The tariffs imposed by the Trump administration have triggered market turbulence, while the proposed "crypto strategic reserves" may become unconventional financial tools, affecting global capital flows and the landscape of the crypto market.

Author: OKG Research

Translation: Baihua Blockchain

U.S. President Donald Trump officially announced yesterday that tariffs will be imposed on Canada and Mexico, with the policy set to take effect on April 2. The market had hoped for a last-minute agreement to avoid widespread tariffs, but this hope was ultimately dashed, leading to severe fluctuations in global markets.

Bitcoin had just received a boost from the favorable news of the "crypto strategic reserves" the day before, and before it could fully digest this optimistic sentiment, it plummeted 8% within 48 hours. U.S. stocks were similarly impacted, with the Nasdaq index falling 2.6%. Since Trump's return to the White House just over a month ago, the total market capitalization of the crypto market has shrunk by 22%, while the Trump Media & Technology Group (DJT) has plummeted by 34.75%. Even Trump's staunch supporter Elon Musk was not spared, as Tesla's stock price fell by 32.87% due to his controversial Dogecoin-related initiatives and increasing involvement in global politics.

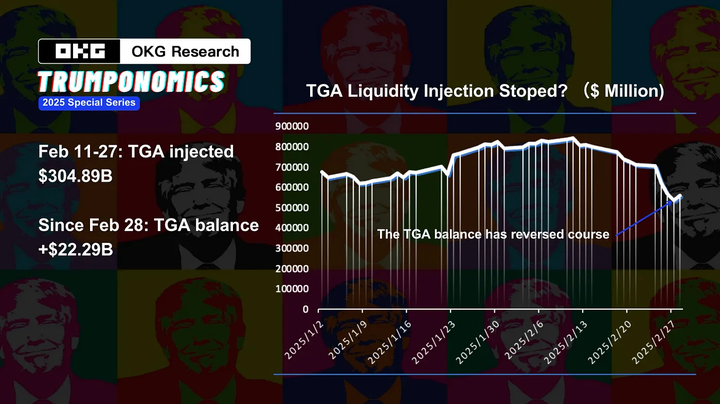

Every word and decision from Trump continues to impact the crypto market, further reinforcing the impression that the market is inextricably linked to his policy direction—whether for better or worse. In 2025, OKG Research will launch a special feature titled "Trumpnomics," tracking the impact of the Trump 2.0 era on the crypto market. In our previous article "A New Wave of Liquidity: Can the Crypto Market Break Through New Highs?" we pointed out that market participants should focus on real liquidity (such as changes in the U.S. Treasury General Account) rather than media noise. We emphasized that without substantial liquidity support, market enthusiasm driven solely by slogans is ultimately unsustainable. Notably, according to official data from the U.S. Treasury, as of February 28, the Treasury General Account (TGA) has ceased injecting liquidity into the market, with a total of $304.89 billion injected.

Now, tariffs have become the first major policy lever of the Trump administration, and global risk markets—especially those closely tied to the U.S.—are feeling the pressure. But why does Trump insist on relying on the trade war despite the significant impact of the tariff battle?

1. Tariffs as Negotiation Chips

Trump made many promises before and after his campaign, but his first significant action was to impose tariffs.

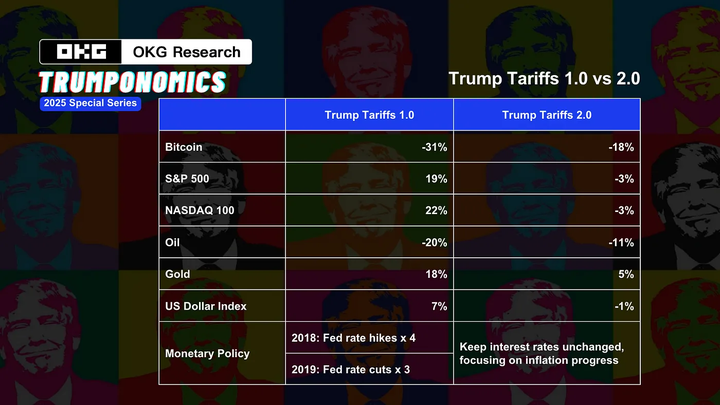

On the surface, his tariff policy aims to reduce the trade deficit, promote employment, and boost the economy. However, past experiences indicate that—whether during Trump's first term's trade war or the global trade war triggered by the Smoot-Hawley Tariff Act in the 1930s—tariffs are often not a surefire bet.

The U.S. Congressional Budget Office (CBO) estimates that Trump's trade war from 2018 to 2019 reduced U.S. GDP by 0.3%, equivalent to a loss of $40 billion. Research from the Peterson Institute for International Economics shows that Trump's tariffs on steel and aluminum directly led to the loss of about 75,000 manufacturing jobs in the U.S. In fact, the tariff policy did not encourage manufacturing to return to the U.S.; instead, it prompted many companies to shift production to lower-cost countries like Vietnam and Mexico (Kearney data).

Historical tariff wars often lead to severe consequences. In 1930, after the U.S. passed the Smoot-Hawley Tariff Act, global trade shrank by 66%, U.S. exports plummeted by 67%, and price distortions led to the bankruptcy of many farms, ultimately dragging the economy into further recession.

