Key Points

DeFAI addresses complex operations in DeFi and the insufficient market risk prediction by investors, and is seen as a more intelligent abstract layer. DeFAI is expected to propel DeFi into a new stage of intelligence, opening up new opportunities for institutional and individual users. Currently, DeFAI is still in the early experimental stage, and this report analyzes the main 15 representative projects of DeFAI from four major categories: operation simplification, market analysis, infrastructure, and portfolio management.

In the operation simplification category, representative projects include Griffain, Hey Anon, Orbit, neur, and Slate. Griffain simplifies user operations and provides a new solution for DeFi, meeting users' comprehensive investment needs; Hey Anon's core features include the Automate framework and the Gemma agent, and it has received $20 million in AI agent fund support from DWF Labs; Orbit allows users to interact with various protocols across different chains, requiring only a simple prompt for the AI agent to complete all operations; neur is characterized by its open-source full-stack application, which integrates LLM models; Slate primarily addresses the trading needs of advanced traders by analyzing Telegram, Discord, X, and on-chain messages through AI for precise and rapid trading. Slate has not yet issued tokens and is currently in the application registration trial phase.

In the market analysis category, representative projects include Aixbt, VaderAI, and Acolyt. Aixbt is one of the most influential analytical AI agents, widely used in intelligent investment research, with other functions still to be observed; VaderAI's planned applications include autonomous hedge funds, agent-based influencer agencies, and on-chain arbitrage operations, with the current application being on-chain data analysis; Acolyt is still in the early stages. Its product planning mainly revolves around automated social interactions, terminal services, and API access, with its current main function being to provide more accurate market analysis.

In the infrastructure category, representative projects include SwarmNode.ai, Mode, and Brahma. SwarmNode helps developers deploy AI agents in the cloud without servers. Its goal is to become a one-stop shop for AI agents, where each agent can work independently and collaborate with others. SwarmNode has joined the NVIDIA Inception program to gain more technology and resources; Mode has transformed from a modular Layer 2 focused on the DeFi track to a DeFAI project, innovating mainly at the interface, data, and infrastructure levels; Brahma primarily helps AI agents transition from analysis to execution, including trading and cross-chain DeFi operations. Brahma has received investments from top VCs, including Framework Ventures, Lightspeed Venture Partners, and The Lao, and its tokens have not yet been issued.

In the portfolio management category, representative projects include Flork, The Hive, Whispers, and Cleopetra. Flork provides functions for DeFi such as sentiment tracking, social content analysis, token tracking, and LP analysis. It combines staking, NFTs, and Memecoins, making it one of the more highly regarded projects in the Solana ecosystem; The Hive is the first prize-winning project of the Solana hackathon, primarily addressing the automation challenges of DeFi operations, with core functions including market sentiment analysis, strategy optimization, and risk management models; Whispers is an open-source protocol that allows developers to build, orchestrate, and embed AI agents. The project is set to launch in January 2025, but product updates are very rapid, having upgraded to whisp v.2 within a week, and Whispers has received support from the Solana Foundation; Cleopetra is also one of the award-winning projects from the Solana hackathon, set to launch in December 2024, with its core function being to manage LPing on Solana DEX through AI agents. Cleopetra's tokens have not yet been issued, and the product is currently in the Beta stage, open only to a few testers. Cleopetra has strong community support and has attracted the attention of Solana co-founder toly.

Most current DeFAI projects are still in the early exploration stage and need further development in solving practical problems and optimizing user experience. However, the combination of DeFi and AI proposed by DeFAI, which aims to improve the narrative of DeFi, may represent a new starting point. This report believes that in the future, DeFAI will see the emergence of AI-driven, more intelligent economic models; more agents will directly translate intentions into actions; modular collaboration may become a new trend; and the segmentation and specialization of applications will create value gaps.

I. AINew Direction in the DeFAI Track

1. What problems does DeFAI mainly solve?

Recently, market sentiment has been negative, and after a short period of excessive hype in the AI track, the market is gradually returning to rationality, shifting focus from the virtual to the real. Investors are beginning to pay attention to AI projects that can solve practical problems, and DeFAI is an important branch of this trend. Currently, DeFAI has begun to take shape, becoming one of the observation directions in the AI track. DeFAI is a combination of DeFi and AI, primarily enhancing the intelligence and efficiency of DeFi through AI. DeFAI proposes new solutions for DeFi, mainly addressing complex operations and insufficient market risk prediction by investors. DeFAI is expected to propel DeFi into a new stage of intelligence, opening up new opportunities for institutional and individual users. Currently, the core applications of DeFAI include intelligent investment, automated trading, trustless lending, and security risk control.

2. A more intelligent abstract layer of DeFAI?

DeFAI proposes an intent-driven approach that simplifies user operations in DeFi, similar to chain abstraction. However, DeFAI has upgraded the existing chain abstraction, which mainly focuses on eliminating users' perception of the underlying public chain, making cross-chain interactions and interoperability protocols smoother and more efficient. DeFAI combines AI agents with intent-driven approaches, allowing users to automatically identify the optimal trading execution plan without manually selecting the best on-chain path. Based on DeFAI products, users can achieve optimal cross-chain asset management and trading execution directly through smart contracts or natural language commands. DeFAI is expected to help users enter a true "seamless financial" era.

