On March 4, Marc Zeller, a service provider for Aave DAO, released a governance proposal seeking governance approval, officially named Aave Request for Final Comments (ARFC), aimed at reshaping Aave's economic model. It is not a simple adjustment to the existing mechanisms but a fundamental upgrade involving revenue distribution, incentive mechanisms, and optimization of long-term stability.

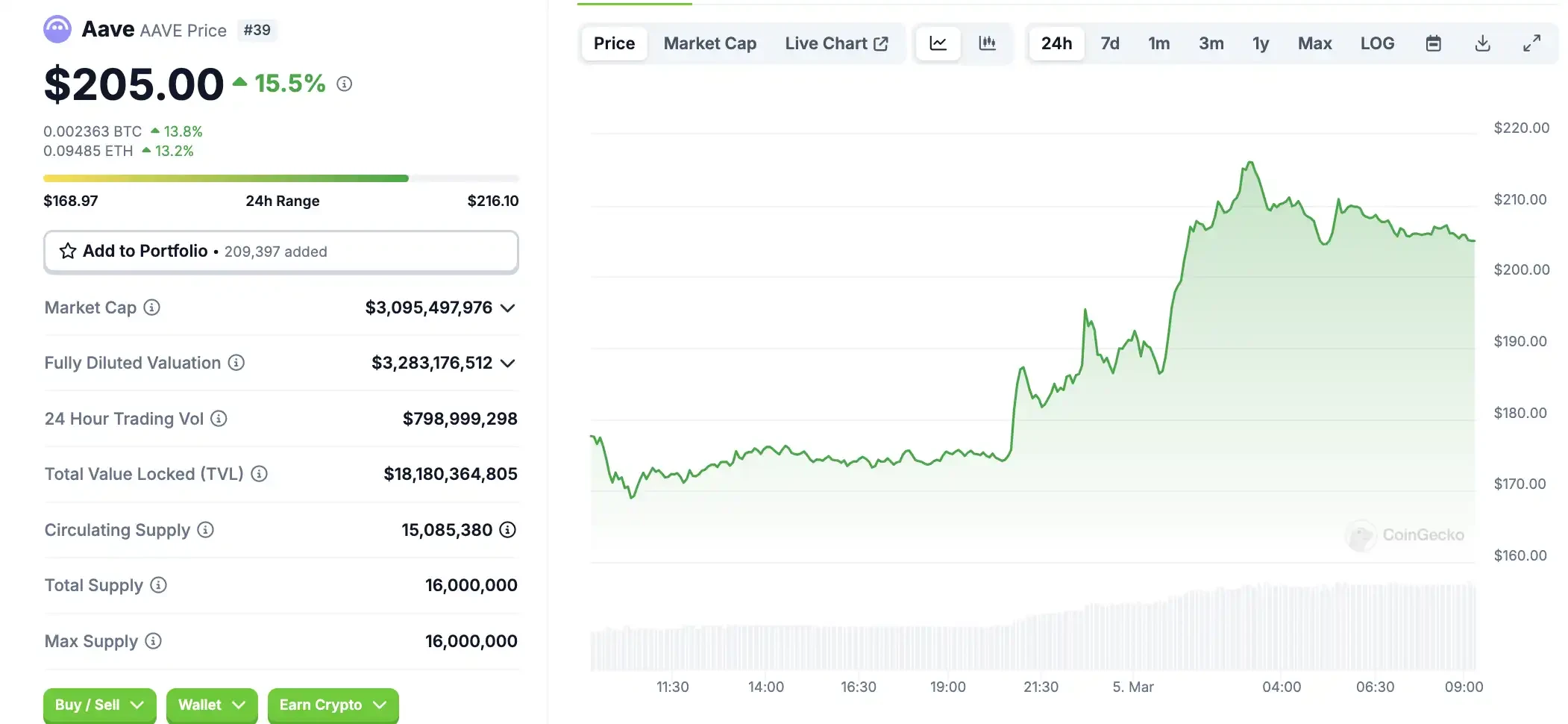

The proposal currently only includes the first part and is in the opinion collection stage, while the AAVE token has risen to a maximum of $216 since the proposal was released, with the current AAVE price at $215, up 15.5% in 24 hours.

