This article provides a detailed analysis of how the SIMD-0228 proposal will change Solana's inflation mechanism.

Author: @lvxuan147

Key Points | Too Long; Didn't Read | TL;DR

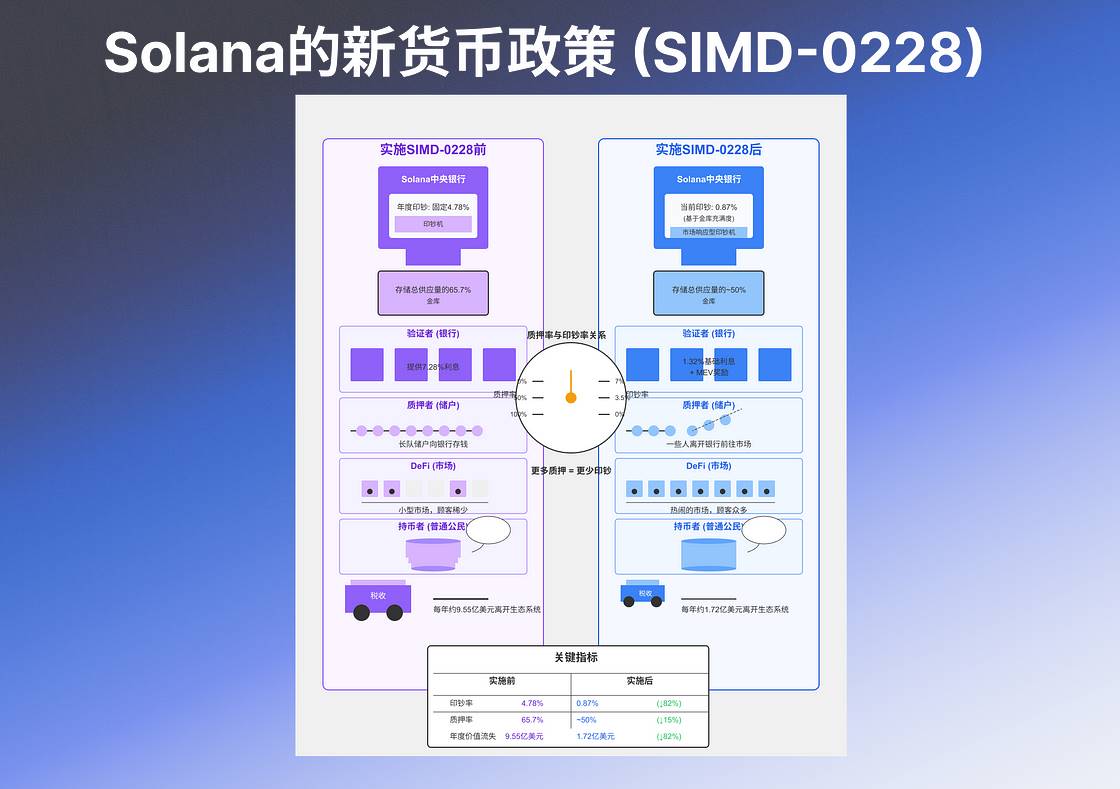

Proposal Essence: SIMD-0228 significantly reduces Solana's inflation rate (from 4.779% to 0.87%), decreases token issuance, ensures network security, and releases capital for DeFi.

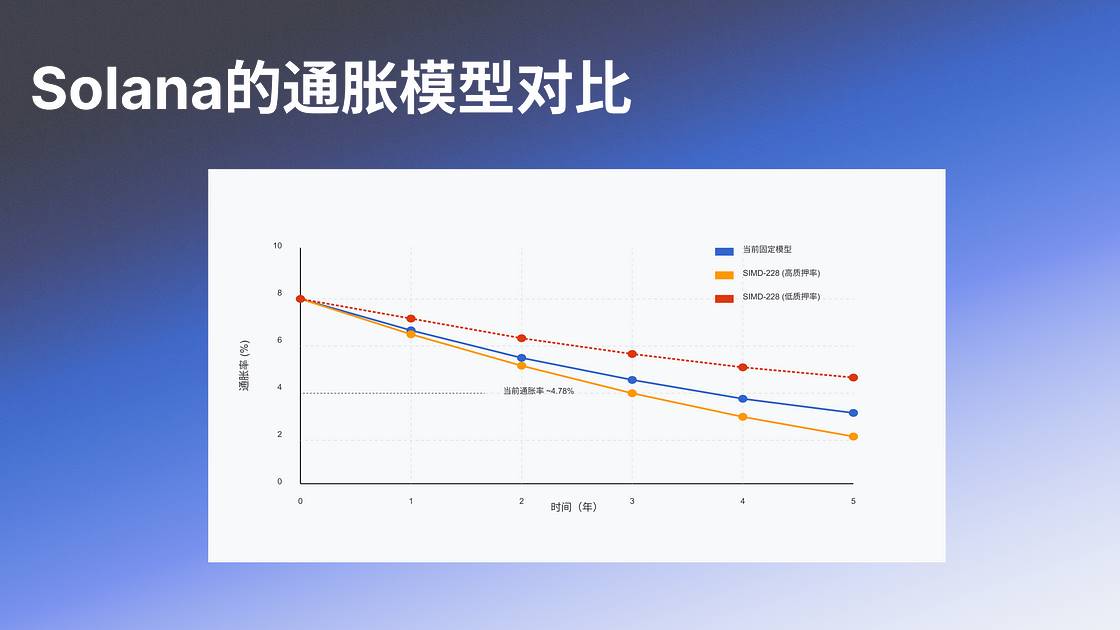

Core Mechanism: The current fixed inflation decreases (8% reduced by 15% annually, targeting 1.5%) has been criticized as "foolish issuance"; the new model is market-driven, with high staking rates (>65%) leading to low inflation, and low staking rates (33.3%) leading to high inflation, with 33.3% as the equilibrium point.

