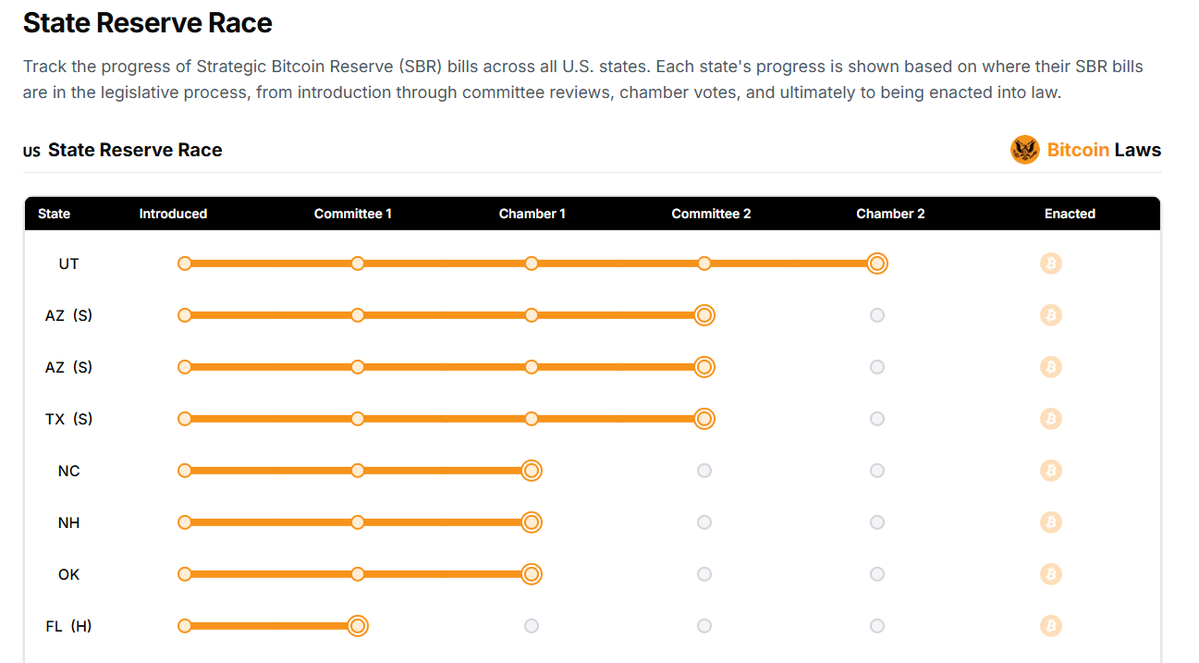

Recent assignments have been all about cats and dogs; the market is under constant pressure every day. It seems that the positive news from the previous day turns into negative news the next day. The difficulty of this market is really increasing. Now, let me share some bad news: today many media outlets are reporting that the #Bitcoin Strategic Reserve Bill in Texas has passed the Senate. This is true, but it does not mean it has been fully passed; it has only passed the Senate, and the next step is to go through the process in the House of Representatives.

In fact, the state that is closest to completion is still Utah, which is waiting for the final approval from the Senate. If it passes, it will be submitted to the governor for signing, and then it will officially become law, potentially taking effect on May 7, 2025. Of course, as long as it passes, it is a good thing, as 5% of a specific fund will be allocated each year to invest in cryptocurrencies with a market value of at least $50 million.

However, regarding the strategic reserve, not only the Chinese-speaking community but even the English-speaking community has lost interest. This recent sell-off is a result of repeated blows to investor sentiment.

Moreover, the sell-off is not limited to cryptocurrencies; even U.S. stocks are facing sell-offs from hedge funds. The trade war (tariffs) has triggered panic among investors. The S&P 500 has fallen below all the gains since Trump's election, and it's not just the S&P 500; U.S. stocks that were leading in gains for 2024 have also dropped below their post-election gains.

Of course, it may not be entirely fair to blame everything on tariffs, but tariffs do bear some responsibility. The S&P 500 and Nasdaq began to decline after reaching new highs on February 19, and U.S. stock investors are starting to declare that the U.S. stock market has entered a bear market.

In the short term, the U.S. may face significant challenges, and it may also be tough for cryptocurrencies. Today, the S&P fell by 2%, and the Nasdaq dropped by 3%, with even the dollar index falling below the gains made after Trump's victory.

Currently, the only positive news that can be confirmed is the potential end of the Russia-Ukraine war. If all goes well, Zelensky should visit the U.S. again for negotiations with Trump within the month. Additionally, before April, Canada and Mexico will not have to implement new tariffs on goods that comply with the USMCA agreement.

If the U.S. can reach an agreement with Ukraine and sign a rare earth minerals agreement before this, it would indicate that the end of the war is in sight, and European tariffs may also be easier to handle. If Canada and Mexico can fully implement the USMCA agreement, it may become somewhat simpler.

Looking back at BTC data, the restlessness of short-term investors has not yet ended, with turnover rates continuing to increase. In recent days, the market has been repeating a pattern of rising one day and falling the next. As mentioned earlier, today's positive news may turn into negative news by tomorrow, and even Trump's decision to delay tariffs did not lead to a second day of market gains.