Proposal Content Interpretation

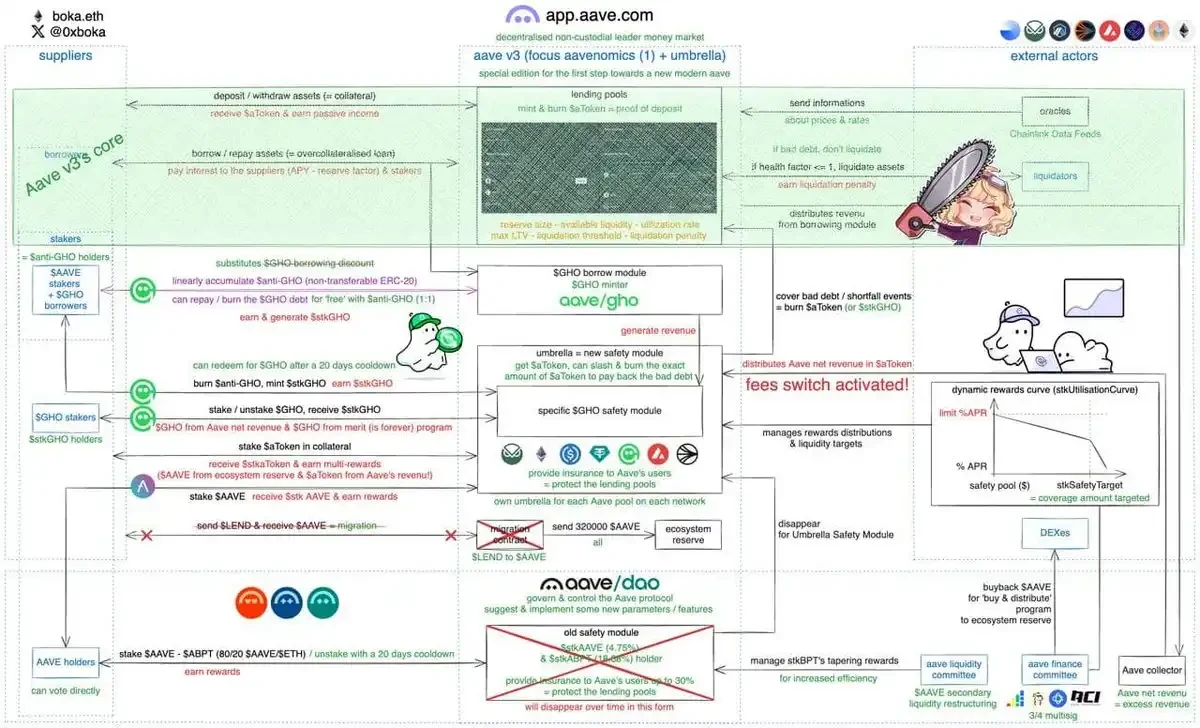

Marc Zeller stated on X that this is "the most important proposal in Aave's history," highlighting its significant impact. The core pillars of the proposal include:

Revenue redistribution mechanism

AAVE token buyback and distribution plan

Umbrella security mechanism

Retirement of LEND tokens

According to the proposal, Aave has continuously expanded its market footprint over the past two years, building a solid financial foundation.

Despite market fluctuations, Aave has maintained strong revenue growth, with its DeFi protocol's liquidity reserves increasing by 115% to $115 million. This robust financial condition allows Aave to advance token economics upgrades while remaining competitive.

