Jupiter is currently trying to signal a breakthrough against the headwinds through various strategies such as ecological expansion, token buyback plans, and product iterations.

Written by: Nancy, PANews

Currently, the Solana ecosystem is experiencing a "bleeding" crisis triggered by the Libra token issuance scandal, with a dual blow of liquidity loss and market confidence intensifying internal challenges. As a star project in the Solana ecosystem, Jupiter once played a core role due to its extremely high liquidity ratio, but the fallout from the Libra scandal combined with the overall crisis of the ecosystem has left it mired in difficulties. Nevertheless, Jupiter is currently attempting to signal a breakthrough against the headwinds through ecological expansion, token buyback plans, product iterations, and other strategies.

Is the trading engine slowing down? Jupiter's multiple data points still hold an advantage in the Solana ecosystem

Jupiter once drove the prosperity of the Solana ecosystem with its strong market appeal, but the confidence crisis in the Solana ecosystem has slowed its trading engine, making it difficult to stand alone.

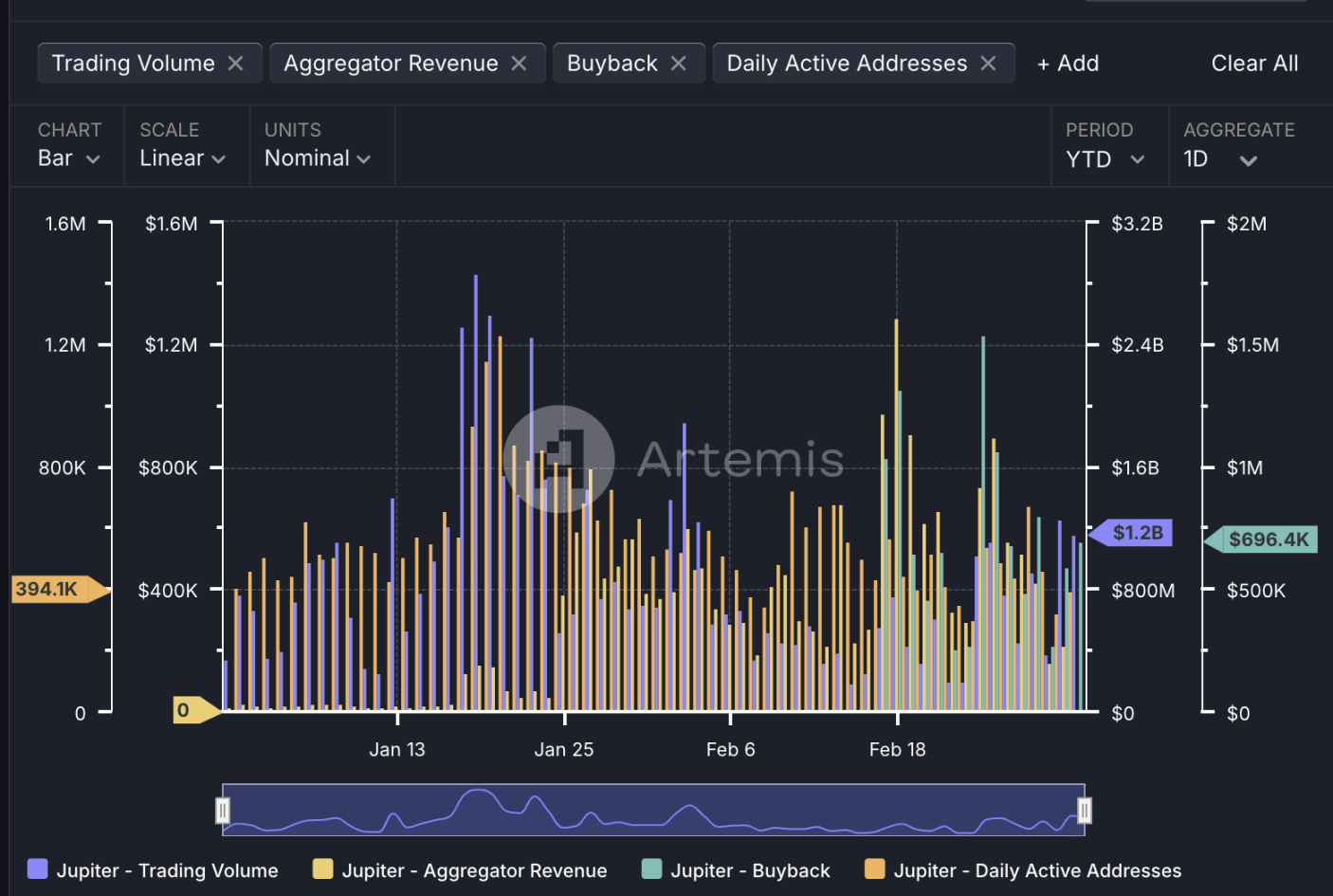

Data from Artemis shows that Jupiter's daily trading volume peaked at a historical high of $2.9 billion in mid-January this year. However, trading activity has shown a gradual downward trend since then. As of March 3, the daily trading volume had fallen back to $1.2 billion, a sharp decline of 58.6% from the peak.

