Modular First Coin: $TIA

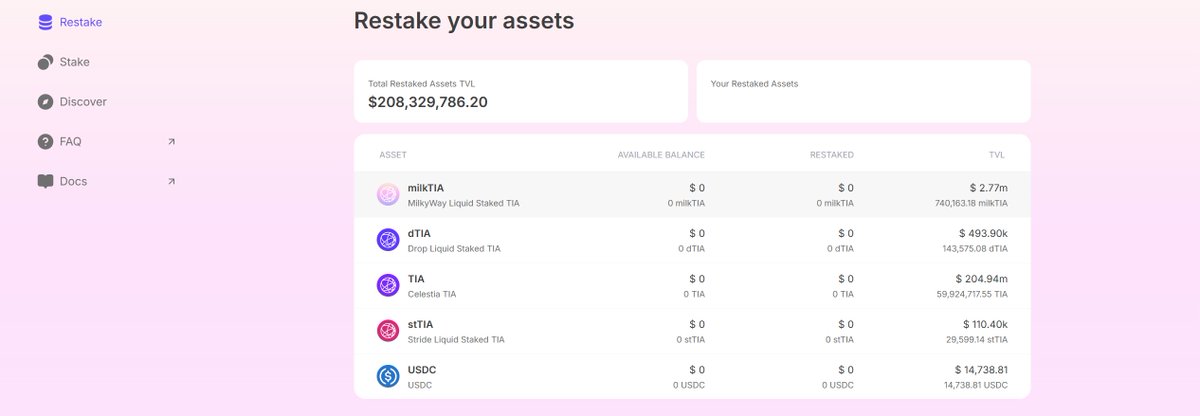

Currently, 5.53% of the total supply of $TIA is staked in MilkyWay. Many people are unclear about what this data level means. Let's make a comparison:

Ethereum ($ETH)

Total Supply: Approximately 120 million $ETH (no hard cap, but low inflation rate)

Circulating Supply: Close to total supply, about 120 million $ETH

TVL: As of March 2025, Ethereum's DeFi TVL is approximately 22 million $ETH. This calculates to a ratio of $ETH locked up as a percentage of the total token supply of about 18%.

Ethereum's locking ratio is higher than 5.53%, but its ecosystem is mature, with TVL distributed across hundreds of protocols (such as Lido, MakerDAO, Aave), unlike $TIA which is concentrated in the MilkyWay protocol.

Solana ($SOL)

Total Supply: Approximately 590 million $SOL.

Circulating Supply: About 500 million $SOL

TVL: As of March 2025, Solana's DeFi TVL is approximately 5 million $SOL. This calculates to a locking ratio of SOL as a percentage of the total token supply of 8%.

Solana's locking ratio is significantly higher than 5.53%, and the TVL is distributed across multiple protocols like Jito, indicating high ecosystem diversity.

What causes this phenomenon? Two reasons can explain it.

First, the diversity and richness of the $TIA ecosystem are not yet comparable to ETH and SOL.

Second, MilkyWay, with its first-mover advantage and careful product refinement, has already established a solid foothold in the modular ecosystem, building a relatively deep moat.

According to the roadmap, MilkyWay will continue to expand horizontally in the future, covering other modular ecosystems like Initia. This is a project worth following, so keep an eye on it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。