Uniswap Foundation votes on a massive $165.5m USD funding.

Why?

Uniswap v4 and Unichain launch is underwhelming.

In more than a month:

• Uni v4 TVL barely at $85M

• Unichain TVL just $8.2M

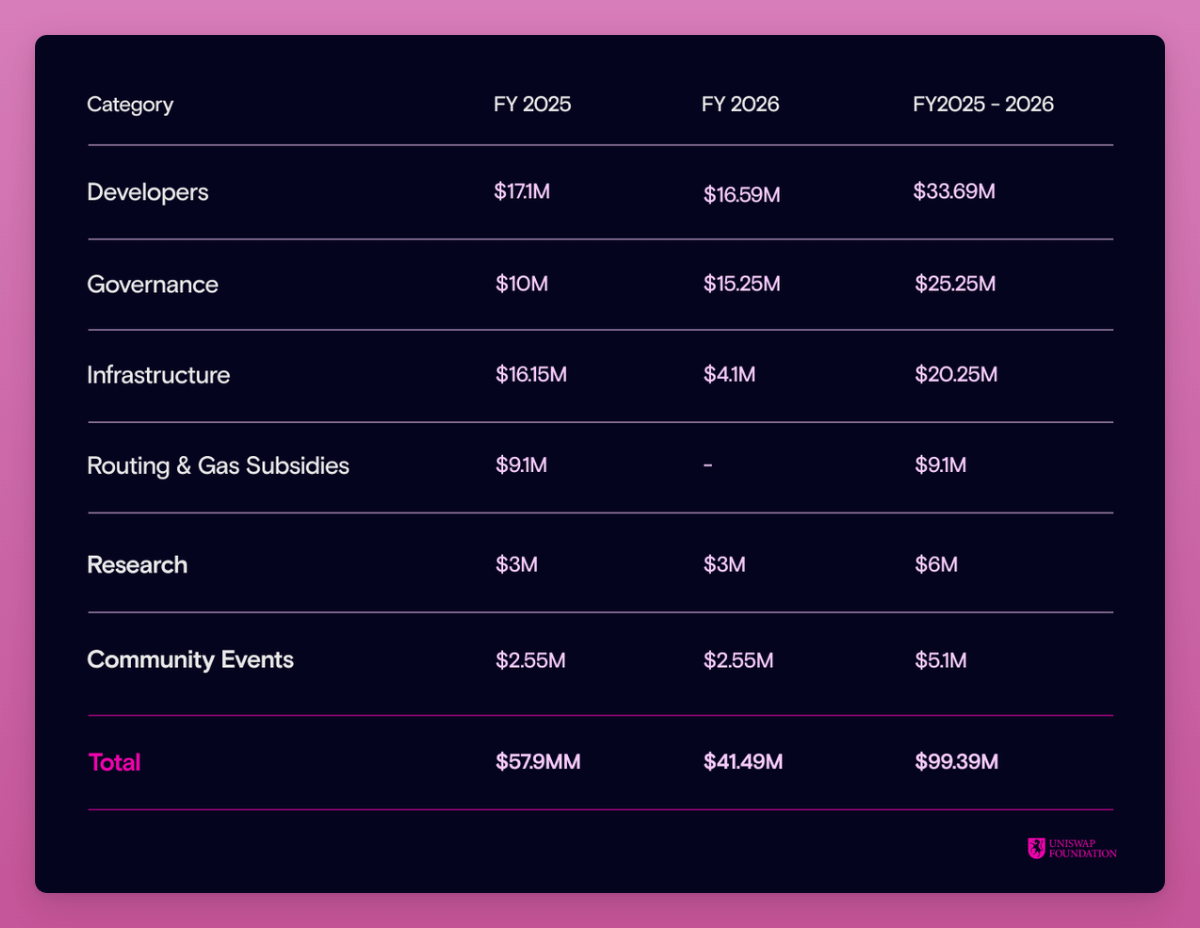

To boost growth, UF's proposed $165.5m funding will be split:

• $95.4M for grants (developer programs, Core Contributors, Validators).

• $25.1M for operations (team expansion, governance tooling).