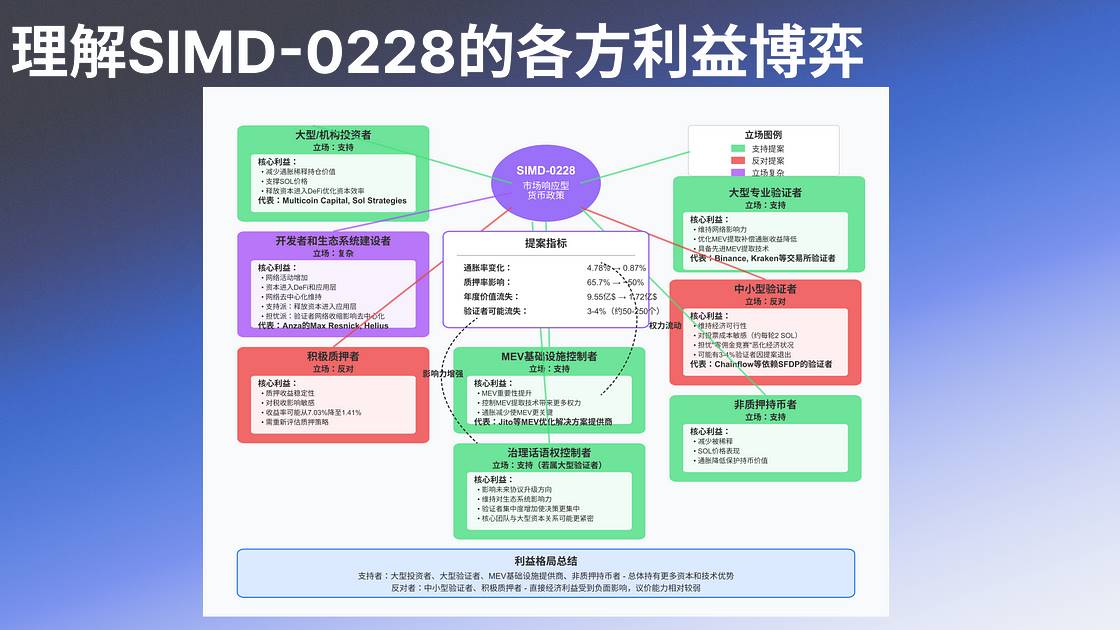

Position Divergence: Large investors and non-stakers support (less dilution, stable prices); small and medium validators and stakers oppose (declining yields); large validators support (strong MEV). Big fish thrive, small fish struggle, like supermarket price cuts, big stores are fine, small stores close.

Validator Impact: Staking rates may drop from 65.7% to 45–55%, with 3–4% of validators (40–55) potentially exiting, income shifting from inflation to MEV, and DeFi locking SOL increasing by 5–10%, similar to factory layoffs, with efficient ones staying and inefficient ones leaving.

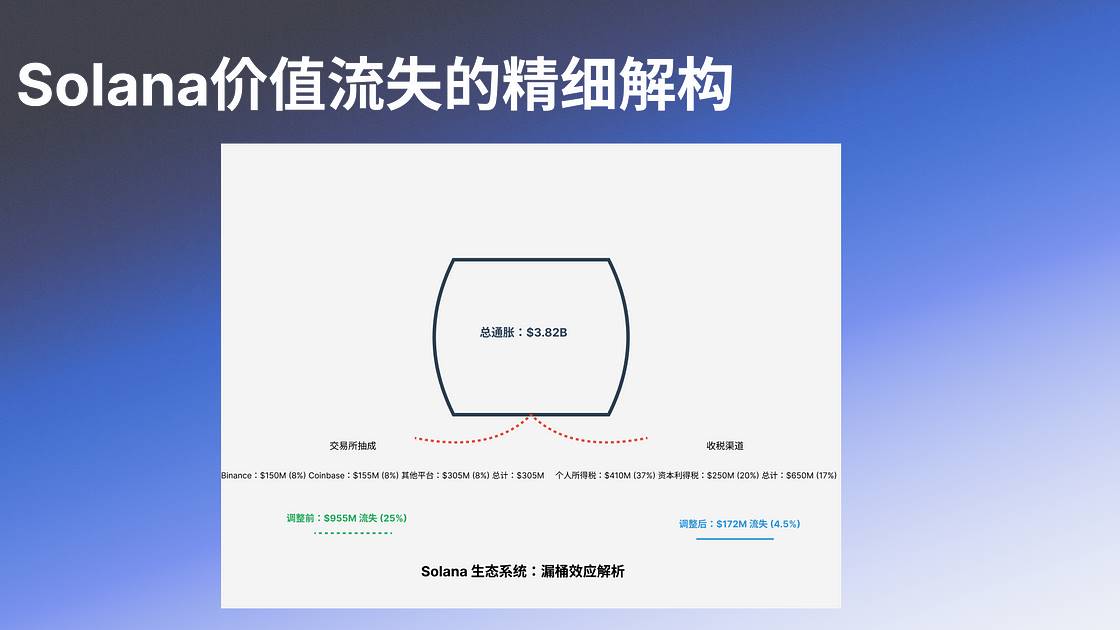

Ecological Impact: Annual issuance of 382 million, with 25% (95.5 million) leaking out; the SIMD-0228 proposal plugs the "leaky bucket," retaining 783 million annually, promoting DeFi development, optimizing resources, and reducing dilution.

MEV and Inflation: Validator income shifts from "fixed salary" to relying on "tips" (MEV), with MEV reaching 675 million in 2024, accounting for 14% of issuance, high yield but unstable.

Security Risks: Low staking rates → inflation rises → price drops → validators exit, creating a vicious cycle; increased reliance on MEV raises centralization risks, stability under extreme conditions remains to be tested, similar to economic recessions, with preventive measures but not foolproof.

Proposal Significance: SIMD-0228 represents not just a technical change but a profound restructuring of Solana's economic framework, shifting from "overpaying for security" to "finding the minimum necessary payment," moving from artificial rules to market balance, akin to transitioning from a planned economy to a market economy, with Solana having the potential to evolve into a more mature, market-oriented economic model.

Action Recommendations: Depending on whether the proposal passes, if it does, holders need to adjust staking strategies, validators need to optimize MEV, and developers should seize new DeFi opportunities.

Key Terms Explained

Before diving deeper, let's understand a few core concepts:

Staking Rate (s): The percentage of SOL locked for network validation out of the total supply, currently around 65.7%.

Inflation Rate (i): The percentage of newly issued SOL each year out of the total supply, currently around 4.779%.

Validators: Node operators in the Solana network responsible for validating transactions and maintaining network security.

MEV (Maximum Extractable Value): Additional income validators earn from transaction ordering, similar to "transaction tips."

Leaky Bucket Effect: The phenomenon where new value created by inflation leaks out of the ecosystem through taxes and other channels.