However, tariffs are just the opening move; the Trump administration is using economic uncertainty as a negotiation tool. The core of this trade war is not just about goods but also involves technology controls, capital flows, and currency competition. Today, trade disputes have transcended tariff barriers, evolving into deep interventions in the global financial system—covering foreign exchange markets, stock market valuations, bond yields, and risk assets.

Even the usually cautious Warren Buffett has broken his silence, warning that punitive tariffs could exacerbate inflation and harm consumer interests. Changes in economic expectations may complicate the already difficult balancing act for the Federal Reserve—how to control inflation without triggering a severe recession? Eroding consumer confidence could drag down economic growth, while inflationary pressures may limit the Fed's ability to cut interest rates, further tightening market liquidity and putting policymakers in a dilemma.

For the crypto market, which amplifies global risk sentiment, the impact of these policies is particularly significant. For example, Bitcoin mining still heavily relies on Nvidia GPUs, and crypto-related companies like Coinbase and MicroStrategy are important components of the Nasdaq 100 index. For a long time, U.S. financial policies and regulatory decisions have shaped the landscape of the crypto industry.

In other words, the crypto market is less an independent safe-haven asset and more a derivative of U.S. financial policy. As discussed in OKG Research's article "Repositioning the Crypto Market: The Growing Pains of Global Liquidity Tightening" (July 2024), if the macro environment remains unchanged, the market's response to tariff policies will depend on how other countries react. If countries choose to compromise, the current volatility in the crypto market may be short-lived; in the long run, U.S. risk assets, including crypto assets, may benefit. However, if countries take countermeasures, imposing tariffs and escalating the trade war, risk assets may face sustained downward pressure.

2. Cryptocurrency: An Unconventional Solution in Turbulent Times

When tariff policies damage the economy and fail to bring substantial benefits to Trump's core support group—the "MEGA" (Mega Interest Groups)—how will Trump’s second term leverage tariffs and cryptocurrencies to "Make America Great Again"?

In the past month, the turbulence in the U.S. financial markets reflects a continued loss of confidence in the American system. As Nobel laureate Paul Krugman recently pointed out in his blog, Elon Musk and Donald Trump have acted recklessly on multiple levels within just five weeks of regaining power—breaking promises, threatening allies, employing mafia-style coercion, and even interfering in democratic elections, severely undermining America's international influence.

Historical experience shows that when a country's creditworthiness declines, capital does not stagnate but seeks alternative channels.

Take Japan as an example. In the 1980s, as the U.S.-Japan trade imbalance worsened, the U.S. attempted to intervene to correct the situation, forcing Japan to sign the Plaza Accord, which led to a sharp appreciation of the yen. Japan's export-dependent economy was thus severely impacted, triggering financial turmoil. In the context of increased government regulation, the market began to seek alternative liquidity channels, ultimately giving rise to a boom in black market finance—including gold smuggling, offshore dollar trading, and informal foreign exchange markets. At its peak, there were about 17,000 underground financial centers in Japan (Nikkei data). These unofficial financial systems became a natural hedge against the collapse of the traditional financial system. After Japan's economy was severely damaged, the U.S. re-integrated Japan into the global system through military procurement orders and currency liberalization, briefly boosting the economy, but ultimately it could not escape the fate of an asset bubble burst.

This historical precedent highlights the key role of parallel financial systems in trade wars. Today, Trump's proposal to establish "crypto strategic reserves" may seem like a financial innovation, but it is more likely an unconventional tool for extraordinary times.

There are two core reasons for this:

1) The credibility of the dollar is under pressure, the Federal Reserve's policy tools are exhausted, and the U.S. urgently needs new means to maintain global capital confidence. In this context, cryptocurrencies may become a "quasi-financial weapon"—serving as strategic reserve assets to enhance government control over capital flows while maintaining a facade of "independence" to avoid the suspicion of direct intervention.

2) The trend of de-dollarization is accelerating. As trade conflicts escalate, countries will inevitably accelerate their de-dollarization processes, reducing reliance on dollar assets. Since the beginning of 2025, gold prices have steadily risen, directly reflecting this trend. In a world increasingly skeptical of the dollar, a truly decentralized crypto ecosystem—if not controlled by any single country—will possess significant geopolitical value.

The Trump 2.0 government is taking a more radical stance on the global economic order, attempting to dismantle the international political and financial system established after World War II. Rather than directly consolidating the dollar's credit system, it is more about constructing a reserve of crypto assets to provide the government with a more covert means of market intervention. With the development of crypto assets and related technologies, they may drive a new cross-border payment system and ultimately give rise to a state-supported crypto financial network.

Trump's biography mentions that his family originates from Germany and describes himself as a "fighter," believing that passion outweighs wisdom and talent. For him, facilitating deals at an astonishing speed and defeating competitors is the strongest motivation. However, in the context of a trade war, rushing to renegotiate agreements and seeking to outpace opponents may not necessarily yield the most favorable outcomes for his administration.

This article link: https://www.hellobtc.com/kp/du/03/5700.html

Source: https://medium.com/thecapital/from-tariffs-to-crypto-reserves-what-game-is-trump-really-playing-7894d8e454b2

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。