• $45M for liquidity incentives

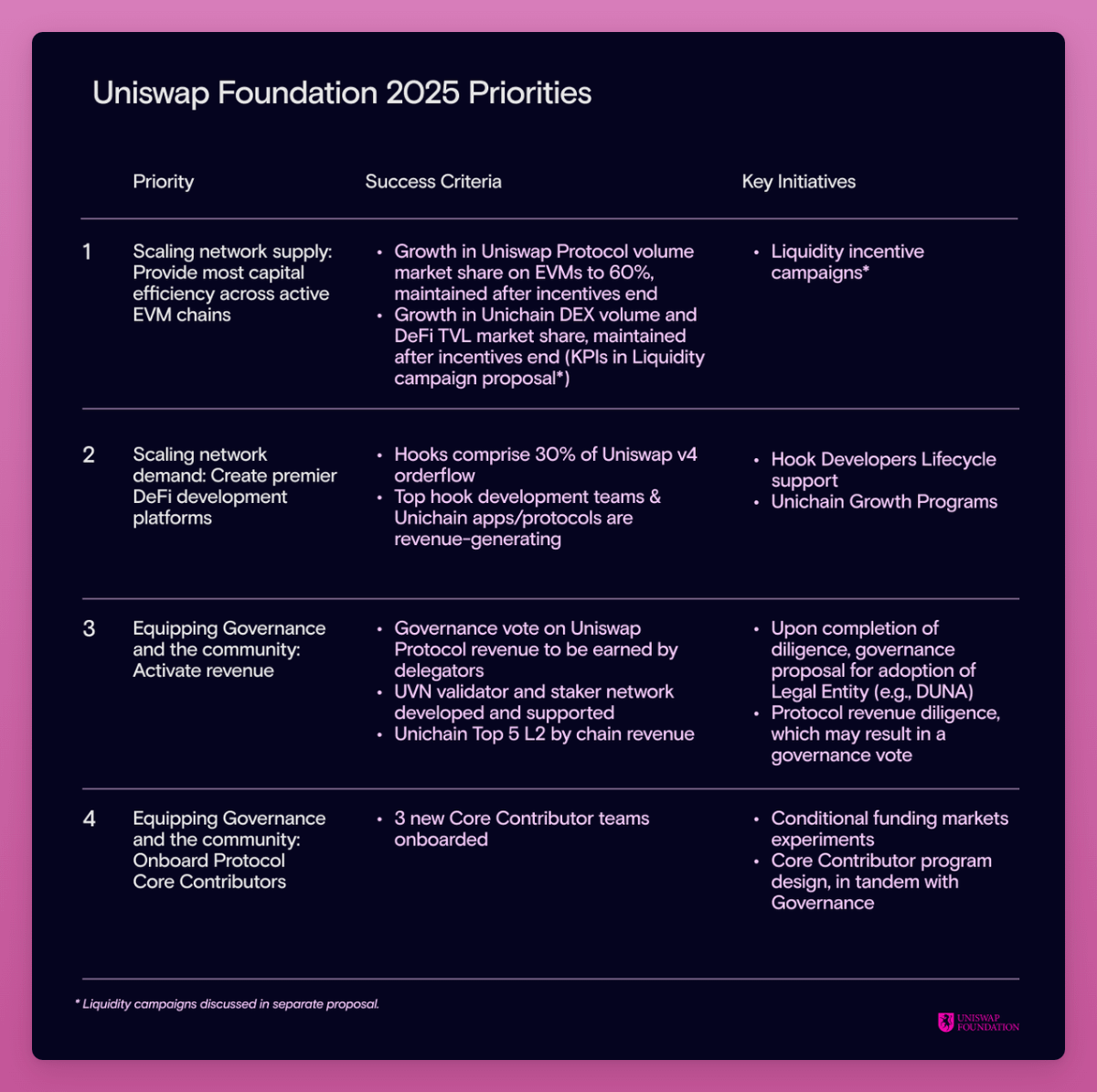

You see, Uni v4 isn't just a DEX: it's a liquidity platform and Hooks are apps built on it.

Hooks should drive growth for Uni v4 so grants are needed to jumpstart the process.

Detailed breakdown on Grants budget:

$45M in LP incentives will be used for:

• $24M over 6 months to incentivize migrating liquidity to Uni v4

• $21M for 3 months to grow Unichain TVL from current $8.2m to $750m

In perspective Aerodrome mints $40-$50M AERO monthly for LP incentives.

Proposals passed TEMP CHECK but not without criticism:

In a shifting era where Aave proposes buying back $1M of $AAVE per week and Maker $30/month buy backs, $UNI holders are a milking cow with now value accrual to the token.

UNI has no fee switch while Uniswap Labs generated $171M USD in front-end fees in 2 years.

It all comes down to how Uniswap organizations are structured:

• Uniswap Labs focuses on technical protocol development

• Uniswap Foundation drives ecosystem growth, governance, and funding initiatives (e.g., grants, liquidity incentives)

Smart lawyers.

Aave and Maker have a more aligned relationship with token holders, and I don't see why front-end fees couldn't be shared with $UNI holders.

Anyway, other criticisms focus on high salaries for the core team, Gauntlet being in charge of liquidity incentive implementation, and establishing a new centralized DAO legal structure (DUNA).

I'm a small Uniswap delegate and voted YES but with big concerns for the $UNI holders' future.

Incentives are not aligned with the holders.

Yet, I'm a big fan of Uniswap and its driving role in DeFi. Uni v4 & Unichain growth is abysmal. They need incentives for growth.

The next Uni DAO vote should be on UNI value accrual. If you agree, consider delegating $UNI to me:

0x3DDC7d25c7a1dc381443e491Bbf1Caa8928A05B0

Note: You can use same address to delegate $OP, $AAVE and $LDO

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。