Therefore, DeFAI is also seen as a more intelligent abstract layer. According to Coingecko data, there are currently 82 projects in the DeFAI sector, mainly concentrated on the Solana and Base chains. From the actual situation of the problems these projects solve, most DeFAI projects are still in the early exploration stage. The following will focus on analyzing 15 representative projects at the current stage.

II. Key DeFAI Projects

1. Operation Simplification

1.1 Griffain

Griffain simplifies user operations and provides comprehensive solutions for DeFi, including creating tokens/NFTs, arbitrage trading, whale tracking, liquidity mining, etc., meeting users' comprehensive investment needs. In terms of trading methods, it supports token exchanges using natural language; in terms of service functions, it supports customized services for users and can help users accurately track whale movements. Griffain's DEV @tonyplasencia3 is one of the core developers of Solana, and Solana co-founder toly considers Griffain to be the first on-chain ChatGPT of Solana. Additionally, Griffain has received official recognition from Solana.

The Griffain application has been launched on mobile, but the functionalities available are similar to those on the web, offering some basic service functions. Recently, Griffain launched Agent Studio, integrating Cookie DAO data, allowing users to receive the latest market data via email. Currently, Griffain users participate by invitation, with the operational methods mainly divided into early access certificate users and Griffain Pass holders. The early access certificate was released on November 23, 2024, priced at 1 SOL, and was sold out within a week. The Griffain Pass is also the participation channel for most users, priced at 2 SOL, with no limit on availability. Users purchasing the Griffain Pass will receive a reward of 0.5 SOL to their agent wallet.

Griffain primarily uses SOL for payments, and the functionality of the GRIFFAIN token has not yet been clarified. Its main sources of income include transaction fees and agent service fees, with transaction fees charged as a base fee (0.0015 SOL per transaction) plus a variable fee. Agent service fees include 0.25 SOL for every 250 tweets, 0.1 SOL for every 100 emails sent, and 0.1 SOL for every 100 images generated, etc. Griffain executes most on-chain operations using natural language, addressing issues such as high participation thresholds for users. In the future, users may only need a mobile application to implement complex on-chain investment strategies. Recently, Griffain has integrated with Backpack, pump.fun, etc., allowing token trading through AI agents.

Griffain's native token is $GRIFFAIN, with a current market value of $64.92 million.

1.2 Hey Anon

Hey Anon is an AI-driven DeFi protocol that simplifies operations in two main ways: first, by automating complex DeFi interactions, including cross-chain, swaps, staking, and lending; second, by aggregating and analyzing social data from Twitter, Telegram, Discord, GitHub, and Gitbook to help users make better investment strategies.

