Key Summary

– Cryptocurrency Strategic Reserves (CSR) may change the landscape of trade wars: Governments may hoard digital assets like Bitcoin and stablecoins to combat inflation, evade sanctions, and reduce reliance on traditional fiat currency reserves.

– Opportunities and risks coexist: CSR may enhance financial resilience and drive financial innovation, but it also brings about market volatility, regulatory uncertainty, and could even threaten the stability of national monetary systems.

– Escalation of trade wars may accelerate the adoption of cryptocurrencies: The global financial system may thus become fragmented, forming different "digital currency camps," intensifying competition between cryptocurrencies and traditional fiat currencies.

– How should governments find a balance between innovation and stability?: By gradually regulating stablecoins, exploring partial applications of cryptocurrencies, and promoting blockchain technology research and development, it may be possible to seize opportunities in emerging financial technologies while mitigating economic shocks.

In recent years, the concept of "Cryptocurrency Strategic Reserves (CSR)" has gradually gained attention among economists and geopolitical experts. Traditionally, the core means of trade wars revolved around tariffs, supply chain adjustments, and currency manipulation. However, if countries begin to incorporate cryptocurrencies into their national reserves, it could fundamentally change the operation of financial power and even reshape the global economic landscape.

This article will delve into this emerging trend, analyzing how governments can combine protectionist trade measures with cryptocurrency strategic reserves, and will detail the strategies, potential advantages, risks, and the possible impacts on the global financial system.

Table of Contents

The Rise of Cryptocurrency Strategic Reserves (CSR)

– Redefining National Reserves: From Gold to Bitcoin

– Goals of CSR: Combatting Inflation, Evading Sanctions, and Enhancing Financial Autonomy

– Bitcoin (BTC): Digital Gold or High-Risk Asset?

– Stablecoins: Stability vs. Centralization Risks

– Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA): How Do They Play a Role in Trade Strategy?