The change in the number of daily active addresses also reveals a decline in community participation. On January 20 of this year, the number of active addresses for Jupiter reached a new high of 1.2 million, highlighting the user participation boom at that time. However, as of March 3, this number had plummeted to 394,000, a drop of 67.2%. The sharp decrease in active addresses not only points to a slowdown in trading activity but also suggests that user confidence in Jupiter and the Solana ecosystem has been impacted. However, the overall daily active addresses in Solana also decreased by about 48.1% during the same period, indicating that Jupiter's decline is in sync with the broader ecological environment.

The weakening trading activity has directly affected Jupiter's revenue performance. Data from Artemis shows that its aggregator's daily revenue dropped by 83.3% from a peak of $1.3 million, falling to just $216,000 as of March 3. This weakness in revenue also reflects Jupiter's vulnerability in the current market environment.

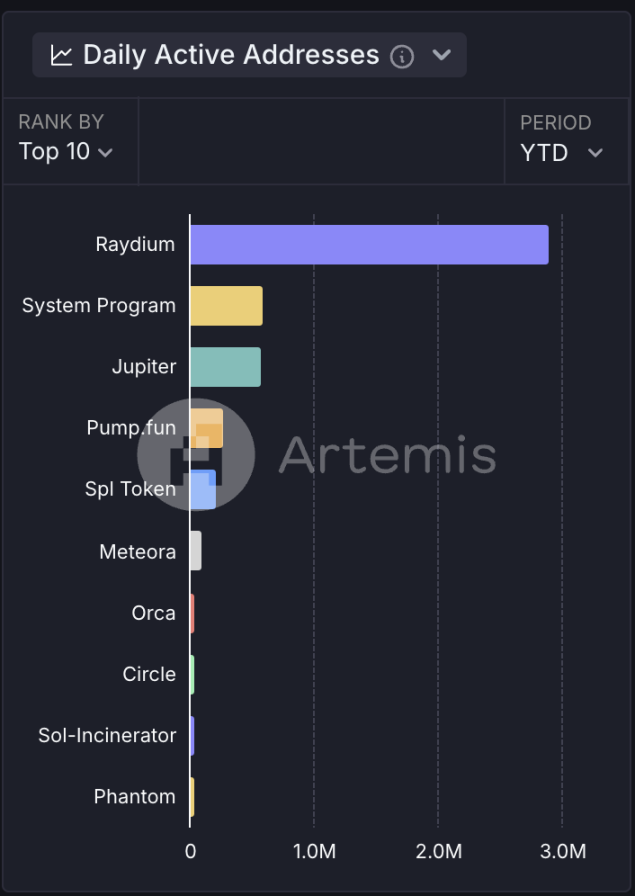

Despite the pressure on trading activity and revenue, Jupiter's weight in the Solana ecosystem still shows some resilience. Data from Artemis indicates that Jupiter's daily trading volume accounts for 11.6% of the overall Solana ecosystem, slightly up from 10.4% at the peak in January. However, the proportion of daily active addresses for Jupiter has decreased by 36.5% from the peak, accounting for 9.4% of the overall Solana ecosystem as of March 3.

