggregator consolidates almost all mainstream DEXs on-chain, ensuring that every transaction is executed at the best price. When large transactions may cause price fluctuations, it automatically splits orders to execute across multiple DEXs.

Security, speed, convenience, and optimal pricing constitute the four core evaluation standards for on-chain trading products. Security is the foundation, but it is impossible to achieve absolute excellence in all four dimensions simultaneously; some aspects must be prioritized.

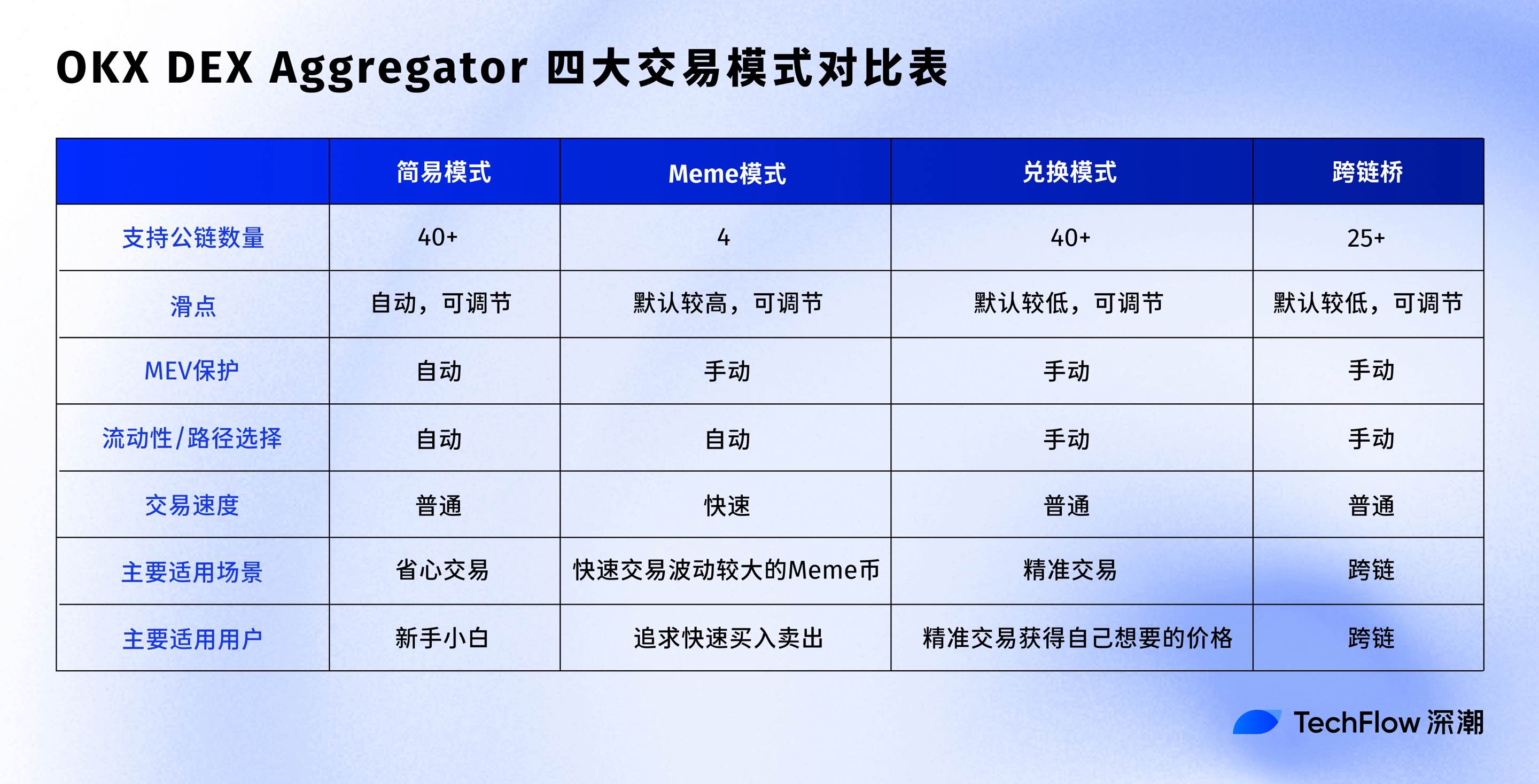

There is no perfect product, only solutions suitable for specific scenarios. The OKX WEB3 team has realized that users' core demands differ in various scenarios. For example, in a highly volatile market, speed is the primary demand, not transaction fees, while in regular large exchanges, price and fees become particularly important. Product strategies need to be dynamically adjusted based on scenarios, leading to the four trading modes of OKX DEX.

