Recent assignments have always been a bit late. Starting tomorrow, I really can't be distracted by trivial matters. As I mentioned yesterday, although this world is a huge makeshift stage, even a makeshift market will have its expectations. Today, although there was no agreement signed with Ukraine regarding rare earth minerals, Zelensky did indeed make another statement saying that they can sign at any time. So, the control of timing is in Trump's hands, and it seems there are still some details that haven't been settled.

Overall, a ceasefire in the Russia-Ukraine war should be expected. Next is Trump's attitude towards tariffs. He mentioned yesterday that there would be adjustments today, but it seems that only a one-month tariff exemption was granted for cars imported under the US-Mexico-Canada Agreement. This also indicates that tariffs are not completely unchangeable. Interestingly, the American Automobile Association (or something like that) expressed gratitude to Trump for protecting their rights yesterday.

Early this morning, the Federal Reserve's Beige Book was released. A friend asked about this today, and I said it wasn't important. The Federal Reserve won't say there's an economic recession. Indeed, the Beige Book stated that the economy is experiencing slight growth, with a small increase in employment, while prices are rising moderately. It believes that the economic outlook for the US in the coming months is still quite optimistic.

This indicates that the Federal Reserve currently does not see signs of an economic recession. Of course, they can't admit that now. However, after being battered by the market repeatedly, it has lost its temper. Both the US stock market and cryptocurrencies are rising, with the price of $BTC temporarily breaking through $90,000 again. Especially for cryptocurrencies, there are only two days left until the critical "big day."

What Trump will say at this summit is hard to predict, but it is certain that he will mention the strategic reserve of Bitcoin. As for other cryptocurrencies that he previously verbally committed to, it's still uncertain. After all, even the Secretary of Commerce is having a headache, let alone us.

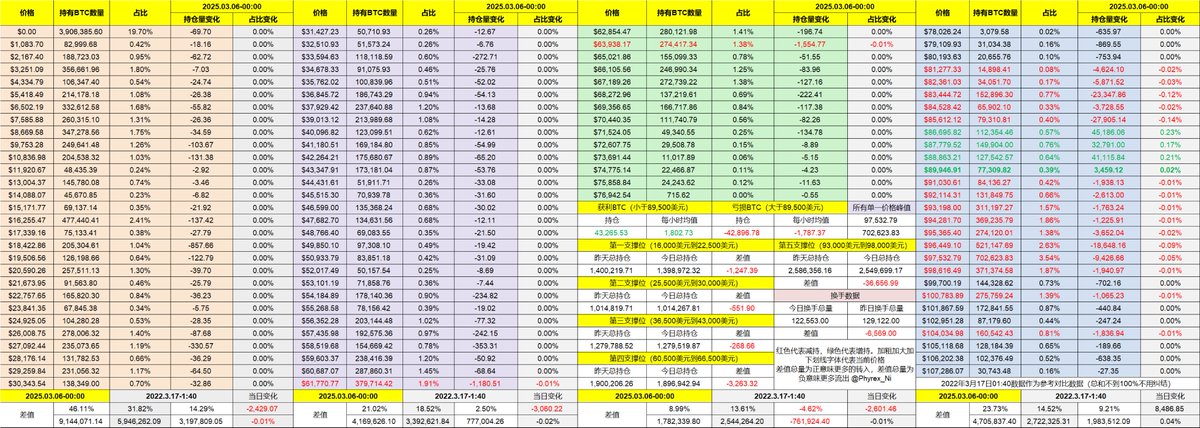

Looking at the data for BTC itself, in the last 24 hours, friends have faced quite a bit of news pressure, so the turnover rate is still quite high. Both bulls and bears are calling each other fools, and the number of profit-taking and loss-taking chips leaving the market is about the same. The market sentiment is still not very friendly, as can be seen from the data on spot ETFs. Investors' buying sentiment is too poor.

A news item that needs some attention today is that Coinbase is going to issue a token, which should be a platform token. I actually learned about this possibility two weeks ago while doing an interview, and we discussed related content in the video. Unfortunately, the video is still being edited, so it hasn't been released, which is really a pity.

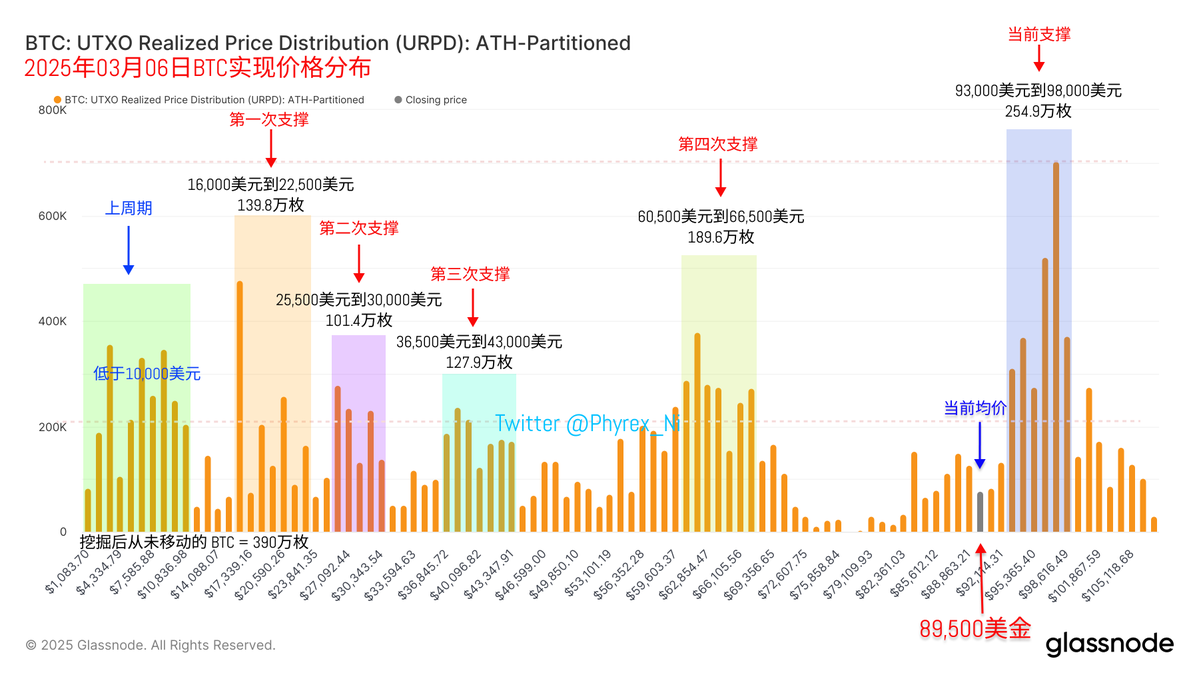

As for the support for BTC itself, although there are investors leaving between $93,000 and $98,000, overall, the number of those leaving is still a minority. Currently, this support position remains the area with the most concentrated chips, with over 2.5 million #BTC accumulated. So, at this point, the support at this position is still very solid.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。