Motivations for Cryptocurrency Trade Strategies

– Hedging Currency Fluctuations and Exchange Rate Risks

– Financial Leverage Against Sanctions and Trade Barriers

– Digitalization Trends and Future Layouts of National Economies

Potential Advantages of Cryptocurrency Strategic Reserves

– Enhancing Economic Resilience and Avoiding Fiat Currency Instability Risks

– Evading Financial Blockades and Sanction Impacts

– Stimulating Domestic Blockchain Innovation and FinTech Development

– Enhancing National Competitiveness in the Global Digital Financial System

– Market Volatility and Economic Instability

– Undermining Sovereign Currency and Central Bank Policy Influence

– Regulatory Uncertainty and Political Risks

– Security, Custody Challenges, and Environmental Costs

Escalation of Trade Wars and the Contest of Cryptocurrency Strategic Reserves

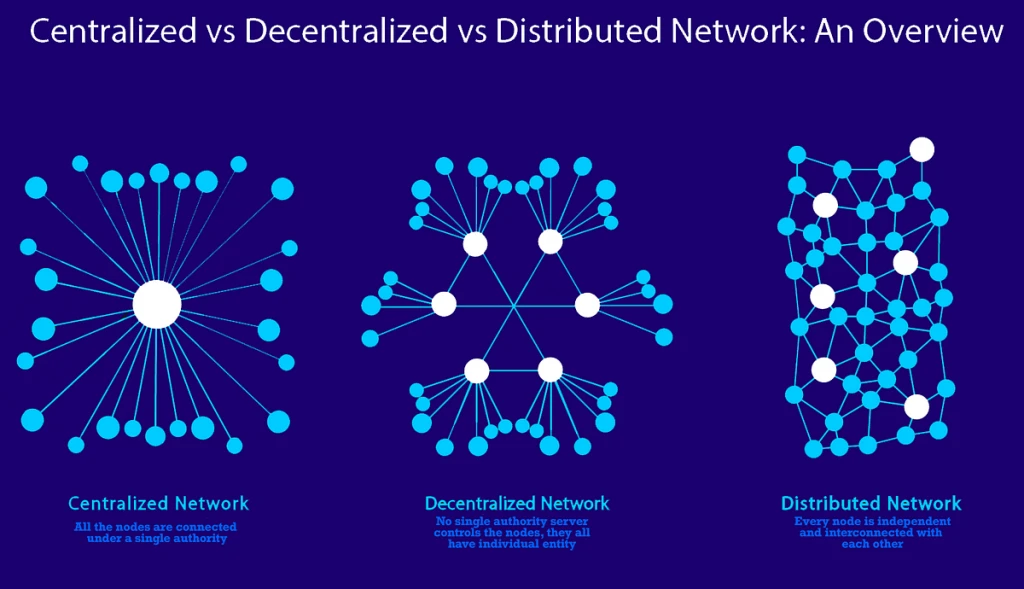

– Competing Digital Camps: Bitcoin Reserves vs. Central Bank Digital Currencies (CBDC)

– Best and Worst Case Scenarios for Global Finance

Federal Reserve and the Digital Dollar Ban

– Potential Conflicts Between the Federal Reserve and U.S. Cryptocurrency Strategy

– Possible Impacts on Monetary Policy and Financial Markets

Investment Strategies and Key Recommendations

Origins of Trade Wars

Trade wars typically occur when countries impose tariffs or other trade barriers on imported goods to protect domestic industries and reduce foreign dependence. A typical case is the "America First" policy implemented by U.S. President Donald Trump, which involved imposing tariffs on countries like China, Canada, and Mexico.

Tariff policies are like a double-edged sword—on one hand, they can promote the development of domestic manufacturing industries, such as steel and automotive; on the other hand, they often drive up product prices, increase inflationary pressures, and exacerbate international tensions.

Such protectionist policies have far-reaching impacts on national economies. When inflation rises, central banks may respond by raising interest rates, which in turn affects business operations and consumer spending. Supporters argue that tariffs can help revive certain industries, while opponents contend that they raise consumer costs and increase instability in global markets. Regardless, tariffs and trade barriers remain important bargaining chips for governments in economic and geopolitical games.

Image Credit: Supply Chain Beyond

The Rise of Cryptocurrency Strategic Reserves (CSR)

For a long time, national reserves of various countries mainly included foreign exchange, gold, and government bonds. However, in recent years, some policymakers and economists have begun to ponder: Would incorporating cryptocurrencies, especially Bitcoin or stablecoins, into national reserves enhance financial resilience? This idea has given rise to the concept of Cryptocurrency Strategic Reserves (CSR).

Goals of CSR

Combating Inflation

- – During trade wars, tariffs often drive up the cost of goods, exacerbating inflationary pressures. Allocating a portion of national reserves to limited-supply assets like Bitcoin may help hedge against the risk of declining fiat currency purchasing power.

Evading Sanctions and Economic Blockades

- – In geopolitical conflicts, hostile nations may freeze assets or restrict banking transactions. Cryptocurrencies, being outside the control of any single country or institution, theoretically can help governments maintain liquidity and financial autonomy, ensuring the flow of funds even when traditional financial channels are obstructed.

Reducing Dependence on Competitor Currencies

- – If trade wars involve major economies like China or the Eurozone, some countries may wish to reduce their reliance on the yuan or euro, and cryptocurrencies can serve as an alternative option.

Promoting Digital Economic Development

- – Developing CSR can attract domestic blockchain and FinTech investments, positioning the country as a global leader in financial technology and laying the groundwork for the future development of the digital economy.

Although CSR is still in the conceptual stage, it is gradually becoming a focal point of global attention as countries actively seek alternatives to de-dollarization and strive to adapt to changes in the global monetary system.

Image Credit: Coinlive

Key Cryptocurrency Analysis

Due to its fixed supply and long history, Bitcoin is referred to as "digital gold."

– Advantages: High global recognition and relatively high degree of decentralization.

– Disadvantages: Price volatility; large-scale use may lead to economic instability.

Stablecoins (e.g., USDC, USDT)

Stablecoins are typically pegged to fiat currencies or commodities (like gold) to reduce price volatility.

– Advantages: Price stability, suitable for cross-border transactions and daily payments.

– Disadvantages: Dependence on the issuer's reserve management and regulatory framework, which poses trust risks.

Features smart contract functionality and has established a mature ecosystem of decentralized applications (dApps).