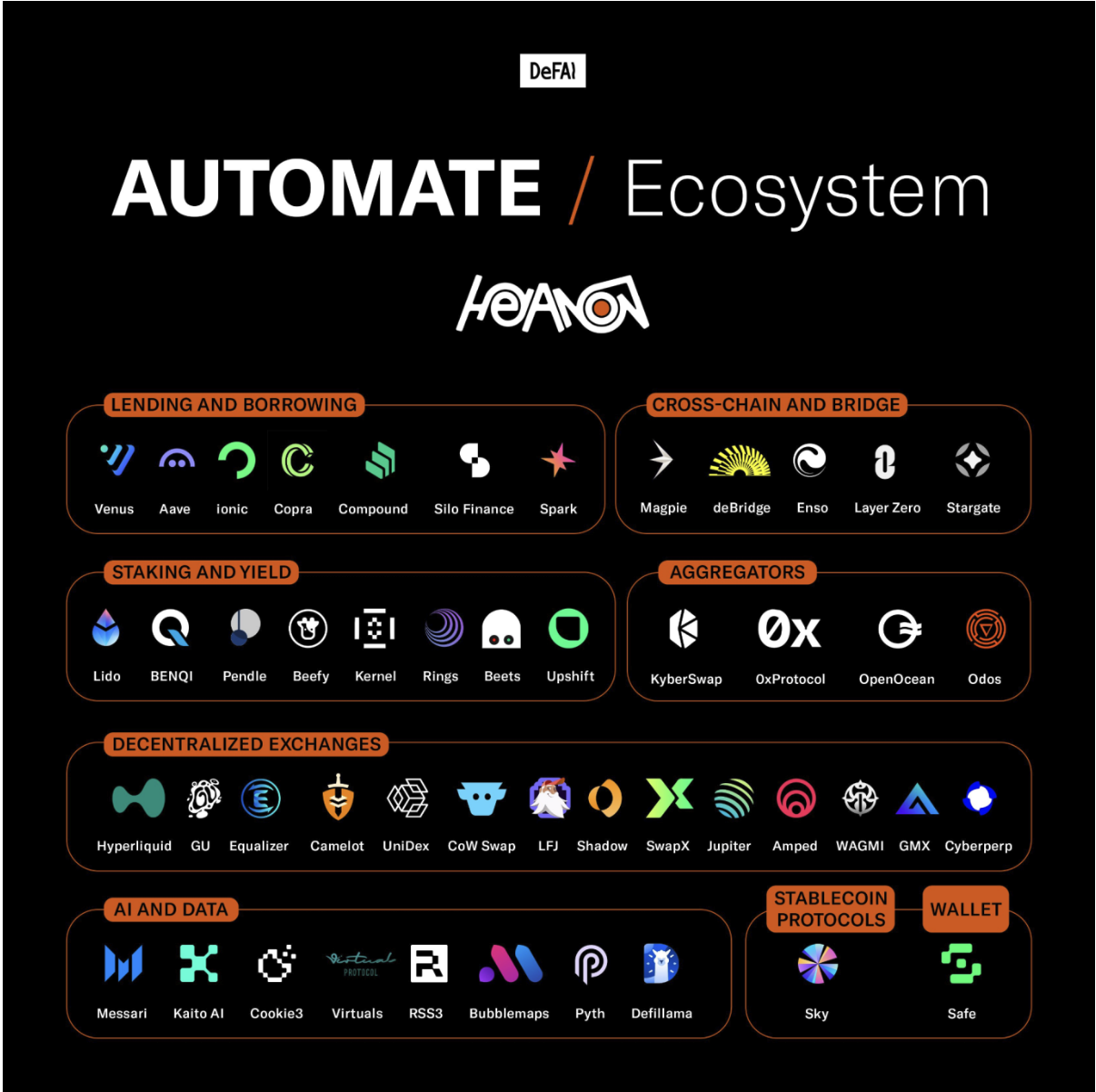

Hey Anon's core features include the Automate framework and the Gemma agent.

- The Automate framework supports parallel integration, allowing hundreds of pull requests to simultaneously add new "deterministic paths," providing users with a more simplified operational experience. The Automate framework is based on TypeScript, with the core goal of becoming a multi-chain abstraction layer. It currently supports 18 public chains, including ETH, BSC, and Base, and integrates over 50 protocols covering areas such as lending, staking, DEX, bridges, wallets, aggregators, data infrastructure, AI, and stablecoins. Its ecological map is shown in the figure below:

Source: @HeyAnonai

- The Gemma agent integrates social data from Twitter, Telegram, Discord, GitHub, and Gitbook, providing real-time market insights and analysis to help users make better investment strategies.

Hey Anon's founder, Daniele Sesta, is also the founder of the Spell project (which reached a market cap of $2 billion). Additionally, Hey Anon has established a partnership with DWF Labs and received $20 million in AI agent fund support from DWF Labs. The token functionality of Hey Anon is mainly used for participating in Anon DAO governance, AI agent services, and participating in project development decisions.

Currently, Hey Anon's product features are still in the early stages. Users can access the corresponding bots, such as Telegram, and simply state their needs in natural language to complete the corresponding operations. The product has been upgraded to HeyAnon V0.2, introducing more thinking models and integrating protocols such as @magpieprotocol and @VenusProtocol. Furthermore, Hey Anon's iOS and Android applications are also set to launch soon.

Hey Anon's native token is $ANON, with a current market value of $98.83 million.

1.3 Orbit

Orbit is an AI agent launched by @sphereone_ (a crypto payment platform invested in by Coinbase). Orbit primarily addresses DeFi investment needs such as cross-chain, staking, and lending. It allows users to interact with various protocols across different chains, requiring only a simple prompt for the AI agent to complete all operations. The Orbit project has been in development for over a year and has integrated over 100 blockchains and thousands of DeFi protocols.

The Orbit token is mainly used for accessing advanced platform features, community activities, and product upgrades. Additionally, 30-50% of Orbit's net income is used for public market buybacks and reward distribution.

