⚡️Pause the gossip and take a moment to focus on the Ethereum Pectra upgrade——

While everyone is gossiping, ETH briefly dipped below 2000, causing this important update to be overlooked. This upgrade may not have made a big splash, but it represents a significant improvement. Here are some key points!

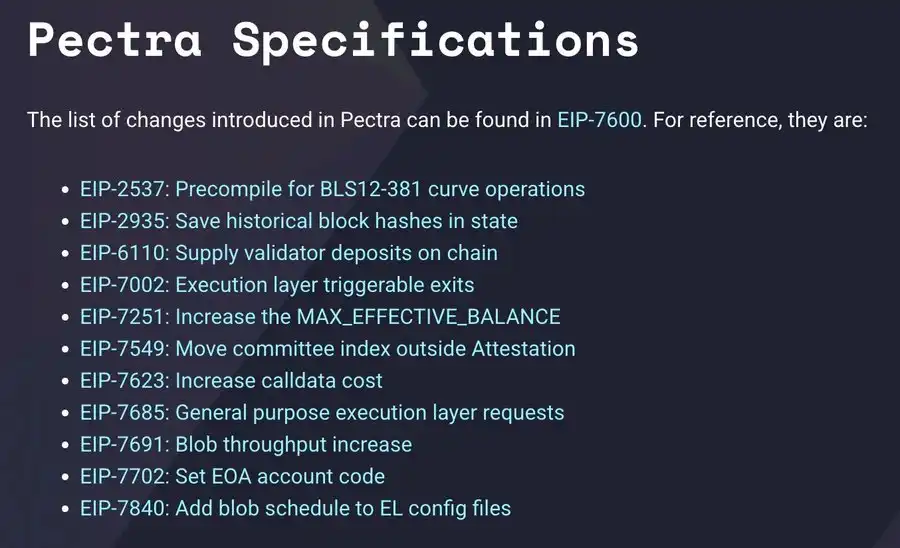

1⃣Core Upgrade Content

1)EIP-7702: Allows traditional wallets (EOA) to interact with smart contracts, supporting batch transactions, sponsored gas fees (such as DApp payment), and other features, advancing account abstraction.

2)EIP-7251: Increases the maximum collateral amount for a single validator from 32 ETH to 2,048 ETH, allowing large staking service providers to consolidate collateral pools, reduce the number of validators, and lower network load. This optimizes the staking mechanism, making it more flexible for small stakers.

3)EIP-7549: Achieves aggregation of the same votes by removing the committee index from the signature, reducing the number of pairing operations required for validation.

The focus of the upgrade is on continuously optimizing the staking experience, essentially to strengthen the community of stakers and node operators, which is the lifeblood of Ethereum post-merge.

Once a large amount of funds no longer revolves around Ethereum, the security of #ETH itself will be undermined.

2⃣What should retail investors pay attention to and do?

1)Observe whether mainstream wallets support account abstraction features, especially new features like sponsored transactions and batch operations, as they may directly impact transaction costs.

2)For future staking, prioritize service providers that support Distributed Validator Technology (DVT) to reduce single point of failure risks.

3)PeerDAS may further reduce L2 fees, so keep an eye on tokens from leading L2 ecosystems like Arbitrum and Optimism.

3⃣Are there potential information and benefits?

1)The enhanced security and stability of the Pectra upgrade may attract more traditional financial institutions, benefiting the RWA sector.

2)The upgrade adds a "highway" for L2, but the ecological optimization does not show significant effects at the moment. We will see if it can solve the issue of L2 liquidity fragmentation. Keep an eye on modular and cross-chain interoperability solutions.

3)With the increase in collateral limits, leading staking service providers (like Lido, Coinbase) may launch higher yield products, so check if there are tools with higher APR.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。