– Advantages: Wide range of applications, usable in areas like supply chain tracking and identity verification.

– Disadvantages: High transaction fees; network congestion may affect user experience.

Focuses on fast, low-cost cross-border payments and fund transfers.

– Advantages: Potential for adoption by official payment systems, which could lower remittance costs and increase transaction speed.

– Disadvantages: Lower degree of decentralization and faces regulatory controversies in some countries.

Main advantages include high transaction throughput and low transaction costs.

– Advantages: Suitable for large-scale government applications, such as digital identity verification and public services.

– Disadvantages: Relatively new compared to other cryptocurrencies and has experienced network stability issues multiple times.

Adopts a research-driven development model with a focus on sustainable development.

– Advantages: Rigorous technical roadmap, emphasis on environmental protection and long-term stability.

– Disadvantages: Slower ecosystem development and adoption process compared to competitors.

If governments plan to choose cryptocurrencies as strategic reserves, decisions must be made based on specific needs, such as liquidity requirements, cross-border transaction capabilities, or potential for technological innovation.

Image Credit: MSN

Motivations for Cryptocurrency Trade Strategies

Currency Hedging

- – Trade wars often lead to significant exchange rate fluctuations, reducing investor confidence and potentially triggering capital outflows. Cryptocurrency Strategic Reserves (CSR), as assets outside the traditional banking system, can serve as a hedging tool to help countries protect part of their wealth from fiat currency depreciation.

Financial Leverage

- – If international payment systems like SWIFT are restricted, governments can maintain liquidity through cryptocurrency channels. There are precedents for this; some sanctioned countries have reportedly bypassed global banking system blockades using cryptocurrencies.

Digitalization Trends

- – With the development of Central Bank Digital Currencies (CBDC) and Decentralized Finance (DeFi), adopting CSR may help make monetary policy more forward-looking while promoting innovation in the local digital finance industry.

Historical Comparison

- – In the past, the gold standard helped countries withstand external economic shocks. Today, cryptocurrencies may play a similar role as a hedging tool for national wealth. However, compared to the stability of gold, the price volatility of cryptocurrencies may introduce greater uncertainty.

Image Credit: UPI

Potential Advantages of Cryptocurrency Strategic Reserves

Enhancing Fiat Currency Stability

- – When a country is in a prolonged trade war, investors often sell off the national currency, leading to capital outflows and fiat currency depreciation. Diversifying national reserve assets to include cryptocurrencies may help mitigate the impact of capital flight on the economy.

Evading Financial Blockades

- – If a country faces economic sanctions or financial blockades, cryptocurrency transactions can serve as an emergency solution to ensure that the flow of funds is not completely cut off, helping the government maintain the ability to purchase essential goods.

Promoting Local Industry Development

- – Government support for cryptocurrencies may attract mining investments, while also promoting blockchain research and development and FinTech startups, creating jobs and fostering overall economic growth.

Establishing Global FinTech Leadership

- – Countries that are early adopters of cryptocurrency strategic reserves have the opportunity to become centers of the global cryptocurrency industry, attracting businesses and capital, and further establishing long-term influence and competitiveness in the international FinTech arena.

Image Credit: Vecteezy

Major Risks and Drawbacks of Cryptocurrency Strategic Reserves

Market Volatility and Economic Instability

- – Cryptocurrency prices are highly volatile and can rise or fall dramatically in a short period. If a country relies excessively on cryptocurrencies as reserve assets, significant market fluctuations may impact overall economic stability, especially during economic downturns or periods of heightened global market risk aversion.

Undermining Fiat Currency Credibility and Monetary Sovereignty

- – If a government adopts cryptocurrencies as reserves on a large scale, it may inadvertently weaken public trust in the national fiat currency. For example, if a reserve currency issuer like the United States decides to hold large amounts of Bitcoin, it could accelerate "de-dollarization" and prompt competitors to develop their own digital currencies to undermine the global influence of the dollar.

Regulatory Uncertainty

- – Governments around the world have varying attitudes toward cryptocurrencies, and new administrations may overturn previous pro-crypto policies, leading to market instability and even capital outflows, affecting financial security.