Product Thinking Under Four Trading Modes

The dilemma of traditional DEXs lies in the difficulty of achieving security, trading speed, and price advantage simultaneously. OKX DEX Aggregator breaks through this by differentiating demand.

For different scenarios, OKX has four trading modes:

Simple Mode (Beginner Friendly): No cognitive threshold, direct one-click trading.

Exchange Mode (Professional Mode): Opens manual parameter adjustments to meet the deep needs of "precise price control/complex strategies."

Meme Mode (For Meme Traders): Supports four chains: Solana, BSC, ETH, and Base, with a default high slippage, pursuing the fastest buying speed, while also allowing users to set some parameters, aligning with the FOMO mentality of "better to buy high than miss out."

Cross-Chain Mode: Quickly realizes asset flow across multiple chains, supporting rapid cross-chain transfers between EVM chains and from Ethereum and other EVM chains to Solana and others.

The four modes of OKX DEX essentially represent the "risk-efficiency-control" triangular game model of on-chain trading scenarios, implying three layers of product thinking.

Scenario Segmentation

Breaking down the vague behavior of "trading" into:

Newbies lack experience (security) → Simple Mode

Adrenaline demand (speed) → Meme Mode

Precision calculation demand (control) → Exchange Mode

Infrastructure demand (cross-chain) → Cross-Chain Bridge

Game Equilibrium Pricing

The essence of on-chain trading is a competition of risk pricing abilities, with different people bidding differently for risk.

There is also an implicit game mechanism between different modes: the Meme Mode exchanges higher slippage for speed premium; the Exchange Mode exchanges operational complexity for cost advantage.

Ecological Positioning Battle

By covering the entire lifecycle of on-chain users with four modes, it ensures that from beginners to advanced users, they are all using OKX DEX.

- Beginner Phase: Simple Mode cultivates trading habits;

- Growth Phase: Meme Mode releases speculative desires, high-frequency trading;

- Mature Phase: Exchange Mode meets strategic needs;

- Expansion Phase: Cross-Chain Bridge opens up multi-chain layouts.

From Trading Infrastructure to Information Infrastructure

The first step in on-chain trading is to meet the needs for trading, faster trading, and more convenient trading. Whether it is OKX DEX or others, they can meet these needs well. The new battlefield for on-chain products lies before trading—helping users avoid risks and discover alpha.

On-chain is a dark forest, with conspiracy groups and rug pulls emerging endlessly. On one hand, some people gamble small amounts for large returns, earning hundreds of times, but beneath the spotlight of success, there are countless failures, with many small players falling victim.

The advantage of OKX DEX Aggregator lies in being not just a single on-chain trading tool but also a platform that breaks the information gap.

Data Visualization, Discovering New Trends On-Chain: Transforms complex on-chain data into intuitive visual presentations, providing multi-dimensional information aggregation such as popular sectors and rankings, allowing users to directly see the hottest narratives and supporting custom filtering and sorting functions to discover the hottest coins in the market.

Security Protection: Token detection is a unique security feature of OKX, assessing token risks based on on-chain information and continuously monitoring on-chain AMM liquidity pools to gain insights into liquidity changes.

Trader Profiling: View suspicious, sniper, and smart money positions, gain insights into chip distribution information, analyze the profit and loss (PNL) of individual holding addresses, and track historical transactions.

In the latest version of OKX, several practical features have been added:

- Finding Smart Money: Users can monitor smart money movements in real-time on the app, view rankings of smart money addresses, and filter smart money addresses based on metrics such as address count, transaction volume, opening market value, and entry liquidity.

- Twitter Floating Window: While browsing Twitter for wealth information, when hovering the mouse over a token name with a $ tag, the OKX wallet plugin will identify the basic information of that coin, allowing users to view all chain tokens with the same name in the upper right corner and jump to the OKX website to complete transactions in the lower right corner.