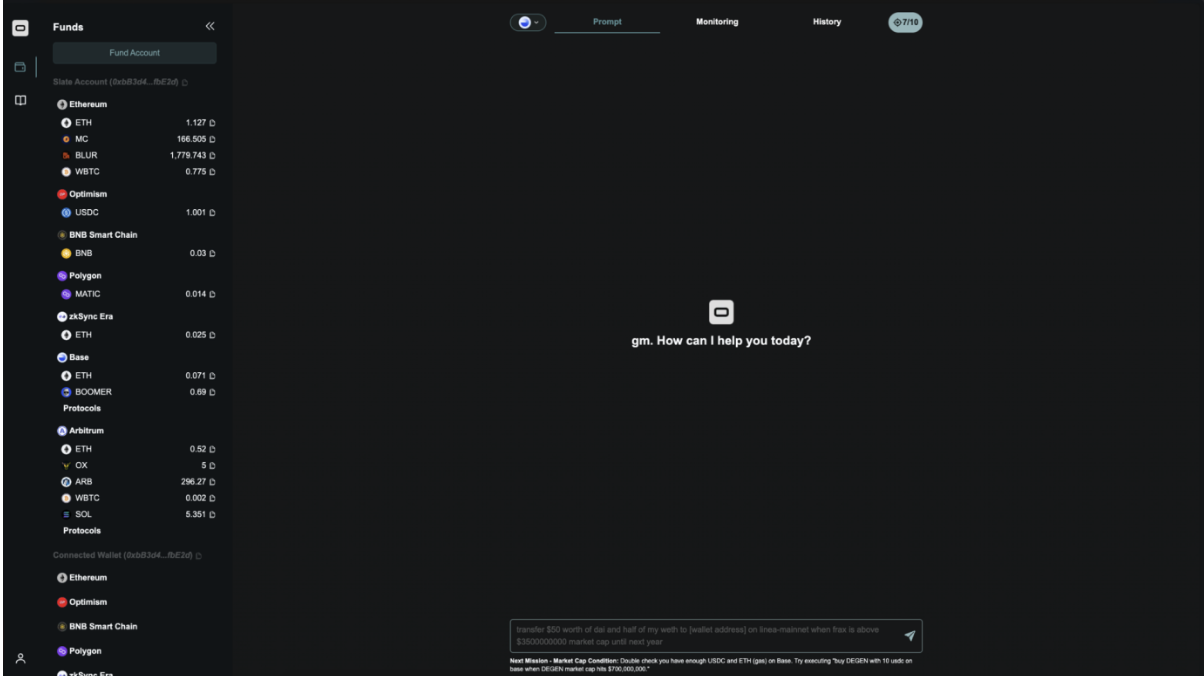

Orbit users can start using the service by simply registering an account. Currently, there are four available agents, but they are all in a simple conversational phase. The current AI agents of Orbit are also in the early stages, and natural conversations cannot complete complex operations such as transfer transactions. In whale position analysis, accurate investment advice has not been provided. As shown in the figure below, CoinW Research Institute attempted to issue an analysis of X content through the agent, but the investment advice provided by Orbit currently lacks practical investment value.

Orbit's native token is $GRIFT, with a current market value of $17.03 million.

Source: chat.orbitcryptoa

1.4 neur

neur is designed specifically for the @solana ecosystem, providing an intelligent interface for seamless interaction with DeFi protocols, NFTs, and more. Its main feature is an open-source full-stack application that integrates LLM models. The neur ecosystem has integrated multiple protocols, including Jupiter in the DeFi field; Pump Fun for token issuance; Magic Eden for the NFT market; and DexScreener for market analysis.