Security and Custody Issues

- – National-level cryptocurrency reserves require high-security storage solutions, such as multi-signature wallets or Hardware Security Modules (HSM). If a hacking incident or security breach occurs, it could result in significant asset losses and impact public trust.

Energy Consumption and Environmental Impact

- – Bitcoin mining consumes a large amount of energy; if a country invests heavily in large-scale mining, it may increase pressure on the power grid and trigger environmental controversies, potentially leading to policy opposition.

Image Credit: Freepik

Escalation of Trade Wars and the Contest of Cryptocurrency Strategic Reserves (CSR)

As tensions escalate between major global economies, leading to increased tariffs, export restrictions, and even currency flow disruptions, Cryptocurrency Strategic Reserves (CSR) may become a parallel financial network, helping governments maintain trade relations. If both sides adopt different digital currency systems (e.g., digital yuan vs. Bitcoin-based CSR), the global financial system may further fragment, forming "digital currency camps."

Possible Best Case Scenario

– Trade remains smooth: Countries with CSR can bypass blockades from traditional banking systems, relying on cryptocurrencies to maintain international trade without stagnation due to sanctions or currency restrictions.

– Financial innovation explosion: Competition among digital currency camps may spur rapid development of technologies such as blockchain, stablecoins, and asset tokenization (e.g., energy, commodities, real estate), leading to a new wave of FinTech innovation.

Possible Worst Case Scenario

– Market volatility: Geopolitical news may trigger panic among investors, leading to significant fluctuations in the cryptocurrency market, which could spill over into the traditional financial system.

– "Mining arms race": Governments may compete to accumulate cryptocurrencies or expand mining operations, driving up market prices and intensifying competition between nations, but the lack of unified regulation may lead to greater financial uncertainty.

Image Credit: The Wall Street Journal

Federal Reserve and the Digital Dollar Ban

In January 2025, U.S. President Donald Trump signed Executive Order 14178, officially banning the issuance of a Digital Dollar. The order stipulates that the Federal Reserve and any federal agency are prohibited from developing or issuing Central Bank Digital Currency (CBDC). Meanwhile, the U.S. government decided to adopt a Crypto Strategic Reserve (CSR), incorporating cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana (SOL), and Cardano (ADA).

The refusal to launch a Digital Dollar may trigger several key impacts:

Weakened Influence of the Federal Reserve

- – With the ban on CBDC, the Federal Reserve loses the ability to directly control the money supply through digital currency, making U.S. monetary policy more difficult to operate in a cryptocurrency-driven financial environment.

Increased Market Volatility

- – The federal government supports CSR while the Federal Reserve maintains the traditional fiat currency system; this policy divergence may exacerbate volatility between the cryptocurrency market and traditional financial markets.

Division in U.S. Financial Strategy

- – The Federal Reserve continues to implement traditional fiat-based policies, while the federal government opts for cryptocurrencies as reserves. This dual-track financial system may lead to regulatory confusion and increase market uncertainty.

Accelerated Global De-dollarization

- – Without a Digital Dollar as a competitor, other countries may be more inclined to adopt China's Digital Yuan (e-CNY) or other state-led digital currencies, further weakening the dollar's dominant position in the global economy.

Image Credit: CryptoSlate

Investment Strategies and Key Recommendations

Diversify Investments to Reduce Risk

– Do not put all funds into a single cryptocurrency or stablecoin; instead, allocate reasonably to mitigate the impact of market volatility.

– It is advisable to pay attention to both large crypto assets (BTC/USDT, ETH/USDT) and potential projects (ADA/USDT, SOL/USDT), but avoid over-concentration in any one category of assets.

Monitor Market Dynamics

– Stay updated on geopolitical news and central bank announcements, as policy adjustments may have a significant impact on the crypto market.

– Track the real-world applications of cryptocurrencies (e.g., El Salvador's Bitcoin initiative), as these trends may become important indicators for future market direction.

Adopt Defensive Strategies

– During trade wars or tense international situations, it is advisable to allocate some funds to stablecoins (USDT, USDC) or fiat currencies to have capital available for buying at market lows.

– If you have more advanced investment experience, consider using derivatives (options, futures) to hedge risks and ensure profit protection during significant market fluctuations.