From an ecological ranking perspective, according to Artemis data, since 2025, Jupiter has maintained a daily trading volume of $260 million, ranking second in the Solana ecosystem, only behind Raydium; the number of daily active addresses ranks third with 572,000; and gas fee consumption contributed $45.7 million, also ranking second. These data indicate that Jupiter still maintains its role as a core liquidity pillar in Solana, although its influence has diminished.

Additionally, the official website shows that the total staking amount of JUP exceeds 580 million, accounting for more than 21.5% of the circulating supply, reflecting the community's continued participation in JUP DAO governance, which may provide a short-term buffer against selling pressure on the token.

From a trust crisis to long-termism, Jupiter's multi-line layout aims to restore confidence

The Libra scandal was the trigger for Jupiter's troubles. In February of this year, during the insider trading storm involving Libra, Libra created a liquidity pool on Meteora, and Jupiter was accused of colluding with Meteora due to Meow's dual identity (co-founder of Meteora). Although Meteora co-founder Ben resigned afterward, and Jupiter responded that it did not participate in the issuance of Libra in any form, stating that no team members were found to have engaged in front-running, it did not allow Jupiter to escape the reputational crisis, and its token JUP also experienced a significant drop.

"We talk about crypto being the future, but in reality, we often show a serious lack of willingness to be responsible for long-termism and results. One thing is certain: we believe in what we are doing, believe in being responsible for long-term results, and believe that the crypto industry will truly change the world in the future, no matter how severe the short-term fluctuations may be," Meow recently stated.

In the face of the slowdown in the Solana ecosystem and the Libra scandal, Jupiter is responding with a diversified strategy. Recently, it announced acquisitions, adjustments to token economics, and transparent governance, among other multi-line layouts, in an effort to regain market trust.

In terms of ecological expansion, Jupiter has made several hires and acquisitions over the past year, including the recent acquisition of a majority stake in Sonarwatch and Moonshot, and is currently pursuing two undisclosed acquisitions to enhance the capabilities of its team and the three major pillar platforms: Jup.ag, Jupiverse, and Jupnet. The acquisition funds will be paid from the treasury.

