This is my personal view on the market, not investment advice.

Currently, the market is either controlled by the Federal Reserve's monetary policy or swayed by Trump's carrot and stick approach. Both bulls and bears have moments of calling each other fools. It seems tariffs are about to be increased, causing a significant drop in market sentiment, and then Trump's carrot appears.

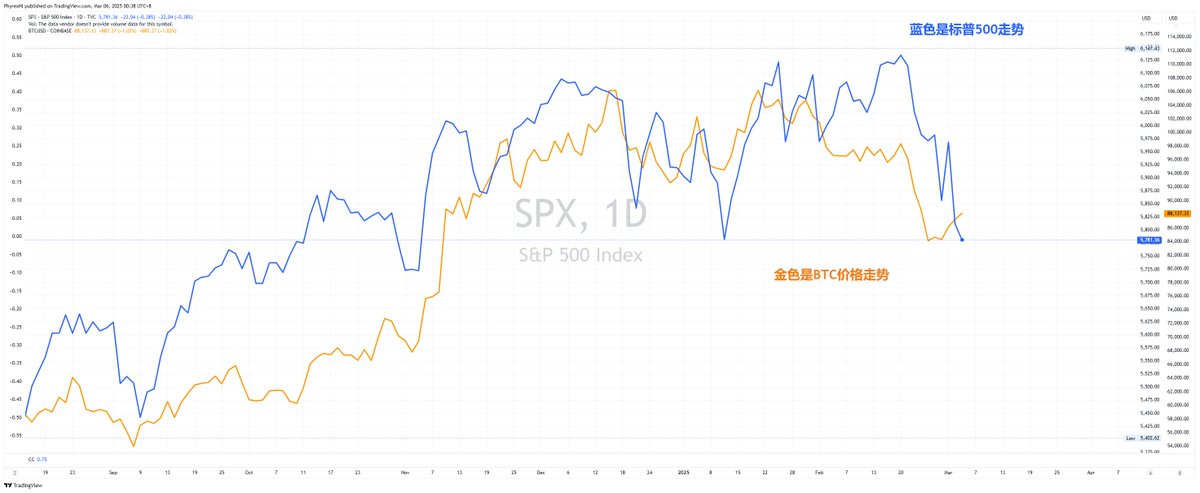

There are clear signs of a ceasefire in the Russia-Ukraine war, and the market shows signs of recovery, but then Trump's stick comes into play. Overall, the sentiment among U.S. investors in both the stock market and cryptocurrency is not good, and that's a fact.

The main reason for the rebound in $BTC is still due to the cryptocurrency summit held by Trump at the White House, which is scheduled from 2:30 AM to 6:30 AM Beijing time on March 8. It should be divided into two sessions: one is a discussion with about 20 people, including Michael from $MSTR and Brian from $COIN, along with a few other industry figures, and some government officials from the White House.

The discussion will conclude with a public summit. It is currently unclear whether Trump will announce some details about the Bitcoin strategic reserve during the discussion or at the summit. This is what investors are looking forward to, but don't set your expectations too high. Trump's original words at the 2024 Consensus Conference were:

"The U.S. will no longer sell any $BTC and will hold these BTC as a strategic reserve."

So, in reality, Trump's intention is not to buy BTC but not to sell it, which is the most likely scenario. If there is a buying opportunity, it might be related to the national sovereign fund mentioned last month. This fund comes from tax revenue, and it is possible to buy a portion through this fund, but the total amount will not be too large. Therefore, the impact on sentiment may be limited.

What can really drive some liquidity is still related to tariffs, the end of the Russia-Ukraine war, the development of Ukraine's rare earth minerals, and U.S. macro data. This data will be more important and have a longer impact, so if there is a directional move, it will inevitably come from macro-political situations.

Without clear data, such as the dot plot, both bullish and bearish directions are possible. Betting on a single direction carries greater risk. If there are truly skilled traders who can make money in repeated fluctuations, that is quite impressive. If you don't have that ability, it may not be wrong to observe during this period.

Data to pay attention to:

Ukraine and the U.S. signing a rare earth mineral development agreement, seen as a condition for the end of the war.

Trump weakening or slowing down tariffs on Canada and Mexico, or abandoning them.

The Federal Reserve's dot plot and Powell's speech on March 20; the macro data before this is actually all for the dot plot.

That's all; I don't know if there's anything else that needs to be added.

PS: My optimism for Q1 is purely personal behavior; I've explained the logic, but the risks are not nonexistent. Therefore, I do not recommend blindly betting; it's best to have a sufficient understanding, especially now, as both bulls and bears may be in one person's hands or mouth. The risk is actually quite significant.

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。