Establishment of Aave Finance Committee

One of the core aspects of the proposal is the establishment of the Aave Finance Committee (AFC), which will serve as an important entity under Aave's governance framework, fully responsible for managing Aave's treasury and liquidity strategies. The establishment of the AFC marks a move towards more professional and transparent financial management for Aave.

The main responsibilities of the AFC include overseeing all financial allocations within the Aave ecosystem, ensuring that funds are used reasonably and efficiently, and achieving sustainable revenue growth. Additionally, it will formulate and execute Aave's liquidity strategies to ensure the protocol maintains sufficient liquidity under various market conditions. Most importantly, the AFC will be responsible for assessing and managing various financial risks faced by the Aave protocol, including market risk, credit risk, and operational risk.

To ensure the professionalism and effectiveness of the AFC, the committee will include core stakeholders such as Chaos Labs, TokenLogic, Llamarisk, and ACI. These organizations have extensive experience and expertise in the DeFi field, providing strong support for the AFC's decision-making.

Benefits for Stakers: Aave's Revenue Distribution Mechanism

The most notable aspect of this proposal is the significant adjustment to the protocol's revenue distribution mechanism. Aave plans to allocate a portion of the revenue generated by the protocol to stkAAVE stakers, directly linking the protocol's success to the interests of AAVE token holders.

Specifically, Aave plans to introduce a "Fee Switch" mechanism. This mechanism will allow Aave to release excess revenue generated by the protocol (such as borrowing fees) from the treasury and redistribute it to AAVE stakers and users, rather than simply accumulating this revenue in the treasury.

To further optimize the incentive mechanism and enhance the appeal of the GHO stablecoin, Aave also plans to launch Anti-GHO as a new incentive mechanism for GHO, replacing the existing discount model. Anti-GHO is a non-transferable ERC20 token, and its issuance will be directly linked to the revenue generated by GHO.

At the beginning of GHO's launch, Aave tested a revenue-sharing incentive based on stable fee income through the Merit program, with an annual distribution scale reaching $12 million at one point. Now, this program has achieved self-sufficiency and no longer requires additional stablecoin funding support. This mechanism links revenue and incentives, not only enhancing AAVE staking returns but also avoiding the "lack of momentum" defect that pure fee discounts may encounter during market cycles.

The specific distribution mechanism is as follows:

GHO fees generate Anti-GHO: 50% of GHO fees will be used to generate non-transferable Anti-GHO tokens.

The generated Anti-GHO tokens will be distributed as follows: 80% to StkAAVE holders (AAVE stakers), 20% to StkBPT holders (Balancer pool stakers).

The existing GHO fee discount will be canceled, replaced by profit distribution based on protocol revenue.

Anti-GHO holders have two usage options:

1:1 burn to offset GHO debt: Holders can burn Anti-GHO at a 1:1 ratio to offset their GHO debt.

Convert to StkGHO: Holders can also choose to convert Anti-GHO to StkGHO to earn GHO staking rewards.

However, the implementation of Anti-GHO still requires additional development and auditing, and it may be officially activated in the subsequent "Aavenomics Part Two" proposal.

Initiating Buybacks

In addition to revenue distribution, Aave also plans to launch an ambitious AAVE token buyback program. Over the next six months, Aave will invest $1 million weekly to buy back AAVE tokens, with this plan being overseen and executed by the newly established Aave Finance Committee (AFC).

The AFC can execute buybacks directly or collaborate with market makers to purchase AAVE from the secondary market. The repurchased tokens will be allocated to Aave's ecological reserves to support the long-term development of the ecosystem.

As the financial service provider for Aave DAO, TokenLogic will plan the buyback strategy based on the overall budget of the protocol, aiming to ultimately cover and exceed all AAVE-related expenditures within the Aave ecosystem while maintaining prudent fund management.

With the expansion of new revenue sources for Aave in 2025, the AFC may propose to increase the buyback budget. TokenLogic will adjust funding sources and strategies monthly based on the asset allocation of Aave's treasury.