Beginner-Friendly Guide: This article provides a detailed analysis of how the SIMD-0228 proposal will change Solana's inflation mechanism. Even if you're not familiar with blockchain and cryptocurrency concepts, you can focus on the "💡 Beginner's Explanation" sections, where I will explain obscure and complex concepts in simple language. Now, let's officially get into the topic below.👇🏻

0. Introduction: Five Key Questions Interpreting the Turning Point of Solana's Inflation Policy

Solana stands at a historic turning point — the SIMD-228 proposal could fundamentally change its inflation mechanism from a fixed schedule to a market-driven dynamic model. This is not just a technical change but a profound restructuring of the entire Solana ecosystem's economic structure.

The core issue the SIMD-228 proposal seeks to address is: how to minimize unnecessary token issuance while ensuring network security?

After understanding the core issue, let's delve into the background. The following five questions I have outlined will help understand why this proposal has sparked such widespread discussion:

What deep games are behind the proposal? How will the distribution of the interest pie be reshaped?

What impacts will the validator economy face? How will it be reshaped?

Will a lower staking rate threaten network security? Is there a critical point?

How will the relationship between MEV and inflation change? What impacts will the shift in income sources bring?

How is the "leaky bucket effect" quietly eroding the Solana ecosystem? Are hundreds of millions of dollars leaking out every year?

Could a low staking rate trigger systemic risks? Will the negative feedback loop threaten network stability?

💡 Beginner's Explanation: Imagine Solana as a country considering changing its "money printing" method. Currently, this country prints new money each year according to a fixed plan; the new proposal suggests determining how much new money to print based on how many people deposit money in banks (staking). If many people deposit money, less new money is printed; if few people deposit, more new money is printed. This change will affect everyone: banks (validators), depositors (stakers), consumers (application users), and ordinary holders.

1. Deep Understanding of SIMD-0228: Authors, Timing, Core Changes, and Interests

Proposal Authors: Heavyweights

The SIMD-0228 proposal is co-authored by three influential figures in the Solana ecosystem:

Tushar Jain— Co-founder of Multicoin Capital, one of the earliest and largest institutional investors in Solana. Tushar has publicly expressed long-term optimism for Solana and discussed blockchain monetary policy on multiple occasions.

Vishal Kankani— Investment partner at Multicoin Capital, focusing on cryptocurrency economics and market structure research. He has published several analytical articles on the Solana ecosystem and value capture mechanisms.

Max Resnick— Engineer at Anza, a member of the Solana core development team, with a strong technical background and deep understanding of the Solana codebase. He provides expertise in technical implementation in the proposal.

It is noteworthy that two of the authors are from Multicoin Capital, which is one of the largest institutional investors in the Solana ecosystem, holding a significant amount of SOL tokens. This background is crucial for understanding certain interests behind the proposal.

💡 Beginner's Explanation: The authors of the proposal are not ordinary people but "big players" in the Solana world. Two are executives of a large investment fund holding a lot of SOL; the other is a core technical person in Solana. Understanding who is driving this change is important because it may influence how they design the proposal.

Proposal Timing: In January 2025

MEV Revenue Growth— In Q4 2024, Solana's MEV revenue reached an astonishing 430 million dollars, more than ten times that of Q1. This data strongly supports lowering inflation (Solana Floor), indicating that validators already have sufficient alternative income sources.

High Staking Rate Status— The current staking rate of 65.7% is at a historical high, creating favorable conditions for lowering inflation.

Ecosystem Maturity— The Solana DeFi ecosystem is mature enough to absorb and utilize the capital released from staking.

Market Environment— In the broader cryptocurrency market, monetary policy and inflation control have become hot topics.

Core Changes: Current Status vs. Proposal Goals (Idealized)

The following table compares the current state of the Solana network (as of January 18, 2025) with the expected goals after the implementation of the SIMD-0228 proposal:

These data clearly show the core goals of SIMD-0228:

Significantly reduce the inflation rate

Decrease unnecessary token issuance

Maintain sufficient network security while releasing more capital into the DeFi ecosystem.

💡 Beginner's Explanation: The comparison of Solana's inflation model in this table shows how significant the changes are. Simply put: currently, Solana's "money printing" speed is 4.78% per year, and the new proposal aims to reduce it to around 0.9%, an 82% reduction! This means that the basic salary of validators (network maintainers) will significantly decrease, but they can compensate through other income (MEV, which can be understood as "tips" for transaction ordering). At the same time, about 40–55 small validators may exit the network due to insufficient income.

Original Formula and Design Concept

The SIMD-0228 proposal centers on introducing a dynamic inflation formula based on the staking rate:

This formula may look complex, but its design is very clever:

It uses a square root function instead of a linear relationship, which reduces inflation more gently at high staking rates and increases inflation more aggressively at low staking rates.

A critical point is designed: when the staking rate is 33.3%, the inflation rate equals the current fixed rate.

The coefficient c (approximately equal to π) ensures a smooth transition of the formula across different staking rate ranges.

💡 Beginner's Explanation: Don't worry about this complex formula! The following image will help you understand it simply; the key is to grasp its function: when many people stake SOL (over 65%), the "money printing" speed will significantly decrease; when fewer people stake (below 50%), the "money printing" speed will moderately increase; if the staking rate falls below 33.3%, the "money printing" speed will significantly increase to attract more people to stake. It's like an automatic regulator that maintains the balance of the network.

SIMD-0228 scenario simulations: high staking rate, medium staking rate, low staking rate; the formula design reflects: automatically adjusting the inflation rate through market mechanisms to just meet the network security needs, neither more nor less.