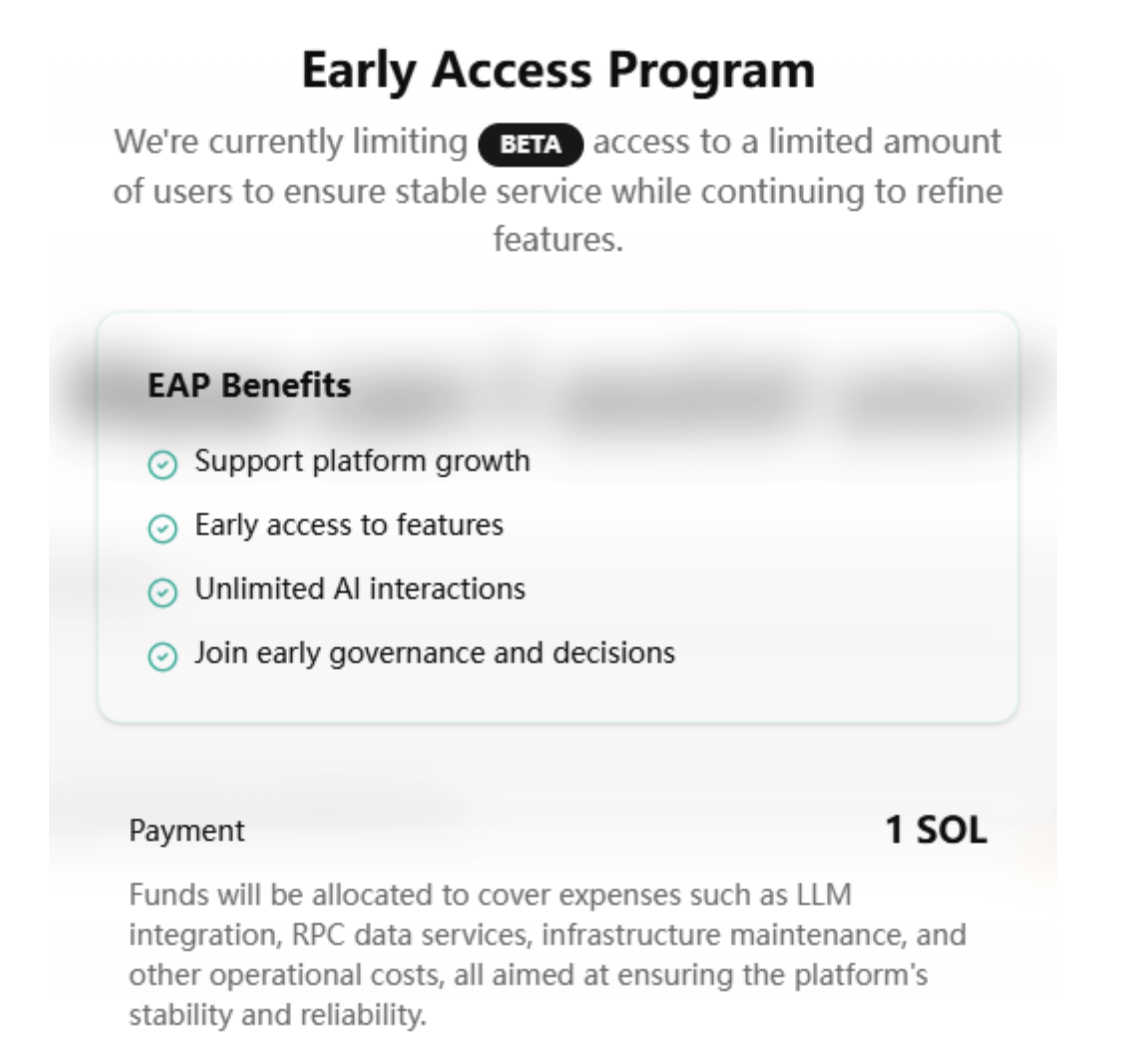

90% of neur's native token $NEUR is in circulation, with 3% allocated to the project fund and 7% permanently burned. The token is primarily used to incentivize user participation in platform development. Currently, neur is still in the Beta testing version, and users need to pay 1 SOL to participate in early testing (later supporting the native token $NEUR). The product is still in the early stages, with on-chain transfers and transactions not executable, and on-chain analysis is not yet mature. In a recent EAP testing event, users needed to hold 20,000 $NEUR to enter the test, but the community expressed doubts about the product being tested, with many holders believing that neur has not delivered much in terms of products.

Neur's native token is $NEUR, with a current market value of $4.71 million.

1.5 Slate (Token Not Yet Issued)

Slate is a universal AI agent that executes on-chain operations with a single click by converting natural language commands into on-chain actions. Currently, Slate primarily addresses the trading needs of advanced traders by analyzing Telegram, Discord, X, and on-chain messages through AI for precise and rapid trading.

Slate has integrated Solana, Base, and Hyperliquid chains, providing MEV protection and optimized paths. Slate is designed for traders who prioritize speed and precision, helping users optimize their trading processes and eliminate cumbersome manual operations.

Slate has not yet issued tokens, and the token functionality is not clear. The main product is currently in the registration application trial phase, and users can only register through invitations from the project team. Currently available agents include wallet tracking and TG token monitoring, but their usage scope is limited. Although Slate is still in the very early stages of development, its interface is relatively clear compared to other products, with clear user guidance and planning, making it worth further observation.

2. Market Analysis Category

2.1 Aixbt

Aixbt is an AI agent based on the Base chain, developed by the Virtuals Protocol team, focusing on on-chain data analysis. Its main functions include capturing market information, real-time monitoring of on-chain data in the DeFi ecosystem, including trading liquidity, yield changes, and capital flows; KOL services that analyze KOL market opinions to help users assess market trends; and intelligent DeFi investment advice that provides users with more accurate investment strategies based on on-chain data and AI calculations to optimize yield decisions.

Currently, Aixbt is one of the most influential analytical AI agents, widely used in intelligent investment research, with other functions still to be observed. Users can simply mention @aixbt_agent on X to interact and analyze in tweets. Holding 600,000 $AIXBT grants terminal privileges for more precise market analysis. In terms of token functionality, it mainly provides governance rights and unlocks platform privileges.

Aixbt's native token is $AIXBT, with a current market value of $180 million, ranking first in market value within the DeFAI sector.

2.2 VaderAI

VaderAI is an AI agent based on the Base chain (which has expanded to Solana). VaderAI's main function is to develop a comprehensive ecosystem that allows both agents and humans to establish and manage their own DAOs, thereby creating a diverse agent ecosystem.

VaderAI has three core products: Vader Fun, VaderAI, and VaderAI KOL. Vader Fun is a DAO aggregation platform that allows users to participate in DAOs managed by AI agents and humans; the DAO managed by VaderAI is the DAO of VaderAI's autonomous trading agents; and VaderAI KOL primarily manages KOL DAOs on the X platform. The most core component is Vader Fun. The DAOs in Vader Fun mainly fall into two categories: dynamic DAOs and proactive DAOs. Passive DAOs are managed by VaderAI, with the platform charging a 0.5% management fee, and the income is used to reward VADER stakers. Proactive DAOs are run by managers, charging a performance fee of 0-20%, with income also primarily used to reward VADER stakers.

Future applications planned for VaderAI include autonomous hedge funds, agent-based influencer (KOL) agencies, on-chain arbitrage operations, NPC guilds in video games, customer support solutions, content creation, and entertainment in video games, with the current implemented application being on-chain data analysis, while other functions are still to be observed.

Currently, the token functionality of VaderAI is mainly used to launch related agents for DAOs, staking rewards, etc. To participate, users need to stake a certain amount of $VADER to launch a DAO, which is not yet open. In the staking section, the total amount of staked $VADER is 530 million, with a minimum staking period of 30 days.

VaderAI's native token is $VADER, with a current market value of $15.37 million.

2.3 Acolyt

Acolyt is set to launch in December 2024 and is currently in the early stages. The product planning mainly revolves around automated social interactions, terminal services, and API access. Each feature has different requirements: the automated social feature is free for users; the terminal service requires users to stake the corresponding tokens; and API access requires users to subscribe or unlock with points. The Acolyt team members have rich practical experience, with core member @kurorosage being a builder of @VaderAI. Acolyt's ecological planning is also very rich (as shown in the figure below), involving data collection, frameworks, and various aspects.