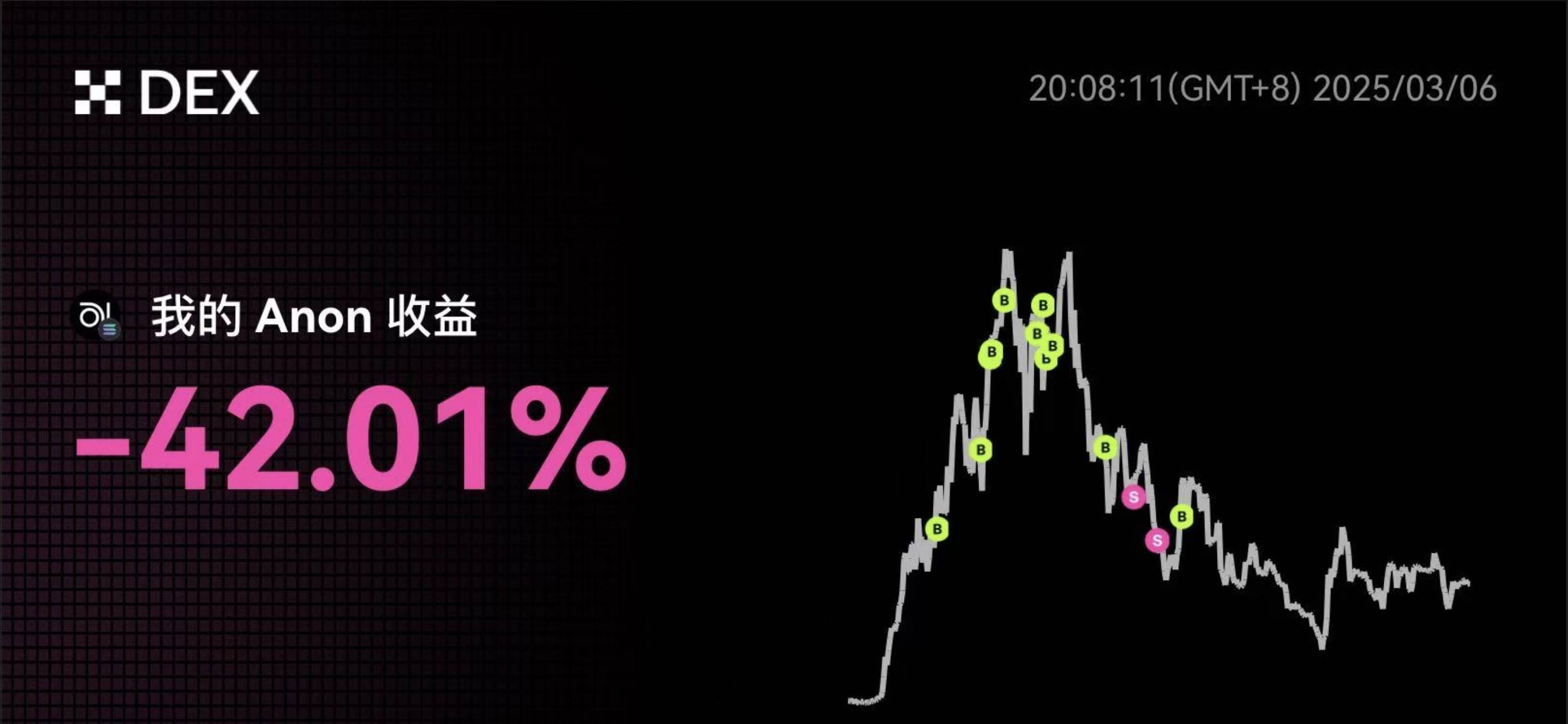

- On-Chain PNL Information Sharing: Users can share their profit and loss situations like on CEX, just like the author, boldly sharing losses for others to see as a joke.

Letting information and data serve on-chain trading, OKX DEX is upgrading from a simple trading channel to building a "cognitive operating system" for on-chain behavior—when trading tools begin to deconstruct the data acquisition methods, risk control models, and decision paths of professional players, the traditional information gap arbitrage space will be systematically compressed.

The ambition of OKX WEB3 may lie in becoming a composite of "Bloomberg Terminal + Trading Platform + Social Graph" in the crypto world. This is the next high ground in the DEX war and the new opportunity that lies ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。