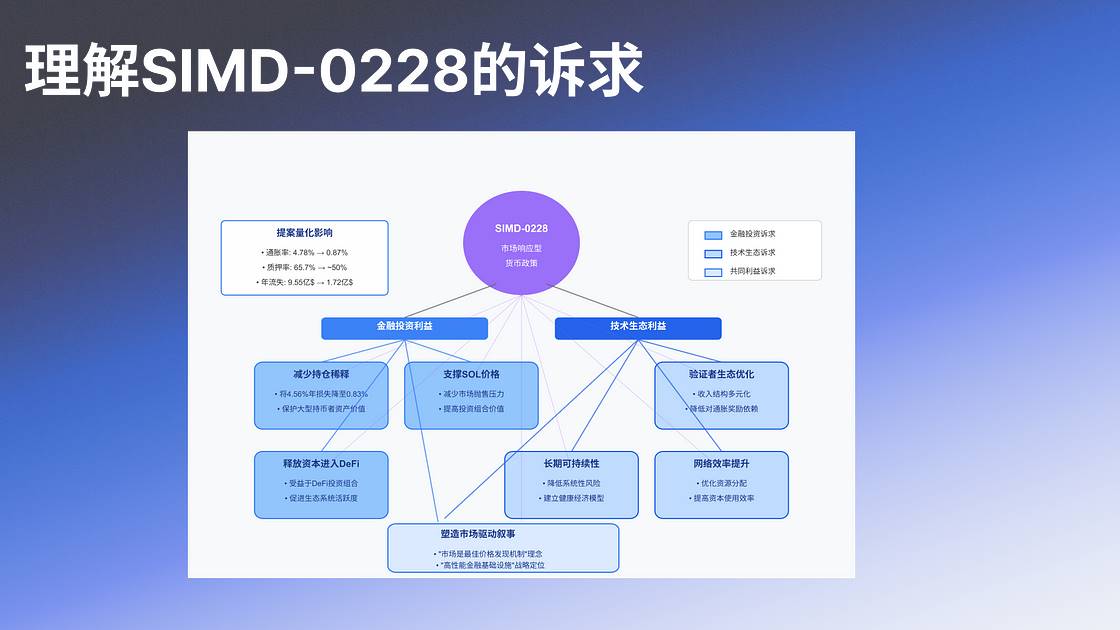

Proposal Interests

By carefully analyzing the proposal content, author backgrounds, and timing, we can identify the following main interests:

Reduce holding dilution— Multicoin Capital holds a large amount of SOL, and lowering inflation reduces annual dilution by 4.56%.

Support SOL price— Reducing new supply may push prices up (Cryptotimes).

Release capital into DeFi— The proposal emphasizes that high staking rates suppress DeFi development, promoting capital inflow into DeFi, benefiting projects invested by Multicoin.

Shape a market-driven narrative— The proposal emphasizes that "the market is the best price discovery mechanism in the world," reinforcing Solana's positioning as an "efficient network."

Optimize the validator ecosystem— Max Resnick focuses on long-term sustainability, reducing reliance on inflation.

💡 Beginner's Explanation: There are multiple motivations behind the proposal. Imagine you own 10% of a company. If the company issues 5% new shares to employees each year, and you don't receive any of those new shares, your ownership percentage will be diluted over the years. Large investor Multicoin wants to reduce this dilution while also hoping for an increase in SOL prices (reducing supply growth is usually favorable for prices). Additionally, they want more SOL to flow into DeFi applications because they have also invested in these applications.

It is worth noting that, as shown in the diagram below, although the proposal may align with the interests of large investors, its design indeed considers the healthy development of the entire ecosystem. The safety threshold design in the formula, the 50-round smooth transition period, and other details indicate that the authors are trying to find a balance among multiple interests.

Proposal Timing

The proposal's choice to be presented in January 2025 also has specific strategic significance:

MEV revenue growth— In Q4 2024, MEV revenue reached an astonishing 430 million dollars, more than ten times that of Q1. This data strongly supports lowering inflation, indicating that validators already have sufficient alternative income sources.

High staking rate status— The current staking rate of 65.7% is at a historical high, creating favorable conditions for lowering inflation.

Ecosystem maturity— The Solana DeFi ecosystem is mature enough to absorb and utilize the capital released from staking.

Market environment— In the broader cryptocurrency market, monetary policy and inflation control have become hot topics, and this proposal resonates with broader market trends.

💡 Beginner's Explanation: The timing of the proposal is also very deliberate. Just like choosing to reform during a good economy, the proposers have chosen a moment of "favorable timing, location, and harmony": validators have seen a significant increase in additional income from transactions (MEV); the current staking rate is high (65.7%); and Solana's application ecosystem is already mature. All these factors make it a good time to reduce the "money printing" speed.

2. From Fixed Time to Market-Driven: More Staking, Less Money Printing

Currently, Solana adopts a fixed declining inflation mechanism: starting from an initial 8%, it decreases by 15% each year, currently down to about 4.78%, ultimately reaching a bottom line of 1.5%. This mechanism has been referred to by the proposers as "dumb emissions" because it does not consider the actual state of the network.

The new model proposed by SIMD-0228 introduces market factors, dynamically linking the inflation rate to the staking rate. This design aims to let the market determine inflation rather than following a preset fixed schedule. When the staking rate is 33.3%, the inflation rate will equal the current fixed rate, forming a critical balance point.

The key feature of this formula is: the higher the staking rate, the lower the inflation rate; the lower the staking rate, the higher the inflation rate. This design allows the network to automatically adjust the inflation rate to maintain an appropriate level of staking participation, ensuring network security while avoiding excessive issuance.

💡 Beginner's Explanation: Currently, Solana's "money printing" plan is fixed: it decreases by 15% each year until it reaches 1.5%. This is like a country printing money according to a fixed plan regardless of economic conditions. The new proposal is more like a modern central bank: dynamically adjusting the money supply based on economic conditions (staking rate). If the economy is active (high staking rate), it reduces money printing; if the economy is sluggish (low staking rate), it increases money printing to stimulate activity.

3. How Will Solana's New Monetary Policy Reshape?

3.1 Large Investors/Institutional Investors

Core Interests: Reduce dilution, support prices, optimize DeFi capital efficiency.

Representative Views: Tushar Jain and Vishal Kankani state that lowering inflation stimulates DeFi (SIMD-228 and Solana DeFi).

Max Kaplan from Sol Strategies proposes the idea of "better to be roughly right than precisely wrong," emphasizing the flexibility of market-driven mechanisms.

Marius, co-founder of Kamino, points out that "staking encourages hoarding and reduces financial activity," supporting reduced inflation to enhance liquidity.

Potential Motivation: Shape the narrative of a "market-driven efficient network," attract more institutional investment, and potentially diversify investments within the ecosystem to optimize overall portfolio value.

Position: Support, as lowering inflation reduces new supply, protects their holding value, and enhances the ecosystem's attractiveness through DeFi activities.

3.2 Validators

Large Professional Validators

Core Interests: Maintain network influence, optimize MEV extraction to compensate for reduced inflation income.

Characteristics: Possess advanced MEV extraction technology, significant voting power, important influence on network governance, and strong adaptability to inflation changes.