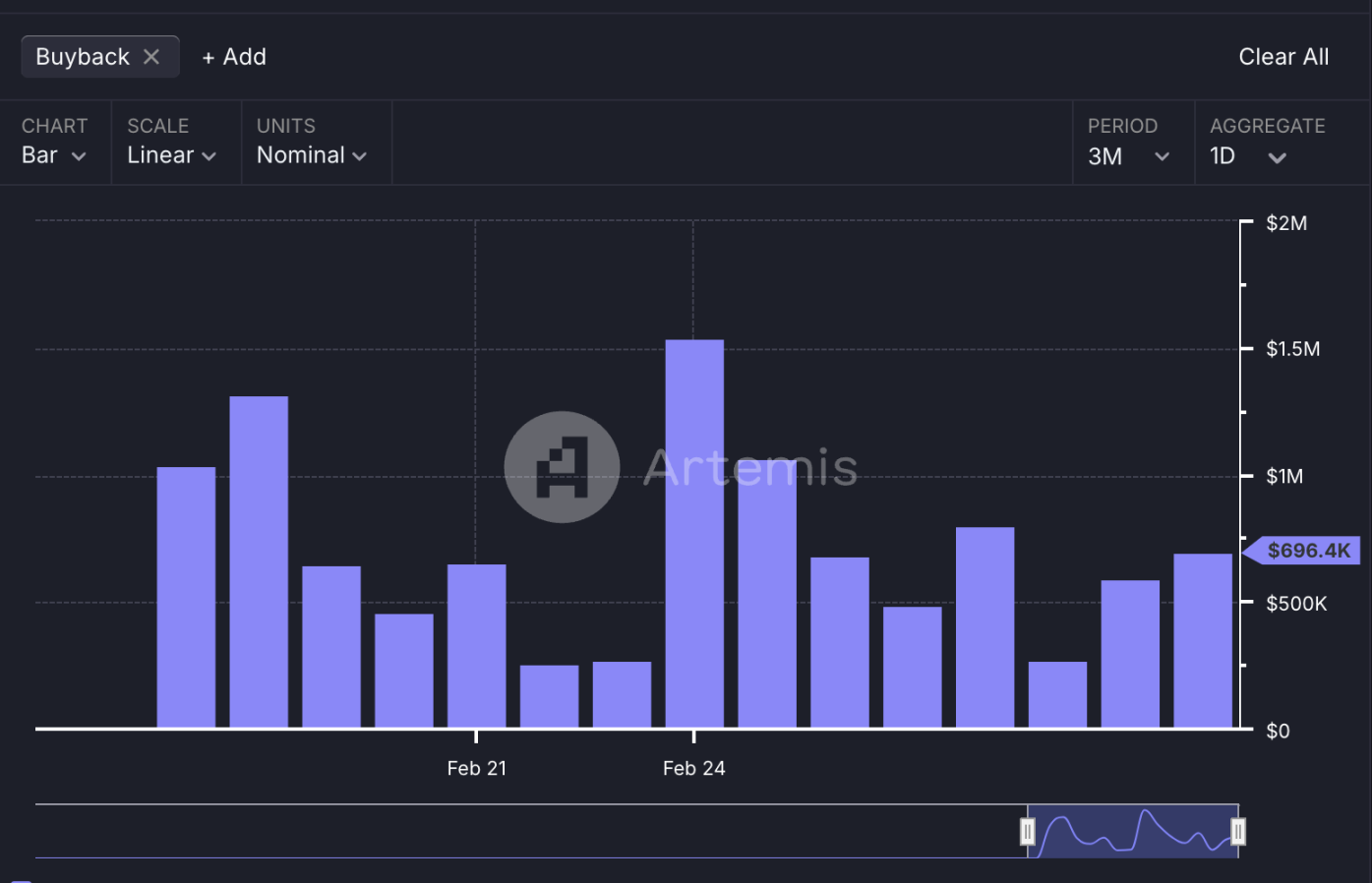

In terms of empowering token value, Jupiter recently announced a comprehensive audit by an independent third party of the founders, Jupiter treasury, Meteora treasury, and JUP tokens; at the same time, Jupiter established the Litterbox Trust, which is managed by an independent third party and has begun operations, planning to receive 50% of the protocol's revenue over the next two years for strategic accumulation of JUP, aimed at enhancing the long-term stability of the token. The official statement indicates that this move does not involve recent earnings but is aimed at laying out for the long-term development of the ecosystem and community. According to Artemis data, as of March 3, Jupiter has repurchased $10.8 million worth of JUP since February 17.

Moreover, Meow recently proposed the "2030 Proposal," planning to use his 280 million personal JUP tokens for team incentives and to receive 500 million JUP as compensation in 2030, which still requires community voting to decide. Additionally, Jupiter recently announced the launch of the "GOAT Framework," aimed at establishing JUP as the best token in the crypto industry through four core dimensions—governance (including 30% supply destruction, "Jupuary" events, and budget adjustments for working groups), organic nature (emphasizing the rejection of behind-the-scenes trading, KOL promotion, or market manipulation), consistency (aligning the interests of holders, the community, and the team), and transparency (three token audits, public multi-signature wallets, and large liquidity records).

Furthermore, Jupiter has recently announced its 2030 team strategy, focusing on decentralized liquidity platforms, global community expansion, and the Jupnet ecosystem over the next five years, and plans to allocate 280 million JUP to new team members over the next three years (the current founding team still holds 1.4 billion JUP), but the funding source needs community decision-making, with two main options: one is to use strategic reserve grants, unlocking from July 2025 without requiring community voting; the other is to pay from Meow's personal holdings, recovering to the strategic reserve in 2030, and applying for an additional 220 million JUP as incentives (which can be adjusted by the DAO).

In terms of product iteration, Jupiter has merged with ApePro and rebranded as Jup Trenches, offering features including dual account types, private key export, real-time data, and significant updates to the Jupiter Mobile launched last year.

In summary, although the slowdown of the trading engine puts pressure on Jupiter in the short term, its position as a core pillar of the Solana ecosystem remains intact. Whether it can achieve ecological stabilization and even positive growth through diversified strategic layouts and a recovery in Solana remains to be seen over time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。