Author: Evan, @EvanCrypto17

After spending another 24 hours organizing, it's perfect! I hope everyone can refer to more detailed and comprehensive content!

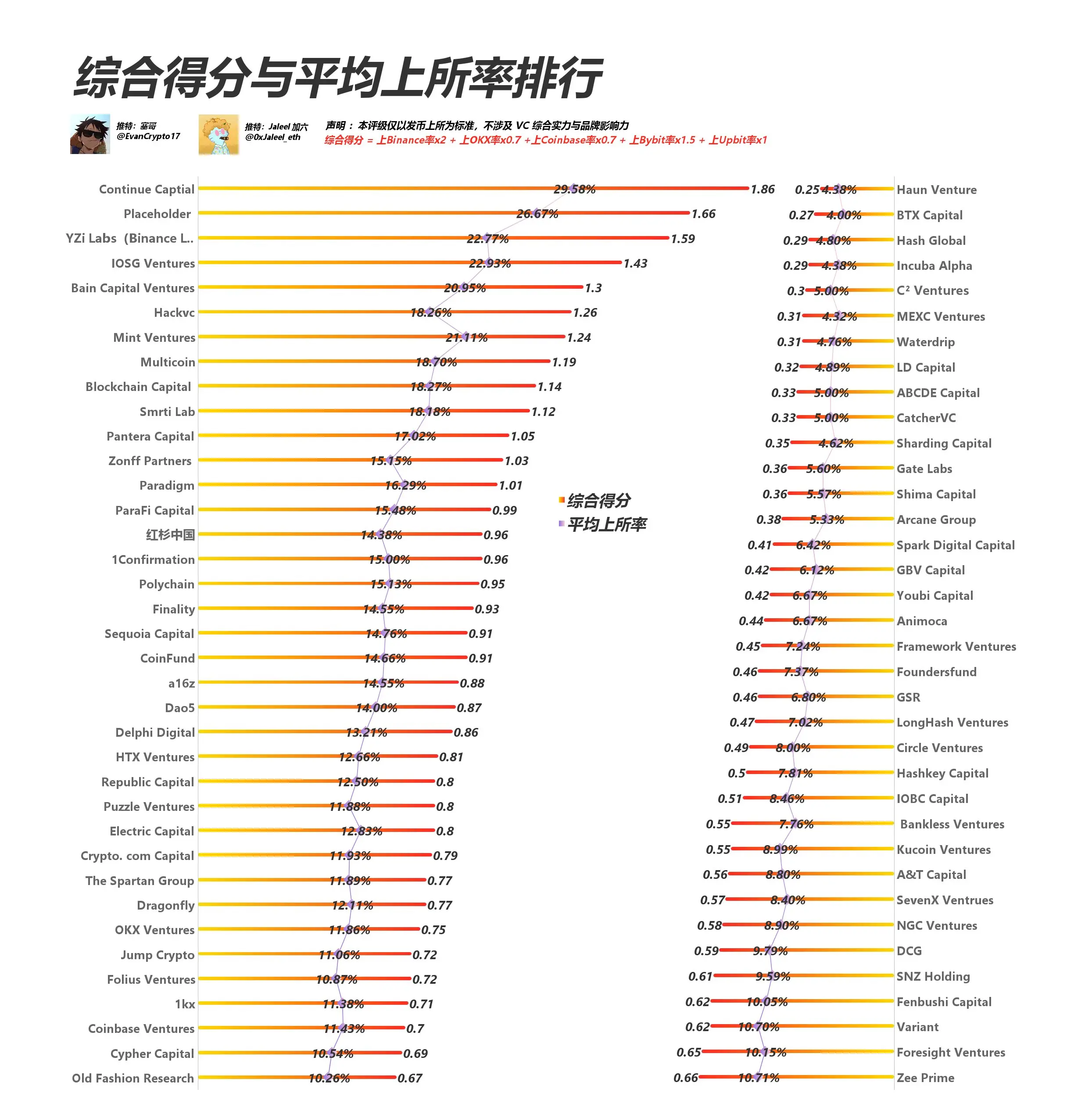

In the previous issue, we only selected three exchanges: Binance, OKX, and Coinbase. This time we updated the listing rates for Bybit and Upbit, improved the indicators for better statistical results.

In this issue, we updated:

- Unaccounted VCs

- Added Bybit listing rate

- Added Upbit listing rate

- Average VC listing rate

- Excellent VC evaluation

- More objective quantitative scores

- More intuitive UI interface

A total of 73 VCs were selected, including 35 domestic VCs, 30 foreign VCs, and 8 exchange VCs.