Representatives: Validators operated by exchanges, such as Binance and Kraken; institutional key validators, with an average inflation commission rate of 2.75%.

Position: Support, as they can compensate for reduced income through MEV and transaction fees, maintaining profitability.

Small and Medium Validators

Core Interests: Maintain economic viability, sensitive to voting costs (about 2 SOL per round).

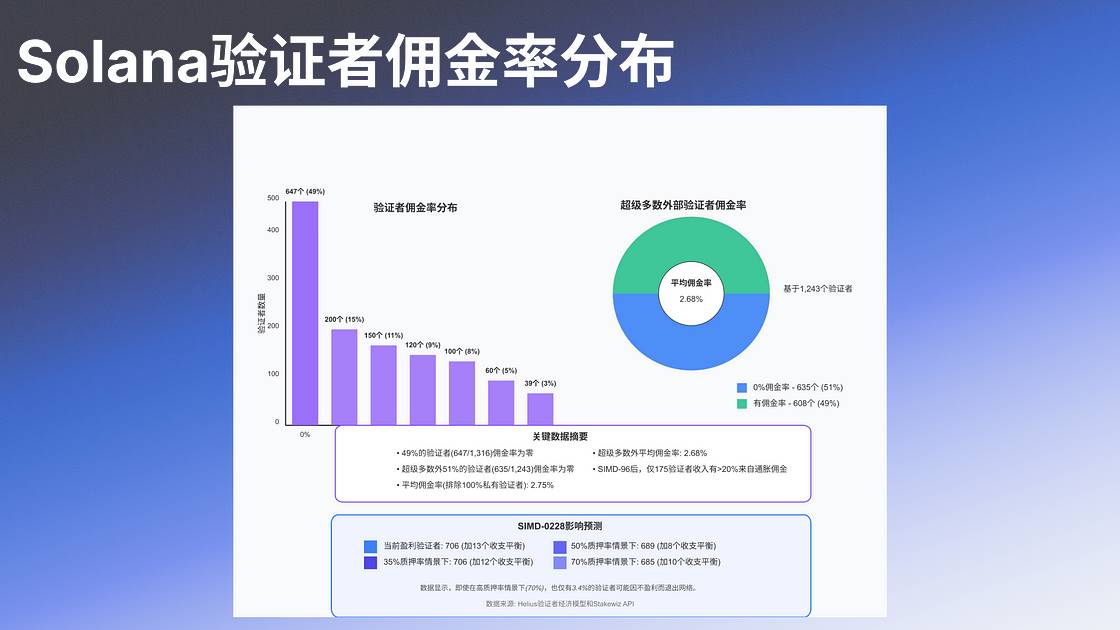

Concerns: Helius data shows that 3–4% of validators may exit due to the proposal; they worry that a "zero-commission race" will further worsen economic conditions, with 49% of validators having a zero commission rate, showing low sensitivity to inflation changes.

Representatives: Validators relying on the Solana Foundation Delegation Program (SFDP), such as Chainflow.

Position: Oppose, with potential exits (David Grider on X).

3.3 Developers and Ecosystem Builders

Core Interests: Increased network activity, capital entering DeFi and application layers, and maintaining network decentralization.

Diverging Views:

Supporters: Believe the proposal will release more capital into the application layer, such as Max Resnick from Anza (co-author of the proposal) emphasizing the "leaky bucket" effect, reducing tax loss (Solana’s SIMD-0228 Proposal Could Slash SOL Inflation to 0.87%).

Concerned Parties: Worry that the contraction of the validator network may impact decentralization, as Leapfrog mentioned in community discussions that it could trigger an inflation spiral (Six Questions and Answers: A Comprehensive Analysis of Solana’s Latest Proposal SIMD-0228 and Its Impact on the Industry).

Representatives: Helius (node service provider) provides neutral data analysis, emphasizing network health.

Position: Complex, with some seeing growth potential in DeFi while others worry about decentralization risks.

3.4 Ordinary Token Holders

Active Stakers

Core Interests: Stability of staking rewards, sensitivity to tax impacts.

Impact: In high staking scenarios, yields may slightly decrease but become more sustainable, for example, from 7.03% to 1.41%, requiring a reassessment of staking strategies, possibly concentrating on validators with strong MEV capabilities.

Position: Opposed, as reduced yields affect their investment returns.

Non-Staking Holders

Core Interests: Reduction of dilution, performance of SOL prices.

Impact: Directly benefit from reduced inflation, as prices may receive support when the "leaky bucket" effect diminishes.

Position: Supportive, as reduced inflation protects their token value.

2.5 Hidden Games

MEV Infrastructure Controllers

Core Interests: As inflation rewards decrease, the importance of MEV increases, and controlling MEV extraction technology brings more power.

Representatives: Providers of MEV optimization solutions like Jito, entities controlling block packaging algorithms.

Position: Supportive, as reduced inflation makes MEV more critical, enhancing their market position.

Governance Discourse Controllers

Core Interests: Influence the direction of future protocol upgrades and maintain influence over the ecosystem.

Potential Outcomes: If validator concentration increases, governance decisions may become more centralized, and the core development team may have closer ties to large capital.

Position: Supportive (if large validators), as increased validator concentration makes it easier to control network decisions.

Community Controversy:

There is controversy in the community regarding IMD-0228, especially concerning its impact on small validators. David Grider's long tweet shows that under different scenarios, 50–250 validators may be lost, which could lead to risks in network decentralization, raising community concerns. An unexpected detail is that the exit of small validators could trigger a "zero-commission race," further worsening their economic conditions, while large validators may enhance their influence through MEV.

Helius Blog's Latest Article Also Analyzes: Validator Economic Models Under Challenge

Large Professional Validators: Potential Winners of Survival of the Fittest, large professional validators typically have the following advantages:

Possess advanced MEV extraction technology to compensate for reduced inflation income.

Have sufficient capital and technical resources to adapt to the new environment.

Hold greater influence in network governance.

For this group, SIMD-0228 may present an opportunity to gain a larger market share in the validator ecosystem. By optimizing MEV extraction and reducing operational costs, they can maintain or even increase profitability.

Small and Medium Validators: Facing Survival Challenges Compared to large professional validators, small and medium validators face greater challenges:

Typically lack efficient MEV extraction capabilities.

More sensitive to voting costs (about 2 SOL per round).

At a disadvantage in the "zero-commission race."