Today, Trump has again called for the Federal Reserve to lower interest rates, which is quite interesting. He called for the Fed to lower rates when he first took office in January, then initiated the tariff mode, and after the Fed maintained interest rates in January, Trump praised the Fed for not lowering rates, only to start calling for rate cuts again more than a month later.

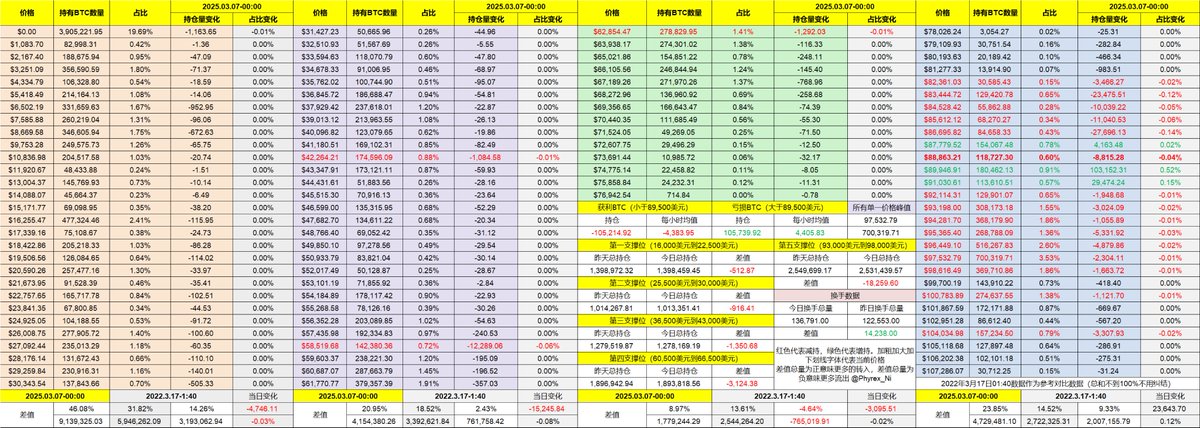

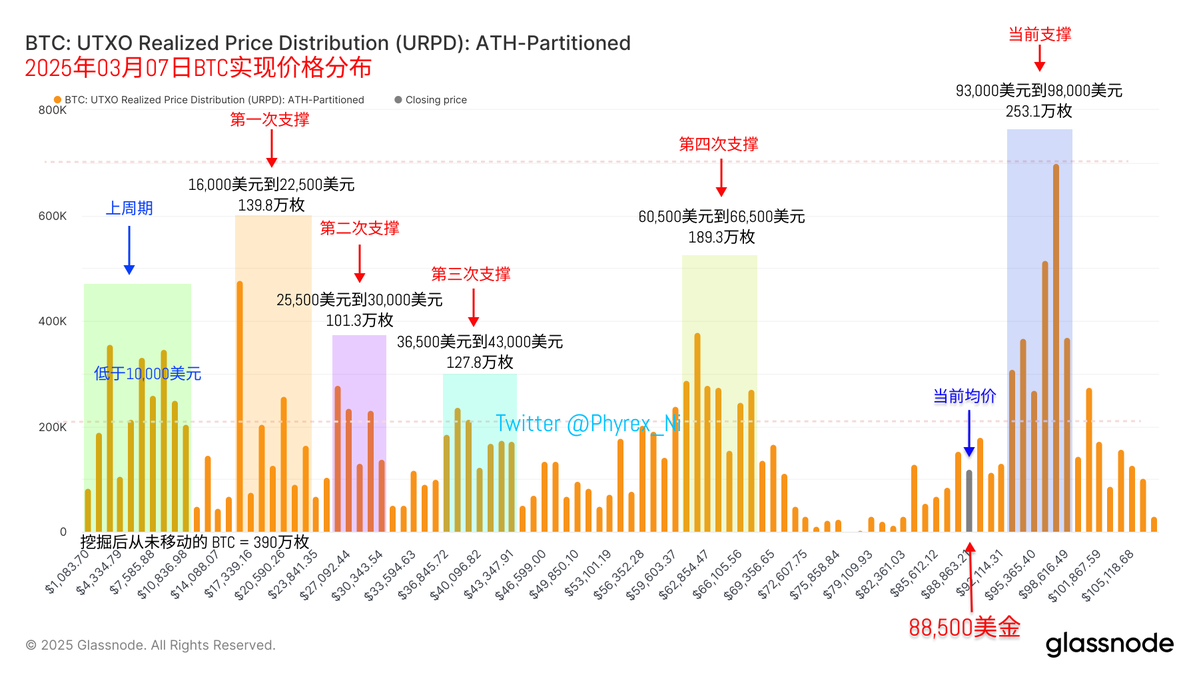

Currently, BTC's support remains between $93,000 and $98,000. I know many friends are very sensitive to the term "support," believing it has already broken down and should not be called support but rather resistance. But to be honest, the sell-off at this level is very small; it is not because of significant sell-offs at this level that it cannot rise.

Additionally, support is not just about price; it also includes investor confidence and concentrated holdings. Last year, it took six months to explain this, but now it cannot be explained.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。