[Advance Statement]: This rating is based solely on the standard of token listings and does not involve the overall strength and brand influence of VCs.

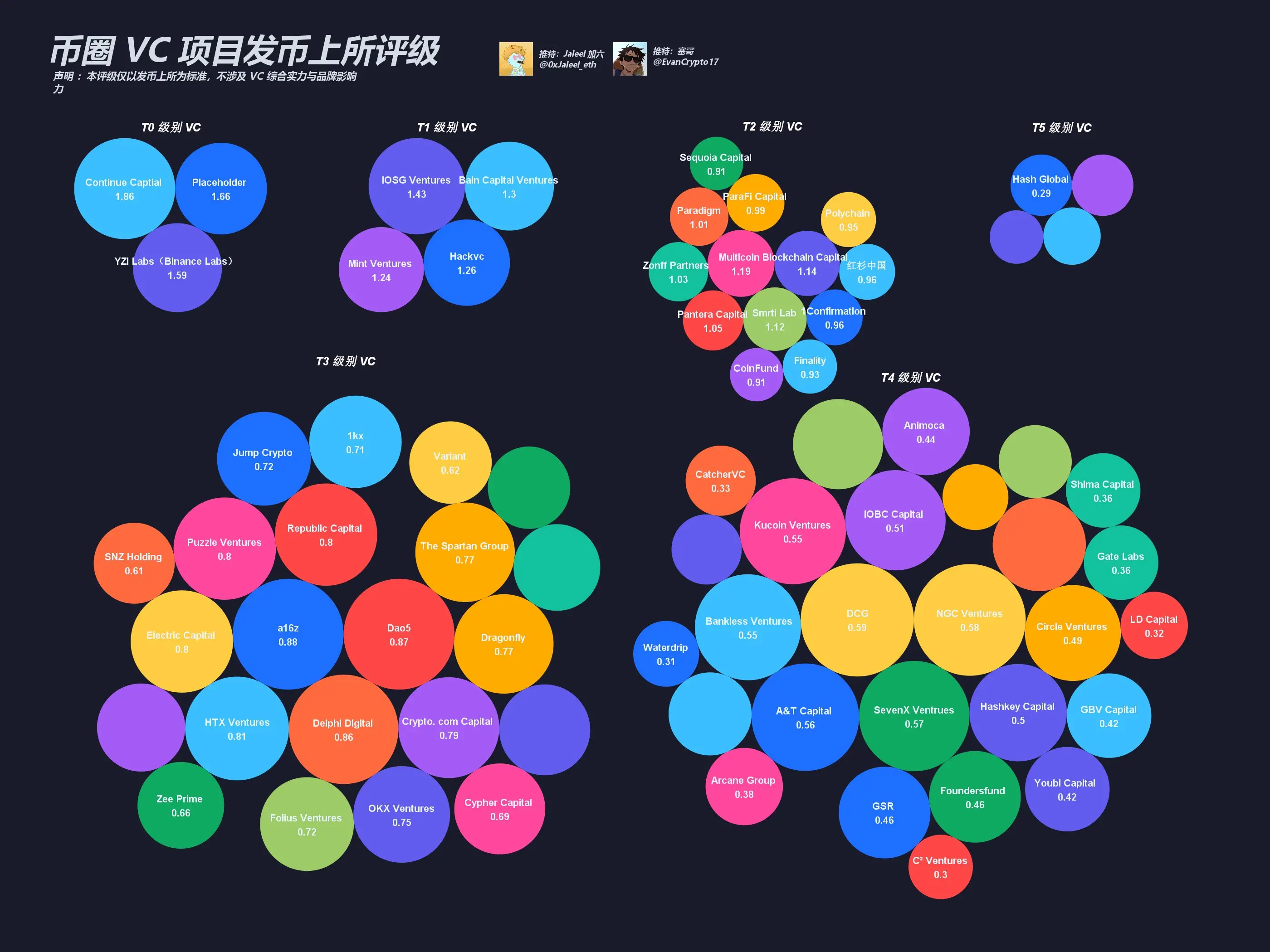

Based on the market share/growth rate/listing effect of Binance/Coinbase/OKX/Bybit/Upbit exchanges, the conclusions are as follows:

T0 Level: Continue Capital, Placeholder, YZi Labs (Binance Labs)

T1 Level: IOSG Ventures, Hack VC, Bain Capital Ventures, Mint Ventures

T2 Level: Paradigm, Sequoia China, Sequoia Capital, Multicoin, Polychain, etc.