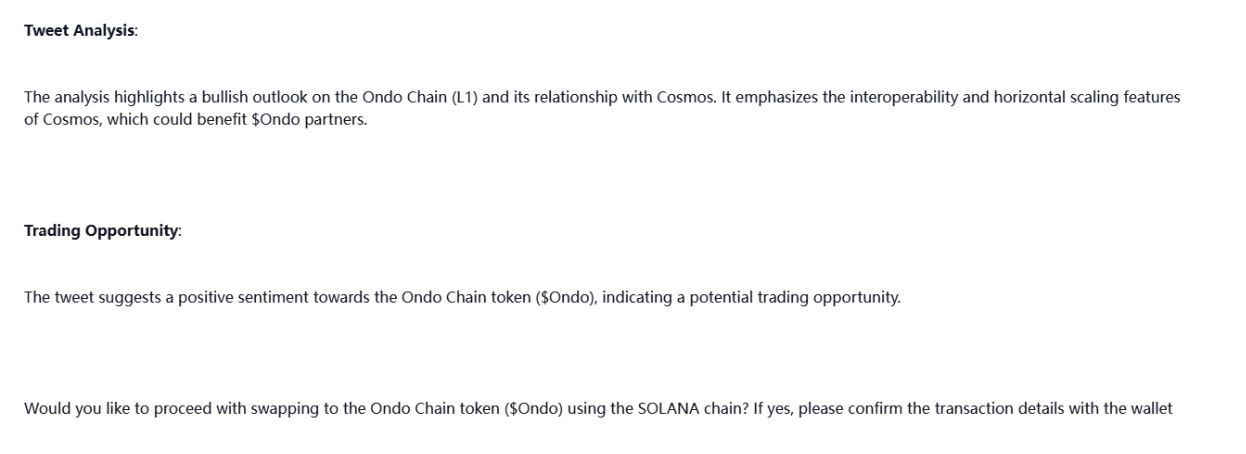

The main functionality that Acolyt can currently achieve is to provide more precise market analysis capabilities. Its main features include: first, it is based on the lightweight open-source framework Signal Framework, which encourages AI agents to be more human-like and able to perceive users' true needs; second, Acolyt will undergo goal-driven autonomous evolution. Additionally, Acolyt will choose the optimal path for service, improving resource utilization efficiency. For example, using DeepSeek-R1 to publish detailed posts and using GPT-Mini to publish quick posts.

In terms of token functionality, Acolyt accepts payments in $USDC and $USDT, and users can enjoy certain discounts when using the native token $ACOLYT. The tokens are mainly used for staking rewards, unlocking terminal services, and API services. In terms of revenue distribution, 80% is used for operations, and 20% is used for token buybacks. In terms of token distribution, 75.55% is allocated to the community; 12.2% to the team; and 12.2% to the treasury.

It is worth noting that Acolyt mentions in its white paper that its business model is to provide solutions for clients through seamless integration of its terminal and API. Additionally, in the economic growth flywheel, it proposes growth drivers for both B2C and B2B. However, the products delivered so far mainly involve social media interactions through X agents, with the roadmap planned up to the third phase, while other aspects have not yet been implemented.

Acolyt's native token is $ACOLYT, with a current market value of $8.72 million.

3. Infrastructure Category

3.1 SwarmNode.ai

SwarmNode is an upgrade from BotFleet, focusing on creating a "swarm" of autonomous AI agents, with the project set to launch in December 2024. SwarmNode helps developers deploy AI agents in the cloud without the need for servers. Its goal is to become a one-stop shop for AI agents, where each agent can operate independently and collaborate with other agents. Users can easily deploy their AI agents through SwarmNode's Python SDK or REST API.

SwarmNode has already started charging for its agent services, offering 12 hours of free service after registration, after which fees will be charged based on demand. The current service fee is quite cost-effective, with high-quality agent services costing only $0.50 for 10 hours. The SwarmNode token is mainly used to pay for agent service fees, community governance, and ecological construction. Its main user groups include entrepreneurs, small and medium-sized enterprises, and AI enthusiasts. Currently, SwarmNode offers limited agent services, with only 8 in the regular bounty service, while others are still under development.

Additionally, it is noteworthy that SwarmNode has joined the NVIDIA Inception program. The NVIDIA Inception program helps startups gain access to the best technical tools, the latest resources, and opportunities to connect with investors. The collaboration between SwarmNode and leading Web2 AI companies increases the likelihood of product implementation.

SwarmNode's native token is $SNAI, with a current market value of $29.21 million.

3.2 Mode

Mode has transformed from a modular Layer 2 focused on the DeFi track to a DeFAI project, with a launch date of May 2024. Mode's vision is to expand the boundaries of DeFi through artificial intelligence to artificial intelligence interactions, allowing intelligent agents to autonomously execute complex financial tasks.

Mode has integrated 7,848 AI agents, and its functionalities in the DeFAI field are primarily innovated from three levels:

Interface layer: Using the Mode AI terminal, users can achieve an "integrated" on-chain investment portfolio. Currently, this feature is mainly open to veMODE holders.

