Master Discusses Hot Topics:

The current market is either being led by the Federal Reserve's monetary policy or swayed by Trump's occasional carrot-and-stick approach. Both bulls and bears think they are the best, viewing each other as fools. Just when it seemed tariffs were about to be increased, market sentiment collapsed. Then, as soon as Trump's carrot appeared, it left everyone confused again.

Take this morning, for instance, when the Federal Reserve's Beige Book was just released. A fan came to ask me what I thought, and I said it wasn't important; when has the Federal Reserve ever admitted to an economic recession? Sure enough, the Beige Book painted a rosy picture.

The economy is growing slightly, employment is increasing modestly, prices are rising moderately, and they are optimistically believing that the American economic outlook is good for the next few months. This means that the Federal Reserve doesn't think a recession is on the horizon at all.

Of course, they won't admit it now. The market has been tossed around so much that it has lost its temper, yet the U.S. stock market and Bitcoin continue to rise, especially as Bitcoin has broken through 90k again. Particularly, in the crypto circle, the day after tomorrow is considered a big day by retail investors, and everyone is watching closely.

But who can accurately guess what Trump will say at this White House crypto summit? One thing is for sure: the issue of BTC strategic reserves will definitely be mentioned. As for the other cryptocurrencies he verbally promised before, it's still unclear, and even the Secretary of Commerce is having a headache, so we shouldn't make wild guesses.

That said, whether details about Bitcoin's strategic reserves will be revealed at the roundtable or the summit is still uncertain. Investors are certainly eager, but I advise everyone not to hold too high hopes.

Trump's intention is likely not to buy Bitcoin but rather not to sell it; that probability is the highest. If he really wants to buy, it might be like what was said last month, using national sovereign funds to invest some tax money, but the amount won't be too large, so the emotional impact might be limited.

Therefore, before any clear data comes out, such as the dot plot, both bulls and bears might have a chance. Betting on one side carries too much risk. If you don't have the means and enough resources, then it's not a bad thing to just observe during this period.

So personally, I really don't have a positive outlook. On Friday, we have the non-farm payrolls, which is a bearish factor, and then there's the artificially stirred sentiment from the summit; isn't it just the old routine of shaking out positions? Waiting to short at a high point is much more reliable than guessing whether it will break through some resistance level.

Looking back at the surge that started on September 16 last year, there might still be one last wave left. But now there are too many interfering factors, making it hard to judge. After this, we might either see a bloodbath or, like last year, have a prolonged range-bound consolidation.

Looking at the outside market, the S&P and Nasdaq have just stopped falling, without truly strengthening. Altcoins are likely to become completely fertilizer in a big drop, nurturing new things to emerge. Now we just have to see how tomorrow's non-farm payrolls turn out, which will determine how many rate cuts will follow.

Master Looks at Trends:

Resistance Levels Reference:

First Resistance Level: 94300

Second Resistance Level: 92300

Support Levels Reference:

First Support Level: 91000

Second Support Level: 89600

Today's Suggestions:

The first resistance is near the 60-day moving average, which is a key resistance level in the short term. Currently, it has stabilized at 91K, and the probability of breaking through the first resistance level has increased, but we need to confirm that the price stabilizes at the first resistance before it can be considered a true bottom.

After the first support was broken in the morning, there will be short-term fluctuations. If the price of the coin can raise its low points around 91K during the European trading session, then we can continue to look for a rebound.

Since the price broke through the high point of the convergence area in the morning, we can expect a gradual rise. In the ultra-short term, we can maintain a rebound trading strategy. Additionally, both the first and second resistance levels coincide with the 4-hour moving average and previous highs, so when the price rises, it is essential to pay attention to trading volume.

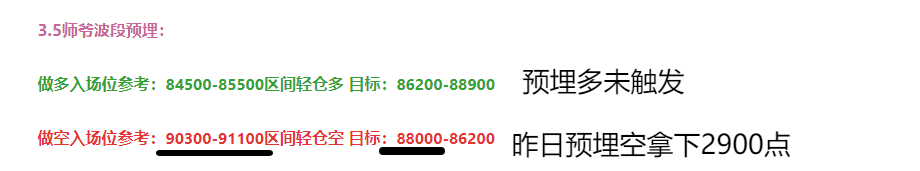

3.6 Master’s Wave Strategy:

Long Entry Reference: Not currently referenced

Short Entry Reference: Light short in the 94300-94950 range Target: 92300-91000

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。