Small validators like Chainflow have expressed concerns, stating, "Despite our best efforts to attract staking, we still rely heavily on the SFDP delegation to continue operations."

According to validator economic model data:

Among 1,316 validators, 647 (49%) have a staking reward commission rate of zero, making them less affected by inflation changes.

In high staking scenarios (70%), approximately 3.4% of validators are expected to exit due to unprofitability.

David Grider's model indicates that under different scenarios, 50–250 validators may exit.

In Summary

The interest game of the IMD-0228 proposal reflects the complexity of the ecosystem. Large investors and institutions support it, the validator group is divided (large validators support, small validators oppose), developers and ecosystem builders have complex positions, and ordinary token holders are also divided (stakers oppose, non-stakers support). In the hidden power dynamics, MEV controllers and governance influencers may be supportive.

💡 Beginner's Explanation: This is like the retail industry's transformation: large chain stores (large validators) have the resources to invest in advanced technology and can survive through efficiency and scale advantages when profits decrease; while small independent stores (small validators) face greater pressure and may be forced to close or be acquired. SIMD-0228 may lead to about 40–55 small validators exiting the network because they cannot be profitable in the new environment.

4. Impact of SIMD-0228 on the Validator Landscape

SIMD-0228 may have drastically different impacts on different types of validators. According to Helius's validator economic model:

Among 1,316 validators, 647 (49%) have a staking reward commission rate of zero, making them less affected by inflation changes.

In high staking scenarios (70%), approximately 3.4% of validators are expected to exit due to unprofitability.

David Grider's model indicates that under different scenarios, 50–250 validators may exit.

This change not only affects the economic viability of individual validators but may also alter the structure and competitive landscape of the entire validator ecosystem. The key question is: Are we willing to accept a reduction in the number of validators in exchange for a more efficient economic model?

💡 Beginner's Explanation: The "Survival Game" of Validators

Imagine the Solana network as a large factory, with validators as the quality inspectors of the factory. Now, the factory management (network governance) is adjusting the reward mechanism:

Previously: Each inspector received a fixed salary.

Now: Only the most efficient inspectors can earn more rewards.

The result? Some less efficient inspectors may be eliminated, the entire quality inspection process may become more refined, but the overall number of inspectors will slightly decrease.

The key question: Are we willing to exchange a slightly reduced number of "inspectors" for a more efficient and precise system?

5. Will a Decrease in Staking Rate Threaten Network Security? Finding the Balance Between Security and Efficiency

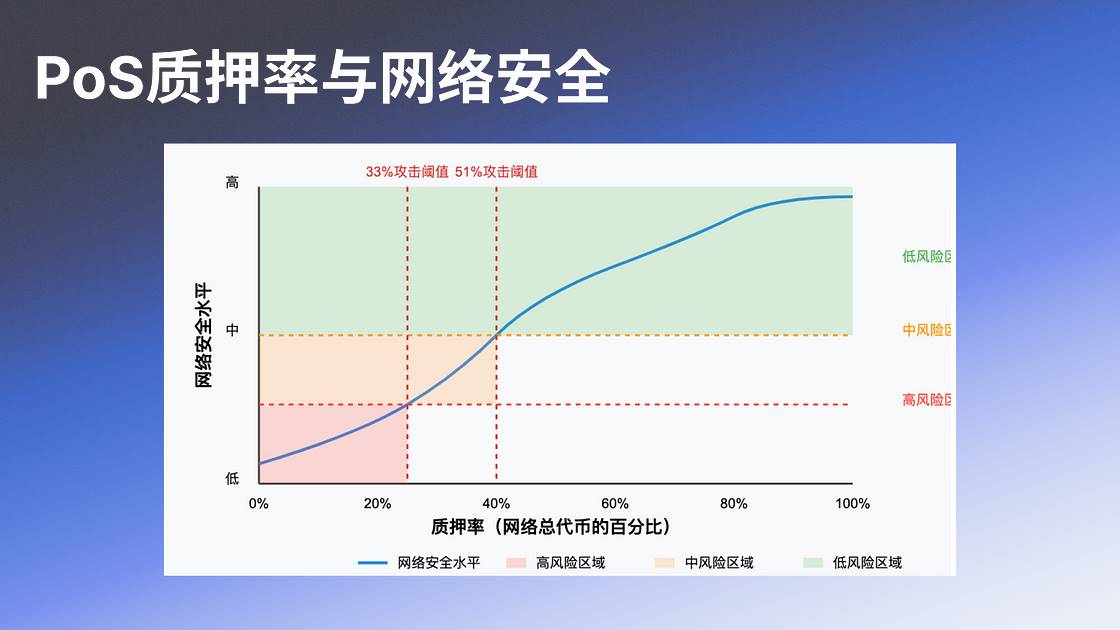

The staking rate is one of the key indicators for assessing the security of PoS networks. Currently, Solana's staking rate is about 65.7%, significantly higher than many other PoS networks. SIMD-0228 may lead to a decrease in this number, raising concerns about network security.

Staking Rate Predictions and Security Thresholds

According to simulation data:

At the market equilibrium point, the staking rate may drop from 65.7% to the 45–55% range.

When the staking rate falls to 33.3%, the inflation rate will equal the current fixed rate.

In the worst-case scenario, the staking rate may further decline, triggering a negative feedback loop.

The key question is: What is the "sufficient" threshold for network security? Is it 33%, 40%, or higher? This remains undecided in the community.

Another Aspect: The Shift in Security Models

SIMD-0228 essentially represents a shift in security models:

From "overpaying to ensure security" to "finding the minimum necessary payment."

From "fixed incentives" to "market-determined incentives."

From "inflation-driven security" to "value-based security."

This shift reflects Solana's transition from its startup phase to maturity. As network activity and MEV revenues increase, excessive inflation may no longer be necessary.

The following diagram👇🏻 illustrates the relationship between staking rate and network security. As the staking rate increases, the cost of attacks rises, enhancing network security, but there is a clear diminishing return.

The design of SIMD-0228 can maintain network security while improving capital efficiency: the SIMD-0228 proposal adjusts Solana's staking rate from the current "potentially over-secure" area to a more balanced range while retaining sufficient safety margins.

💡 Beginner's Explanation: Imagine a country's military: currently, 65.7% of the population serves in the military, which far exceeds actual needs. The new proposal may reduce this number to 45–55%, still sufficient to ensure security while releasing more manpower for economic activities. However, if the ratio drops too low (below 33.3%), it may threaten national security. The key question is: Where is the critical point for security?