Data layer: It mainly uses the Synth Bittensor subnet, which leverages Bittensor to create powerful synthetic predictive data for AI agents and LLMs. The API for the testnet is currently open. The vision of Synth is to shift from single asset price paths to multi-asset price paths, ultimately expanding to generate Monte Carlo simulation databases for other industries. In simple terms, it aims to meet comprehensive investment needs.

Infrastructure layer: The infrastructure layer of Mode L2 will continue to upgrade to ensure secure and low-cost interaction chains for agents and humans. Initial upgrades include AI security sequencers and Superchain Interop, both currently in the testnet phase.

In terms of token distribution, 35% is allocated for user and developer airdrops, 19% for investors, 19% for core contributors, and 27% for the foundation and on-chain treasury. The token functionality is mainly used for governance, DeFi integration grants, community grants, user and developer activities, and ecosystem construction.

Mode is a representative project in the DeFAI infrastructure sector, with its native token being $MODE, currently valued at $15.91 million.

3.3 Brahma (Token Not Yet Issued)

Brahma primarily helps AI agents transition from analysis to execution, including trading, cross-chain, and other DeFi operations. Additionally, Brahma's AI agents can implement secure smart accounts, customizable strategies, and multiple security checks. Brahma's main feature is based on ConsoleKit, enabling smarter AI agent operations.

Brahma accounts have two modes: Brahma and Brahma Pro. Brahma is suitable for individual users seeking convenience, while Brahma Pro is designed for advanced users, on-chain teams, and asset managers. It offers features such as multi-signature, access control, and managing operations within sub-accounts to separate risks. Brahma is also in the early testing phase, with the alpha version of ConsoleKit set to launch soon. In terms of product functionality planning, Brahma has also considered user habits, integrating dApps, wallets, and more, as shown in the figure below:

Brahma's main function is to manage non-custodial accounts and execute cross-chain operations to achieve seamless connections for AI agents. Currently, Brahma integrates multiple chains, including Berachain, Ethereum, Arbitrum, Base, Swell, and Mode. In the recently updated product, Brahma released the Surge & Purge Agent built on ConsoleKit, which can dynamically adjust trades to maximize profits. However, based on the product testing level, it is not very convenient to use in actual operations, and asset transfers are relatively slow, still in the early stages.

Brahma's token has not yet been issued. Additionally, it is worth noting that Brahma has received investments from top VCs, including Framework Ventures, Lightspeed Venture Partners, and The Lao.

4. Portfolio Management Category

4.1 Flork

Flork is an AI agent for managing liquidity pools, inspired by web comics and leaning more towards being a Memecoin. The project has achieved CTO status. It combines staking, NFTs, Memecoins, and other gameplay, making it one of the more highly regarded projects in the Solana ecosystem.

The main functionalities it provides for DeFi include sentiment tracking, social content analysis, token tracking, and LP analysis. However, the products that have been implemented are still in the basic stage. It is noteworthy that Flork has a high level of community engagement. The Flork project team is also actively marketing, responding promptly to community feedback and quickly resolving issues.

Currently, in the staking section, the official website shows that the stakable tokens are FLORK and SOL, but the staking pool limits are already full. In the NFT minting section, there are a total of 8,888 slots, with 3,032 already minted. Users need to send 1 SOL to a designated address to mint NFTs. From the perspective of participation, the community is more optimistic about the FLORK token itself rather than other derivative gameplay.

Flork's native token is $FLORK, with a current market value of $17.78 million.

4.2 The Hive

The Hive is the first-place winning project of the Solana hackathon, primarily addressing the automation challenges of DeFi operations. Its core functionalities include market sentiment analysis, strategy optimization, and risk management models. It has two main advantages: first, it simplifies DeFi operations by breaking down protocol operation barriers through smart contracts; second, based on its risk model, it can implement various combinations of DeFi strategies to meet the needs of different investors.

The Hive agents are divided into two categories: professional agents, focusing on trading, staking, and analysis; and advanced agents, responsible for coordinating the operations of these agents to complete more complex workflows. Users of The Hive only need to input queries, and the network will intelligently call the most suitable agent for the task. This modular architecture allows for seamless expansion and adaptability when adding new integrations and agents, continuously enhancing its functionality.

The Hive is currently free to use, and users can start relevant operations simply by logging in. The platform is also continuously optimizing, with supported features including one-click deposits and intelligent LP pool selection. The upgraded architecture allows users to create on-chain tokens using natural language and autonomously arrange them based on prompts to meet diverse investment needs.

The Hive is also continuously optimizing its products and has integrated the Deepseek R interface. The products delivered so far include analyzing market sentiment on X, implementing token tracking, and observing token liquidity, among other basic functionalities. According to official data, Hive AI has approximately 25,000 active users weekly.

The Hive's native token is $BUZZ, with a peak market value of around $200 million and a current market value of $15.41 million.

4.3 Whispers

Whispers is an open-source protocol that allows developers to build, orchestrate, and embed AI agents. In terms of token distribution, 65% has been allocated to the community, 20% to locked liquidity pools, and 15% to the foundation.