Enhancing Protocol Security and Efficiency

To further enhance the security of the protocol and improve capital efficiency, Aave plans to introduce the "Umbrella" mechanism. Umbrella will integrate staking and liquidity management to effectively guard against bad debt risks and liquidity crises. This is seen as a significant upgrade to the existing Safety Module.

The main advantages of the Umbrella mechanism include:

Strong bad debt protection: Umbrella will provide Aave with a robust bad debt protection mechanism, enhancing its resilience against market volatility and potential risks, especially in the context of frequent hacking incidents in the DeFi space.

Attracting institutional users: Umbrella's institutional-level risk management capabilities will help attract more institutional users to participate in the Aave ecosystem, enhancing the protocol's security in on-chain asset management.

Cross-chain deployment: The Umbrella system will be deployed across multiple blockchain networks, including Ethereum, Avalanche, Arbitrum, and Base, achieving broader applicability and higher security.

Additionally, the Anti-GHO mechanism will also be integrated into Umbrella, making the repayment of GHO debt or conversion to interest-bearing StkGHO simpler and more convenient. Aave currently faces $27 million in liquidity costs annually, and the introduction of the Umbrella mechanism will effectively enhance capital efficiency.

Finally, the proposal also plans to completely retire the LEND token. LEND was the original governance token for Aave before it upgraded to AAVE in 2020. Since 2020, the LEND token has been in a transition period towards AAVE.

This proposal plans to freeze the LEND migration contract, completely terminate the LEND token, and recover 320,000 unexchanged AAVE tokens (currently valued at approximately $65 million). The proposal notes that the community has had ample time to complete the token conversion, thus recommending the formal closure of the migration process. The recovered funds will be decided by Aave governance for specific uses, such as ecosystem growth, security upgrades, or token destruction.

This move will help clear historical legacy issues in Aave governance and improve the operational efficiency of the protocol. At the same time, releasing these underutilized funds will further enhance Aave's financial strength, providing more ample resources for its future development.

New Blue Chip in Turbulent Times? Community's View on This Proposal

Currently, the proposal is still in the ARFC (opinion collection stage), and the community can discuss it on the Aave governance forum. The next step for the proposal will be to collect community feedback and strive to reach a consensus before entering the Snapshot offline voting. If approved, the proposal will formally enter the on-chain governance proposal (AIP), and if executed smoothly, buyback and other plans will start in 2025.

Community members estimate that AAVE holders can expect an annualized return of about 3% from this proposal. Although this yield may not seem outstanding in absolute terms, Aave has established its core position in the entire DeFi ecosystem, demonstrating characteristics similar to high-quality blue-chip stocks in traditional financial markets, attracting more rational investors' attention with its robust operations, continuous growth, and clear revenue model.

In an economic downturn, such assets typically exhibit strong defensive qualities, providing investors with relatively stable returns and a reassuring holding experience. Notably, as the global regulatory environment gradually relaxes and recognizes the DeFi space, there is potential for the value of DeFi assets to be reassessed. Therefore, redefining Aave as a "blue-chip" asset under the new order of the cryptocurrency market is fully reasonable and forward-looking. It not only represents a sound investment strategy but also indicates a certain trend in the future development of the DeFi field.

Additionally, David Sacks, the White House AI and cryptocurrency supervisor, indicated that the so-called "DeFi Broker Rule" may be revoked—this was an attack on the crypto community by the Biden administration at the last moment.

The DeFi Broker Rule is a regulatory framework targeting intermediaries in decentralized finance (DeFi), such as trading platforms and lending protocols, aimed at ensuring compliance, user protection, and risk management. Core contents include anti-money laundering (AML), user identity verification (KYC), smart contract auditing, fund security, and transparency requirements.

The cancellation of the DeFi Broker Rule means that DeFi protocols are not required to report and disclose customer information, which alleviates regulatory pressure on DeFi, and this is also a positive development for Aave.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。