6. How Will the Relationship Between MEV and Inflation Change? The Impact of Shifting Revenue Sources

As blockchain technology continues to mature, the role and importance of MEV will continue to evolve. The key is how to balance the economic incentives brought by MEV while maintaining network decentralization and efficiency.

As SIMD-0228 may reduce inflation rewards, MEV (Maximum Extractable Value) will become a more important component of validator income. This shift could profoundly impact the transformation of validator income structures and the dynamic changes within the Solana network.

Transformation of Income Structure

Shift in Revenue Sources: Traditionally, validators' main source of income has been inflation rewards. However, with the potential implementation of the SIMD-0228 proposal, MEV will gradually become a key component of validator income. This shift reflects a deep evolution in blockchain economic models.

Rapid Growth of MEV Earnings: The provided data indicates that this growth trend shows MEV has become an important source of income for validators, even surpassing inflation rewards in certain quarters of 2024. The total MEV earnings for 2024 are estimated to be around 3.7M SOL ($675M), with MEV earnings showing significant exponential growth.

Impact Analysis

Compression of Inflation Rate: The SIMD-0228 proposal aims to reduce inflation rewards, which will directly lead to a decrease in income for validators derived from inflation. In contrast, MEV provides a rapidly growing alternative source of income.

Diversification of Income: The rapid growth of MEV means that the income structure of validators is undergoing fundamental changes: under the traditional inflation model, income is relatively stable and predictable, while under the MEV model, income becomes more dynamic and volatile, reflecting changes in network dynamics.

Changes in Network Dynamics: The growth of MEV earnings will bring about a series of profound impacts: validators' behavior will become more market-oriented, competition over block construction and transaction ordering will intensify, and the incentive mechanisms for network participants will become more complex.

Potential Risks and Challenges

Income Uncertainty: The volatility of MEV earnings may increase financial uncertainty for validators, leading to more aggressive network participation strategies, which could trigger new centralization risks.

Reshaping Blockchain Economic Incentive Models: In 2024, MEV earnings (3.7M SOL) are close to 14% of the new issuance under the current inflation rate, indicating that MEV is becoming a revenue source comparable to inflation rewards. In the long run, this could reshape the economic incentive models of blockchain.

Chain Reaction of Validator Behavior and New Risks

This shift will lead to:

Validators focusing more on optimizing MEV extraction technology.

MEV extraction capabilities becoming a key differentiating factor in validator competitiveness.

Network security shifting from reliance on inflation incentives to greater dependence on MEV earnings.

However, this also brings new risks:

High volatility of MEV earnings may lead to unstable income for validators.

Validators may prioritize optimizing MEV extraction over network security.

Dependence on MEV infrastructure may become a new point of centralization risk.

This transformation represents not only a change in the economic model but also a profound restructuring of the network security incentive mechanism.

💡 Beginner's Explanation: Imagine the blockchain as a busy restaurant, where transactions are customers. In the traditional model, waiters (validators) mainly rely on a fixed salary (inflation rewards). Now, they can earn extra tips by providing better service (MEV).

In 2024, these "tips" skyrocketed from an initial $42 million per quarter to $430 million in the fourth quarter! This means validators are shifting from passively waiting for their "salary" to actively creating value.

7. How Does the "Leaky Bucket Effect" Subtly Erode the Solana Ecosystem?

The proposal authors emphasize that inflation has a "leaky bucket effect" — part of the value flows out of the ecosystem through channels like taxes. This concept is one of the key reasons supporting SIMD-0228.

Inflation Basic Data:

Market Cap: $80B

Annual Inflation Rate: 4.779%

Annual New Issuance Value: $3.82B

Multiple Channels of Value Loss

Tax Channels: Compliance Costs

Centralized Exchange Fees

Overall Value Loss Structure

Tax Channels: $650M (68%)

Exchange Fees: $305M (32%)

Total Loss: $955M (25%)

Intervention Effects of SIMD-0228

Deep Economic Impacts

- Ecosystem Capital Retention

Reducing external value extraction.

Enhancing internal capital circulation.

Increasing ecosystem autonomy.

- Restructuring Investor Incentives

Reducing selling pressure.

Attracting long-term investors.

Improving market expectations.

- Dynamics of Capital Flow

Increased DeFi activity.

More innovative funding pools.

Internal reinvestment of ecosystem value.

As Kamino co-founder Marius stated: "Staking encourages hoarding and reduces financial activity… similar to the Federal Reserve raising interest rates and tightening financial conditions." From this perspective, reducing inflation may enhance the overall vitality of the ecosystem.

The leaky bucket effect reveals a truth: the resilience of an economic system lies not only in the total amount of capital but also in the efficiency and direction of capital flow.

SIMD-0228 represents a fine-tuned, systematic economic intervention, marking a significant evolution in the governance model of the Solana ecosystem.

💡 Beginner's Explanation: The "leaky bucket effect" is Solana's water-saving "project." Imagine Solana as a large reservoir:

In the past: Nearly $1 billion leaked out each year.

Now: Through precise management, leaks have been reduced to less than $200 million.

Effect: Retaining nearly $800 million of "water" for the ecosystem.

8. Will Low Staking Rates Trigger Systemic Risks? Understanding Potential Negative Feedback Loops

Another major concern of SIMD-0228 is the potential negative feedback loop that may arise under low staking rate conditions, especially when the staking rate is significantly below current levels.

Potential Negative Feedback Loop Mechanism

In the worst-case scenario, the following loop may occur:

Low staking rate (e.g., 30%) → Triggers an increase in inflation rate.

Inflation rate increases → Increases selling pressure, leading to price declines.

Price declines → Validator yields decrease, causing some validators to exit.

Validator exits → Staking rate further declines.

When yields fall below 3.5%, it may trigger a "penalty mechanism," accelerating staking withdrawals.

Key Considerations for System Stability

This negative feedback loop is not just a theoretical model but a substantial threat to the security of the Solana network and the stability of its ecosystem. The key challenges are:

How to maintain network security in a low staking rate environment.

How to design self-regulating economic incentive mechanisms.

How to prevent small fluctuations from evolving into systemic risks.

Mitigation Strategies

To address this potential risk, the following countermeasures can be considered:

Establishing a smoother inflation adjustment mechanism.

Introducing dynamic staking reward mechanisms.