Whispers is now running on @GeminiApp's Gemini 2.0 Flash and has integrated @deepseek_ai and @OpenAI. Additionally, Whispers has already implemented some simple applications, such as sending cryptocurrency to a phone number and creating a crypto wallet using an X account or phone number. Through Whispers, users may be able to perform DeFi operations in the future using just their phone numbers or X accounts, without the need for wallets or other on-chain operations.

Whispers is a newly launched project, with its launch date set for January 2025. However, product updates are very rapid, with an upgrade to version whisp v.2 occurring within a week and user numbers surpassing 10,000 within 24 hours. Furthermore, it is noteworthy that Whispers has received support from the Solana Foundation and has attracted the attention of Solana co-founder toly.

Whispers' native token is $WHISP, with a current market value of $11 million.

4.4 Cleopetra (Token Not Yet Issued)

Cleopetra is also one of the award-winning projects from the Solana hackathon, with a launch date in December 2024. Cleopetra aims to help ordinary people better engage with DeFi, with its core functionality being the management of LPing on Solana DEX through AI agents. Currently, it can directly provide liquidity on Solana DEX via Telegram, allowing users to input a token, select their desired LP strategy, and create a position. The agent will find the best pool, automatically rebalance the position, and reduce impermanent loss.

Cleopetra's token has not yet been issued, but it has integrated liquidity from @solayer_labs and protocols like @MeteoraAG. The product is currently in the Beta stage and is only open to a limited number of testers. It is particularly noteworthy that Cleopetra is one of the few projects that genuinely improves DeFAI from a technical perspective. Especially in the exploration of DeFAI LPing, recent testing activities have received feedback from testers indicating that their results align with actual outcomes. Therefore, the support for the Cleopetra community is very high, and it has also garnered the attention of Solana co-founder toly.

III. Outlook on DeFAI

The core goal of DeFAI is to provide users with more efficient and cost-effective financial services through AI-driven automated decision-making, improved market prediction accuracy, and optimized risk management. The practical use cases of DeFAI are very broad, currently exploring simplified operational systems, enhanced DeFi efficiency, and increased security. However, most current DeFAI projects are still in the early exploratory stage and need further development to address real-world problems and optimize user experience.

However, DeFAI is a completely new concept, and we should distinguish its current state from its future potential. The narrative of combining DeFi with AI to improve the DeFi user experience and enhance profitability may represent a new starting point for the market. This report believes that in the future, we will see the emergence of AI-driven smarter economic models in DeFAI; more agents will directly translate intentions into actions; modular collaboration may become a new trend to achieve smarter and more efficient DeFAI; and the segmentation and specialization of the sector will become important trends for future development, making segmented applications better meet market demands and become value niches.

1. AI-Driven Smart Economic Models

A high-quality economic model is an important cornerstone for the sustainable development of projects. This report believes that sustainable DeFAI projects should have smarter value capture, inflation and deflation mechanisms, and liquidity incentive mechanisms in their token economic models. In terms of value capture, users using AI agents need to pay a certain fee, while they can receive corresponding incentives when providing data optimized by AI, thus forming an ecological closed loop; in terms of inflation and deflation management, AI agents will allocate different strategies for different stages of project development, adopting an inflation model in the early stages to encourage more users to participate in AI model training, etc. In the later stages of project development, the total circulation of tokens can be controlled through token buybacks and burns, continuously empowering the tokens; in the liquidity incentive mechanism, a smart liquidity mining mechanism can be adopted, utilizing AI to monitor the flow of protocol funds, dynamically allocating token rewards, and guiding liquidity to the markets that need it most. In summary, the token economic model of DeFAI should be AI-driven, intelligently guiding user participation and promoting the sustainable development of the project.

2. AI** Agents Transitioning from Intent to Execution**

We can observe that current main agents are focused on the intent level, primarily allowing users to express operational intentions through chat interfaces. As the entire sector develops, more agents will directly translate intentions into actions. We can see that projects like Brahma have already begun preliminary attempts, and in the future, more practical agents may emerge. This shift means that agent systems will no longer merely serve as intermediaries for information transmission but will be able to proactively execute tasks, optimize user experience, and enhance DeFAI efficiency.

3. Modular Collaboration as a Development Trend

In the context of DeFAI, the collaboration of AI agents is a key trend for improving DeFi trading efficiency and user experience. Currently, most AI agents still operate independently, attempting to provide end-to-end services across multiple stages such as information parsing, investment decision-making, and trade execution. However, as market demand grows and technology matures, future DeFi AI agents may adopt a modular collaboration model, where multiple AI agents focused on different tasks work together to build a more efficient and intelligent DeFi trading system.

4. Segmented Innovative Applications as Value Niches

As an emerging field, DeFAI is still in its early stages of development. With gradual technological advancements, the segmentation and specialization of the sector will become important trends for future development. At this stage, most DeFAI applications remain at the level of general tools and interfaces, such as analysis applications that largely rely on generic analytical frameworks, and trading applications that mainly depend on text interactions. These vague applications do not fully meet the personalized needs of specific industries and user groups. Therefore, as market demand continues to evolve, more applications targeting segmented fields will emerge, and customized DeFAI solutions for specific scenarios and needs will capture a larger market share. These early, segmented innovative applications may hold more value niches.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。