T3 Level: a16z, Dragonfly, Coinbase Ventures, 1kx, etc.

T4 Level: Circle Ventures, Hashkey Capital, DCG, Bankless Ventures, etc.

T5 Level: Hash Global, Haun Venture, BTX Capital, Incuba Alpha

Based on the regional ranking of VCs, the conclusions are as follows: Foreign VCs > Exchange VCs > Domestic VCs

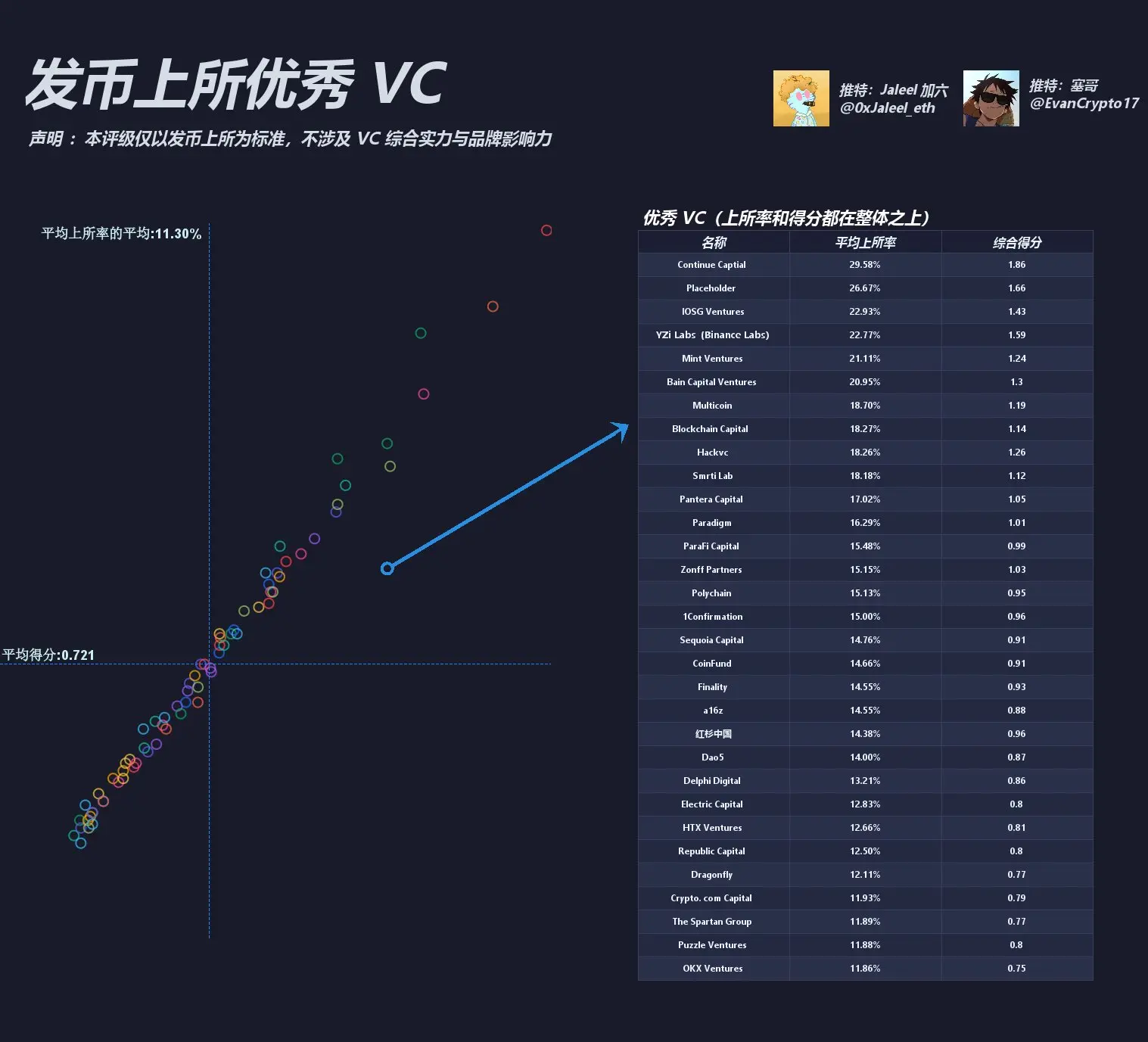

Based on the average level of VC token listings:

31 "excellent" VCs are above the average level for better reference, details can be seen in the chart.

For detailed data on each VC, see the Thread.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。