The greatest dilemma in life often lies in seeing all the paths clearly, yet not being able to see one's own footprints. Some hold torches chasing the sunrise, while the wise listen to the direction of the tides in the fog. When lost, remember: the deepest clarity often arises from the center of chaos. The direction is not in the distance, but in the heart that continues to beat even when the steps pause!

Yesterday, the operation with Bitcoin ultimately ended with a stop-loss. The market showed a strong upward trend, and despite the continuous rise, after shorting above 88000, we did not see any effective pullback, and it directly broke through 90000, resulting in a stop-loss on the short position. According to yesterday's analysis, the idea of shorting after a rebound was based on the expectation that the market would rise but not so strongly; rather, it would oscillate and wait for the news from the crypto summit on the 7th to stimulate a phase of market movement. However, the strength of the movement was unexpected. The current short position in Ethereum is still held, with Bitcoin losing around 1500 points. Next, we will look for good opportunities to earn back more.

Currently, the main market news is focused on Friday, which is of significant importance. On Friday, there will be non-farm payroll data, and it is also the first crypto summit. The importance of this Friday is evident; whether it is the non-farm data or the crypto conference, the non-farm data is crucial for economic indicators, which may impact the Federal Reserve's subsequent monetary policy. The crypto conference will directly determine the future development of virtual currencies. Therefore, any key information that emerges will have a huge impact on the entire market.

From a technical cycle perspective, after a series of consecutive bullish K-lines on the four-hour level, the market strongly surged again, forming a V-shaped reversal pattern. Looking at the four-hour chart, the technical indicators show that the coin price is approaching the resistance near 94000. It is crucial to consider whether the market can strongly surge and break through this resistance, or even the larger resistance at 98000, before any actual positive news from the crypto conference comes out. Additionally, the recent market has been oscillating back and forth, with severe polarization, making it somewhat unrealistic for the market to establish a strong one-sided trend. On the hourly cycle, although the K-line shows a continuous upward bullish trend, the MACD volume is starting to decline, indicating some divergence, so we need to be cautious of a corrective pullback after a high.

Now everything depends on the expectations of the summit. If there is no mention or if the strategic reserves are rejected, it will be a significant negative in the short term, and the market will likely retest support. Conversely, if positive news emerges, the strong market will be maintained. This is currently a major uncertainty in the market.

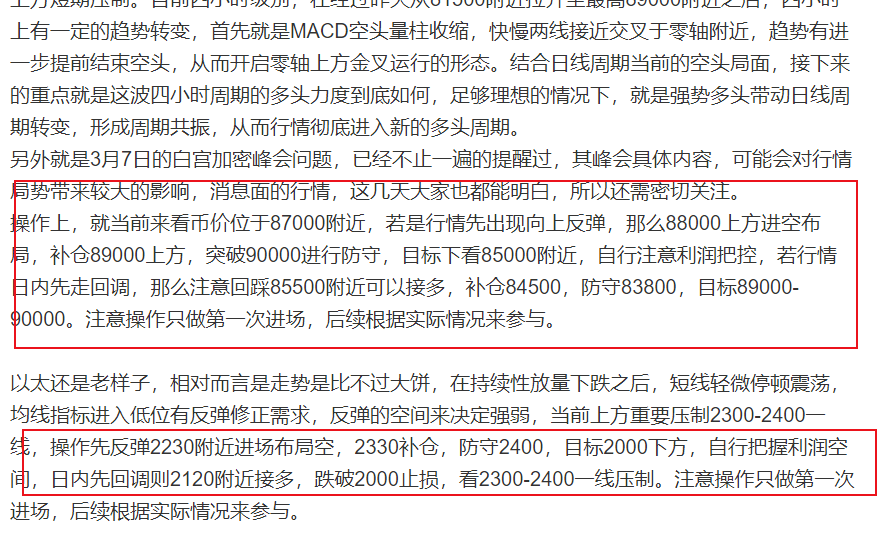

In terms of operations, the current position is not suitable for directly participating in long positions; it is better to short in the short term, waiting for a test of the short-term support at the 90000 level and around 88500. Near 93000, one can short directly, with a stop-loss above 94000, targeting 90000 and the continuation of the decline thereafter, entering short positions only on the first touch.

As for Ethereum, the situation remains the same; yesterday's short position is still held. For those without short positions, participation can be considered above 2300. Currently, Ethereum's upward momentum is not as strong as Bitcoin's, and if a decline occurs, it will certainly follow suit. Therefore, it is advisable to view Ethereum as weak.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be delayed, and strategies may not be timely. Specific operations should follow real-time strategies. Feel free to contact us for market discussions.】

Scan to follow our public account!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。