Creating emergency buffer mechanisms to protect network stability in extreme cases.

Strengthening community communication to enhance investor confidence.

Resilience Comparison

It is worth noting that while this risk exists, the design of SIMD-0228 aims to have stronger resilience than the current fixed model:

Providing higher yields when staking rates are low to attract staking back.

As staking rates recover, inflation rates will automatically adjust downward, forming a self-balancing mechanism.

The adjustment coefficient c (approximately equal to π) in the formula is designed to make the curve more incentivizing at low staking rates.

This adaptive mechanism is one of the key advantages of SIMD-0228 compared to fixed models, although risks still exist in extreme cases.

💡 Beginner's Explanation: This is like a vicious cycle during an economic recession:

When too many people withdraw money from banks (low staking rates),

Banks raise interest rates (inflation rises) to attract deposits;

But high interest rates hurt the economy, leading to more people withdrawing money to cope with difficulties;

Banks become overwhelmed, some go bankrupt; people panic, and more withdraw money…

This cycle is hard to break. Although SIMD-0228 has mechanisms designed to prevent this situation, risks still exist under extreme conditions.

8. Future Outlook: How Will SIMD-0228 Change the Solana Ecosystem?

If SIMD-0228 is implemented, it could have profound effects on the Solana ecosystem, ranging from short-term adaptations to long-term structural changes.

Short-term Adaptation Period (0–6 months)

Staking rates gradually decline from 65.7% to the 50–55% range.

Some small validators exit or are acquired.

SOL prices may receive support, and market attention increases.

Validators begin to adjust their business models to adapt to the new environment.

Mid-term Adjustment Period (6–18 months)

Validators focus more on optimizing MEV extraction.

New staking pools and services emerge to help stakers obtain MEV.

Increased DeFi activity, with growth in applications using unstaked SOL.

Measures to reduce voting costs are implemented to help small validators survive.

Long-term Structural Changes (18+ months)

Restructuring of the validator industry landscape, with increased specialization.

Network security models shift from primarily relying on inflation incentives to market-driven comprehensive incentives.

Solana's economy transitions from "inflation-driven" to "value-driven."

It may become a model of monetary policy innovation for other PoS networks.

💡 Beginner's Explanation: Imagine a country transitioning from a planned economy to a market economy: in the short term, there will be adjustment pains, and some businesses will close; in the mid-term, new business models and services will emerge; in the long term, the entire economic structure will become more efficient. SIMD-0228 could transform Solana from a network primarily incentivized by "printing money" to one supported mainly by actual usage value, representing a maturation.

These changes will not only affect the technical and economic aspects but may also alter the power structure and development trajectory of the entire ecosystem.

9. Conclusion: Evaluating SIMD-0228 from Three Dimensions

SIMD-0228 is not just a technical proposal; it represents a profound transformation of the Solana ecosystem in terms of economics, governance, and technology. This proposal signifies a significant leap from simple inflation models to complex market mechanisms in the blockchain world.

Economic Dimension:

Reducing unnecessary token issuance to avoid value loss.

Adjusting the inflation rate through market mechanisms to optimize network security costs.

Releasing capital into DeFi to improve overall capital efficiency.

Governance Dimension:

Reflecting the Solana community's ability to discuss complex economic models.

Seeking a balance between optimizing resources and maintaining network health.

Allowing different stakeholders to express their positions and influence decisions.

Technical Dimension:

Utilizing mathematical models to adjust core economic parameters.

Designing dynamic response mechanisms to adapt to network changes.

Providing new ideas for blockchain monetary policy.

Key Questions for the Future

As discussions and potential implementation of SIMD-0228 continue, the following questions warrant our ongoing attention:

Can the diversity of the validator ecosystem be maintained?

What new risks will arise from increased reliance on MEV?

Can market-driven mechanisms remain stable under extreme conditions?

Can this model be adopted by other blockchain networks?

💡 Beginner's Explanation: SIMD-0228 represents the evolution of the blockchain world from "simple inflation rules" to "complex market mechanisms," much like modern central banks replacing the simple gold standard. This is both a revolution (as it fundamentally changes the rules) and a natural evolution (as it reflects the actual needs after network maturity). Regardless of the outcome, this is an important experiment in blockchain economics.

In a sense, SIMD-0228 is both a revolution and an evolution — it signifies a revolutionary shift in thinking while also reflecting Solana's natural transition from a nascent blockchain to a mature financial infrastructure. Regardless of the final result, this proposal and the extensive discussions it has sparked demonstrate the blockchain community's growing maturity in economic design and governance.

10. Action Recommendations (If the Proposal Passes)

Ordinary SOL Holders:

If you primarily hold SOL rather than staking, SIMD-0228 may benefit you, as reducing inflation helps protect the value of your holdings.

If you are staking SOL, consider reassessing your staking strategy; you may need to look for validators that can effectively extract MEV.

Keep a close eye on the implementation progress of the proposal, especially changes in staking rates and prices.

Validators:

Large Validators: Invest in MEV optimization technology and prepare to adapt to the new income structure.

Small Validators: Assess economic feasibility and consider specialization strategies or differentiated services.

All Validators: Pay attention to the progress of measures to reduce voting costs, as this may significantly impact the economic model.

Developers:

Prepare to leverage the potential liquidity of released capital.

Consider developing tools to help stakers participate in MEV earnings distribution.

Explore new application scenarios for more efficient use of SOL in DeFi.

💡 Beginner's Explanation: Whether you are a SOL holder, validator, or developer, you should prepare for the changes that SIMD-0228 may bring based on your role. Ordinary holders should focus on the proposal's progress; validators need to adjust their business models; developers can look for new opportunities. Like any economic policy change, those who prepare in advance often benefit from the changes.

Final Thoughts

SIMD-0228 represents an important turning point, marking Solana's move towards a more mature and market-oriented economic model.

By introducing a dynamic inflation mechanism, it aims to establish a more efficient and sustainable ecosystem that maximizes capital efficiency while ensuring network security.

Like any major change, it brings both opportunities and challenges, with supporters and opponents alike. By understanding the motivations, mechanisms, and potential impacts behind the proposal, we can better prepare for this transformation and find our place in the new economic environment.

Regardless of the final outcome, the discussion process surrounding SIMD-0228 has already demonstrated the blockchain community's ability to solve complex economic problems through collective wisdom, which may be the truly revolutionary aspect of blockchain technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。