Author: BitpushNews

The recent downturn of Ethereum has truly left many investors feeling heartbroken. A latest report from Matrixport indicates that the global search interest in Ethereum has approached a historical low, which in the past often foreshadowed a further significant price drop. The decrease in on-chain activity, the decline in total locked value (TVL), combined with market speculation about the potential strategic digital asset reserves in the U.S., have led to a significant weakening of demand for Ethereum's native token, ETH. The current market environment shows that the weak demand for ETH has become an undeniable fact.

However, there are still many staunch supporters of the Ethereum ecosystem within the industry. Du Jun, the founder of ABCDE, publicly stated on March 3 that despite accumulating Ethereum over the past year, resulting in a paper loss of over $20 million, he still firmly believes in Ethereum's value and is even considering selling other assets to lower his ETH holding cost.

Nick Tomaino, founder of the well-known investment firm 1confirmation, openly stated on social media that they will "double down on ETH," as he believes Ethereum is one of the only two ecosystems in the crypto world that is "trustworthy, neutral, and sufficiently decentralized," possessing unique long-term "social scalability."

In the face of the ongoing sluggish market sentiment and the "counter-trend support" from industry giants, what does the future hold for Ethereum?

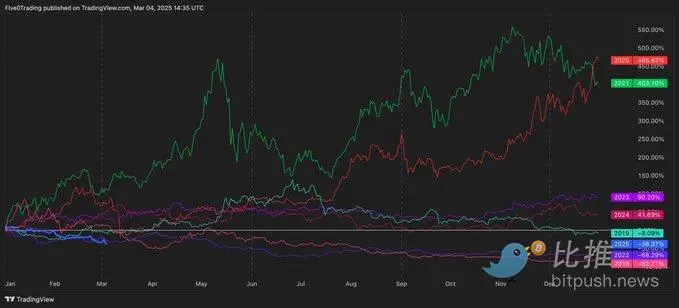

Historical Cycle Comparison: A Script Replaying?

Some market observers point out that Ethereum's recent performance is similar to the bear market trends of 2018 and 2022. An anonymous trader, 5.0 Inverted, stated that Ethereum is "following the price trends of the bear markets in 2018 and 2022." The data in the chart below shows that Ethereum fell by 82.71% in 2018 and 68.29% in 2022, continuing to decline in the second half of those years.

Another trader noted that Ethereum previously dropped 60% from $4,200 to $1,800 in the last cycle, then rebounded strongly by 170% in the following months, eventually reaching an all-time high of $4,800. Drawing from the experience of 2021, Ethereum may continue to maintain its current weak trend before rebounding at the end of the year.

Technical Analysis: Mixed Signals

As of the time of writing, Ethereum has rebounded from a low of below $2,000 to around $2,240, finding strong support near the $2,000 mark, which aligns with the key ICT optimal trade entry (OTE) level closely monitored by traders, temporarily halting the downward momentum of the price.

From the hourly chart, ETH's price shows mixed signals. After briefly breaking through the local resistance level of $2,262, the price began to retreat, and the bears may further push the price down in the short term.

The daily chart, however, conveys a more positive message. After rebounding from the support level of $2,076, Ethereum's price has started to rise. In the medium term, there are no clear reversal signals yet. Traders should focus on the key area around $2,000. If this level is breached, the price may quickly test the $1,750 area.

Market analysts expect Ethereum to undergo wide-ranging consolidation between $2,000 and $2,500, and this range-bound movement may continue until a breakout signal appears, indicating the next major trend. Both bulls and bears are closely monitoring these key levels.

If Ethereum can maintain above $2,000 and build momentum, the current phase may evolve into a new bullish wave. Chart analyst Ali Martinez believes that the most critical resistance level for Ethereum is at the $2,400 mark, where over 2.41 million investors have purchased 62.68 million ETH. For analysts, breaking this level could "pave the way for a rebound to $3,000."

CryptoQuant analyst MACD believes that Ethereum's MVRV ratio has fallen below 1, placing Ethereum in an undervalued zone. Historically, this level has seen significant price increases during previous bull market cycles. Additionally, MACD points out that the number of accumulating addresses (addresses that continuously receive ETH but have never withdrawn) has sharply increased, indicating that institutional investors are building their positions during the current market downturn.

However, MACD also acknowledges that broader economic conditions, such as U.S. liquidity and monetary policies, may continue to exert downward pressure on asset prices, and market sentiment has not fully turned optimistic. Investors need to remain cautious and wait for more clear signals for validation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。