Adapt to Regulatory Changes

– Changes in regulatory policies may bring new opportunities; for example, clearer tax rules may attract institutional investors, even if short-term KYC/AML (Know Your Customer/Anti-Money Laundering) requirements may increase compliance costs, they could promote market growth in the long run.

– Proactively adapt to regulations to ensure compliance in trading; compliant investors often occupy more favorable positions when the market matures.

Evaluate Mining and Staking Opportunities

– If the government supports staking of Proof of Stake (PoS) assets, then staking rewards may become a mainstream investment method.

– In regions with low energy costs and policy support, cryptocurrency mining may still be a profitable investment strategy, especially for mining models based on green energy.

Image Credit: Biyond

Future Outlook

The intertwining of trade protectionism and the proliferation of cryptocurrencies brings unprecedented opportunities along with significant risks. As the global financial landscape rapidly evolves, governments need more flexible and forward-looking strategies to address challenges.

Crypto Strategic Reserves (CSR) may help combat inflation and evade sanctions, but they also introduce market volatility and could potentially undermine the dominance of existing fiat currencies. When formulating policies, countries must carefully weigh the following key factors:

Sovereignty vs. Decentralization

- – Adopting cryptocurrencies may help countries reduce dependence on foreign banking systems and enhance financial autonomy, but it may also weaken government control over domestic money supply.

Volatility vs. Innovation

- – The extreme volatility of cryptocurrencies indeed poses risks, but it may also help countries achieve leadership in the FinTech sector and drive economic growth.

Short-term Instability vs. Long-term Strategy

- – A well-executed CSR could play a crucial role in future economic crises, but if policies are poorly formulated, they could severely impact national financial stability.

The combination of cryptocurrencies and trade wars is reshaping the global financial landscape. How countries find a balance between risks and opportunities will directly affect their future economic competitiveness.

Image Credit: Medium

Conclusion

"The Rise of Trade Wars and Cryptocurrency Strategic Reserves" explores the future intertwined with geopolitical tensions and digital financial transformations. Crypto Strategic Reserves (CSR) may become important tools for nations to combat inflation, evade sanctions, and reduce currency risks, providing financial buffers in trade conflicts. However, extreme price volatility, regulatory uncertainty, and potential impacts on sovereign fiat currency systems make this path challenging.

Rather than "fully accepting" or "completely rejecting," decision-makers are more likely to adopt a "gradual strategy":

– Strengthen regulation of stablecoins to ensure the financial system does not become turbulent due to uncontrolled markets.

– Explore partial applications of cryptocurrencies, piloting operations in trade settlements, government payments, and other areas.

– Encourage private sector innovation to promote the development of cryptocurrencies and blockchain technology within a regulatory framework.

For most countries, the best response to trade wars may not rely solely on digital currencies but rather on diplomatic means and diversified economic policies to mitigate risks. However, as the trend of de-dollarization and the evolution of the global digital currency system continue, those countries that actively explore CSR may occupy more favorable positions in future international monetary competition.

Ultimately, the fate of cryptocurrency strategic reserves depends on how governments balance "innovation" and "stability," finding strategies that suit their own needs between monetary sovereignty and global cooperation. History has shown that technological breakthroughs are often key to national competitive advantages. Whether CSR can bring economic resilience or trigger new financial crises will depend on the foresight of policies, the maturity of markets, and how countries strategize on the international financial stage.

Disclaimer: The views expressed in this article are solely those of the author and do not represent the official opinions of any institution or organization.

Quick Links

– March Global Economic Trends: A Must-Read for Crypto Investors

– Hong Kong Web3 Revolution: Key Trends and Regulatory Policies Released at Consensus 2025

– Monad vs. Ethereum: Can This Emerging L1 Disrupt the Market?

– $BABY Token and Babylon Labs: Unlocking the Potential of Bitcoin Staking to Enhance PoS Security

– Top 9 Cryptocurrency Trends for 2025: AI, DeFi, Tokenization, and More Innovations

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with more than 1 million monthly active users and over 40 million user traffic within the ecosystem. We are a comprehensive trading platform supporting over 800 quality cryptocurrencies and more than 1,000 trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading options including spot trading, margin trading, and futures trading. XT.COM also features a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。